TeleTrade Editor’s Verdict

TeleTrade, which was established in 1994, is an EU-based broker; as such, it operates under the uncompetitive regulatory framework of the ESMA. The broker makes bold statements about using cutting-edge technology. Regrettably, it only provides clients with the out-of-the-box versions of the MT4/MT5 trading platforms. This appears to be the standard approach by brokers attempting to mask their lack of competitiveness. While the broker does offer its copy-trading service, TeleTrade Invest, it takes 40% of the signal provider's commissions; for reference, a signal provider may set their rate between 1% and 50%.

Overview

The asset selection remains limited, and so does the leverage, and the educational content is of low quality.

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 1994 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | 100$ |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Regulation and Security

The Cyprus Securities and Exchange Commission (CySEC) is the sole regulator of TeleTrade, which is headquartered in Cyprus. While this broker counts this as one of its assets, it remains a distinct liability for committed traders as TeleTrade operates under the uncompetitive ESMA regulatory framework and MiFID II. That essentially prevents the broker from offering a competitive trading environment. Client funds remain segregated, and an investor compensation fund exists, together with negative balance protection. From a regulation and security perspective, TeleTrade delivers a secure and trustworthy environment. The cost traders have to pay for it is one of the least competitive product and services offers globally due to ESMA restrictions, which have been in place since 2018.

TeleTrade, based in Cyprus, operates under the uncompetitive ESMA regulatory framework.

Client protection follows well-established industry standards.

Fees

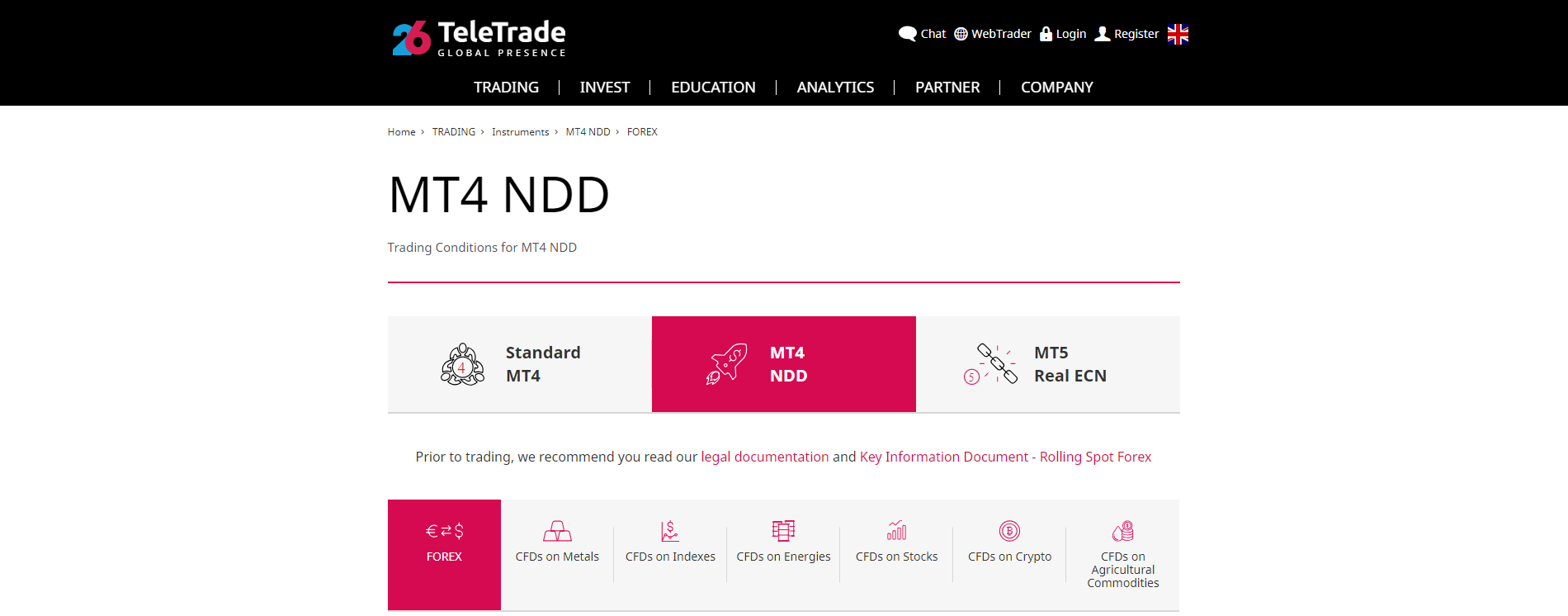

TeleTrade offers one commission-free trading account and two commission-based alternatives. The EUR/USD commences from a mark-up of 1.7 pips or $17 per 1.0 standard lot in the commission-free Standard MT4 account. The commission-based MT4 NDD account features a spread of 0.9 pips for a commission of 0.007% or $16, decreased to 0.2 pips and 0.008% or $10 in the MT5 Real ECN account. Those are the minimum costs, with average prices above that, rendering all three uncompetitive but largely within the norms for CySEC brokers. Equity CFDs face a 0.10% commission and an above-average mark-up. Traders will pay swap rates on leveraged overnight positions, and they do receive the impacts from corporate actions such as dividends, splits, and mergers. Third-party withdrawal fees exist, depending on the payment processor.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

TeleTrade maintains three expensive trading accounts. The minimum spreads listed on the home page contradicts those in the contract specifications for the two MT4 account types.

What Can I Trade?

Forex traders have access to 56 currency pairs, 19 cryptocurrency pairs, and 23 commodities. Completing the asset selection are 104 equity CFDs and eight Index CFDs. The cryptocurrency selection remains a superior offering as compared to many other non-cryptocurrency brokers, and the commodity selection is acceptable. The rest is below average, and while the overall choice of trading instruments may suffice for new retail traders it fails to cater to traders with advanced needs.

TeleTrade offers a sub-standard 210 assets across five sectors.

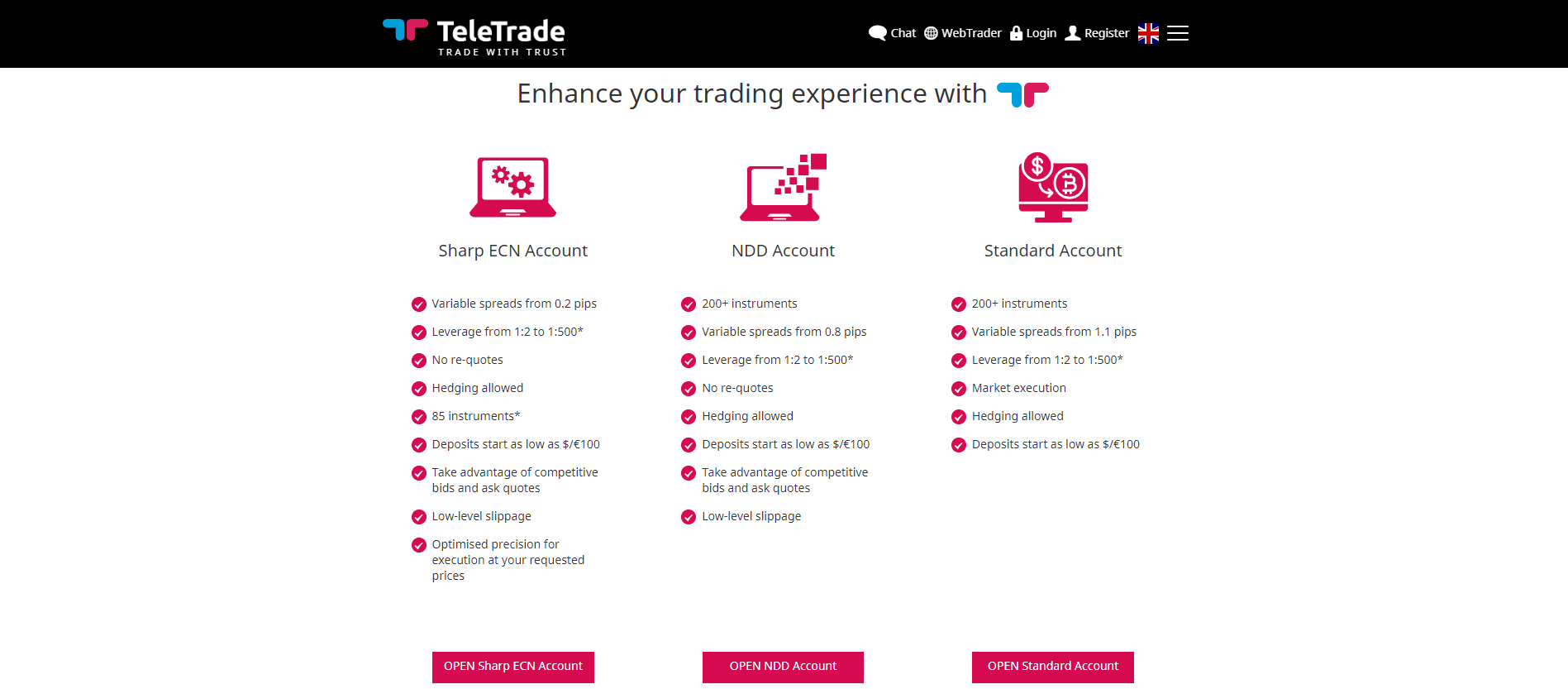

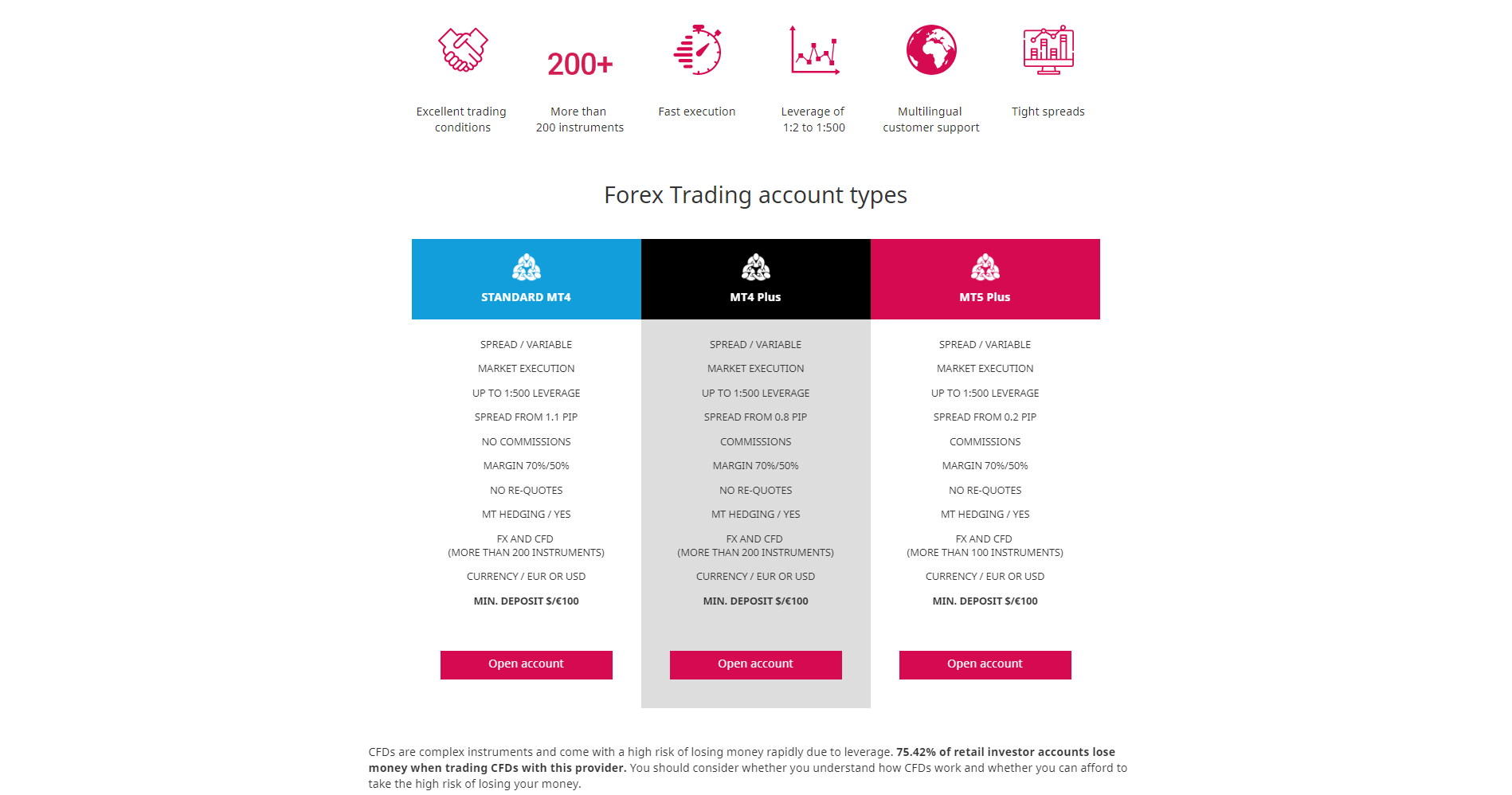

Account Types

Traders may choose between the commission-based MT4 Standard Account or the two commission-based MT4 Plus and MT5 Plus alternatives. Another section refers to the MT4/MT5 Plus as MT4 NDD and MT5 Real ECN, respectively. TeleTrade labels them NDD and Sharp ECN Accounts on the home page. This inconsistency from a broker that has been in operation for 26 years is unacceptable and displays sloppiness and a disturbing degree of unprofessionalism. TeleTrade also lists maximum leverage of 1:500. Due to the ESMA crackdown, that applies to professional clients only. Retail traders remain restricted to 1:30, and from a broker catering to retail traders, this marketing gimmick, while technically correct, is inexcusable. The minimum deposit is $100 across the board, with the MT5 account featuring the best cost structure but not all trading instruments. It leaves the MT4 NDD account as the best choice among three uncompetitive ones.

TeleTrade maintains three account types.

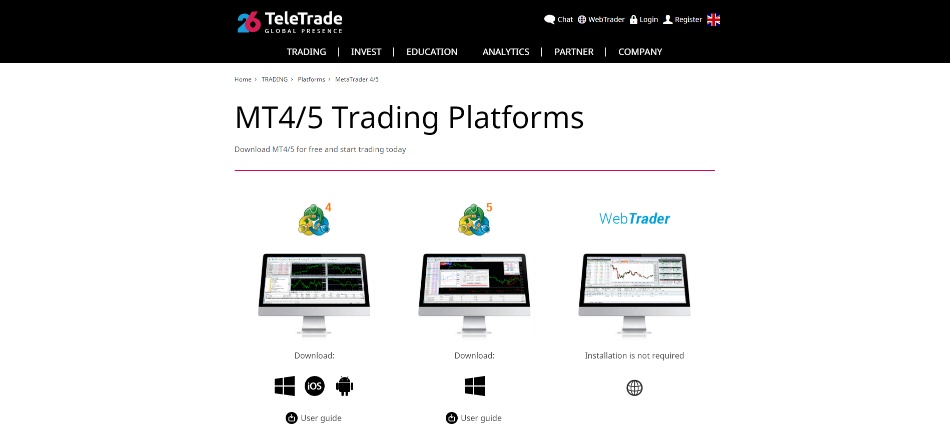

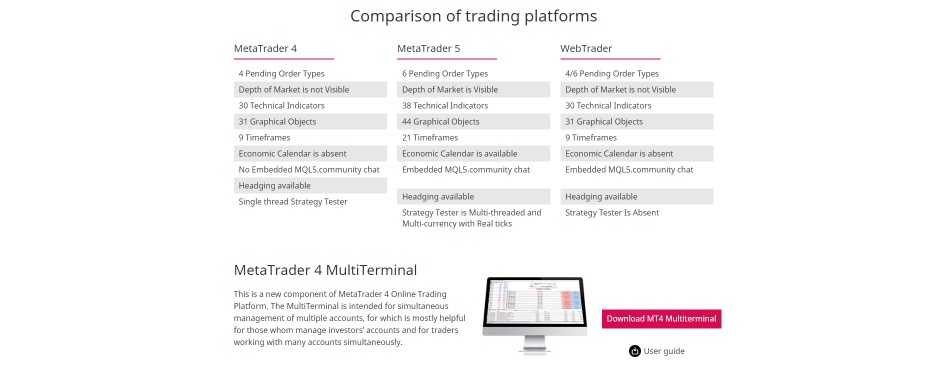

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

TeleTrade delivers the out-of-the-box MT4 and MT5 trading platforms, labeling them and itself as a broker using cutting-edge technology. It is another marketing trick to mask the absence of it. The core versions remain sub-standard and require third-party upgrades. Both support them, with the MT4 home to more than 20,000. TeleTrade does not provide any, however, placing its clients at a further disadvantage. The MT4 MultiTerminal is also available, which supports retail account management.

TeleTrade only serves the core MT4/MT5 trading platforms.

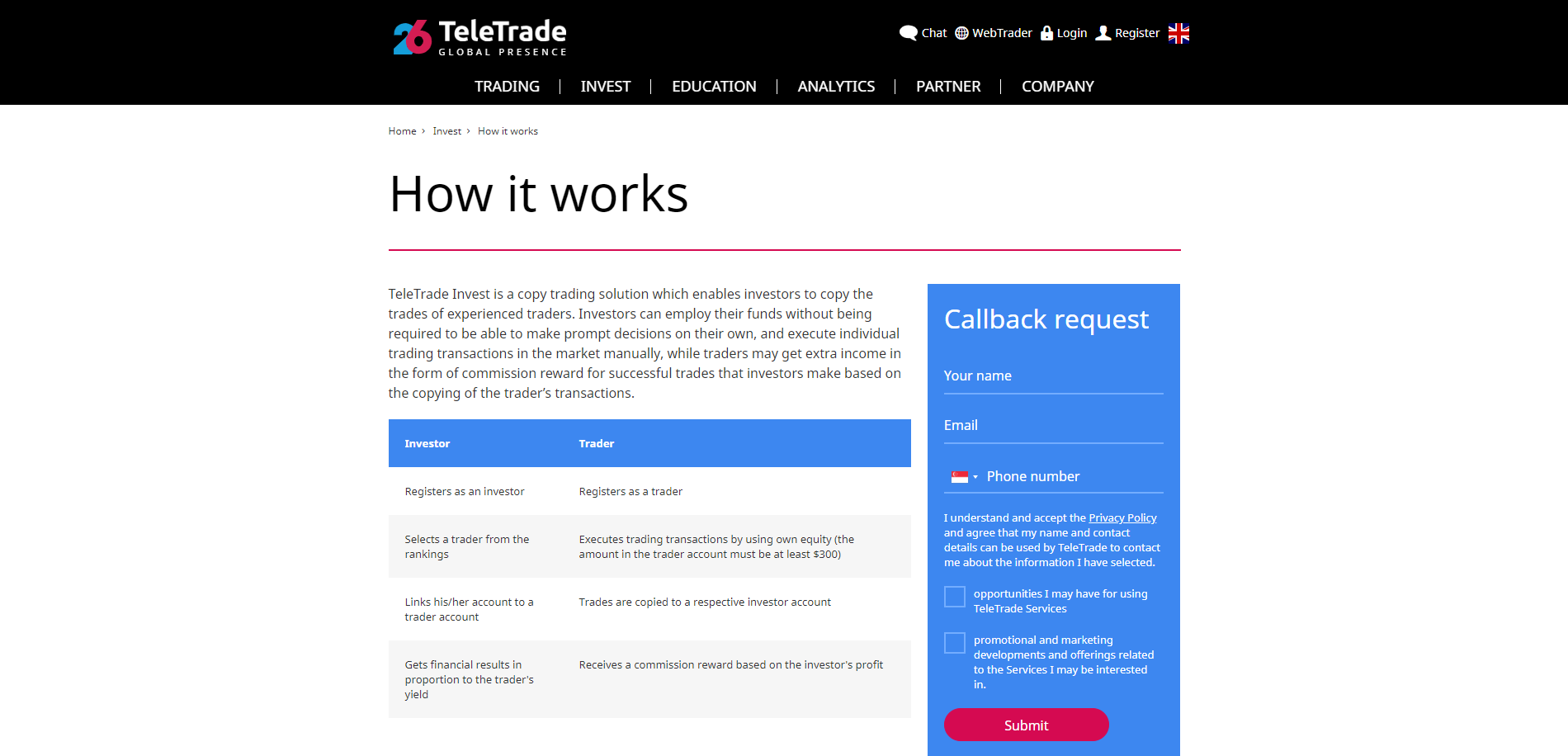

Unique Features

TeleTrade developed its own copy trading platform, which it labeled TeleTrade Invest. Traders who wish to become a signal provider must maintain a minimum of $300 of equity in their trading account. The maximum leverage remains limited to 1:100 which, again, applies only to professional accounts since the ESMA limits retail traders to 1:30. A signal provider may charge a commission between 1% and 50%, however TeleTrade takes a 40% commission from their “reward,” which is an unacceptable, excessive cost. Besides the copy trading platforms, the marketing tricks, many misleading, stand out. The absence of plugins for ECN trading is also worth noting.

Copy trading is available via the proprietary TeleTrade Invest platform.

TeleTrade charges an unacceptable 40% fee of the “trader's reward” for traders who wish to become signal providers.

Research and Education

Traders have access to a competitive research section consisting of numerous sub-categories with frequent updates and fresh daily content. It represents the best asset that TeleTrade offers. The Market News section features fundamental news relevant to the trading day and is a quality source of potentially market-moving events and source of trading ideas. Expanding this resourceful category is the Market Overview category, where traders can read opinions by one of the TeleTrade analysts. Under Technical Analysis, traders will find trading recommendations in a brief but quality format. A video section exists with a daily market briefing, though the last update is from May 2020.

While TeleTrade shines with its in-house research, the educational section remains well behind that of competitors. The live webinars by one of the six analysts or traders form the core, but no details exist. Sixteen videos cover topics on using MT4/MT5 and serve as a help section rather than intended for educational purposes. Overall, poor execution means new traders do not receive quality content.

Traders may start their trading day by reading the Market News section.

The Market Overview features more market commentary and trading ideas.

Trading Ideas are available under Technical Analysis.

The daily market briefing in video format shows the last update in May 2020.

Live webinars are the sole educational tools, but no information exists.

The videos listed under Education are help videos and do not provide educational content.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

Customer support is available 24/5, and TeleTrade lists phone numbers, e-mails, and its physical address. Live chat remains the most convenient way to reach out to the support team, and while a few informative videos do exist, a dedicated FAQ section is missing. TeleTrade describes its products and services well, however, limiting the need for assistance for most traders.

Customer Support is readily available via numerous channels.

Bonuses and Promotions

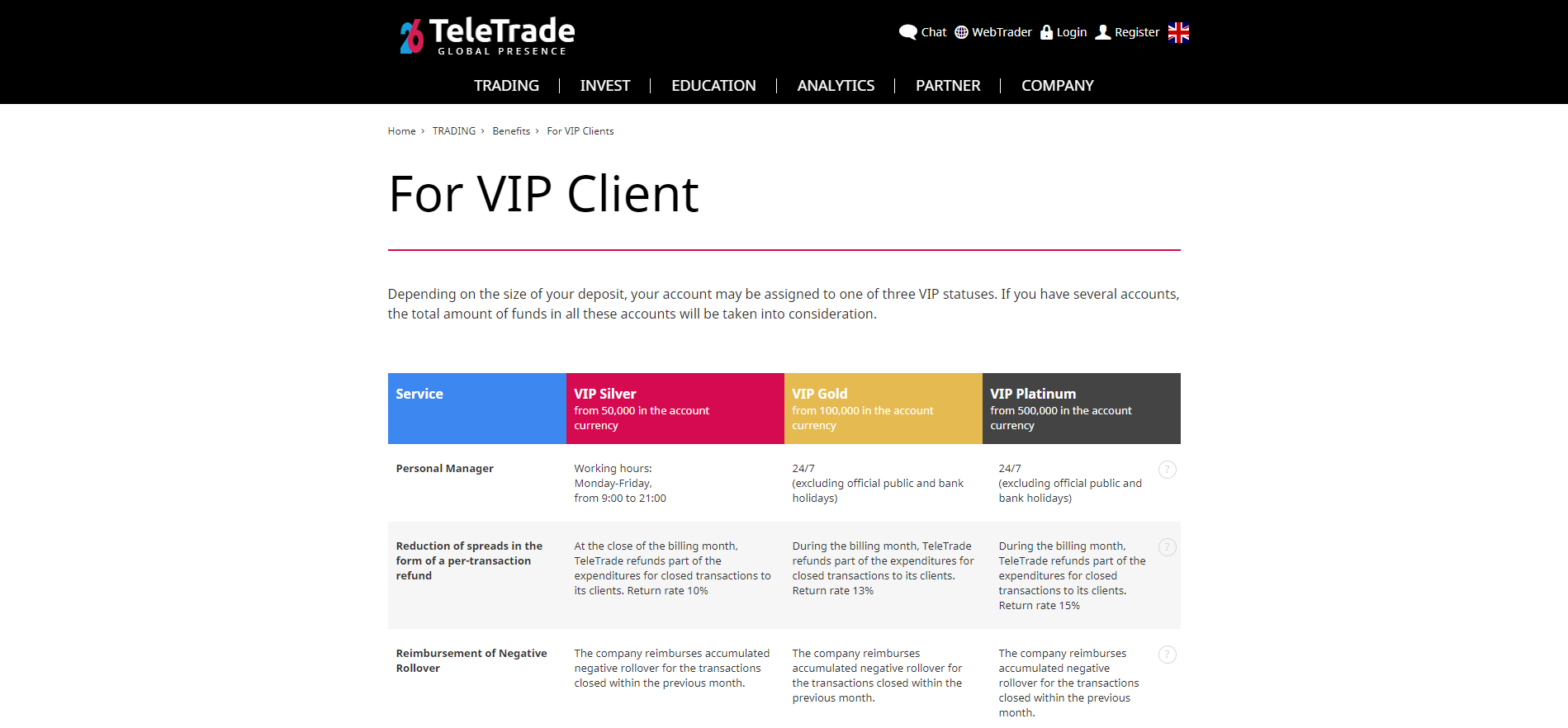

The ESMA regulatory framework prohibits EU-based brokers from offering bonuses and promotions. TeleTrade maintains a three-tier VIP program for clients with deposits above $50,000. It includes a rebate program, but competitive brokers offer more for fewer requirements, making them better destinations for active traders. Given the regulation of TeleTrade, it is unable to compete.

The three-tier VIP offer at TeleTrade remains inferior to competitive brokers.

Opening an Account

An online application handles new applications, following established industry standards. New traders get access to the back office by submitting their name, mobile phone number, e-mail, and desired password. TeleTrade allows clients to use their Google or Facebook accounts for that purpose. Account verification remains mandatory in compliance with AML/KYC stipulations. Traders usually satisfy this requirement after sending a copy of their ID and one proof of residency document.

The Account Opening process is in line with industry standards; mandatory verification is part of the procedure.

Deposits and Withdrawals

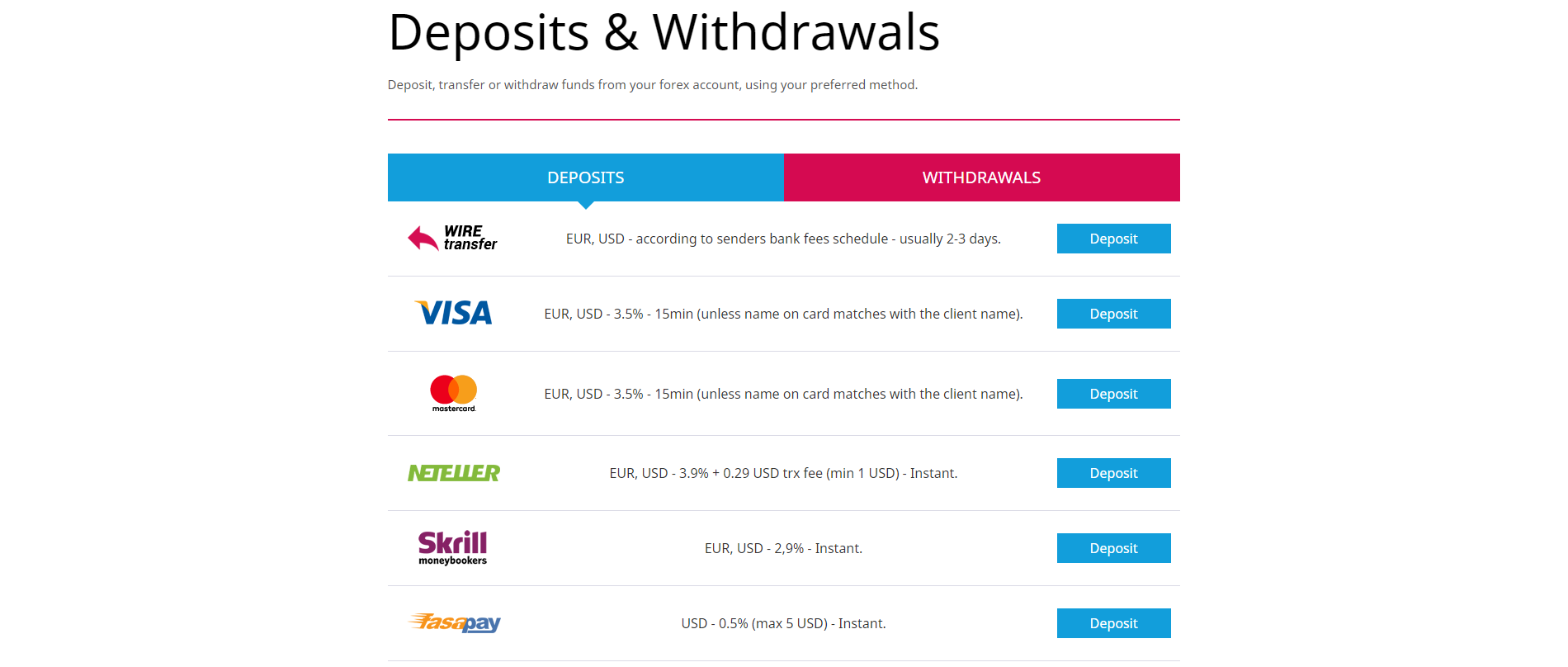

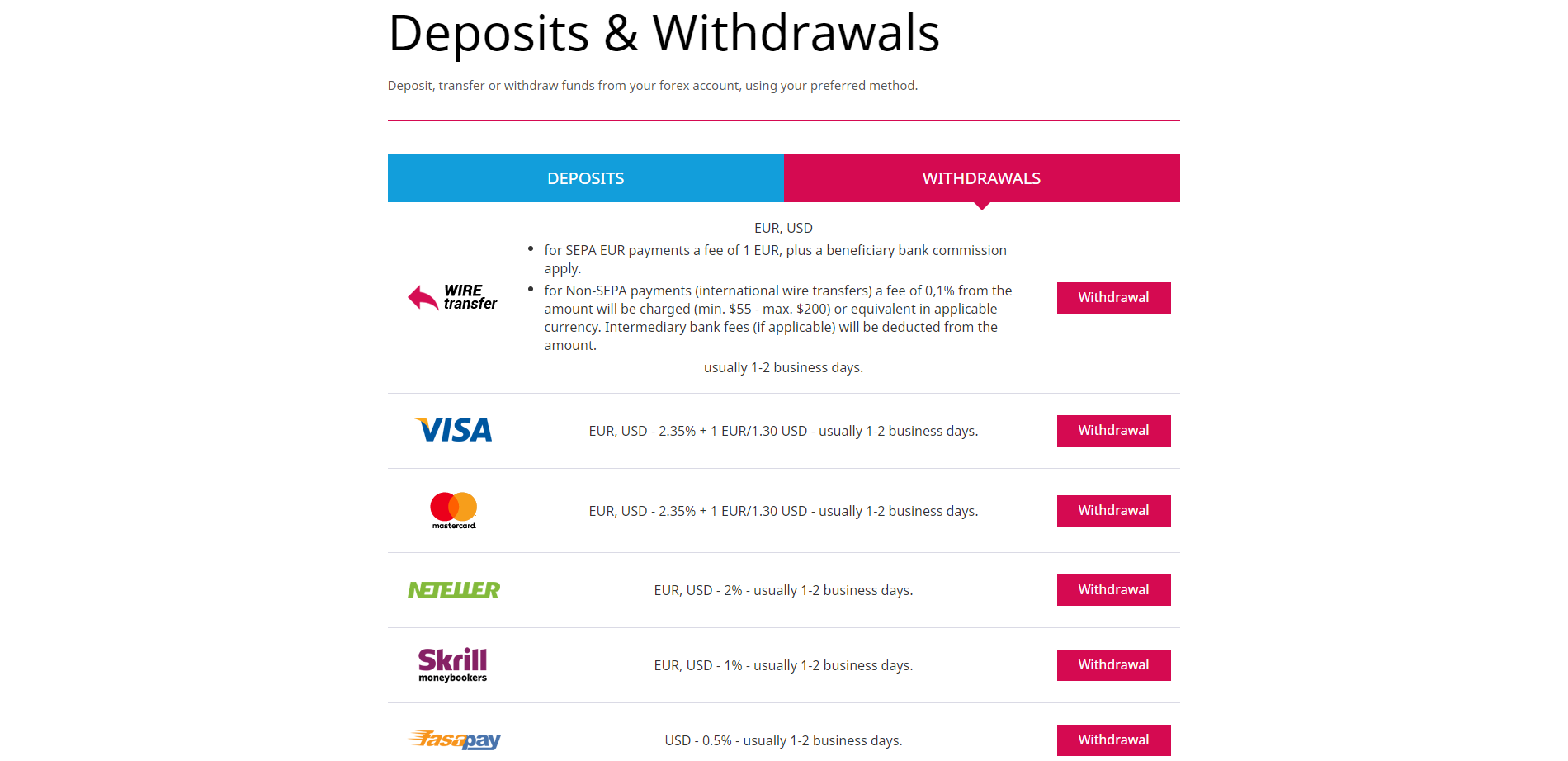

TeleTrade offers bank wires, credit/debit cards, Neteller, Skrill, and FasaPay as deposit and withdrawal options. Processing times and fees depend on the payment processor, but TeleTrade does not feature some of the most cost-efficient options. The available choices will suffice for most traders.

TeleTrade supports only five deposit and withdrawal options.

Costs and processing times vary between providers.

Summary

TeleTrade caters to clients for 26 years out of former broker hot spot Cyprus, which lost its competitiveness in 2018 after the ESMA took counterproductive measures to reign in leverage, including the elimination of bonuses and promotions. Traders have access to one commission-free and two commission-based trading account types. TeleTrade labels the latter two accounts in three different ways in three sections, displaying a sign of carelessness. The pricing environment remains excessive, with the commission-free account commencing from 1.7 pips or $17 per 1.0 standard lot. The commission-based MT4 version lowers the minimum cost to $16, which remains high. The MT5 alternative does not offer all assets, which remain limited at 210.

The in-house research section remains the best asset at TeleTrade. Regrettably, this broker fails to build a competitive brokerage around it. While TeleTrade claims to offer cutting-edge technology, it only provides out-of-the-box MT4/MT5 trading platforms. They support and require third-party upgrades, which this broker does not deliver. It follows the standard mis-marketing of many brokers. TeleTrade also lacks a dedicated educational section. Its in-house developed copy trading platform, TeleTrade Invest, features an unacceptable 40% cost of trader commissions. TeleTrade remains a valuable source of research and trading ideas, which are available to all. As a broker, it remains well behind competitors, across the board.