Editor’s Verdict

TMGM features three trading platforms, competitive commission-based trading fees, 60+ currency pairs for Forex traders, and excellent asset selection for equity traders. It also maintains a cutting-edge infrastructure powered by oneZero Financial Technology and 10+ liquidity providers. I reviewed this broker to evaluate if its trading conditions result in a competitive trading environment. Should you consider TMGM for your trading needs?

Overview

An excellent trading infrastructure with deep liquidity and low trading fees.

Headquarters | Australia |

|---|---|

Regulators | ASIC, FMA, FSC Mauritius, VFSC |

Year Established | 2013 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per lot |

Funding Methods | 11 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the superb trading infrastructure at TMGM, powered by oneZero Financial Technology, making it an ideal choice for demanding traders. The 10+ liquidity providers ensure tight spreads and fast order execution. Manual traders benefit from Trading Central services, algorithmic traders from VPS hosting for 24/5 low latency algorithmic trading, and money managers get the HUBx platform.

TMGM Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. TMGM presents clients with three regulated entities and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Australia | Australian Securities and Investment Commission | 436416 |

New Zealand | Financial Markets Authority | 569807 |

Vanuatu | Vanuatu Financial Services Commission | 40356 |

Is TMGM Legit and Safe?

TMGM, founded in 2013, has a decade of operational history and complies with three regulators, where it has a spotless regulatory record. It segregates client deposits from corporate funds at National Australia Bank, offers negative balance protection, and has established itself as a trustworthy broker.

It is also Hong Kong-based Financial Commission member and its €20,000 per case compensation fund. Additionally, TMGM has a A$5 million professional indemnity insurance coverage. Therefore, my review confirmed that traders should consider TMGM a legit and safe broker.

Fees

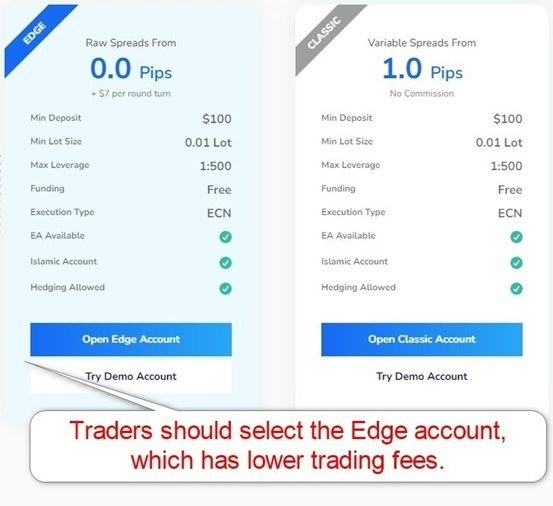

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. The TMGM Edge account offers raw spreads from 0.0 pips for a commission of $7.00 per 1.0 standard round lot. The commission-free alternative, which has the identical $100 minimum deposit requirement, is more expensive with spreads from 1.0 pips or $10.00 per lot. I need clarification on why TMGM has it, as it makes no sense for traders to opt for higher fees voluntarily.

Equity CFD commissions apply, but TMGM does not transparently disclose them. Live chat was unable to answer how high the commissions are. After 45 minutes, the representative noted that he needed more time, which I find unacceptable for a standard question. TMGM should list equity commissions on its website, the industry standard among brokers.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per lot |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at TMGM are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips (Classic) | $0.00 | $10.00 |

0.0 pips (Zero) | $7.00 | $7.00 |

Here is a snapshot of TMGM Forex spreads:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Edge account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $7.00 | -$7.75 | X | $14.75 |

0.0 pips | $7.00 | X | $5.12 | $1.88 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $7.00 | -$54.25 | X | $61.25 |

0.0 pips | $7.00 | X | $35.84 | -$28.84 |

Noteworthy:

- TMGM offers positive swap rates in qualifying assets, meaning traders can be paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

TMGM offers Forex traders a below-average choice of 50 currency pairs and only 5 commodities. Index and cryptocurrency traders get 15 and 20, respectively. While 12,000+ equity CFDs are available, they only cover the US, Australia, and Hong Kong. I also need ETFs as part of the asset selection. Most retail Forex trades have enough currency pairs, but equity traders cannot diversify their portfolios sufficiently.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

TMGM Leverage

Forex traders get maximum leverage of 1:500, ensuring a competitive trading environment. Commodity traders get a generous 1:400, while indices max out at 1:100, equity traders get the industry standard 1:20, and cryptocurrencies a competitive 1:20. Forex Traders at the Australian subsidiary get more restrictive maximum leverage of 1:30. I urge traders to use strict risk management to avoid leveraged trading losses. TMGM offers negative balance protection, ensuring traders can never lose more than their deposits.

TMGM Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:02 | Sunday 23:55 |

Forex | Monday 00:00 | Friday 23:55 |

Commodities | Monday 01:00 | Friday 23:55 |

European Equities | Not applicable | Not applicable |

US Equities | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which trade 24/5, and cryptocurrencies which trade 24/7.

Account Types

TMGM offers a commission-free Classic and commission-based Edge account. The minimum deposit requirement for both is $100, but the Classic account is more expensive. I need clarification on why TMGM keeps the Classic account, as it makes no sense. Supported account base currencies are AUD, EUR, CAD, GBP, NZD, and USD.

The swap-free Islamic account is a version of the commission-based Edge account, but select assets have a financing charge between $20 and $100, but major and minor currency pairs are exempt.

TMGM Demo Account

Traders can customize the TMGM demo account, and I recommend traders select demo account settings similar to their planned live deposits to create the most realistic demo trading experience. I did not find any time restrictions, which is good and shows that TMGM understands the requirements of demo traders.

I want to caution beginner traders when using demo trading as a simulation tool, they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

TMGM offers the MT4/MT5 trading platforms upgraded with the Trading Central Alpha Generation plugin. Both trading platforms support algorithmic trading and have an embedded copy trading service. MT4 remains the most versatile trading platform, with 25,000+ custom indicators, plugins, and EAs available for MT4. MT4/MT5 are available as customizable desktop clients, lightweight web-based alternatives, and user-friendly mobile apps.

Manual traders will get a better out-of-the-box trading experience with the Iress trading platform. It includes TradingView charts, has a modular structure allowing traders to customize their workspace, advanced charting abilities via 50 indicators, and a news feed with smart filter functionality.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

TMGM offers demanding algorithmic traders free VPS hosting for low latency 24/5 trading. Existing clients must trade 7.0 lots monthly, and new ones must deposit $3,000 or $20,000 for high-frequency trading. The service is in partnership with ForexVPS.net.

I also want to note the availability of the HUBx platform for fund managers, which functions as a copy trading service.

Research & Education

Traders get market research via third-party providers Trading Central and Market Buzz. I wish TMGM would offer all Trading Central services via the MT4/MT5 plugin, as traders must subscribe to the newsletter alternative to receive actionable trading recommendations.

Market Buzz provides AI-assisted market sentiment analytics with automated event detection. Two additional research tools are Economic Insights and Feature Ideas. I rank the research capacity at TMGM among the most comprehensive ones industry wide.

While TMGM shows a menu entry for TMGM Academy, I received a 404 error during my review. I do not consider the absence of education a negative, but it creates a services gap compared to established brokers.

I recommend beginners source high-quality and in-depth education elsewhere, which exists online for free. Beginners should begin with trading psychology while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |           |

TMGM offers multilingual 24/7 customer service in 10+ languages, and while the live chat has fast response times, the inability to answer basic questions is unacceptable. One customer services rep also provided contradictory information to what was available on their website and made frequent excuses to contact other departments. After 45+ minutes, he provided an incorrect answer.

I like the availability of phone support for emergencies, but I still need a direct phone line to the finance department, where most issues can arise. The FAQ section provides answers to a range of questions.

Bonuses and Promotions

The TMGM Rewards program is a loyalty program that awards ten points for every traded lot. Traders can redeem rewards from 300 points, which includes a cashback reward of up to $2,500. Geographic restrictions and terms and conditions apply. I urge traders to read and understand them before signing up for the reward program.

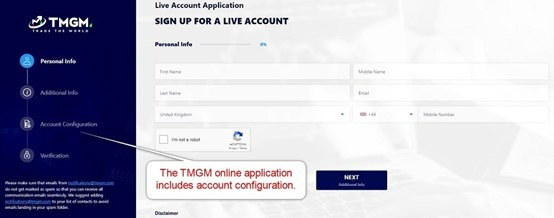

Opening an Account

The TMGM online application only asks for necessary details from international clients. The ASIC subsidiary may feature a questionnaire where TMGM asks additional questions about their finances and trading history.

I like the efficient application, which includes an account configuration set-up and verification step. It ensures traders complete the account registration and configuration process and allows them to use their TMGM account in a few minutes.

Traders should verify their trading account in line with regulatory-mandated AML/KYC requirements. Most traders will pass mandatory verification after uploading a copy of their government-issued ID and one proof of residency document. TMGM might ask for additional information on a case-by-case basis.

Minimum Deposit

The TMGM minimum deposit requirement is $100 or a currency equivalent.

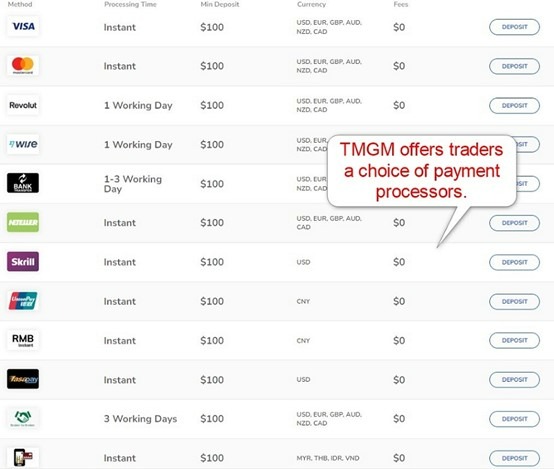

Payment Methods

TMGM supports bank wires, credit/debit cards, Skrill, Neteller, UnionPay, Revolut, Wise, RMB Instant, FasaPay, Broker-to-Broker, and Instant. Geographic restrictions may apply.

Accepted Countries

TMGM accepts traders from many countries but notes, “The information and advertisements offered on this website are not intended for use by any person in any country or jurisdiction where such use is contrary to the local laws and regulations.” It singles out the US as a country whose persons it does not serve.

Deposits and Withdrawals

The secure TMGM client portal manages all financial transactions for verified clients.

TMGM does not levy internal deposit or withdrawal fees, but traders should consider potential third-party payment processing costs and currency conversion charges. Deposit processing times are instant except for Revolut and Wise, which require one business day, while bank wires and broker-to-broker transfers can take up to three days. TMGM processes all withdrawals within one business day.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the TMGM account name. I rate the TMGM deposit and withdrawal process as efficient as it follows well-established industry practices. I'm not too fond of the minimum withdrawal amount of $100, which is identical to the minimum deposit requirement.

Is TMGM a good broker?

I like the trading environment at TMGM for its competitive trading fees and quality trading tools. Traders get a choice of the MT4, MT5, and Iress trading platforms, while VPS hosting caters to algorithmic traders and HUBx to account managers. The asset selection exceeds 12,000 assets but focuses on equity CFDs in the US, Australia, and Hong Kong. I recommend TMGM for demanding traders due to its innovative infrastructure powered by oneZero Financial Technology and 10+ liquidity providers, and I rate TMGM as a trustworthy broker. TMGM offers as deposit methods bank wires, credit/debit cards, Skrill, Neteller, UnionPay, Revolut, Wise, RMB Instant, FasaPay, Broker-to-Broker, and Instant. TMGM operates 24/7, but market trading hours are asset dependent. TMGM levies a $30 monthly inactivity fee after six months. Yes, TMGM is an ECN broker. TMGM charges are spreads, commissions, swap rates, and an inactivity fee. Spreads and commissions depend on the account type. TMGM is ideal for algorithmic scalpers and equity traders focused on the US, Australia, and Hong Kong. TMGM processes all withdrawals from verified clients within one business day. Yes, TMGM is a good broker as it maintains an excellent trading infrastructure, low trading fees, a choice of payment processors, and a trustworthy reputation.FAQs

What are the deposit methods for TMGM?

What are the hours at TMGM?

What is the TMGM inactivity fee?

Is TMGM an ECN broker?

What are TMGM’s charges?

What is TMGM good for?

How long does it take to withdraw money from TMGM?

Is TMGM a good broker?