Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2004 |

Minimum Deposit | N/A |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | Trading Academy |

Average Trading Cost GBP/USD | Trading Academy |

Average Trading Cost WTI Crude Oil | Trading Academy |

Average Trading Cost Gold | Trading Academy |

Average Trading Cost Bitcoin | Trading Academy |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Tradenet is the brand name of Tradenet Capital Markets Ltd., active since 2004 as a day trading training school. It offers a series of paid-for educational courses focused on trading US equities. Per its own account, since inception sixteen years ago, Tradenet claims over 30,000 students globally. The five-member team of self-proclaimed experts also hosts a subscription-based live trading chat room between 9:00 am and 4:30 pm EST, covering US-listed equities during trading hours of the New York Stock Exchange (NYSE). Paying for education remains a controversial topic, as all of the content taught here is available free of charge or at little cost elsewhere on the internet. Via the live trading room, paying subscribers will receive live trading signals, but the costs involved won't make much sense from an economic standpoint for most retail traders.

Regulation and Security

Since Tradenet is neither a broker nor a registered financial advisor but merely an unlicensed online trading school, the company does not require authorization from a regulator. None of the services are licensed, and new retail traders must consider that they are paying to learn what can be achieved elsewhere, either free of charge or at little cost. That, per Tradenet's claim, over 30,000 students have attended and paid for courses does not in any way suggest they are offering a quality product or service. Moreover, transparency about the company, Tradenet Capital Markets Ltd., is missing.

No registration details exist on the website, and the About Us section only notes the team members and a one-paragraph description about them. The only protection for clients remains a 14-day money-back guarantee. It is up to each individual to decide if they want to purchase an unlicensed product or service from an opaque company that only lists a phone number and e-mail, but no address and no company details. While that does not suggest wrongdoing on Tradenet's part, given its sixteen-year history, it does fail to communicate a secure operation.

The 14-day money-back guarantee is the only security feature available at Tradenet.

Fees

Average Trading Cost EUR/USD | Trading Academy |

|---|---|

Average Trading Cost GBP/USD | Trading Academy |

Average Trading Cost WTI Crude Oil | Trading Academy |

Average Trading Cost Gold | Trading Academy |

Average Trading Cost Bitcoin | Trading Academy |

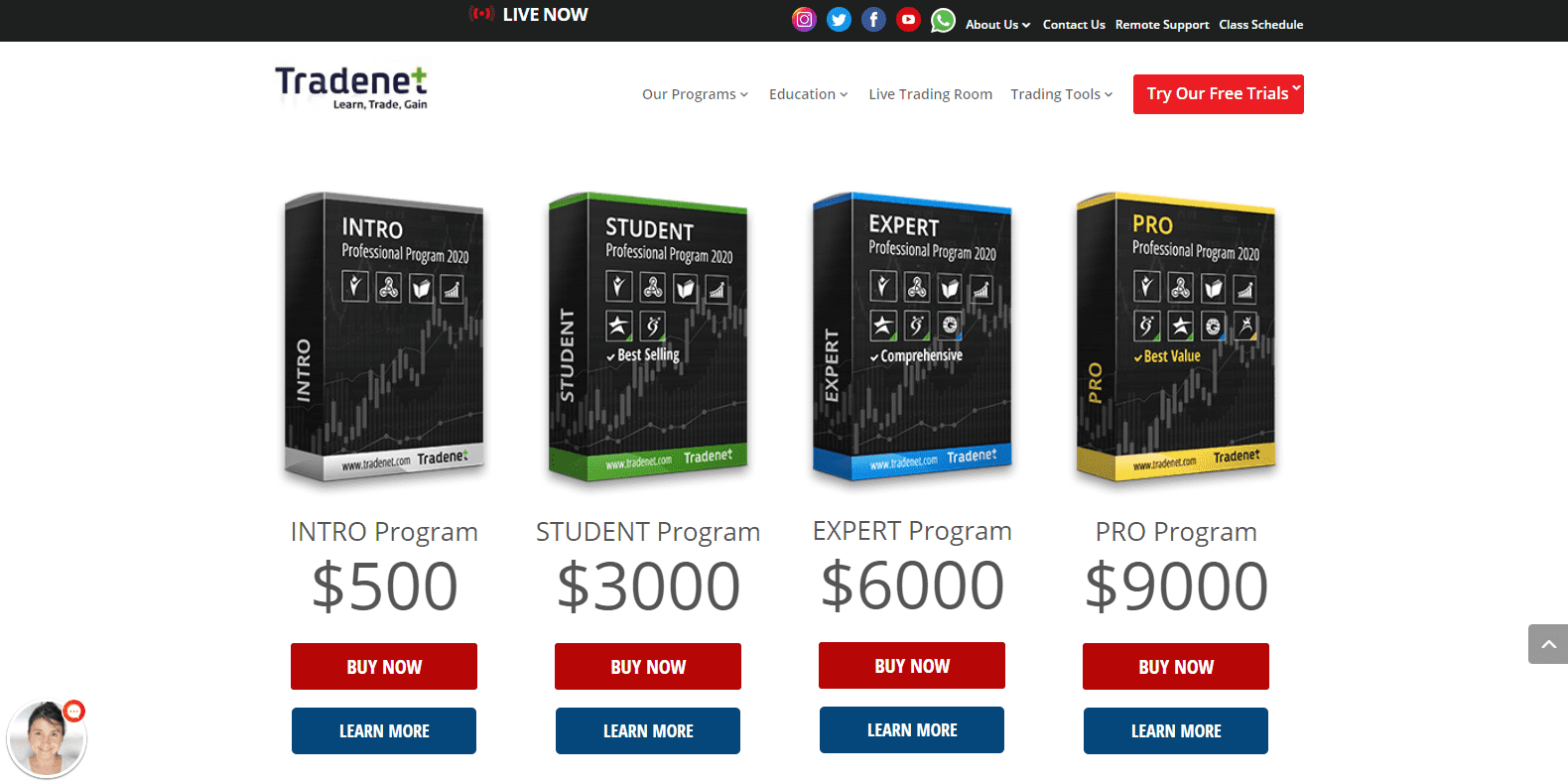

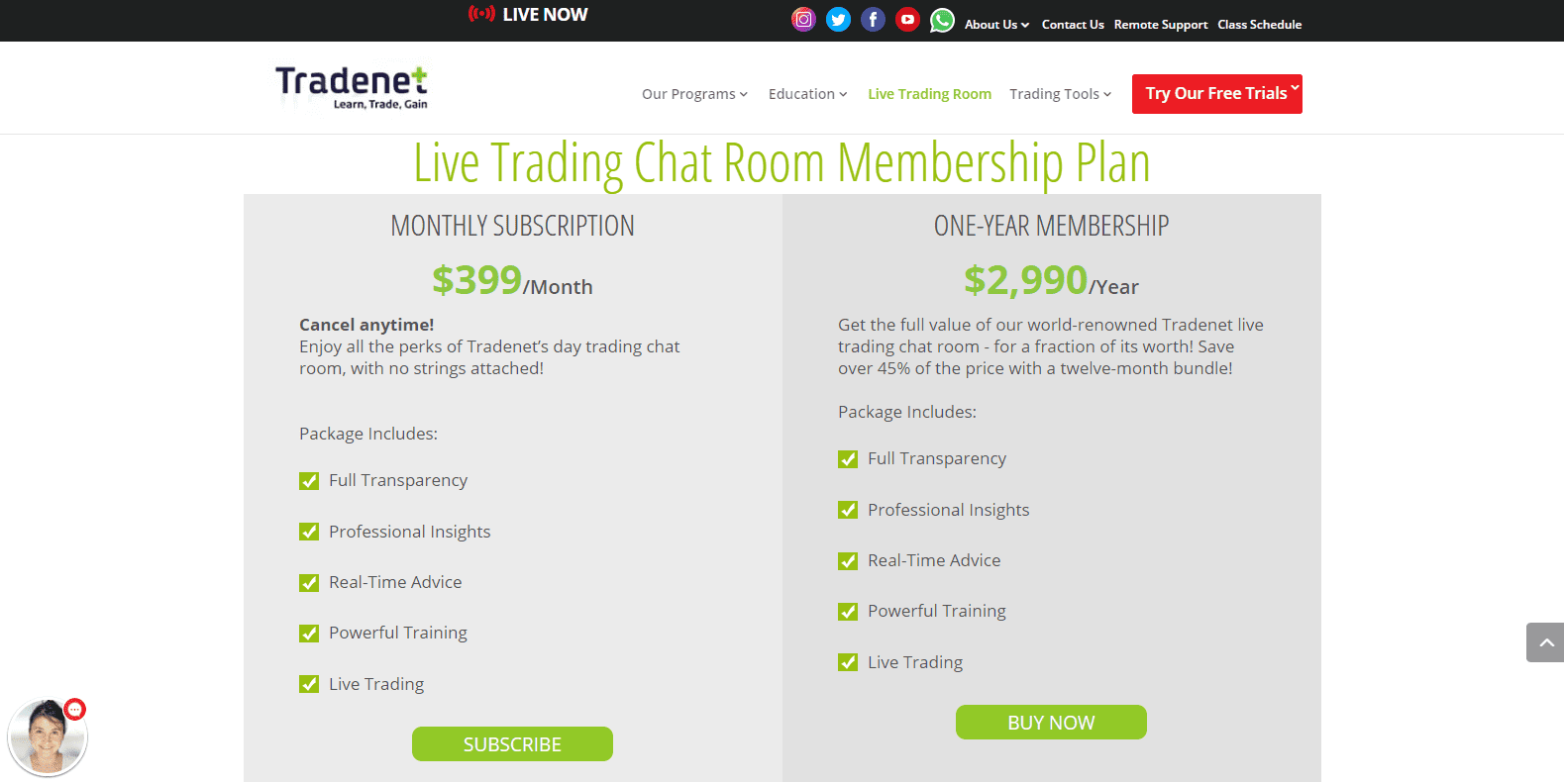

Tradenet offers four educational packages plus its live chat room as its primary services; eight standalone packages are equally available. Tradenet claims to have the best educational offers, a bold marketing statement if ever there was one. While that assertion is dubious at best, what they can rightly claim is the most outrageous pricing structure. To that end, the price of most products are placed well out of the reach of those who actually are in need of education. Those potential clients who could afford their exorbitant costs are, most likely, traders advanced and experienced enough not to fall for the paid-for educational trap. For example, Tradenet's Intro Program costs $500, the Student Program is $3,000, the Expert Program is $6,000, and the Pro Program would set you back a whopping $9,000. An annual subscription to the live chat room would be a “bargain” at a discounted $2,990, though monthly subscriptions at $399 are equally available.

The fact is most traders would acquire a more in-depth and personalized learning experience by depositing a small portion of the amount of a Tradenet class into a trading account with a reputable broker. Many brokers offer traders of all capabilities quality training academies and live webinars, often free of charge or else at a low cost. Until they have learned to profitably trade on their own, a new or novice trader would be better served by taking advantage of those educational offerings at a reputable broker. Many free to low-cost signal providers and retail account managers will offer more value than paying any of the Tradenet costs.

Each individual needs to determine what price they are willing to pay for the Tradenet experience. It is suggested, before making a decision, do the math first, and apply a risk benefit analysis to the cost of each of Tradenet's product, much as you would do before placing an actual trade.

For example, if you are not willing to place more than 3% of your capital into any position, apply that 3% to the cost of the product to determine what portfolio size would warrant such a purchase. Feel free to adjust the 3% level, but by no means should it be above 5%. Below is a mathematical example for each program to give you a marketing-free example to help you better understand whether a purchase from Tradenet would provide you with value.

Using a 3% risk management rule, each Tradenet service would require the below listed portfolio size in order to make it economically feasible and within an acceptable risk parameter:

- Intro Program - $500 / 3% = $16,667 portfolio

- Student Program - $3,000 / 3% = $100,000 portfolio

- Expert Program - $6,000 / 3% = $200,000 portfolio

- Pro Program - $9,000 / 3% = $300,000 portfolio

- Live Chat Room Monthly - $399 / 3% = $13,300 portfolio

- Live Chat Room Annually - $2,990 /3% = $99,667 portfolio

Tradenet markets the annual subscription to the live chat room as 45% more cost-effective, but they remain focused on selling a product. From all advertised packages, the monthly live chat room subscription represents the lowest portfolio entry requirement, and by this measure, the best value. Anyone with a trading portfolio size (as outlined above) will not require the services of Tradenet. Feel free to draw your own conclusion; play around with the numbers, but do not just follow the marketing. There is a saying among genuine traders: “Those who can't, teach.” While there are exceptions, Tradenet does not qualify as one.

Each Tradenet product carries an unacceptable cost. If it were an actual trade, the portfolio size to justify it would likely belong to a seasoned trader who would not require any offered service.

The live chat room is essentially a signal service with the ability to chat directly with the provider.

What Can I Trade

The trades chosen to be discussed in the live chat room are at the sole discretion of the mentors, but it should be understood that Tradenet covers US equities exclusively. With nearly 5,000 companies listed on the NYSE and NASDAQ, and with more than 10,000 companies listed on the OTC, it is highly unlikely that the five-member Tradenet team can offer widespread market coverage unless they deploy cutting-edge technology. Since Tradenet does not note the use of technology anywhere on its website, analyzed assets are likely minimal with an attempt to cover all sectors to the best of their collective abilities. At the listed costs, it appears overly expensive. Traders can achieve a significantly higher quality service with electronic advisors (EAs) in MT4/MT5 at a fraction of the cost.

Account Types

Since Tradenet is not a broker but an unlicensed training academy, there are no account types but rather education packages. Each package consists of several components, which are also available as standalone purchases. Whether acquired individually or as a bundle is irrelevant; in any case, the cost does not justify the product.

Here is a breakdown of the educational packages marketed by Tradenet with the individual courses and standalone prices:

Intro Package - $500

- Self-Study Course - $290

- Month Subscription to live trading chat room - $399

- Trading Book - $9.99 - $19.47

- Demo trading account - $0

Student Package - $3,000

- Self-Study Course - $290

- 3-Month Subscription to live trading chat room - $1,197

- Trading Book - $9.99 - $19.47

- Demo trading account - $0

- Month Weekly Mentorship - $1,200

- Star Trader Course - $1,900

Expert Package - $6,000

- Self-Study Course - $290

- 6-Month Subscription to live trading chat room - $2,394

- Trading Book - $9.99 - $19.47

- Demo trading account - $0

- Month Weekly Mentorship - $2,400

- Star Trader Course - $1,900

- Global Markets Course - $1,900

Pro Package - $9,000

- Self-Study Course - $290

- 8-Month Subscription to live trading chat room - $3,192

- Trading Book - $9.99 - $19.47

- Demo trading account - $0

- Month Weekly Mentorship - $3,600

- Star Trader Course - $1,900

- Global Markets Course - $1,900

- Top Trader Course - $1,900

Additional offers include:

- Advanced Day Trading Strategies - $1,900

- Case Study Course - $1,900

- One-hour One-on-One Training Session - $500

- Ten hours One-on-One Training Session - $5,000

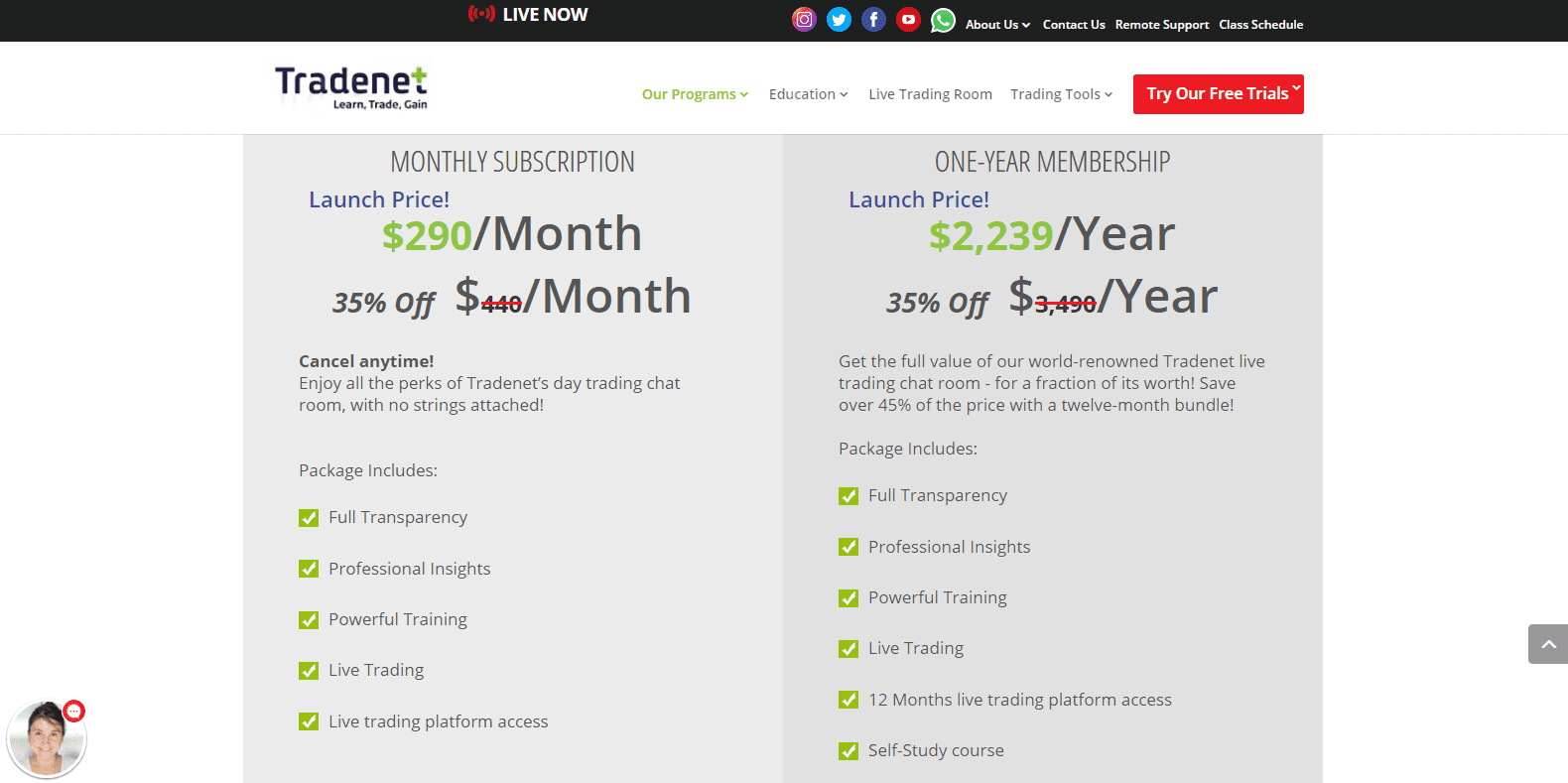

- Tradenet Plus Monthly - $440 (advertised with a discount at $290)

- Tradenet Plus Annually - $3,490 (advertised with a discount at $2,239)

The Intro package will set you back $500.

The Student package costs $3,000.

For $6,000, you will get the Expert package.

Tradenet sells the Pro package for $9,000.

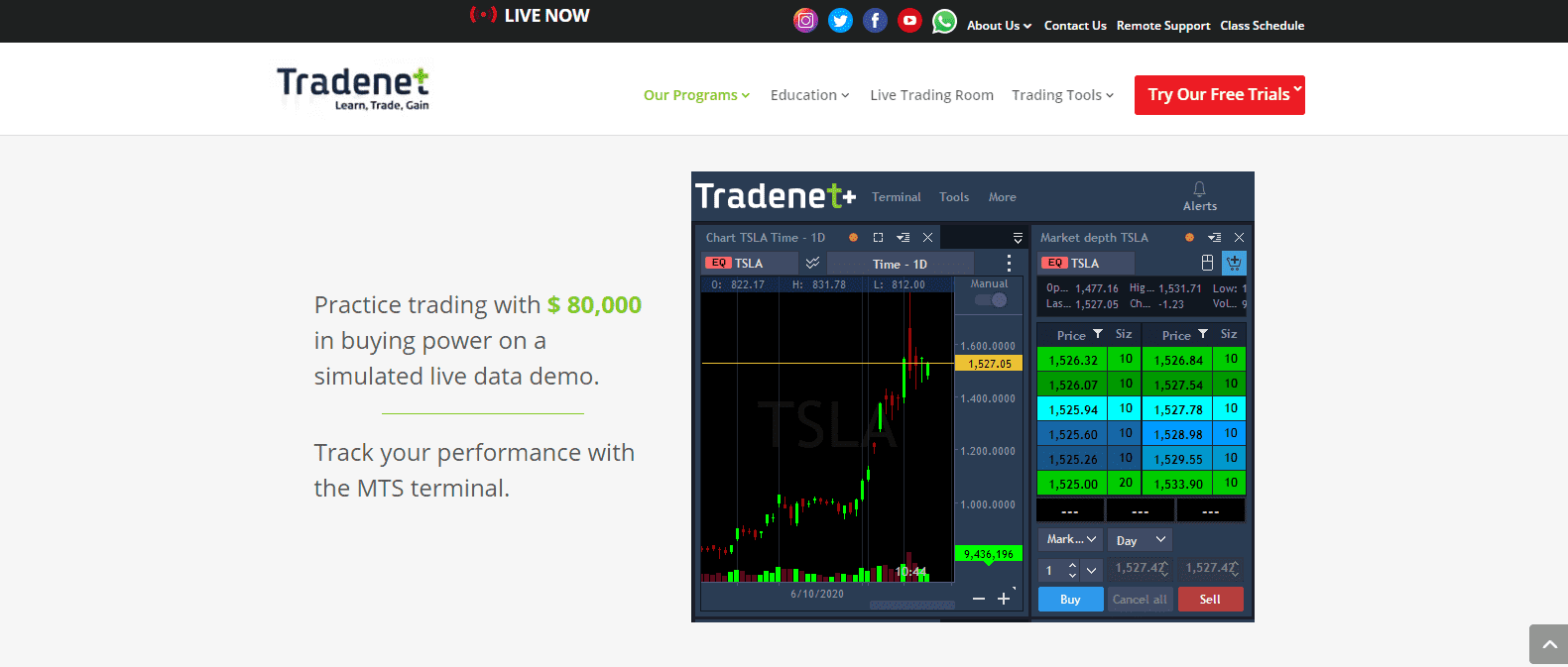

Trading Platforms

Tradenet fails to mention which trading platform it uses, but the Tradenet Plus marketing page references a free demo account on the MTS trading platform from DAS Trader. Tradenet does not introduce the trading platform and exclusively focuses on marketing its products, ignoring transparency along the way.

Tradenet uses DAS MTS as its trading platform but fails to note it transparently.

Unique Features

The unique features at Tradenet are excessive pricing, lack of transparency, and the type of marketing hype generally decried by knowledgeable traders as a scam. Dishonest and misleading marketing campaigns and the promise of massive profits (after only a few minutes trading) is often what initially attracts most failed traders. While the profit claims made by Tradenet are possible, your actual profit will always depend on your portfolio balance and leverage. Regrettably, Tradenet engages in the same tactics as scammers and fraudsters do.

Besides excessive pricing and lack of transparency, Tradenet deploys the same marketing tactics as scammers and fraudsters.

Research and Education

While all the research and education comes in the form of paid-for services, Tradenet publishes a daily US Stocks Review and a Global Markets Daily Report. It remains unclear if it is created in-house or sourced from a third party. They both offer a brief overview of potentially market-moving events and US equities of interest. The quality of the reports is acceptable and does add value to day-to-day trading operations.

The US Stocks Review and a Global Markets Daily Report are free for all to read.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | Unspecified |

Website Languages |  |

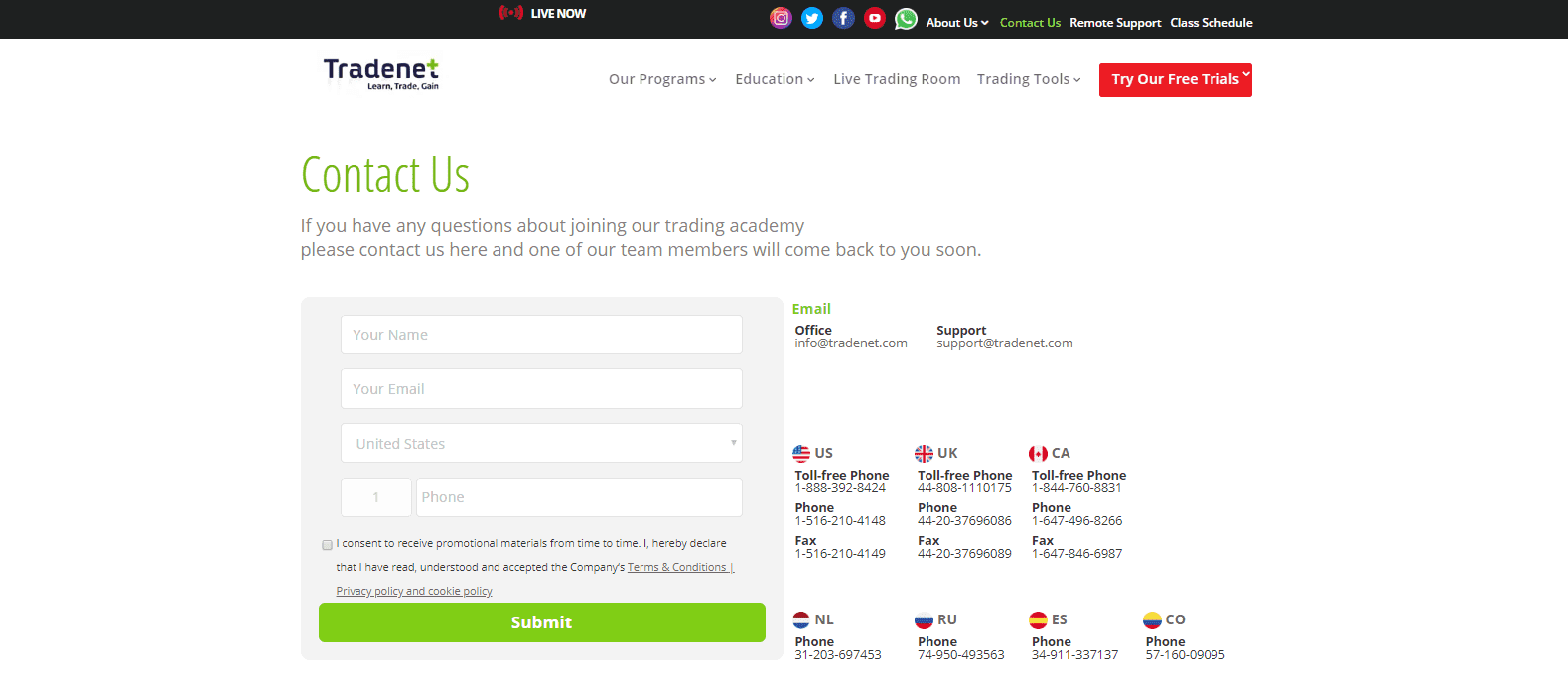

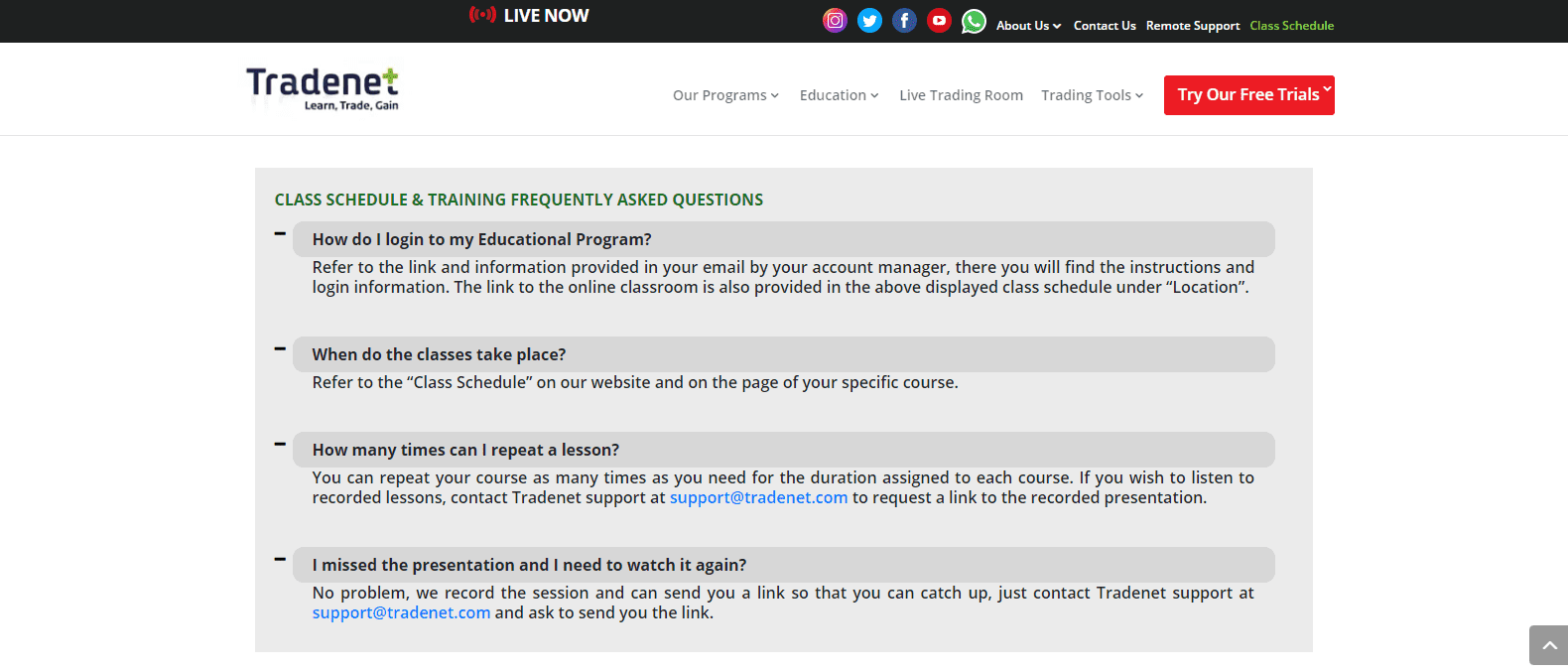

Tradenet does not provide customer support hours, which is available via e-mail, web form, phone, and remotely through TeamViewer. There is no FAQ section, but since all courses carry a personal touch, students can address all questions directly to mentors.

Bonuses and Promotions

Tradenet presently offers a 35% discount on its Tradenet Plus service.

A singular bonus program offers a 35% discount on an overly inflated price.

Opening an Account

There is neither an account opening process nor a login at the Tradenet website. Students can acquire the educational package or course via a simple checkout. Tradenet then e-mails the purchased package to the trader, together with the necessary means to connect to included services, if applicable. Very little is known beforehand, and Tradenet will answer all after-purchase questions with a reference back to the information sent in the purchase verification e-mail. The lack of transparency about the order process remains unacceptable.

Limited information is available before any purchase.

Deposits and Withdrawals

Students can either pay via PayPal or by credit/debit card. No other payment options exist. Again, the 14-day money-back guarantee is the only form of protection available.

PayPal or a credit/debit card are required to complete your purchase order.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Tradenet offers an overpriced educational service and operates a live chat room similar to a signal provider with the ability to engage with the mentors. Transparency about the business itself, the trading platform, and any potential broker-partners is missing. The products remain unlicensed by self-proclaimed experts, and the five-member team covers US-listed equities only. Per its account, it has taught over 30,000 students, but no proof is available to support that claim. Regrettably, Tradenet uses the same over-hyped marketing tactics as scammers and fraudsters, despite claiming to be a genuine educational academy.

While each student needs to determine if the costs are acceptable, most of the material is available 100% free of charge or via a low-cost alternative elsewhere. The trading signals available inside the live chat room are also overpriced and, in a trading scenario, would require a portfolio above $15,000 to be economical. Partnerships with third-party brokers, most likely via an affiliate link, appears to exist, but again, there is no transparency. Tradenet has a distinct focus on marketing, preying on new traders attracted to the hype, and recycling free information, except, through them, it will come with a personalized touch. Traders should proceed with extreme caution and consider the costs carefully. Tradenet sells unlicensed educational products but provides no information regarding its business structure or whether it is duly registered. Tradenet only offers educational services. Any funded account is provided by a third-party, most likely in partnership with Tradenet. There is no option to withdraw funds, as you do not deposit funds. Students purchase educational packages only. Any account deposits/withdrawals are via the partner-broker, if applicable. There is no indication that Tradenet operates a scam, just an overpriced educational service. Given the costs, Tradenet is not suitable for beginners, and those who can afford it, generally do not require it.FAQs

Is Tradenet real?

How does the Tradenet funded account work?

How do I withdraw money from Tradenet?

Is Tradenet a scam?

Is Tradenet for beginners?