Editor’s Verdict

TopStep is a US-based prop trading firm for futures traders that began in the Chicago Board of Trade trading pits. It offers funded trading accounts to traders that pass the real-time simulated Trading Combine. Potential prop traders can choose from three account options, and TopStep allows them to keep the first $10,000 they earn before an 80% payout kicks in. My TopStep review found several unique features worth prop traders' consideration.

Are you curious whether TopStep is the best option for your prop trading ambitions?

Read on and find out.

Overview

TopStep offers futures traders three funded accounts with daily payment processing.

I like the trading platform choices at TopStep, while the monthly evaluation fee is more trader-friendly than most competitors, which require re-buys after rule violations. The maximum loss limit of 4% is restrictive, but TopStep calculates it at the end of the trading day rather than considering intra-day levels and high-water marks. The asset selection is limited but sufficient to manage prop accounts.

Headquarters | United States |

|---|---|

Year Established | 2012 |

Trading Platform(s) | Proprietary platform |

Minimum Evaluation Fee | $198 |

Profit-share | 80% |

Daily Loss Limit | 2% |

Maximum Trailing Drawdown | 4% |

Funded Account Options | 3 |

Minimum Funded Account | $50,000 |

Maximum Funded Account | $150,000 |

TopStep Trustworthiness & Reputation

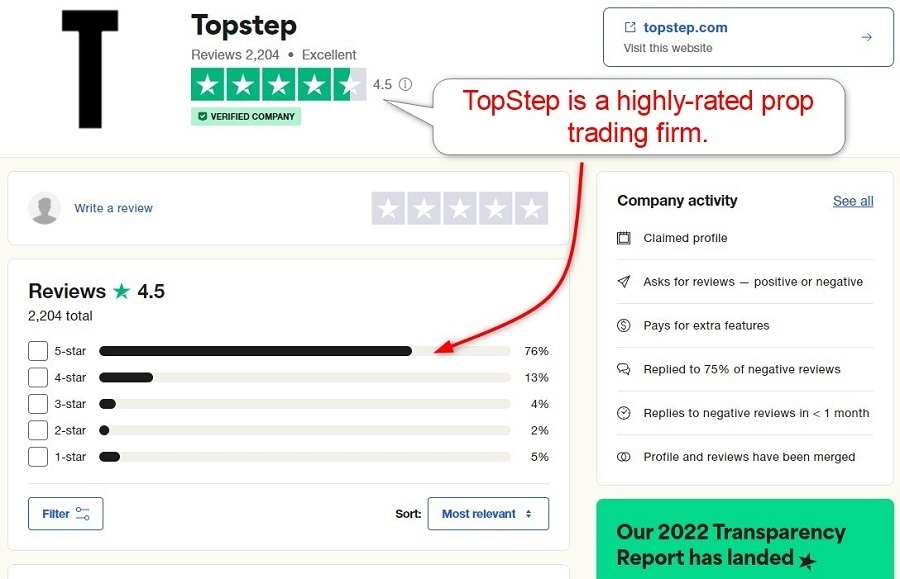

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is TopStep Legit and Safe?

TopStep, founded in 2012 as TopStep Trader before rebranding to TopStep in 2020, stood the test of time. It has a 4.5 out of 5.0 rating on Trustpilot based on 2,205 reviews.

My TopStep review found several negative reviews about trading platform functionality and customer support quality, especially after TopStep ended phone support, which was a disappointment. TopStep is transparent about its team, and its 10+ years of operational experience suggest a genuine prop trading operation. Therefore, I rate TopStep as a legitimate and safe prop trading firm.

TopStep Features

TopStep follows best practices duplicated across the prop firm industry, which remains an expanding industry.

The most notable features at TopStep are:

- One-rule evaluation with a profit target of 6%.

- A minimum of two trading days in the Trading Combine.

- 16 trading platform choices, but only five that are free.

- A maximum loss limit of 4%.

- Daily loss calculation at the end of the trading day rather than intra-day.

- 80% profit share with the first $10,000 for the trader.

- Only futures trading.

- Prop traders can request payouts after five days with $200 minimum profits.

- Daily payout processing.

- $125 minimum withdrawal amount.

- Monthly evaluation fee rather than a one-off account.

- Up to three Express Funded accounts in a simulated trading environment.

- A monthly fee of $9 for Level II data.

- Trading fees depend on the brokerage but are reasonable and below $5 per contract, per round trade, for most futures contracts.

Evaluation Fees & Profit-Share

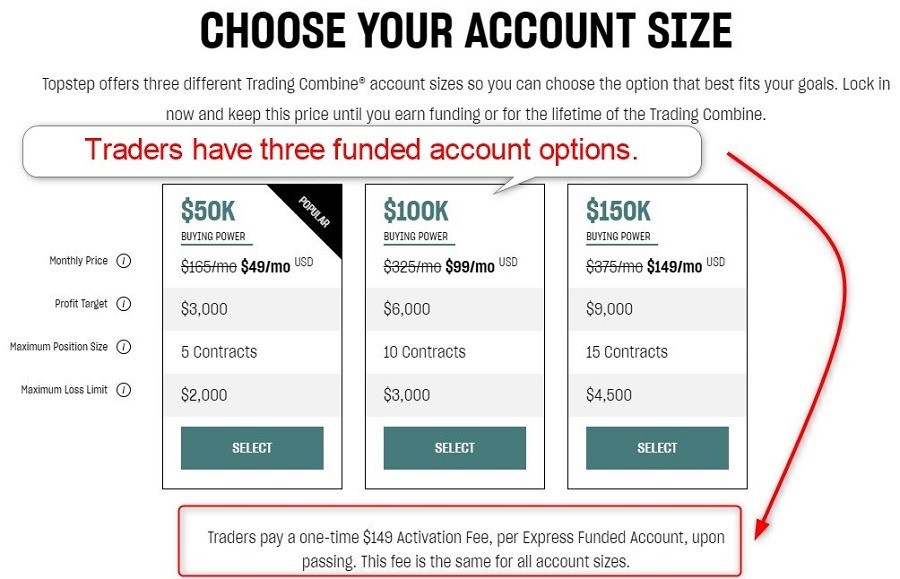

Unlike most prop trading firms that charge a one-time evaluation fee per evaluation, TopStep has a monthly fee, applicable for the evaluation duration, billed each month until traders receive a funded account or cancel the subscription. A $149 one-time fee applies to all traders, regardless of the evaluation account size.

TopStep has three options with the below costs:

- $50,000 - $49 monthly

- $100,000 - $99 monthly

- $150,000 - $149 monthly

Traders need to consider that they cannot change the account value once approved, meaning if they qualify on a $500,000 account, they will manage a $500,000 portfolio.

The maximum profit share is 80%, which places TopStep close to the top of the range, but traders will get 100% of the first $10,000 they earn.

Minimum Evaluation Fee | $198 |

|---|---|

Maximum Evaluation Fee | $298 |

Profit-share | 80% |

The minimum evaluation fee at TopStep for a $50,000 account is:

Type of fee | Fee (without discounts) |

|---|---|

One-time evaluation fee | $149 |

Monthly evaluation fee | $49 |

Hold-over-the-weekend | Not permitted |

Double leverage | Not applicable |

Stop-loss not required at trade entry. | Not applicable |

These are the total fees for a $50,000 account for one month. | $198 |

Account Types

TopStep offers three funded account options, and traders can have up to three Express Funded accounts. Express Funded accounts are simulated trading accounts available after traders pass the Trading Combine, which can take as little as two days.

Prop traders can opt for a $50,000, $100,000, and $150,000 account. My TopStep review found no scaling of portfolios, except for position sizing in the Express Funded account. I appreciate the absence of a time limit to perform, but I dislike the strict 4% maximum loss limit, which is the most restrictive one from my prop trading firm reviews.

What are the Trading Rules at TopStep?

The TopStep evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee plus the monthly fee. There is no time limit, and all three account choices have a profit target of 6%.

Violating the maximum overall loss rule results in an account reset, which is automatic with the next billing cycle.

The trading rules for the TopStep Trading Combine are:

- 4% maximum overall loss.

- 2% daily loss limit, but traders can keep trading the next day if they breach it.

- A minimum of two profitable trading days as part of the TopStep consistency target, where the best trading day cannot exceed 50% of total profitability.

Trading Platforms

Traders can choose from 16 trading platforms, but in the live-funded account, only five are free. TopStep works with five brokers, and I recommend traders carefully consider which combination works best for their strategies.

Please note that traders cannot switch platforms using a different data feed and must pass a new Trading Combine if they wish to change platforms. Plus500 offers the most user-friendly option, but traders should carefully research to determine the best choice for their trading style.

Broker and Trading Platform Choices

Trading Platform | Data Feed | Free in Trading Combine | Free in Live Account | Live Funded Brokerage |

|---|---|---|---|---|

TopStepX (Invite Only) | TopStep | Yes | Yes | Plus500 |

NinjaTrader | Rithmic | Yes | No | NinjaTrader Brokerage |

Quantower | Rithmic | Yes | Yes | NinjaTrader Brokerage |

Tradovate | CQG | Yes | Yes | Dorman |

TradingView | CQG | Yes | Yes | CQC |

T4 | CTS | Yes | Yes | Cunningham |

R|Trader Pro | Rithmic | Yes | No | NinjaTrader Brokerage |

ATAS OrderFlow | Rithmic | Yes | No | NinjaTrader Brokerage |

MotiveWave | Rithmic | No | No | NinjaTrader Brokerage |

VolFix | Rithmic | No | No | NinjaTrader Brokerage |

Bookmap | Rithmic | No | No | NinjaTrader Brokerage |

Investor/RT | Rithmic | No | No | NinjaTrader Brokerage |

Jigsaw Daytradr | Rithmic | No | No | NinjaTrader Brokerage |

MultiCharts | Rithmic | No | No | NinjaTrader Brokerage |

Sierra Chart | Rithmic | No | No | NinjaTrader Brokerage |

Trade Navigator | Rithmic | No | No | NinjaTrader Brokerage |

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

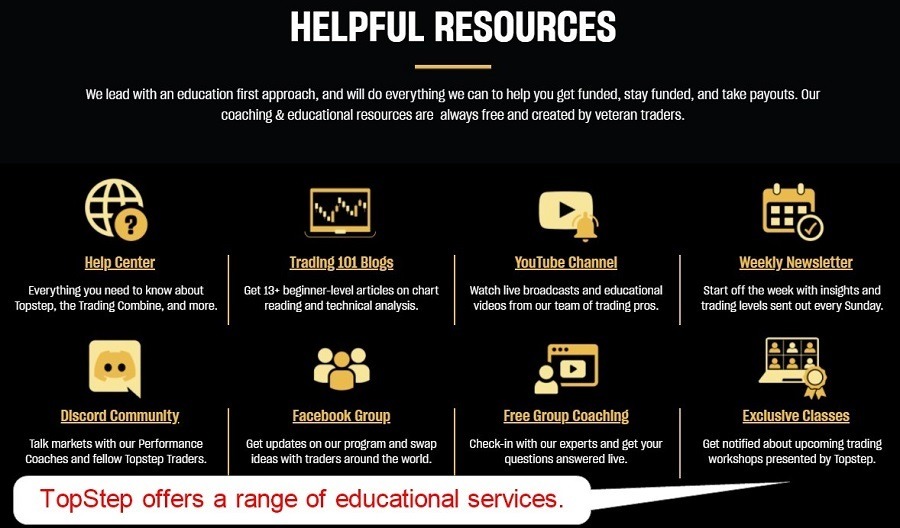

Education

TopStep employs 13 in-house performance coaches, a sign of a committed prop trading firm. It also maintains numerous educational resources, including its digital Coach T.

While beginners may appreciate the hands-on education, I cannot ignore the targeting of beginners. Regardless of the available educational content, they are unlikely to pass the evaluation process. Only seasoned traders with experience should consider prop trading.

Customer Support

My TopStep review found that the prop firm had eliminated phone support. It currently offers live chat via a chatbot for non-clients, while traders gain access to the Discord channel, where they can interact with other traders and coaches. The FAQ section answers the basic questions, though I am missing a direct line to the finance department, where most issues could arise. Customer support is an area where TopStep should improve, especially given the most recent complaints about inadequate support and trading platform issues.

Customer Support Methods |  |

|---|---|

Support Hours | Monday - Friday, 05:30 - 20:00 |

Website Languages |  |

How to Get Started with TopStep

Interested prop traders can start the Trading Combine after selecting their desired package, paying the one-time $149 fee plus the monthly account fee.

Minimum Deposit

The minimum evaluation fee at TopStep is $198 for the $50,000 Trading Combine.

Payment Methods

TopStep supports credit/debit cards and PayPal.

Withdrawal options |  |

|---|---|

Deposit options |    |

Accepted Countries

TopStep accepts traders from many countries and updates a list of restricted ones on its website. Some restrictions are from the brokers they use, namely Plus500 for non-US prop traders.

Here is the list of restricted countries:

Afghanistan | Crimea | Laos | Serbia | Albania | Croatia |

|---|---|---|---|---|---|

Lebanon | Slovenia | Algeria | Cuba | Liberia | Somalia |

Angola | Democratic Republic of Congo | Libya | South Sudan | Bahamas | Ecuador |

Mauritius | Sri Lanka | Barbados | Ethiopia | Mongolia | Sudan |

Belarus | Ghana | Montenegro | Syria | Bosnia and Herzegovina | Guyana |

Nicaragua | Trinidad and Tobago | Botswana | Iceland | North Korea | Tunisia |

Bulgaria | Indonesia | North Macedonia | Uganda | Burma | Iran |

Pakistan | Ukraine | Burundi | Iraq | Panama | Venezuela |

Jamaica | Papua New Guinea | Yemen | Central African Republic | Kosovo | Romania |

Congo Free State | Russia | Cote D'Ivoire (Ivory Coast) |

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and PayPal, where available.

The Bottom Line - Is TopStep a Good Prop Firm?

I like TopStep for its trading platform choices and that traders get to keep the first $10,000 they earn before the 80% profit share applies. Traders face no time or performance pressure, and TopStep employs 13 in-house performance coaches. Top Step is a pure futures trading prop firm with reasonable evaluation fees and daily withdrawal processing. The minimum withdrawal requirement of $125 is OK, but TopStep only pays via bank wires.

My TopStep review found a recent spike in negative reviews, especially concerning trading platform stability. The elimination of phone support is unfortunate and something to monitor. Traders should also consider that they must close their positions daily before 15:10 (CET), and a strict 4% maximum loss limit applies. I rank TopStep among the better US-based prop trading firms due to its established track record. TopStep provides the infrastructure for prop traders to earn, but earning depends 100% on traders, their strategies, and their understanding of the futures market. TopStep will close live funded accounts if a trader breaches the 4% maximum loss limit. TopStep is not a broker but a prop trading firm. It works with regulated brokers, but as a company, it is unregulated. Traders only pay a monthly subscription during the Trading Combine. They may also pay monthly fees dependent on their trading platform choice and if they require Level II data. The 1 rule at TopStep is that traders cannot exceed maximum portfolio losses above 4%, the strictest rule any of my reviews found. TopStep pays its prop traders via bank wires.FAQs

Can you make money with TopStep?

What happens if you lose money on TopStep?

Is TopStep a regulated broker?

Does TopStep charge a monthly subscription?

What is the 1 rule in TopStep?

How does TopStep pay you?