Editor’s Verdict

TradeEU, owned by Titanedge Securities LTD, received its CySEC license in October 2021, making it a new entrant in the EU online brokerage market. Traders get the MT5 trading platform, which supports algorithmic trading and copy trading strategies, 250+ assets, and a commission-free pricing environment. I conducted an in-depth review to evaluate the competitiveness of this broker. Should you open a trading account with TradeEU?

Overview

A new EU-focused multi-asset broker offering commission-free MT5 trading

Headquarters | Germany |

|---|---|

Regulators | CySEC |

Year Established | 2021 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 5 |

Retail Loss Rate | 74% to 89% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 2.5 pips |

Minimum Commission for Forex | Not applicable |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the asset selection at TradeEU, which is small but balanced, making it ideal for beginner traders and those requiring fewer, liquid trading instruments.

TradeEU Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. TradeEU presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 405/21 |

Is TradeEU Legit and Safe?

Titanedge Securities LTD, the owner of TradeEU, shows a registration date of August 10th, 2020, while TradeEU received its CySEC license on October 18th, 2021. Therefore, neither entity has operational longevity but possesses the infrastructure for a secure trading environment, which it delivers.

TradeEU complies with the Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive, while the EU Directive 2014/49/EU mandates an investor compensation fund protecting 90% of client deposits up to a limit of €20,000.

Traders receive negative balance protection, an essential tool for leveraged portfolios, and all client deposits remain segregated from corporate funds. I expect TradeEU to follow dozens of CySEC-regulated brokers, and so I classify this broker as legit and safe.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. They also reveal which trading strategies, if any, a broker discourages and which types of traders it prefers. TradeEU ranks among the more expensive commission-free brokers versus international competitors with a minimum spread of 2.5 pips or $25.00 per 1.0 standard lot in its Silver account, which requires a minimum deposit of $250. Compared to other EU-based brokers, trading costs are average. The Gold and Platinum options see a decrease to 1.3 pips and 0.7 pips, respectively, but the account details do not list minimum deposit requirements.

Therefore, the pricing environment discourages short-term and high-frequency trading and is best suited to low-frequency strategies.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | 2.5 pips |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee |

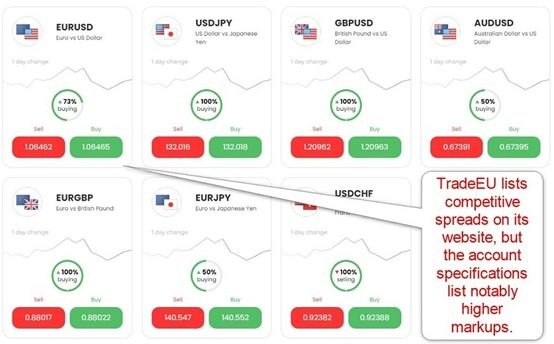

Here is a screenshot of TradeEU quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The minimum trading costs for the EUR/USD at TradeEU are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

2.5 pips (Silver account) | $0.00 | $25.00 |

1.3 pips (Gold account) | $0.00 | $13.00 |

0.7 pips (Platinum account) | $0.00 | $7.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Silver account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread in the commission-free Silver account, and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

2.5 pips | $0.00 | $33.74 | X | $58.74 |

2.5 pips | $0.00 | X | $33.74 | $58.74 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread in the commission-free Silver account, and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

2.5 pips | $0.00 | $236.18 | X | $261.18 |

2.5 pips | $0.00 | X | $236.18 | $261.18 |

Noteworthy:

- Trading fees will increase the longer traders keep leveraged positions open, which is a cost they must consider

- TradeEU lower swap rates for Gold and Platinum accounts (for example, the EUR/USD swap rates for Gold and Platinum accounts were at the time of publication $20.25 and $13.50, respectively)

Range of Assets

TradeEU maintains 250+ trading instruments covering Forex, cryptocurrencies, commodities, indices, and equity CFDs. While the choice remains limited, it suffices for most beginners who receive a sector introduction and traders who require few but liquid assets. ETFs would be a beneficial addition, given their displacement of other market assets and surging demand. Since TradeEU has limited operational experience, they may add them as they mature if client demand warrants them.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

TradeEU Leverage

TradeEU offers maximum retail Forex leverage of 1:30 for major currency pairs, 1:20 for minor currency pairs, 1:10 for commodities, 1:5 for equities, and 1:2 for cryptocurrencies, as limited by ESMA regulations. Negative balance protection exists. It ensures traders cannot lose more than their deposits. EU-based brokers usually offer a professional account option, where leverage for Forex traders is 1:500, the global standard for the industry, and what EU-based traders had before the 2018 changes. TradeEU does not mention its availability on its website but notes it in its terms and conditions.

TradeEU Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Friday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 00:00 | Friday 24:00 |

European Equities | Monday 09:00 | Friday 17:30 |

US Equities | Monday 15:30 | Friday 22:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which trade 24/5

- TradeEU does not offer 24/7 cryptocurrency trading

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

TradeEU lists three account types, then an Islamic account, and the TradeEU demo account. The minimum deposit for the entry-level Silver account and the Islamic option is $250. TradeEU does not publish minimum requirements for the Gold and Platinum account types.

TradeEU notes in its legal documents that the Islamic Pro account requires a minimum deposit of $25,000, which applies to non-Islamic Pro accounts.

Trading costs commence from 2.5 pips or $25.00 per 1.0 standard round lot and decrease to 1.3 and 0.7 pips. Islamic account holders pay a minimum markup of 3.2 pips or $32.00 per 1.0 round lot and a minimum commission of 0.10% on equity CFDs, which does not apply to non-Islamic traders.

The core trading conditions across all non-Islamic account types are identical, with a minimum trading volume of 0.1 lots, the EUR as the sole account base currency, MT5 trading, and a stop-out level of 50%. Therefore, the primary difference is trading fees, which decrease from above average to average.

TradeEU Demo Account

TradeEU offers a demo account, with the default balance at $100,000. MT5 features a demo account set-up offering the necessary flexibility traders require, but based on the TradeEU demo account introduction, it has disabled those options. I want to caution beginner traders against using a demo account as a simulation tool. Trading with real money always feels different, so the absence of trading psychology can negate some of the educational value.

Trading Platforms

Traders get the out-of-the-box MT5 trading platform, which supports algorithmic trading and copy trading. MT5 is available as a desktop client, a webtrader, and a mobile app.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

TradeEU is a new broker and understandably focuses on its core trading environment. It cannot yet be said to have any truly unique features.

Research & Education

TradeEU does not publicly publish research but mentions on its site that it exists for clients. TradeEU mentions daily analysis but does not specify if it includes actionable trading signals. Alternatively, traders may consider the MT5 copy trading and signal service.

Education at TradeEU follows the same approach as research.

I recommend traders source research at trusted online providers free of charge before considering TradeEU. It ensures a deep knowledge-based foundation, which promotes healthier trading behavior and limits avoidable mistakes.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |    |

TradeEU provides 24/5 customer support via e-mail and phone, but its official business hours are from 06:00 a.m. (GMT) on Monday to 3:00 p.m. (GMT) on Friday. A limited FAQ section is provided on the website. Live chat is missing, but a web form exists. TradeEU answers plenty of questions in its terms and conditions but should consider increasing its transparency concerning its core trading environment, which would lower customer support inquiries.

Bonuses and Promotions

As an EU-regulated broker under the ESMA framework, TradeEU cannot offer bonuses and promotions.

Opening an Account

Before qualifying traders can proceed to the online account opening form, they receive a pop-up where they must confirm that they decided to open an account without solicitation from anyone. Clicking “I Understand” will direct clients to the first application step, which requires a name, e-mail, password, and valid phone number. Traders may use their Facebook or Google IDs to complete this step. Since the phone drop-down menu only includes German and Portuguese country codes, it appears that others cannot open accounts. Clicking on “Open an Account” from other countries results in a ‘’Sorry, currently the service is not available in your country.” message.

Account verification is mandatory, following well-established industry standards. Most traders will satisfy this by sending a copy of their ID and one proof of residency document. TradeEU may ask for additional information on a case-by-case basis. Please note that the terms and conditions state an account application fee of €50, £50, or $50.

Minimum Deposit

The minimum deposit at TradeEU is $250, like many other EU-based brokers.

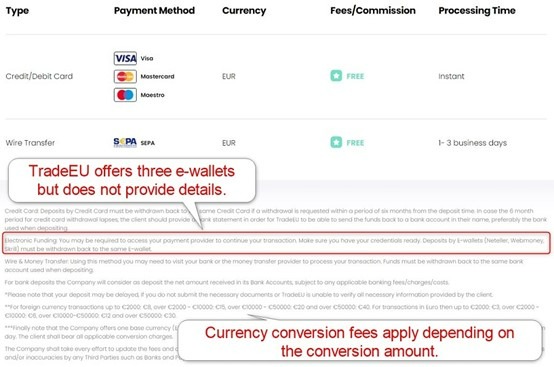

Payment Methods

TradeEU accepts bank wires, credit/debit cards, Skrill, Neteller, and WebMoney.

Accepted Countries

TradeEU lists the United States, Canada, Israel, Iran, and Japan as countries whose residents cannot open trading accounts. Its application form at the time of publication only accepts residents of Germany and Portugal.

Deposits and Withdrawals

The secure TradeEU back office handles all financial transactions for verified clients.

TradeEU supports bank wires, credit/debit cards, Skrill, Neteller, and WebMoney for deposits and withdrawals. While it only provides limited information on bank wires and credit/debit cards, the fine print states that traders must withdraw deposits made via Skrill, Neteller, and WebMoney to the same source. Traders who request withdrawals of credit/debit card deposits within six months of depositing must use the same card for withdrawals.

The minimum deposit is $250 to open a trading account, and TradeEU does not provide minimum withdrawal amounts. Only Euro accounts are available, and non-Euro transactions face currency conversion costs between €8 and €30, dependent on the conversion amount.

Processing times for credit/debit card deposits are instant, and up to three business days for bank wires. TradeEU processes withdrawal requests on the same day if received before 10 a.m. Monday through Friday. Otherwise, it will do so on the following business day. Operating hours for withdrawals are between 8 a.m. and 1 p.m. during working days. It may take up to three business days until clients receive their funds.

TradeEU does not levy internal withdrawal fees, except for currency conversion costs if applicable, but third-party payment processor costs may apply.

Is TradeEU a good broker?

TradeEU is a new entrant to the EU brokerage market and follows the business model of most EU-licensed brokers. Trading costs are at the higher end of the average EU range, the minimum deposit is $250, and the asset selection is limited but balanced, while traders are offered the MT5 trading platform. Given this commission-free cost structure, TradeEU is best-suited for low-frequency beginners. It provides research and education but does not publish it, reserving it for clients. Trading costs decrease in the Gold and Platinum accounts.

Since TradeEU has limited operational experience, traders should exercise patience as this broker potentially improves and adjusts its product and services portfolio.