For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

Global broker Trading.com promises to simplify your trading experience by offering a streamlined approach. Traders get one account type with a minimum deposit requirement of $50, the MT5 trading platform, a commission-free cost structure, and 1,400+ assets. Therefore, I rank Trading.com among the most beginner-friendly Forex brokers ideal for first-time traders. Can its simplicity and accessibility deliver a competitive edge? Read my full Trading.com review to find out.

Overview

Trading.com offers a user-friendly trading environment ideal for beginners.

Headquarters | United States |

|---|---|

Regulators | ASIC, CFTC, CySEC, FCA, NFA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2019 |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Average Trading Cost EUR/USD | $12.00 |

Average Trading Cost GBP/USD | $18.00 |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Trading.com Five Core Takeaways:

- Transparent trading fees

- Education and research for beginners

- No-deposit bonus and demo trading competition

- No MT4 trading platform

- 24/5 customer support

Trading.com Regulation and Security

Country of the Regulator | Australia, Cyprus, United Kingdom, United States |

|---|---|

Name of the Regulator | ASIC, CFTC, CySEC, FCA, NFA |

Regulatory License Number | 705428, 0516820, 256/14, 443670 |

Regulatory Tier | 1, 1, 1, 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. Trading.com has two regulated subsidiaries with a clean track record.

Is Trading.com Legit and Safe?

My Trading.com review found no verifiable misconduct or malpractice by this broker. Therefore, I can recommend Trading.com, which was founded in 2019, as a legitimate and safe broker.

Trading.com regulation and security components:

- Regulated by the US Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA #0516820), and the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities & Investments Commission (ASIC).

- Founded in 2019.

- The corporate owner is the well-known financial firm Trading Point.

- Segregation of client deposits from corporate funds.

What Would I Like Trading.com to Add?

Trading.com ticks most boxes from a security perspective, but I would appreciate more transparency about its core management team and auditors. A third-party insurance policy would increase its safety profile.

Fees

Average Trading Cost EUR/USD | $12.00 |

|---|---|

Average Trading Cost GBP/USD | $18.00 |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

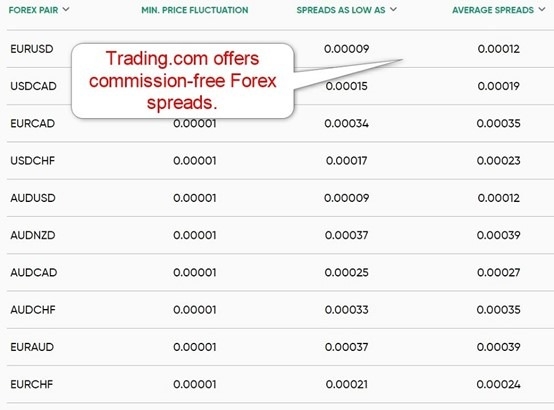

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Trading.com offers traders a commission-free pricing environment with reasonable costs starting from 0.9 pips or $9.00 per 1.0 standard round lot for major currency pairs.

Trading.com has no internal deposit or withdrawal fees, but third-party processing costs and currency conversion fees may apply. After twelve months of dormancy, Trading.com levies a $10 monthly inactivity fee.

The average trading costs for the EUR/USD at Trading.com at the time of writing are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.2 pips | $0.00 | $12.00 |

Here is a snapshot of Trading.com’s Forex spreads:

The most ignored trading costs are typically swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Trading.com real account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the average spread and holding it for one night in the Trading.com T1 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

1.2 pips | $0.00 | $6.57 | X | -$18.57 |

1.2 pips | $0.00 | X | -$3.23 | -$8.77 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the average spread and holding it for seven nights in the Trading.com T1 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

1.2 pips | $0.00 | $45.99 | X | -$57.99 |

1.2 pips | $0.00 | X | -$22.61 | $10.61 |

Noteworthy:

- Trading.com offers positive swap rates on qualifying assets, allowing traders to earn money, as in the example above.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Trading.com is a pure forex broker that offers 69 currency pairs. It allows forex traders to achieve diversification across the forex sector.

Trading.com Leverage

Maximum Retail Leverage | 1:50 |

Maximum Pro Leverage | 1:50 |

What should traders know about leverage ratios offered by Trading.com?

- Maximum retail forex leverage is 1:50.

- Not all currency pairs qualify for the maximum leverage.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

Traders at Trading.com get one account type, T1. A practice account is also available.

My observations concerning the Trading.com account types:

- The minimum deposit is $50.

- The maximum leverage is 1:50.

The Account base currency is the USD.

Trading.com Demo Accounts

Demo trading does not grant exposure to the full reality of trading psychology and can create unrealistic expectations. Therefore, I want to caution beginner traders in using demo trading as a simulator tool – it is more suited to basic education and familiarization with the broker.

What stands out about the Trading.com practice account?

- Trading.com offers customizable MT5 demo accounts.

- There is no expiry date on demo accounts.

- Its demo account requires registration but not account verification.

Trading Platforms

Traders get the out-of-the-box MT5 trading platform as a desktop client and a popular mobile app. Regrettably, Trading.com does not provide any trading platform upgrades. I recommend the desktop client, as it offers all the functions, including algorithmic trading. Traders can upgrade MT5 via 10,000+ custom indicators, templates, and EAs.

Alternatively, traders may use the user-friendly, web-based platform for manual trading. It features detailed charting, advanced tools, and a customizable interface that allows forex traders to manage their portfolios from one browser window.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The unique feature of Trading.com is its simple, novice-friendly trading environment for beginners, making it an ideal niche broker.

Research and Education

Trading.com employs an in-house research team that publishes market commentary and daily updates. Traders also receive actionable trading signals, investor sentiment, and technical summaries of select assets. I rank the research portal at Trading.com among the most competitive resources among US-based online Forex brokers.

What about education at Trading.com?

During my Trading.com review, Trading.com provided beginners with 33 tutorials and 13 video tutorials, sub-divided into lessons for beginner, intermediate, and advanced traders. It offers a solid introduction to Forex trading.

My conclusion:

- Traders can start their education with the quality content provided by Trading.com.

- I also recommend beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

Customer Support

Customer support is available 24/5. Traders can contact Trading.com via e-mail, phone, and live chat. Unlike many brokers with chatbots or call centers, Trading.com provides boutique customer support. An FAQ section answers many questions, though I had no reason to contact customer support during my Trading.com review, as Trading.com explains its products and services well.

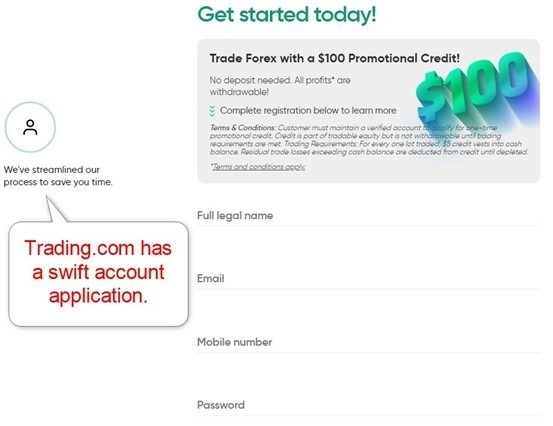

Bonuses and Promotions

During my Trading.com review, traders received a $100 promotional credit. Trading.com also hosts a monthly Forex Paper Trading Competition with real cash rewards of $1,000, $3,000, and $6,000. Terms and conditions apply, and I urge traders to read and understand them before accepting incentives.

Opening an Account

Trading.com has a swift account opening process that takes less than 20 seconds to complete.

What should traders know about the Trading.com account opening process?

- Trading.com complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders can pass verification by uploading a copy of their driver’s license.

- Trading.com may ask for additional information on a case-by-case basis.

Clients should take a few more minutes to go through Trading.com's legal documents.

Minimum Deposit

The minimum deposit at Trading.com is $50.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

Trading.com accepts bank wires transfers and ACH payments.

Accepted Countries

Trading.com does not provide a detailed list of accepted countries, but the US-based entity only caters to US residents.

Deposits and Withdrawals

The secure Trading.com back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Trading.com?

- The minimum deposit is $50.

- Trading.com has a minimum withdrawal amount of $25.

- The processing times and fees depend on the payment processor.

- Trading.com does not charge withdrawal fees except on bank wires below $250, which incur a $13 withdrawal fee.

- Trading.com processes withdrawal requests within 24 hours.

- In compliance with AML regulations, the name of the trading account and payment processor must be identical.

Is Trading.com a Good Broker?

I like the trading environment at Trading.com for beginners, as it offers one of the best niche approaches in the industry. Trading.com keeps everything simple, offering one account type, reasonable commission-free costs, and a $50 minimum deposit requirement. Trading.com has excellent corporate ownership and provides a safe and secure trading environment. Therefore, I recommend Trading.com to beginners who seek a high-quality forex broker. Trading.com is a registered Retail Foreign Exchange Dealer with the NFA and CFTC in the United States (NFA #0516820), the FCA in the United Kingdom, CySEC in Europe, and ASIC in Australia. Opening an account at Trading.com is free, with traders incurring the spread per transaction. Trading.com offers commission-free trading, with the only cost for the trader being the spreads. For withdrawals, Trading.com processes bank wires and ACH payments. Yes, Trading.com operates as a legitimate registered broker with NFA and CFTC, having been approved since 2020.FAQs

Is Trading.com regulated?

Is Trading.com free?

How do I withdraw money from Trading.com?

Is Trading.com a legit broker?