Editor’s Verdict

Overview

Headquarters | Australia |

|---|---|

Regulators | ASIC, CySEC, FCA, FSA, FSCA, JFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | None |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

Average Trading Cost GBP/USD | 0.2 pips ($2.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Bitcoin | $15.10 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

ThinkMarkets is an Australian and UK-based multi-asset broker founded in 2010. It has dual headquarters in Melbourne and London, as well as regional offices across the Asia-Pacific region, the Middle East, North Africa, Europe, and South America. It maintains regulatory oversight in four jurisdictions, namely, the UK, the Seychelles, Australia and South Africa. It maintains a secure trading environment, and ensures superior technology powers its core trading environment. Traders have three trading platforms, three trading tools, and a choice of over 1,500 assets to manage their portfolios. A competitive cost structure increases the competitive advantage ThinkMarkets delivers for its traders. New traders have access to a quality educational section, and their blog offers daily market commentary. Per the UK unit, data shows that 75.43% of retail traders lose money at ThinkMarkets.

Regulation and Security

ThinkMarkets is a well-regulated and fully compliant broker across three jurisdictions. The Australian Securities and Investments Commission (ASIC) regulates TF Global Markets (Australia) while the UK Financial Conduct Authority (FCA) authorizes TF Global Markets (UK). Additional oversight exists via the South African Financial Sector Conduct Authority (FSCA) for TF Global Markets (South Africa) (Pty) Ltd. Most international clients will trade with the unregulated Bermuda entity, Think Capital Limited. The payment processor for all subsidiaries, TFG (Payments) Limited, operates out of the UK.

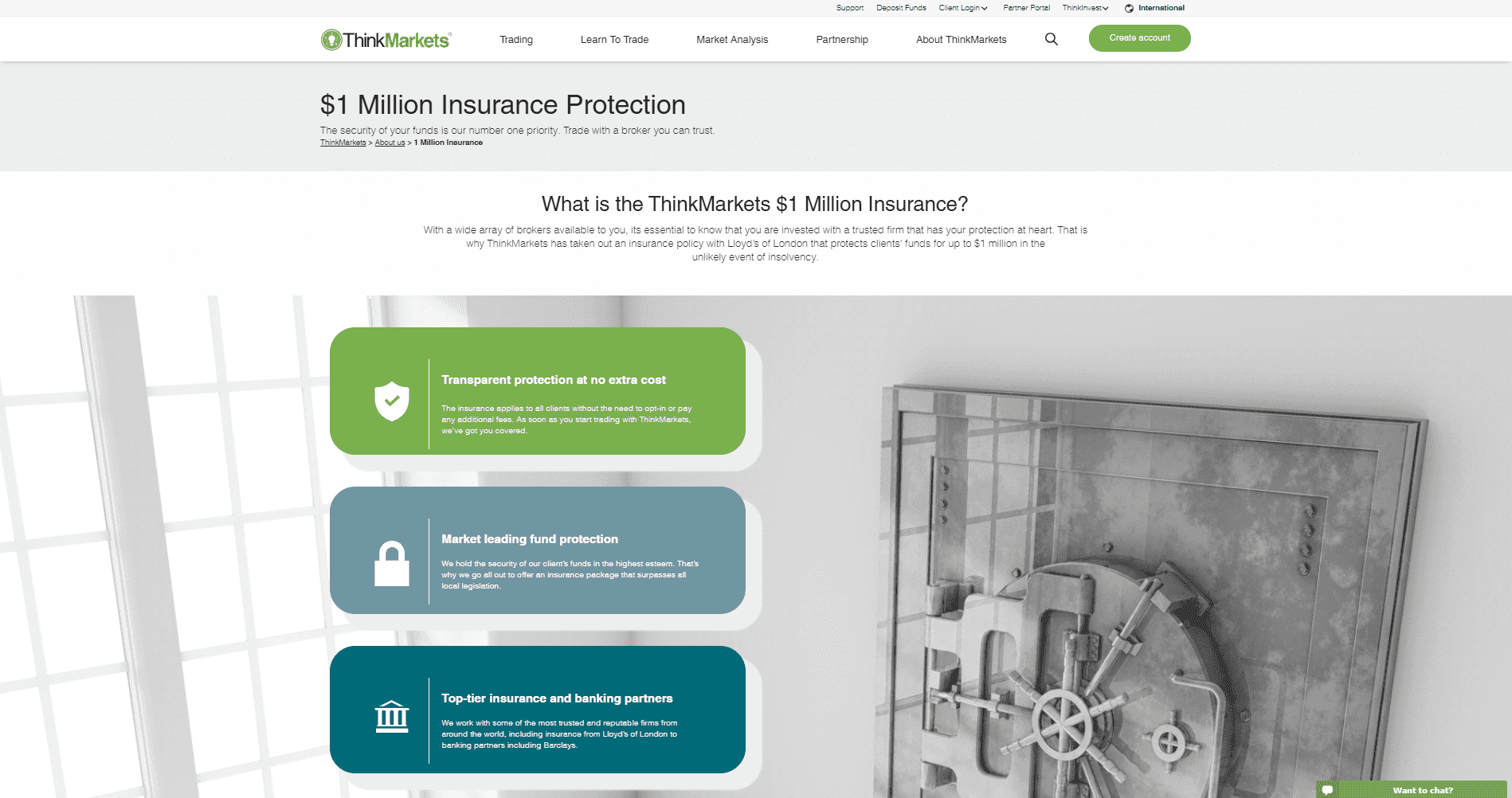

While client deposits remain segregated from corporate funds, as mandated by regulators, the best protection provided by this broker is a separately acquired insurance policy. This market leading policy, with coverage of $1,000,000, covers traders' portfolios in the unlikely event of insolvency. It confirms the financial strength of the broker's balance sheet and the management team's confidence in the operational stability of ThinkMarkets. Traders looking for a well-established multi-asset broker with a safe and secure trading environment will feel reassured trading at ThinkMarkets.

Thinkmarkets is also regulated by the Japanese Financial Services Agency (JFSA) with license no. 0250 & the Cyprus Securities and Exchange Commission (CySEC) with license no. 215/13.

ThinkMarkets is compliant with three regulators.

It also offers industry-leading deposit insurance of up to $1,000,000.

Does ThinkMarkets accept US clients?

No, ThinkMarkets does not accept U.S. traders and is not CFTC/NFA registered. See the leading US forex brokers for U.S. clients.

Fees

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips ($2.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Bitcoin | $15.10 |

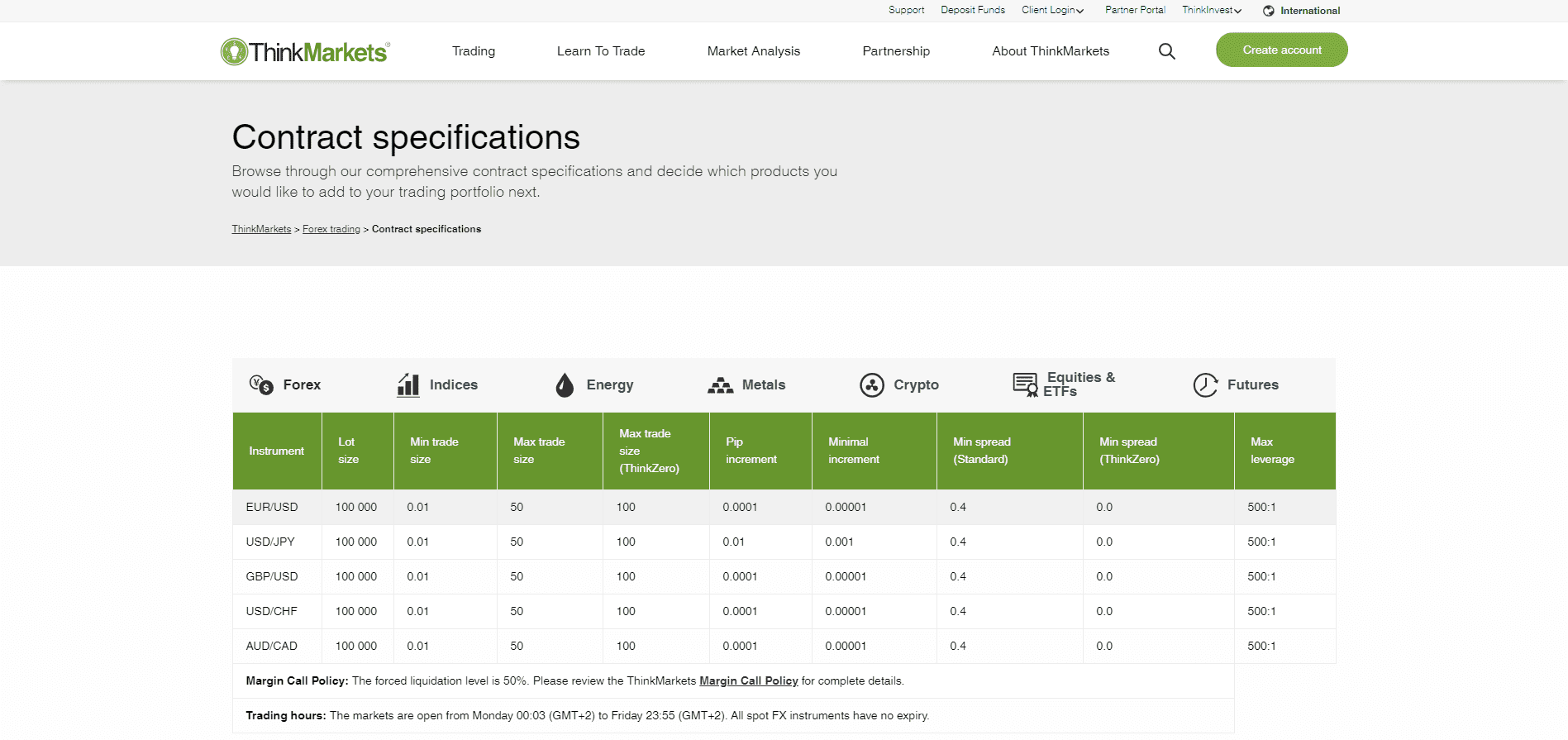

ThinkMarkets earns the bulk of its revenues from spreads and commissions, where it maintains a competitive environment. The commission-free mark-up commences from just 0.4 pips, one of the best offers available among all online brokers, while the average is 1.2 pips. Active traders will benefit from raw spreads as low as 0.0 pips with an average of 0.1 pips for a commission of $3.50 per lot or $7.00 per round lot. Traders have to pay swap rates on leveraged overnight positions, and ThinkMarkets does pass on all corporate events impacting equity and index CFDs. After six months of inactivity, a $30 monthly fee applies, and ThinkMarkets charges an excessive 3.00% currency conversion fee. Select market data fees and third-party payment processor charges also apply. The core pricing environment is competitive, but other costs are notably higher than at many competing brokers.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

ThinkMarkets maintains a competitive core pricing environment.

What Can I Trade

The asset selection at ThinkMarkets is outstanding for most traders. Most assets fall within the equity and ETF space, where more than 1,500 CFDs choices await traders. These are complemented by 16 index CFDs, plus an additional six which are priced in the Australian Dollar. Forex traders have access to only 40 currency pairs, placing ThinkMarkets towards the bottom of the list. Completing the asset selection are ten commodity CFDs, five cryptocurrencies, and 13 futures contracts. ThinkMarkets provides equity traders the best choices, while Forex traders have a more limited selection. The overall asset choice remains competitive.

ThinkMarkets provides over 1,500 assets across seven sectors.

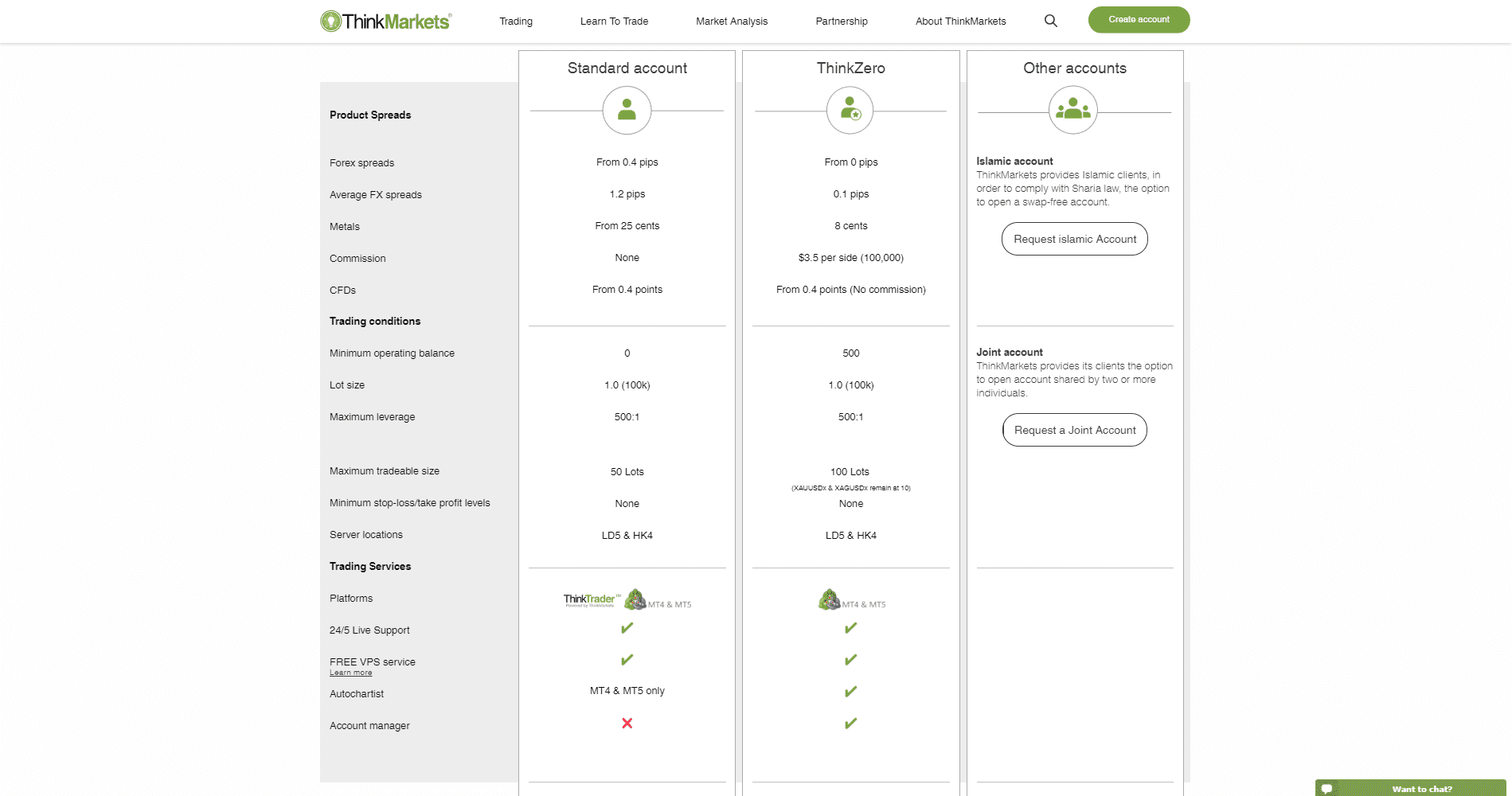

Account Types

Traders may choose between the commission-free Standard Account and the commission-based ThinkZero Account. The former has no minimum deposit requirement, and the latter commands a deposit of $500 or a currency equivalent. Only the Standard Account offers traders access to the proprietary ThinkTrader trading platform, but the maximum leverage on both accounts is 1:30, providing another competitive edge to committed traders. ThinkMarkets also offers a swap-free Islamic Account. The minimum spread in the Standard Account is 0.4 pips, making it one of the lowest commission-free offers among all online multi-asset brokers. ECN traders also have a very cost-efficient pricing environment across the board.

ThinkMarkets maintains two trader-friendly account types.

Trading Platforms

ThinkMarkets provides clients with three trading platforms. Automated traders will likely opt for the industry-leading MT4 trading platform, which remains the most versatile choice due to its excellent infrastructure. With over 20,000 expert advisors (EAs) and custom indicators, many free of charge, it has been at the top of the retail industry since its launch more than 15 years ago. ThinkMarkets also offers the MT5 trading platform, which is often referred to as the failed successor to the MT4. The out-of-the-box MT4/MT5 trading platforms receive two essential upgrades; the Autochartist plugin and Trading Central significantly improve the below-average core versions into cutting-edge solutions. Traders with a Standard Account may also use the proprietary ThinkTrader as an alternative for manual trading, which features a clean user-interface and real-time news from FX Wire Pro. The upgraded MT4 trading platform offers, by far, the best trading experience at ThinkMarkets.

The MT4 trading platform, with the two upgrades, remains the best trading platform.

ThinkMarkets maintains the MT5 trading platform, as well.

Manual traders may find the ThinkTrader a sound alternative solution amid its clean user-interface.

Unique Features

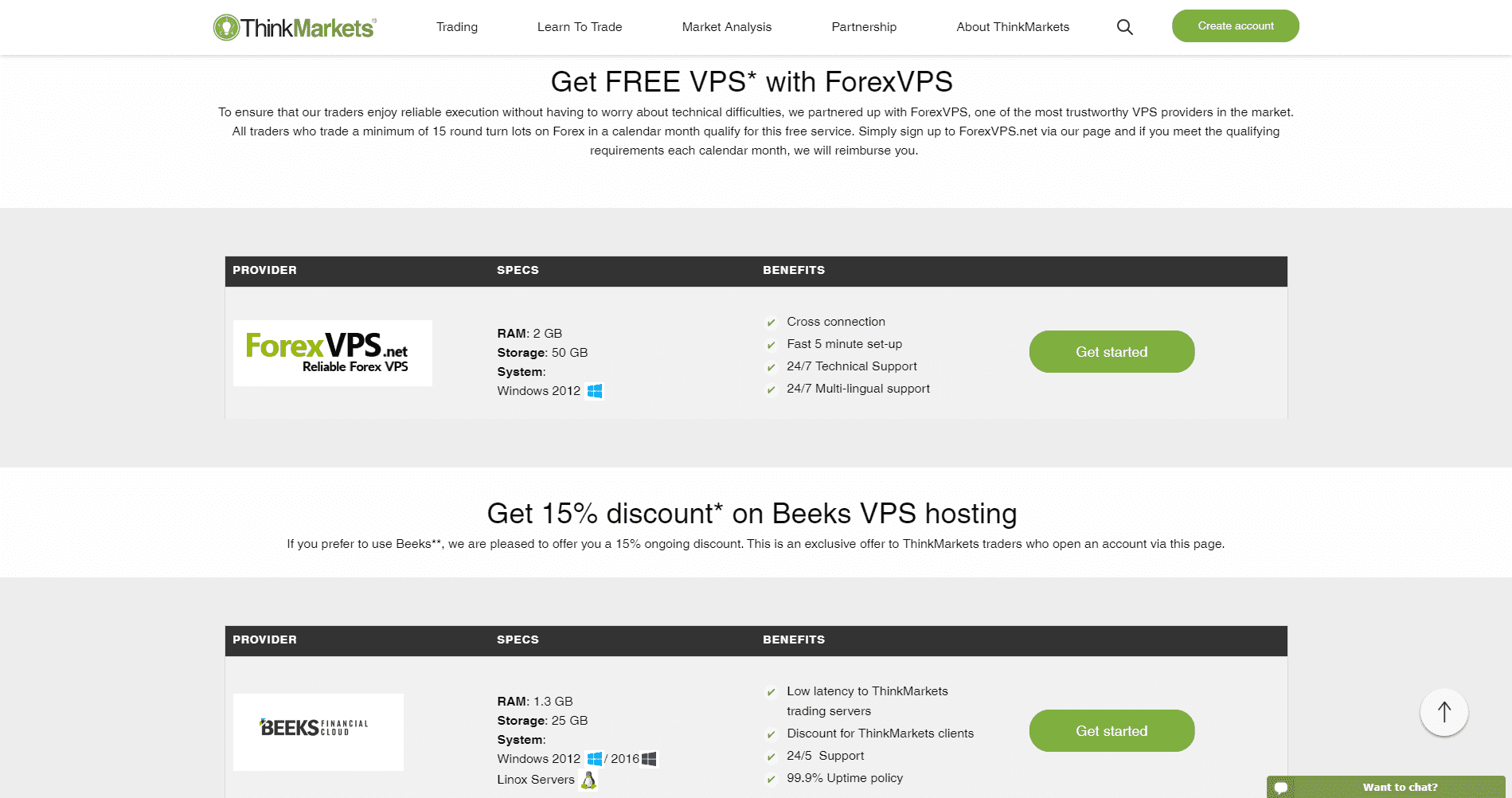

Besides maintaining a competitive core trading environment, ThinkMarkets delivers a series of unique features to further set itself apart from most of its competitors. Manual traders will benefit from the Autochartist MT4/MT5 plugin and its rich suite of features. Trading Central increases the competitive trading tools available at ThinkMarkets and adds another layer of research capabilities. Automated traders have VPS hosting, which is free of charge if they trade 15.0 round lots per month; traders who don't satisfy that criteria will bear an additional fee but one provider does offer a 15% discount. ThinkMarkets supports social trading via market-leader ZuluTrade, while its in-house ThinkInvest caters to retail money managers. Third-party developers can connect to the ThinkMarkets infrastructure via the industry-standard FIX protocol.

Autochartist supports manual traders with automated chart pattern recognition and other tools.

Trading Central adds valuable research and improves the trading environment.

Automated traders will benefit from VPS hosting.

Social trading support exists via ZuluTrade.

ThinkInvest is an in-house retail money management service.

The FIX protocol allows external trading solutions to connect to the ThinkMarkets infrastructure.

Research and Education

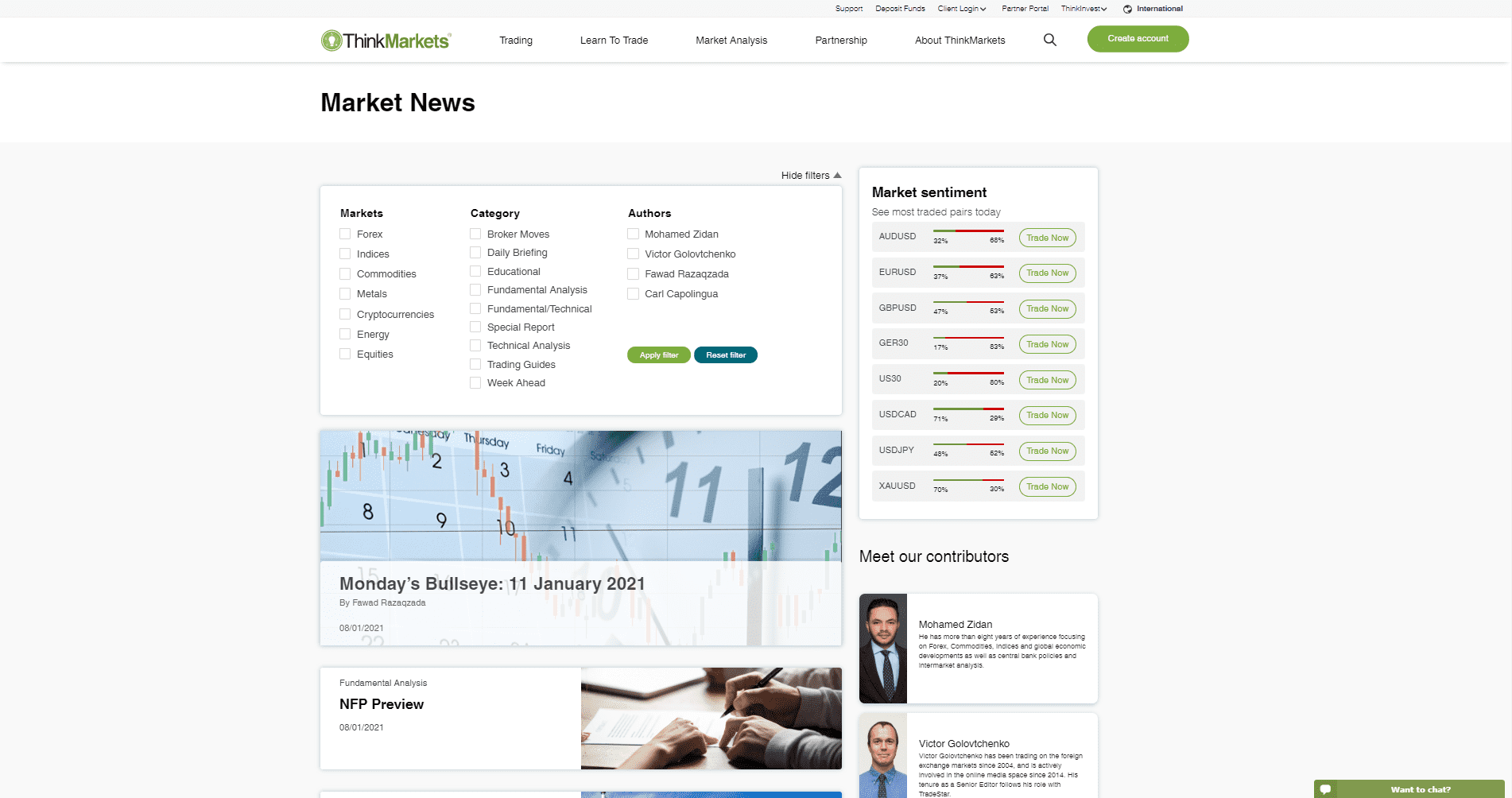

The bulk of research at ThinkMarkets comes from Autochartist and Trading Central. It also deploys four in-house analysts who produce high-quality market commentary and trading ideas under the Market News section. Readers can filter the information based on markets, categories, and authors. It also includes a market sentiment indicator based on client positions.

Daily updates provide traders with quality in-house research.

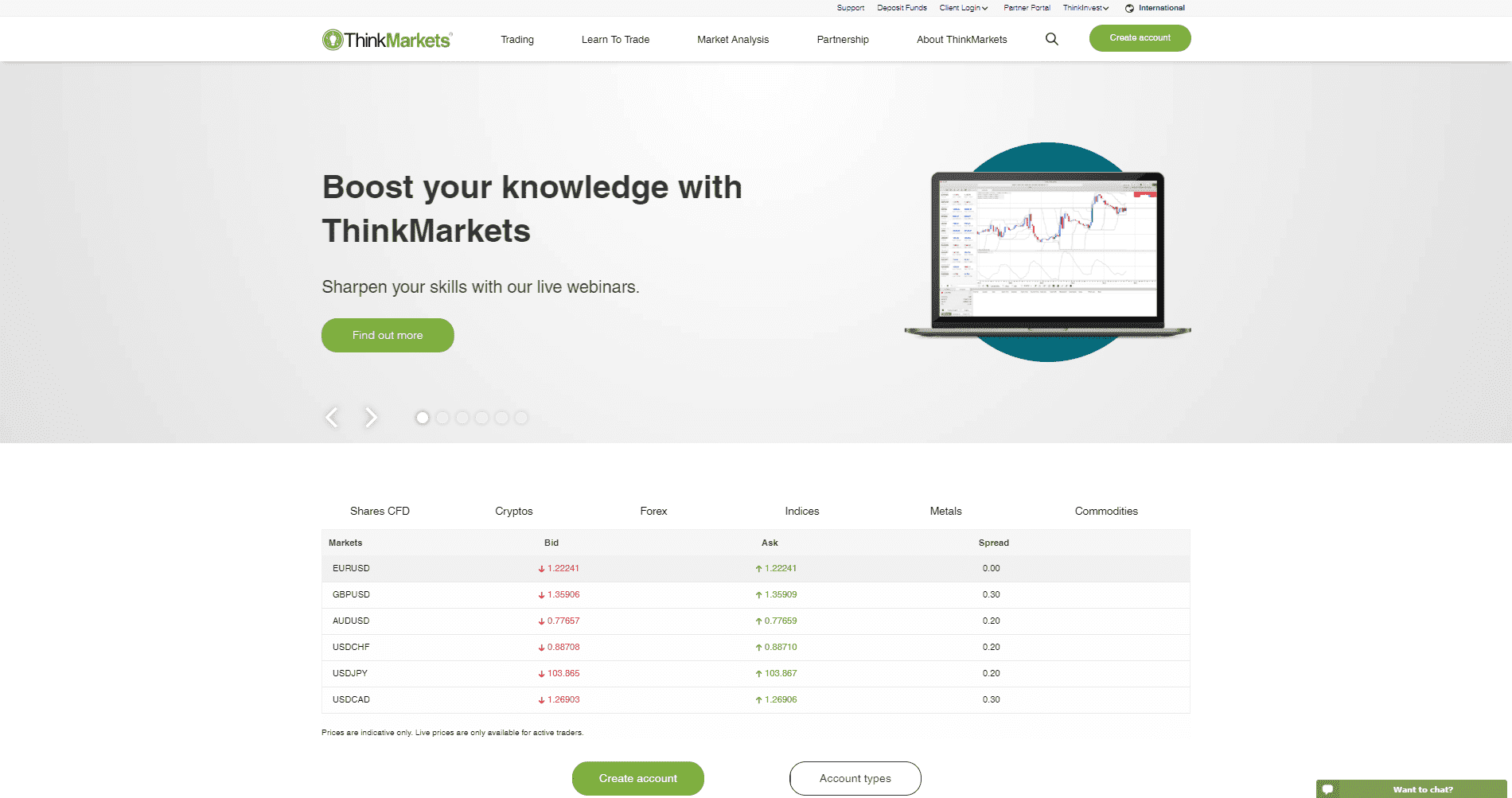

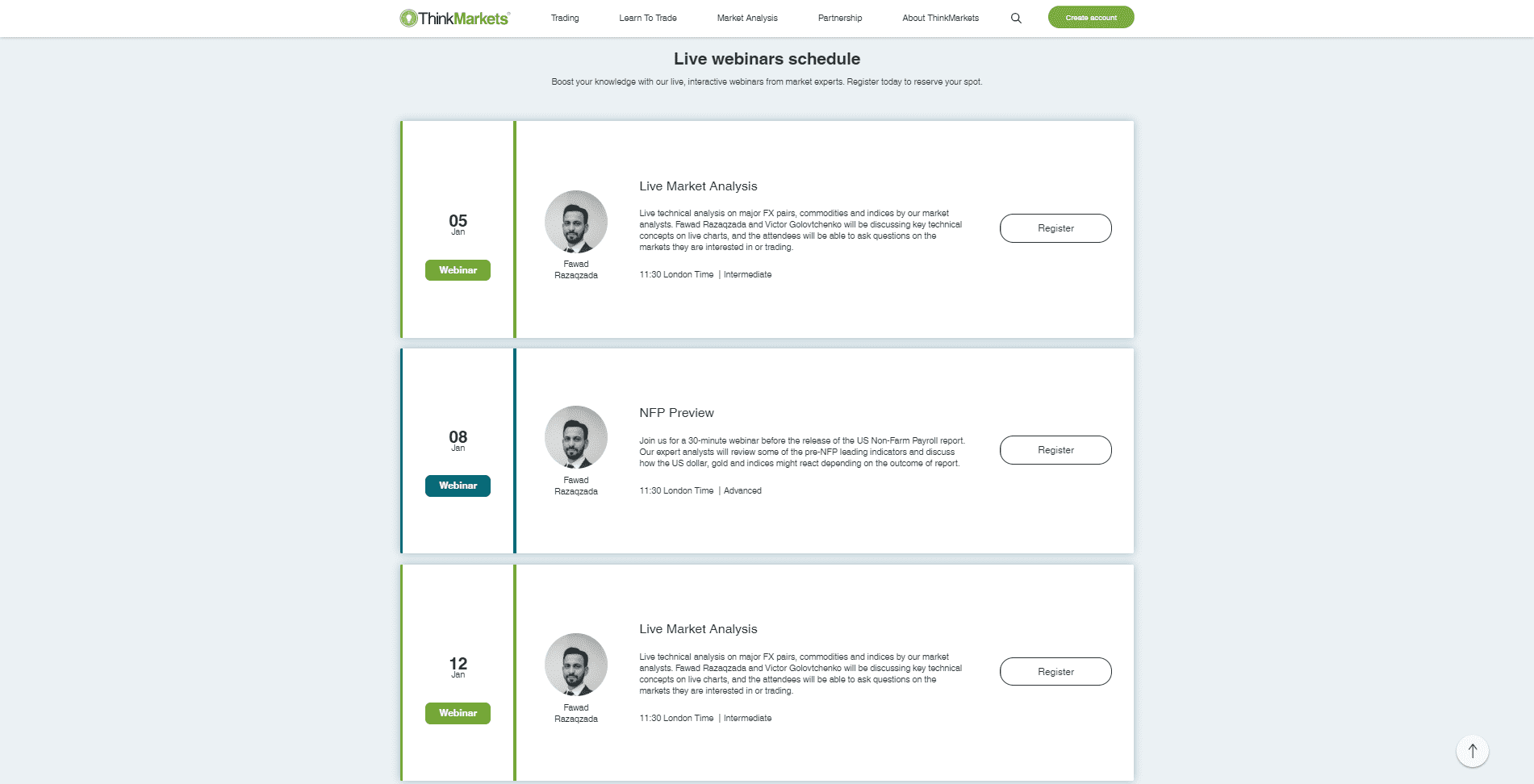

New traders can benefit from the educational content available at ThinkMarkets. While it lacks one uniform portal, the information published in numerous sections across the website are nothing but quality material. The ten trading guides, split into three sections, deliver the best value and are an excellent starting point for new traders. A sign-up is mandatory to download the guides. The MT4 tips and tricks article offers new traders a quick overview of helpful shortcuts. Adding value is the introduction to technical analysis, complemented by the indicators and chart patterns section. ThinkMarkets also hosts live webinars for an interactive experience. The overall educational section provides more in-depth value than many competitors.

The ten trading guides present an excellent starting point for new traders.

Traders should familiarize themselves with the MT4 tips and tricks.

ThinkMarkets provides a valuable introduction to technical analysis.

Some of the most commonly used indicators and chart patterns are well described.

Live webinars enhance the educational value at ThinkMarkets.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |             |

ThinkMarkets maintains 24/7 support. Clients may e-mail, call, or use the live chat function, the most convenient form to reach a support representative. The FAQ section answers the most common questions, and ThinkMarkets explains its products and services well. Most traders will not require assistance, but if the need arises, swift access is available.

Customer Support is readily available, 24/7, across numerous channels; a FAQ section is equally available.

Bonuses and Promotions

At the time of this review, ThinkMarkets neither offered bonuses not hosted promotions.

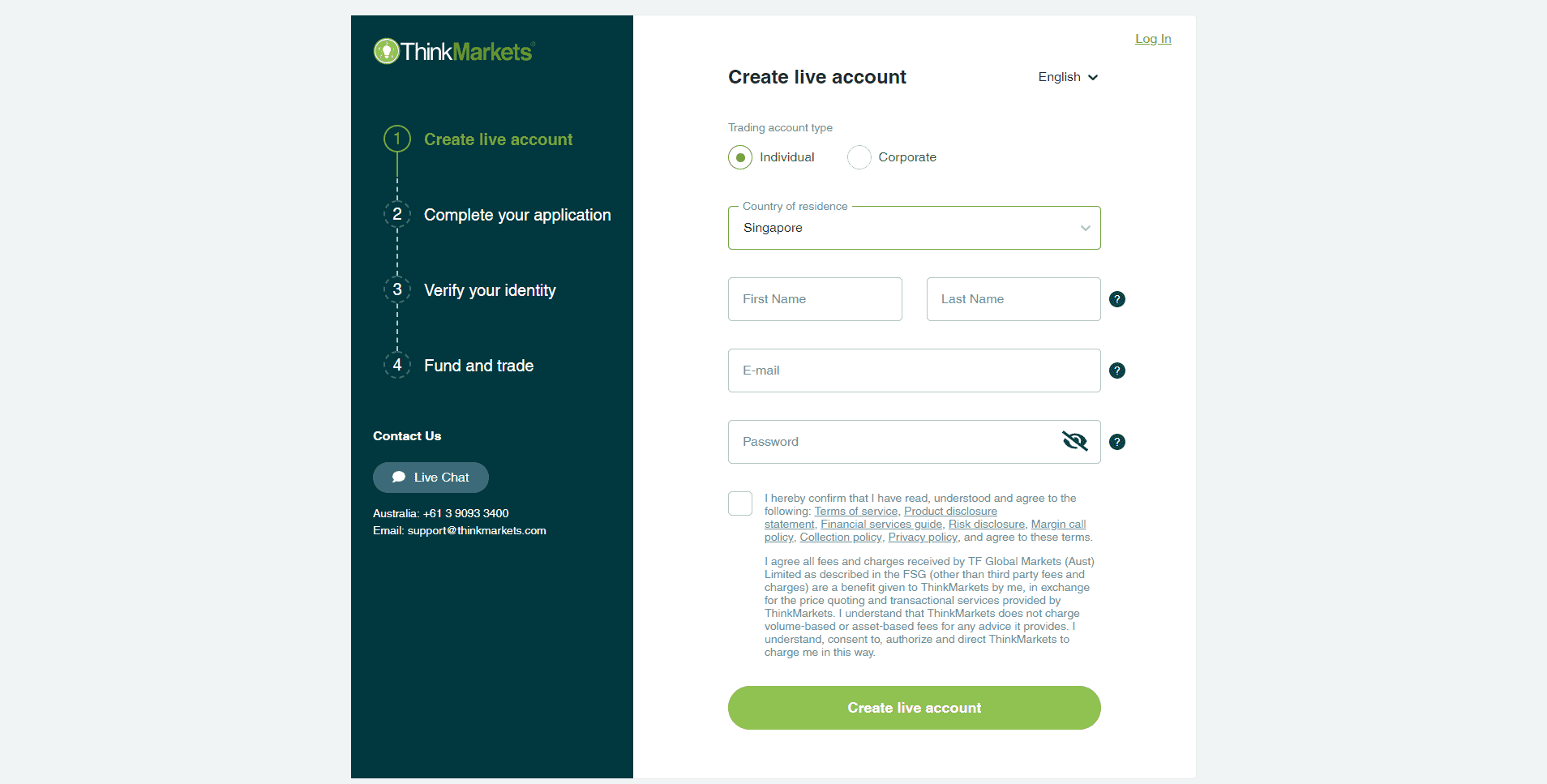

Opening an Account

A four-step online application, which includes funding the trading account, processes all new applicants at ThinkMarkets. It is a straightforward process and follows industry-wide standards. Account verification is mandatory to comply with regulatory AML/KYC rules. New traders must submit a copy of their ID and one proof of residency document dated within the last three months. ThinkMarkets may require additional information, but most new traders will satisfy the verification process with the two items.

The account opening process is straightforward and in line with AML/KYC rules.

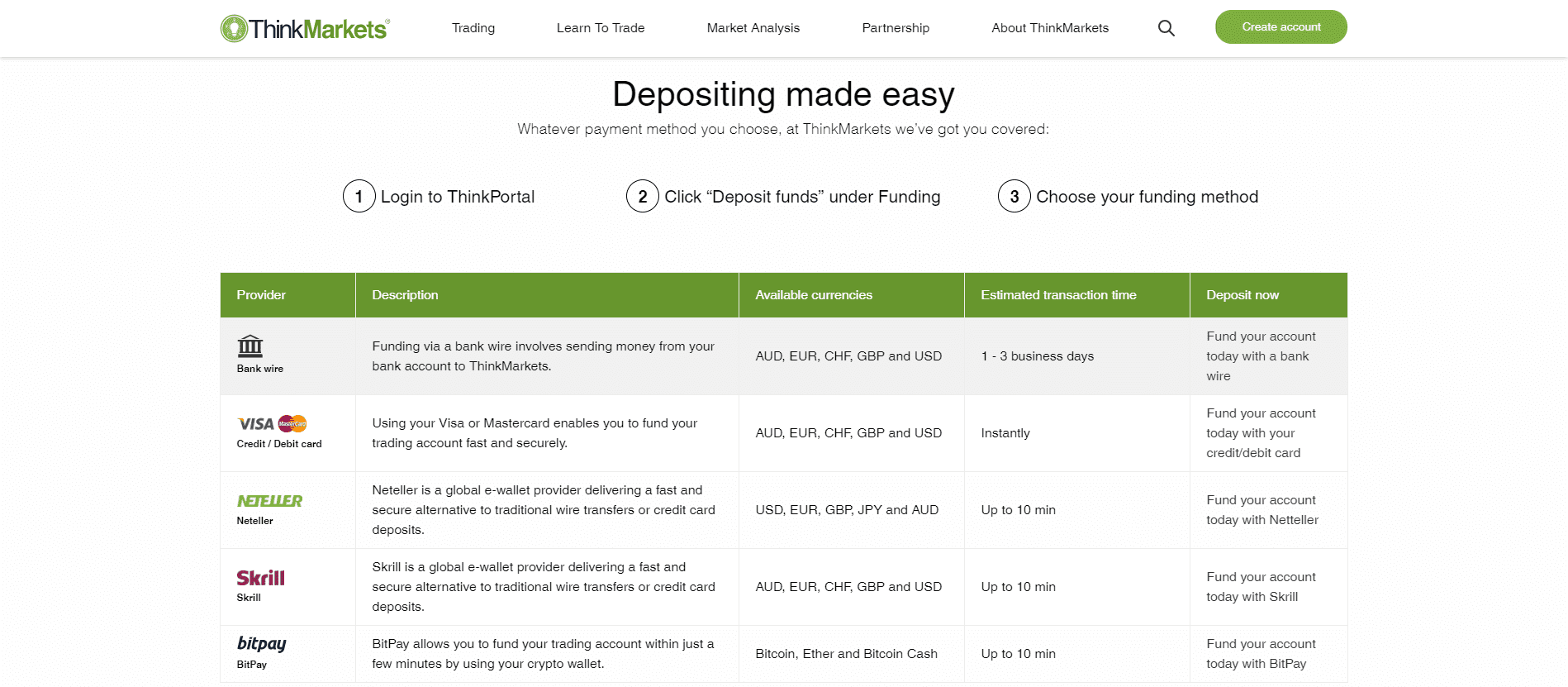

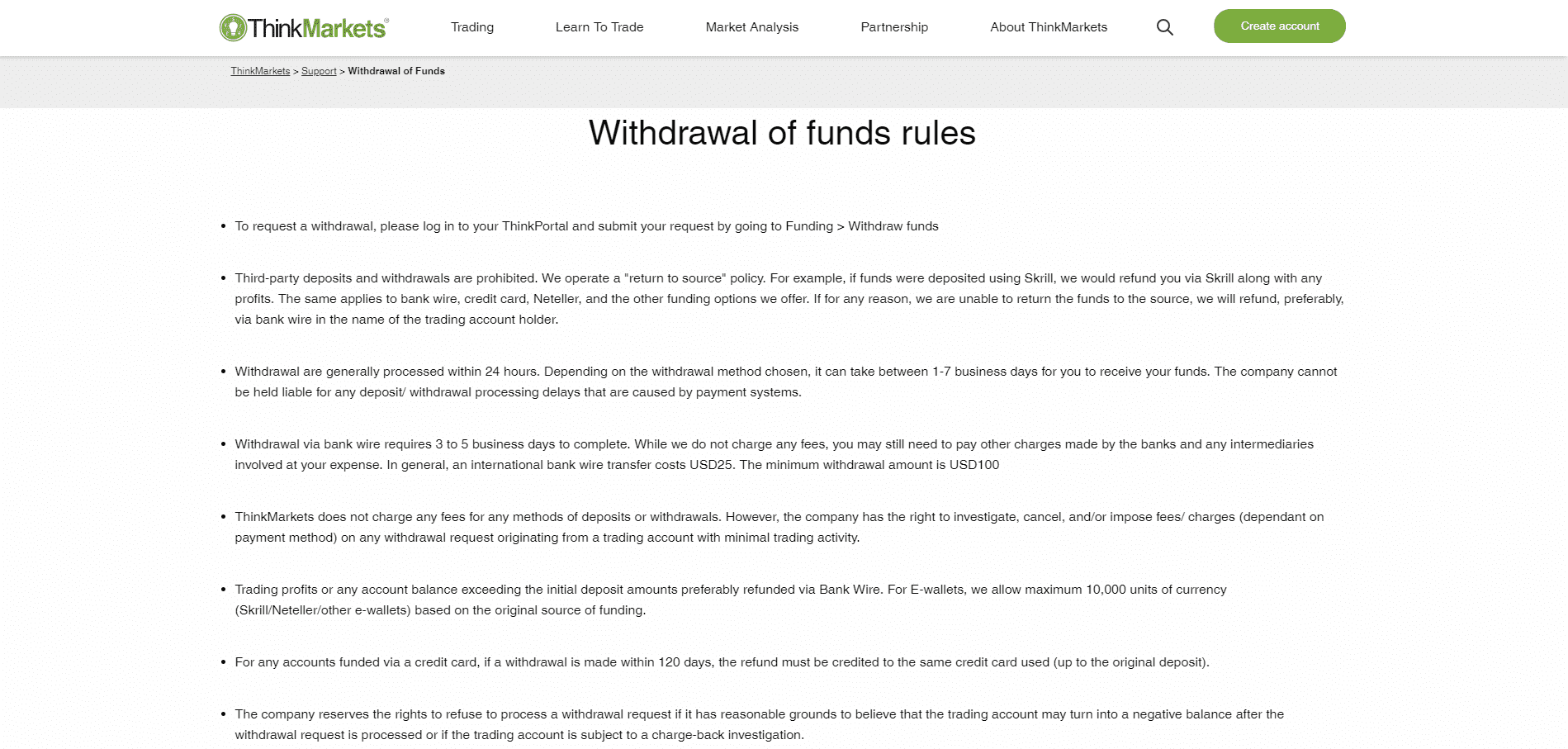

Deposits and Withdrawals

ThinkMarkets offers bank wires, credit/debit cards, Skrill, Neteller, and BitPay as deposit and withdrawal methods. Among its competitors, it is not the most comprehensive selection, but likely will be sufficient for the majority of traders. It appears that there are no deposit fees, and processing times will range from instant to three business days. ThinkMarkets processes withdrawal requests within 24 hours, free of charge, but third-party costs may apply. Bank wires face a $25 fee and require a minimum withdrawal of $100. ThinkMarkets may refuse a request on trading accounts with minimal trading activity, or if the withdrawal risks a negative account balance.

ThinkMarkets does not offer a wide range of deposit and withdrawal options, but the choices will be sufficient for most traders.

Withdrawals may take between one and seven business days to arrive, depending on the payment processor.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

ThinkMarkets is a secure and trustworthy online broker with over ten years of experience. It provides traders with over 1,500 assets across seven categories, mostly in equity CFDs and ETFs. It maintains an excellent technology infrastructure, three trading platform choices, and a competitive core cost structure. A range of trading tools, including Autochartist, Trading Central, and VPS hosting, upgrade the trading environment and allow clients to trade with a competitive edge.

ZuluTrade supports social trading, and ThinkInvest is the in-house retail money management division at ThinkMarkets. Four analysts deliver quality market commentary and trading ideas, while new traders will benefit from a comprehensive educational section. The product and services portfolio at ThinkMarkets remains competitive from a trustworthy trading experience. Forex traders may not have sufficient currency pairs for broad market coverage. Equity traders will find the choices more than adequate. There is no minimum deposit for the commission-free Standard Account. The commission-based ThinkZero Account requires $500 or a currency equivalent. A $25,000 demo account is available at ThinkMarkets. ThinkMarkets established itself as a trustworthy broker with one of the most secure trading environments. The Australian ASIC, UK FCA, and the South African FSCA provide regulatory oversight, but most international clients will trade with the unregulated Bermuda entity. ThinkMarkets is a multi-asset online broker with a dual headquarters in Australia and the UK.FAQs

What is the minimum deposit at ThinkMarkets?

Does ThinkMarkets have a demo account?

Is ThinkMarkets a trustworthy broker?

Is ThinkMarkets regulated?

What is ThinkMarkets?