Editor’s Verdict

Woxa is a new broker, established in 2019, claiming 1,500 clients and referring to itself as a leading social trading broker. It offers traders a proprietary web-based platform and mobile app. Still, during my review, it only accepted traders from five Asian countries. I have reviewed this broker to evaluate its trading conditions. Is Woxa the right choice for your portfolio?

Overview

New copy trading broker with fractional share dealing and a user-friendly mobile app.

Headquarters | Mauritius |

|---|---|

Regulators | FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2019 |

Minimum Deposit | $25 |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 2.2 pips |

Average Trading Cost GBP/USD | 5.4 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $28 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 2.2 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the ambitious approach by Woxa, the focus on its copy trading feature, and the passive trading approach for which it has custom-tailored solutions. Woxa appears to want to emulate eToro but with Asia as its core market. I wish Woxa would provide more details covering its core trading environment, and hopefully this will come soon.

Woxa Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Woxa presents clients with one regulated entity.

Country of the Regulator | Mauritius |

|---|---|

Name of the Regulator | FSC Mauritius |

Regulatory License Number | GB22200605 |

Regulatory Tier | 4 |

Is Woxa Legit and Safe?

The FSC in Mauritius is a capable regulator overseeing some well-known and trustworthy brokers. I trust the FSC in their due diligence before granting a license. Segregation of client deposits from corporate funds and negative balance protection exist. Therefore, Woxa is legit, but I cannot comment on its safety, given the relative lack of operational history.

Fees

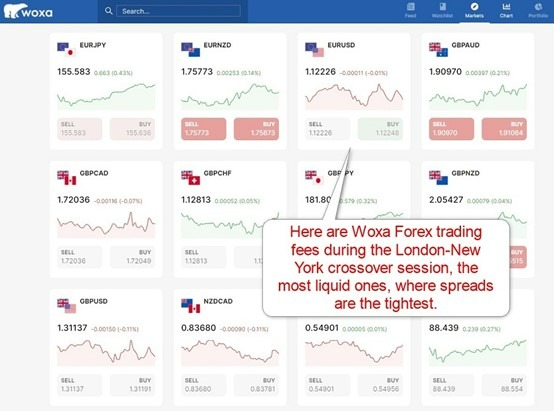

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Regrettably, Woxa lacks full pricing transparency. It notes commission-free trading for buy-only equity and ETF CFDs and the availability of fractional share dealing. One section showed live Forex spreads during the London-New York crossover section for the EUR/USD as 2.2 pips or $22.00 per 1.0 standard round lot, suggesting commission-free trading applies across assets.

Average Trading Cost EUR/USD | 2.2 pips |

|---|---|

Average Trading Cost GBP/USD | 5.4 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $28 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 2.2 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at Woxa are:

Average Spread | Commission per Round Lot | Fee per 1.0 Standard Lot |

|---|---|---|

2.2 pips | $0.00 | $22.00 |

Here is a snapshot of Woxa trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check these before evaluating total trading costs.

Noteworthy:

- Woxa does not disclose its spreads, and customer support could not quote them to me.

Range of Assets

Woxa provides a well-balanced asset selection. Forex traders get 29 currency pairs, complemented by ten cryptocurrencies, eight commodities, eleven indices, 245 equities, and 40 ETFs. Fractional share dealing is available, allowing smaller portfolios to achieve cross-asset diversification. Woxa also offers in-house thematic investments. The asset selection is ideal for beginners and copy traders, who get liquid trading instruments suitable for their trading strategies. While Woxa covers most sectors, the quantity of assets should be increased for more advanced traders.

The minimum position size at Woxa is $5.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Woxa Leverage

The maximum Forex leverage at Woxa is 1:800. Negative balance protection applies, ensuring traders cannot lose more than they deposit.

Woxa Trading Hours (GMT -2)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:00 | Friday 21:59 |

Cryptocurrencies | Sunday 22:00 | Sunday 21:59 |

Commodities | Sunday 22:00 | Sunday 21:59 |

Crude Oil | Sunday 22:00 | Sunday 21:59 |

Gold | Sunday 22:00 | Sunday 21:59 |

Metals | Sunday 22:00 | Sunday 21:59 |

Equity Indices | Monday 13:30 | Friday 20:00 |

Stocks | Monday 13:30 | Friday 20:00 |

ETFs | Monday 13:30 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5, and cryptocurrencies which trade 24/7.

Account Types

Woxa needs to mention more details about account types on its website. The terms and conditions make a general statement that the company will set and display the details on its website, which it did not do during my review. Woxa requires a minimum deposit of $25, and offers a $50 no-deposit bonus.

Woxa Demo Account

Woxa automatically opens a $100,000 demo account with each registration. It does not provide further details, like expiration, leverage selection, or asset availability. Since Woxa focuses on copy trading, it should ideally feature an unlimited demo account.

I want to caution beginner traders in using demo trading as an educational tool, and they should consider the inherent limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders get a proprietary web-based trading platform and mobile app. The website notes MT5, but customer support confirmed it is unavailable and apologized for the inconvenience. Woxa plans to add it as an alternative soon and to support algorithmic trading.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The most unique feature at Woxa is its copy trading feature, which is equal in scope to the best copy trading CFD brokers in the industry.

Research & Education

Woxa does not provide reserach, which I do not view negatively, as traders can access countless free and paid-for research online. Since Woxa is a copy trading platform, it relies on traders copying trades from signal providers, making research redundant. Still, it creates a services gap compared to many other brokers.

Woxa has an excellent educational section featuring 1,235+ articles and videos. Still, the 4.8 rating from 86K reviews puzzled me, as the homepage states 1.5K traders. Woxa incorporated it from a third party, which is perfectly fine. Still, I wish for more honesty and transparency. I highly recommend beginners start their education with well-structured educational content at Woxa.

I also recommend traders focus on trading psychology as their first lesson, followed by leverage and its relationship with risk management. Traders can always source more in-depth education elsewhere, available for free. At the same time, they should avoid paid-for courses and mentors.

Since beginner traders remain the core market for Woxa, I appreciate the educational content at Woxa, which I rate as their best feature.

Customer Support

Customer Support Methods |   |

|---|---|

Website Languages |     |

Woxa offers 24/7 customer support in English, Malay, Indonesian, and Vietnamese. It is only available via live chat with a fast response time. The partnership section lists an e-mail address, but it is unclear if Woxa answers traders there or only to partners. Customer support struggles to answer certain questions.

There is no FAQ section, and Woxa should explain its products and services better.

I like the availability of customer support, but Woxa should train its customer support representatives better.

Bonuses and Promotions

Woxa currently offers a $50 no-deposit bonus. Terms and conditions apply, and I recommend traders read and understand them before accepting the bonus. It also has a well-structured affiliate and IB program for passive income opportunities.

Opening an Account

The online application at Woxa only asks for a desired username, valid e-mail address, and desired password. Woxa will send a confirmation e-mail with a verification link to complete the account registration.

As a regulated broker, account verification at Woxa is mandatory. Most traders will pass it by sending a copy of their government-issued ID and one proof of residency document. Woxa might ask for additional information on a case-by-case basis.

Minimum Deposit

Woxa has a minimum deposit requirement of $25.

Payment Methods

Woxa does not provide any details about payment methods. Its terms and conditions only note bank wires and credit/debit cards.

Withdrawal options |    |

|---|---|

Deposit options |    |

Accepted Countries

Woxa only accepts traders resident in India, Indonesia, Malaysia, the Philippines, and Vietnam. It also states that its “website and contents is not available for residents of FATF blacklist, various countries and jurisdictions, which include but are not limited to the European Union, United Kingdom, Cuba, Myanmar, Turkey, Japan, Singapore, New Zealand, Poland, Canada, Iran, North Korea, and the United States.”

Deposits and Withdrawals

The Woxa back office handles all financial transactions for verified clients.

Woxa publishes no details concerning deposits and withdrawals. The terms and conditions reference bank wires and credit/debit cards. The generic document needs to provide details other than stating the company can dictate minimum deposit and withdrawal amounts, which depend on the account type. I was intrigued, as Woxa needs to introduce its account types. While the terms and conditions state the company will publish details about account types and payment methods on its website, Woxa does neither.

Is Woxa a good broker?

I like the trading environment at Woxa for its ambitions. Still, Woxa needs to ensure its website lists all the necessary details. It also contradicts itself on numerous occasions.

Woxa lacks details concerning its core trading environment, but I want to caution traders about trading fees. The best feature of Woxa is its educational section, which presents an excellent foundation to grow into a reputable broker. I would appreciate more transparency, honesty, and lower trading fees from this new copy trading broker. Still, it has the tools to carve out a spot as a copy trading Forex broker in Asia. Woxa offers a $50 no-deposit bonus for new clients that pass account verification. Woxa needs to gain the operational experience to judge its safety. My review did not uncover any wrongdoing or misconduct, and I trust the due diligence of its regulator, the FSC, as it oversees several industry-leading brokers. Woxa is a legit and regulated broker, licensed since April 2023 in Mauritius.FAQs

What is the Woxa $50 no-deposit bonus?

Is it safe to use Woxa?

Is Woxa legit or a scam?