Editor’s Verdict

Trade Republic is a German investment broker, catering only to German residents with Germany as their primary tax residence. This appears to be a step backwards, as Trade Republic used to offer services in Austria, Belgium, France, Italy, and Spain. The founders initially planned for an online game, allowing gamers to trade virtual funds, but opted for a Robinhood clone in Germany. I have reviewed the limited data the broker offers to evaluate how well it caters to its core market and whether Trade Republic is worth consideration if you are a German investor.

Overview

A German investment broker for long-term investors with a German tax residence.

I like that Trade Republic pays 4.00% in annual interest payments on idle cash deposits in its custodian bank accounts. Trade Republic picked a niche and caters primarily to first-time investors who prefer ETF portfolios and cryptocurrency exposure.

Tier 1 Regulator(s)? | |

|---|---|

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Undisclosed |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Trade Republic Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check the regulatory status, verifying it with the regulator by checking the provided license with their database. Trade Republic operates under the oversight of one regulator.

Is Trade Republic Legit and Safe?

Trade Republic, founded in 2015, is a German FinTech and investment firm regulated by BaFin, the German financial regulator, and Bundesbank, the German central bank. All client deposits are segregated from corporate funds and held in escrow accounts with one of its partner banks, Solaris SE, JP Morgan SE, Citibank Europe PLC, and Deutsche Bank AG. HSBC Germany is the custodian bank for all securities. Cash deposits are guaranteed up to €100,000 by the German Deposit Guarantee Scheme.

My review found no malpractice at Trade Republic. Still, I want to note conflicting details about its business scope across its website. Since 2022, Trade Republic began to downsize, and some of its public information still needs to be updated. Overall, I rate Trade Republic as a legitimate and safe broker.

Country of the Regulator | Germany |

|---|---|

Regulatory License Number | Undisclosed |

Regulatory Tier | 1 |

Fees

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. Trade Republic offers commission-free investments, but a €1.00 per transaction flat fee applies to cover third-party settlement costs, which results in a €2.00 fee for buying and selling a security. Saving plan purchases remain free of any charges. Spreads are additional costs, which Trade Republic notes but does not detail. Trade Republic derives most of its revenues from third parties via rebates from its liquidity providers and payments from order flow, as it sells client data to high-frequency firms and other interested parties.

Here is a snapshot of Trade Republic fees:

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Range of Assets

Trade Republic does not provide details about its range of assets but notes the availability of stocks, ETFs, corporate and government bonds, derivatives, and physical cryptocurrencies. It is an excellent selection for its core market. All assets are available via Trade Republic premium partners Citi, HSBC, Société Général, and UBS.

Trade Republic Leverage

Trade Republic does not offer leveraged trading accounts and only provides unleveraged investment accounts for long-term buy-only investors.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Account Types

Trade Republic does not provide details about its account types but presents one Euro cash account to all clients. It is unclear if its savings plan option remains integrated within the investment account or if clients must open sub-accounts. The lack of clarity is a substantial disadvantage. The FAQ section, the sole support method I have encountered, often suggests opening an account without providing answers to some core questions.

Trade Republic Demo Account

Trade Republic does not offer a demo account, which I find careless, especially since it claims that one-third of its clients have never purchased a security.

Trading Platforms

Trade Republic provides its proprietary mobile trading app on Android, version 6.0 or higher, or iOS devices, version 14.0 or later. Once again, Trade Republic does not introduce its app or features, which has 1M+ downloads on the Google Play Store with a 3.3 rating from 90K+ reviews. Most ratings over the past months are one-to-two-star ratings, reflecting the potential layoffs at this broker. I cannot recommend the app.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform |

Unique Features

Trade Republic offers fractional share dealing, ideal for smaller portfolios, which are the primary market for this investment broker. It also pays 4.00 annual interest on idle cash balances. I must note the absence of core details, as Trade Republic publishes little information about its offering, making it nearly impossible to evaluate it without opening a live account, as demo accounts are unavailable.

Research & Education

Trade Republic neither provides in-house research nor third-party alternatives. It creates a massive service gap compared to well-established investment brokers. Due to the abundance of free and paid-for online research, I do not consider its absence a negative against Trade Republic.

Trade Republic does not offer education, which is an unfortunate oversight, given its core market.

Therefore, I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

To answer questions, Trade Republic relies on its FAQ section, where a web form remains buried. No details about customer support hours exist and given the lack of information concerning core aspects of the Trade Republic trading environment, clients must be left with many queries unless they do not care about essential details. This approach to customer service is a definite drawback.

Support Hours | Undisclosed |

|---|---|

Website Languages |          |

Bonuses and Promotions

Trade Republic offers neither bonuses nor promotions, which are illegal under ESMA regulations. The ESMA is the super-regulator for all EU-based brokers.

Opening an Account

Trade Republic requires a valid EU mobile phone number, and traders must scan the QR code to begin their account application. As an EU-based investment broker, clients must provide plenty of personal data, including employment, financial, and tax data.

Demo Account | No |

|---|---|

Managed Account | No |

Islamic Account | No |

Other Account Types | No |

OCO Orders | No |

Interest on Margin | No |

Account verification is mandatory at Trade Republic, in compliance with global AML/KYC requirements. As an EU-based broker only catering to German residents, a government-issued ID card or passport will suffice for account verification.

Minimum Deposit

There is no Trade Republic minimum deposit requirement.

Payment Methods

Trade Republic accepts bank wires, credit/debit cards, Apple Pay, and Google Pay.

Accepted Countries

Trade Republic only accepts German residents with their primary tax residence in Germany.

Deposits and Withdrawals

The Trade Republic mobile app handles all financial transactions for verified clients.

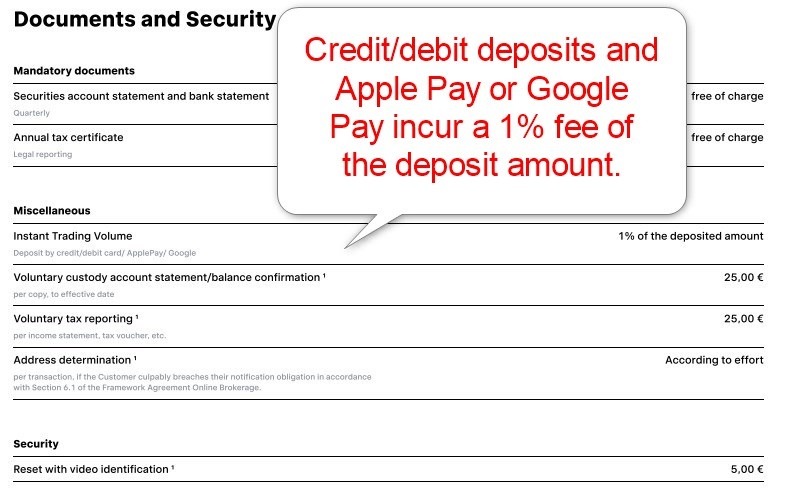

Trade Republic has no minimum deposit or withdrawal amount. Withdrawals can take up to three business days before processing. Credit/debit deposits and Apple Pay or Google Pay incur a 1% fee of the deposit amount. The name on the payment processor and the Trade Republic account must match.

Trade Republic has no minimum deposit or withdrawal amount. Withdrawals can take up to three business days before processing. Credit/debit deposits and Apple Pay or Google Pay incur a 1% fee of the deposit amount. The name on the payment processor and the Trade Republic account must match.

Is Trade Republic a Good Broker?

I am not in favour of the Trade Republic trading environment due to its lack of transparency concerning core elements. The absence of a demo account, contradictory details on its website, and lack of quality customer support are significant drawbacks. Deploying a mobile app as the sole investment platform may suit its millennial first-time investors but fails across the board for anyone serious about their investment portfolios.

However, I like the fractional share dealing, low investment costs, and choice of assets for long-only investors.

I rate Trade Republic among the worst investment brokers I have reviewed, as it lacks a cutting-edge platform and clarity. During my review, Trade Republic only accepted clients with their primary tax residence in Germany, while its website noted 17 countries without specifying them. Since 2022, Trade Republic has begun layoffs, and it shows in its services.

FAQs

How much does Trade Republic charge for deposits?

A 1% fee applies on the deposit amount made via credit/debit cards, Apple Pay, and Google Pay.

Who owns Trade Republic?

Trade Republic is a private FinTech company headquartered in Germany and founded by Marco Cancellieri, Thomas Pischke, and Christian Hecker.

Is Trade Republic good for crypto?

Trade Republic is average regarding physical cryptocurrency purchases, which it stores in cold wallets.

How long does it take to get money from Trade Republic?

Clients may wait up to three business days for Trade Republic to process a withdrawal.

Which countries can use Trade Republic?

Trade Republic only accepts clients who have their tax residence in Germany.

Is money safe in Trade Republic?

Trade Republic segregates all client deposits at well-established partner banks, where cash deposits have a €100,000 deposit guarantee by the German government.

How trustworthy is Trade Republic?

Trade Republic is a highly trusted investment broker regulated in Germany by BaFin and the Bundesbank.