Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | BaFin, CySEC, MiFID |

Year Established | 1999 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1000 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

TFI Markets Ltd, founded in 1999, and domiciled in Nicosia, Cyprus, is a CySec regulated financial institution, providing multi-platform currency trading for its corporate clientele. It is also EU licensed by MiFid, CBC, BaFin and AMF. TFI was one of the pioneers of the concept of currency trading by launching its TFIFX platform which targeted professional and experienced clients. Since 2009 it has also offered FX margin trading services.

Accounts

There is two accounts at TFI Markets--the Standard account and the Mini Account both with a minimum deposit of $1000. Very little additional information is offered regarding these accounts which is limiting in scope and does not give traders an opportunity to choose the account best suited for them.

Their Demo Account offers traders a virtual balance of $50,000 to start which is a generous amount in the industry. They provide real market conditions to help develop trading strategies for successful future trading. In addition, the demo account offers a choice of multiple order types, a professional charting package and an array of technical indicators.

Features

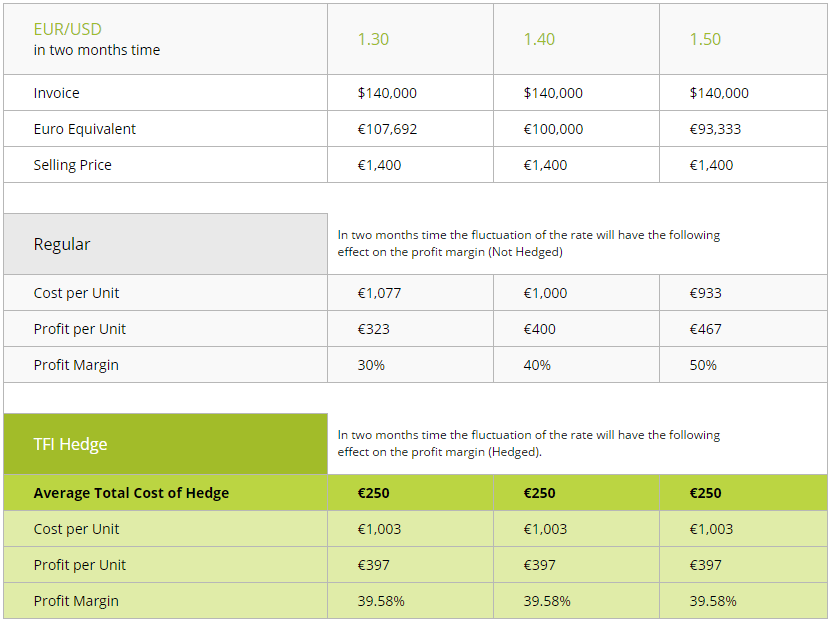

TFI Pay and TFI Hedge services are part of the company’s long term strategy to provide integrated solutions to meet client’s requirements while keeping costs to an absolute minimum.

The company offers its services on a 24 hour basis and clients are able to access their accounts electronically. Imports, exports, prepayments, repayments, payroll, purchases or sales of assets / liabilities and investments in financial instruments are samples of corporate payments handled by TFI Markets for its clients.

TFI Hedge offers the chance to benefit and/or hedge currency risk through a variety of options and option structures. There are four major option strategies: the Long Put option-right to sell, the Long Call option- right to buy, the Short Call option-obligation to sell and the Short Put option- obligation to buy.

TFI Hedge Service

These options can be combined if a more complicated option structure suits the trader’s hedging or investment needs.

The options at TFI Markets include fully flexible choice of maturities up to 1 year, a choice of exercise method-spot or cash, customized solutions to suit any corporates special needs, OTC European-style option structures on 30+ currency pairs, no margin deposit needed for buying options/low margin requirements on selling options, trading lines with the world’s biggest international banks and improved access to interbank liquidity.

TFI Markets offers a currency converter including fees and charges for coverting currencies and this is posted on the landing page.

In addition, traders can access the margin calculator and the pip calculator.

The margin calculator can be used to accurately find out the margin required when a new position is opened. The pip calculator accurately displays the pip value and indicates the smallest incremental move an exchange rate can make in Forex markets. Depending on the context, this is normally one basis point 0.0001

Deposits/Withdrawals

Deposits can be made at TFI markets with credit or debit cards as well as with bank wires. Bank wires take between 1-2 days before they are credited to an account.

Withdrawals are made online and funds are redirected to the method used for the deposit.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |      |

I was surprised to see that TFI Markets does not have a chat which is something that has become pretty standard in today’s online Forex world. In fact, the only way to contact this broker is through email or their online form.

Conclusion

For a broker doing business in today’s market, I found the TFI Markets website very limited in information. There is scant material on their available accounts and I was hard pressed to find anything on their trading platforms. There are only a few educational offerings and when doing this review, I didn’t see any bonuses or promotions. All this does not make this broker particularly attractive to traders.

Features

TFI Markets offers a very diverse set of trade options that would greatly benefit all traders. In addition to the wide range of available securities, the ability to scalp is especially advantageous to short-term traders looking to commit a high volume of daily trades. Meanwhile, the benefits of hedging may appeal to longer-term investors looking to be able to safeguard their trades.

Platforms

Proprietary Platform

TFI Markets can compete with the best of the market’s brokers with their intuitive trading platform custom developed for its traders.

TFIFx Mobile Platform

MetaTrader 4

They also offer the MetaTrader 4 platform with its unique client terminal features that help traders maximize their profitability. These include: 30+ built-In technical Indicators, analytical tools for determining price dynamics, Expert Advisors (EAs) testing, a full screen display of charts for easy analysis, and numerous chart options.

Mobile

With the MetaTrader 4 App for your Android phone or Tablet you gain access to the platform's features and flexibility on your Android mobile operating system.

Traders can also stayed connected to the mainstay of their trading platform MT4 with the use of Smartphones or iPhones with the Mobile Webtrader and Windows Mobile trading platforms

All the apps are available as a free download from the Apple iTunes Store and iPhone App Store.

MetaTrader 4 Mobile Platform

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |