Editor’s Verdict

Overview

Review

Headquarters | Australia |

|---|---|

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $200 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

ZERO Markets is the trade name of ZERO Financial Pty Ltd, which is an authorized representative of First Prudential Markets Pty Ltd. It has been in operation since 2017, according to the Australian Securities and Investments Commission (ASIC), its regulatory body. As the name suggests, this CFD broker offers raw spreads to its traders, features a proprietary trading platform and, being ASIC regulated, a very competitive trading environment. ZERO Markets is a White Label solution of First Prudential Markets (which is also the authorized representative of FPMarkets); all products are designed and maintained by them. The asset selection covers five sectors, and account management services are available via MAM/PAMM accounts.

Regulation and Security

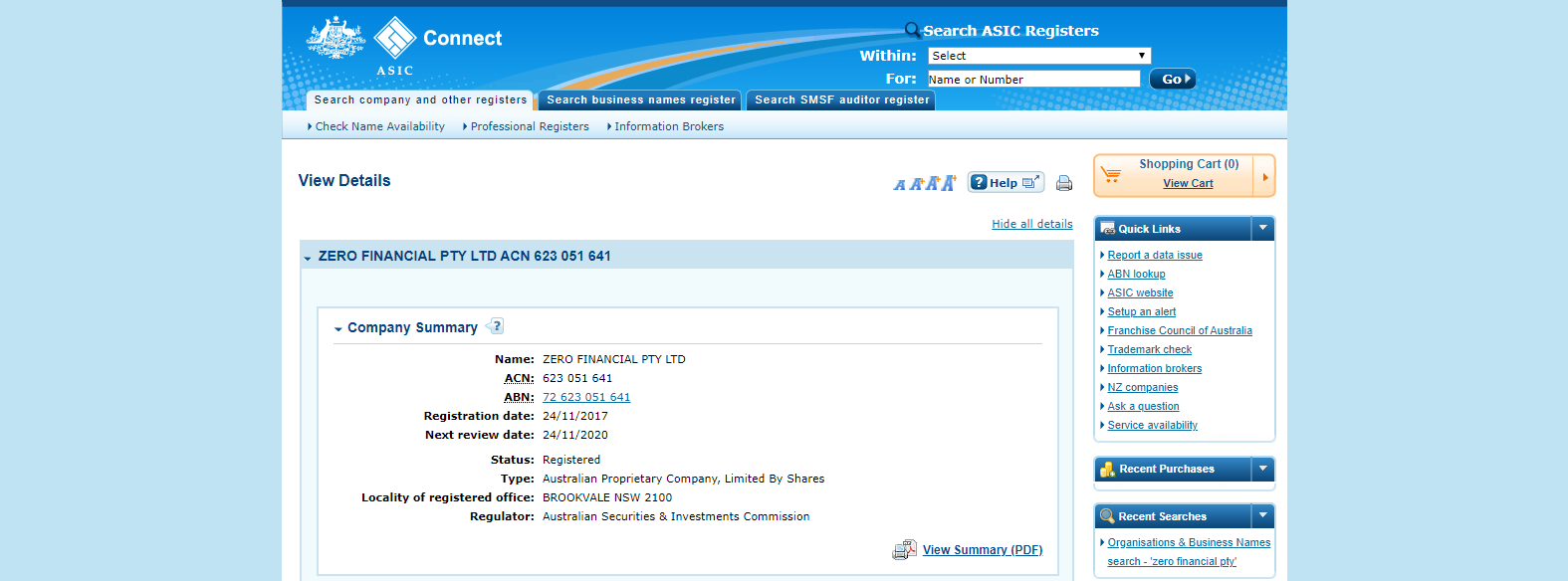

ZERO Financial Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) since November 2017. It is an authorized representative of First Prudential Markets Pty Ltd, which has been in operation since 2005. The Commonwealth Bank of Australia, one of the biggest banks in Australia, is the custodian of segregated client capital. This broker handles all funds per the Australian Client Money Rules under the Corporations Act.

Operating under ASIC regulation, ZERO Markets is protected by the Act of Grace mechanism under Section 65 of the Public Governance, Performance and Accountability Act 2013. The Scheme for Compensation for Detriment caused by Defective Administration (CDDA Scheme) covers traders in the event of a default by this broker. ZERO Markets has had a clean regulatory record, and traders may fully trust this ASIC authorized CFD and Forex broker.

ZERO Markets is an authorized representative of First Prudential Markets Pty Ltd.

ASIC provides the regulatory environment for this broker.

Fees

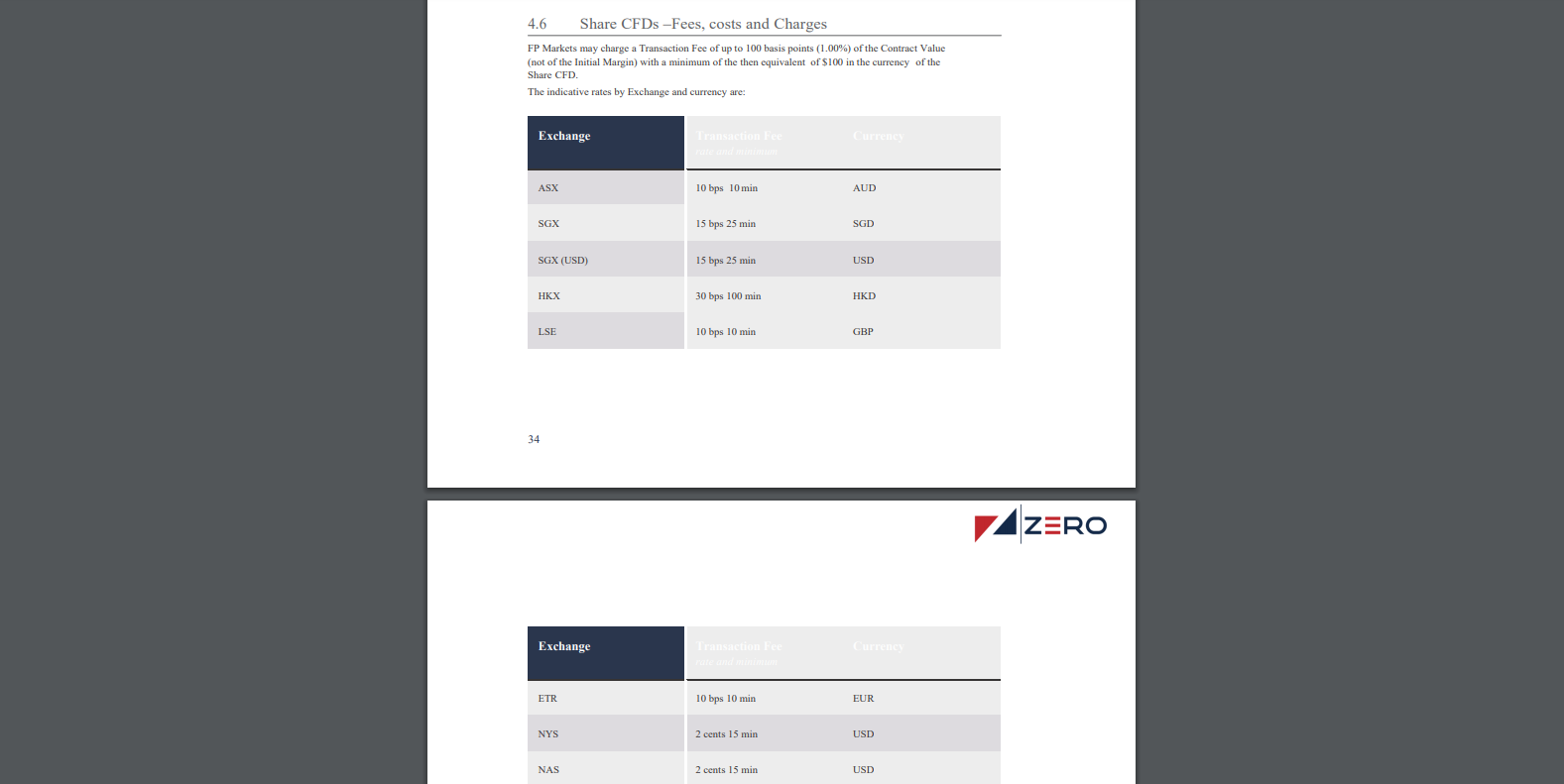

ZERO Markets' primary revenue sources are spreads and commissions. The lowest average spread is listed as 0.1 pips for the EUR/USD, while a commission of $3.50 per lot represents a very competitive offer. Equity CFDs incur an asset-dependent transaction fee; a reference to the fees is contained in the CFD Product Disclosure Statement.

Swap rates on leveraged overnight positions are levied and listed on the website except for equity-related costs. Corporate actions, such as dividends, mergers, or stock splits, impact equity and index positions, and are passed onto traders. Deposit and withdrawal charges may exist from third-party processors and, in isolated cases, by ZERO Markets. The overall cost-structure remains competitive, but traders should ensure they understand all fees.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

- Right-click on the desired symbol in the Market Watch window and select Symbols.

- Select the desired currency and then click on Properties located on the right side.

- Scroll down until you see Swap Long and Swap Short.

Spreads are very competitive at ZERO Markets.

Transaction fees for equity CFDs are contained within the Product Disclosure Statement.

What Can I Trade

Over 10,000 assets are available to traders, with the bulk in equity CFDs. Traders have access to 45 currency pairs, eight commodities and five cryptocurrencies. Complementing more than 10,000 equity CFDs across five countries are nine index CFDs. Equity traders will find the overall selection outstanding, as will asset managers active in this sector. New Forex traders have an acceptable entry-level choice. Cross-asset diversification may be achieved albeit at its most basic.

The equity market accounts for the bulk of ZERO Market assets.

Account Types

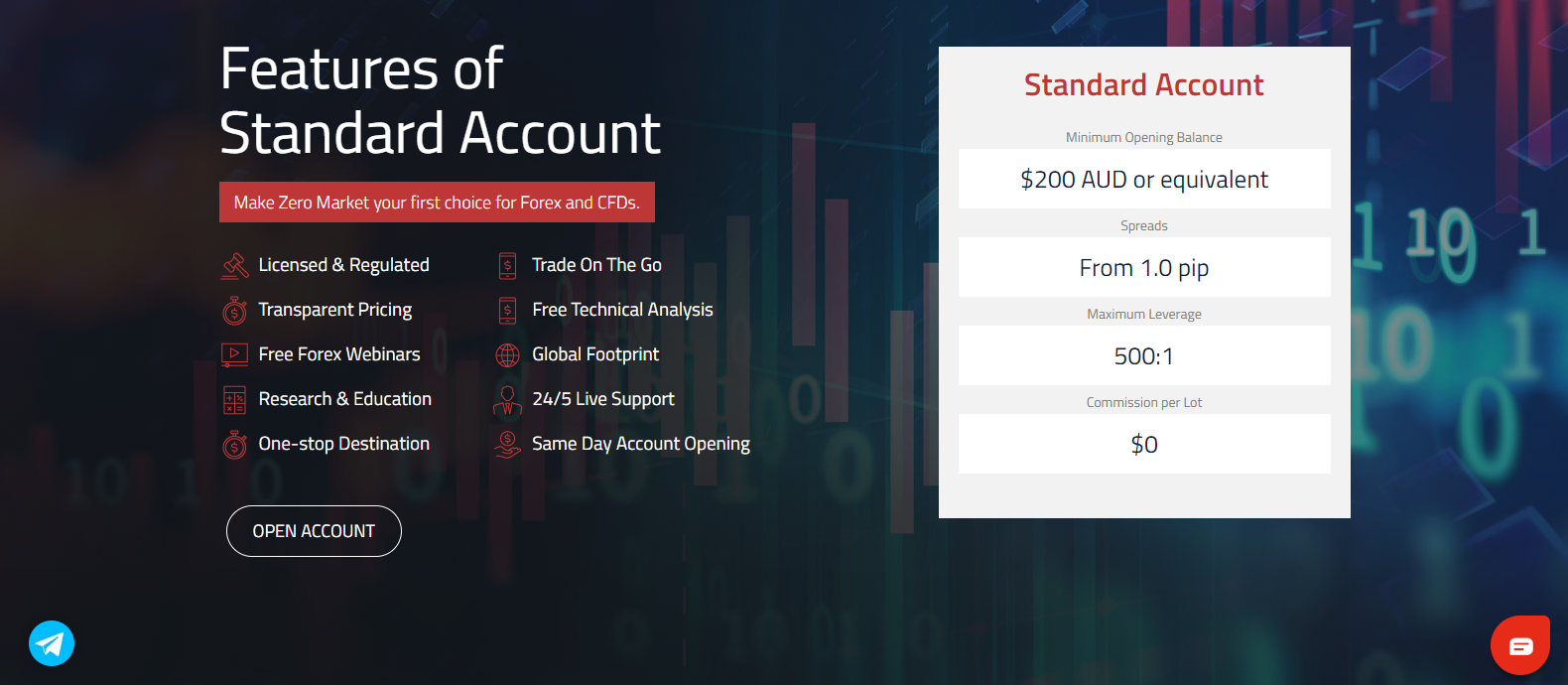

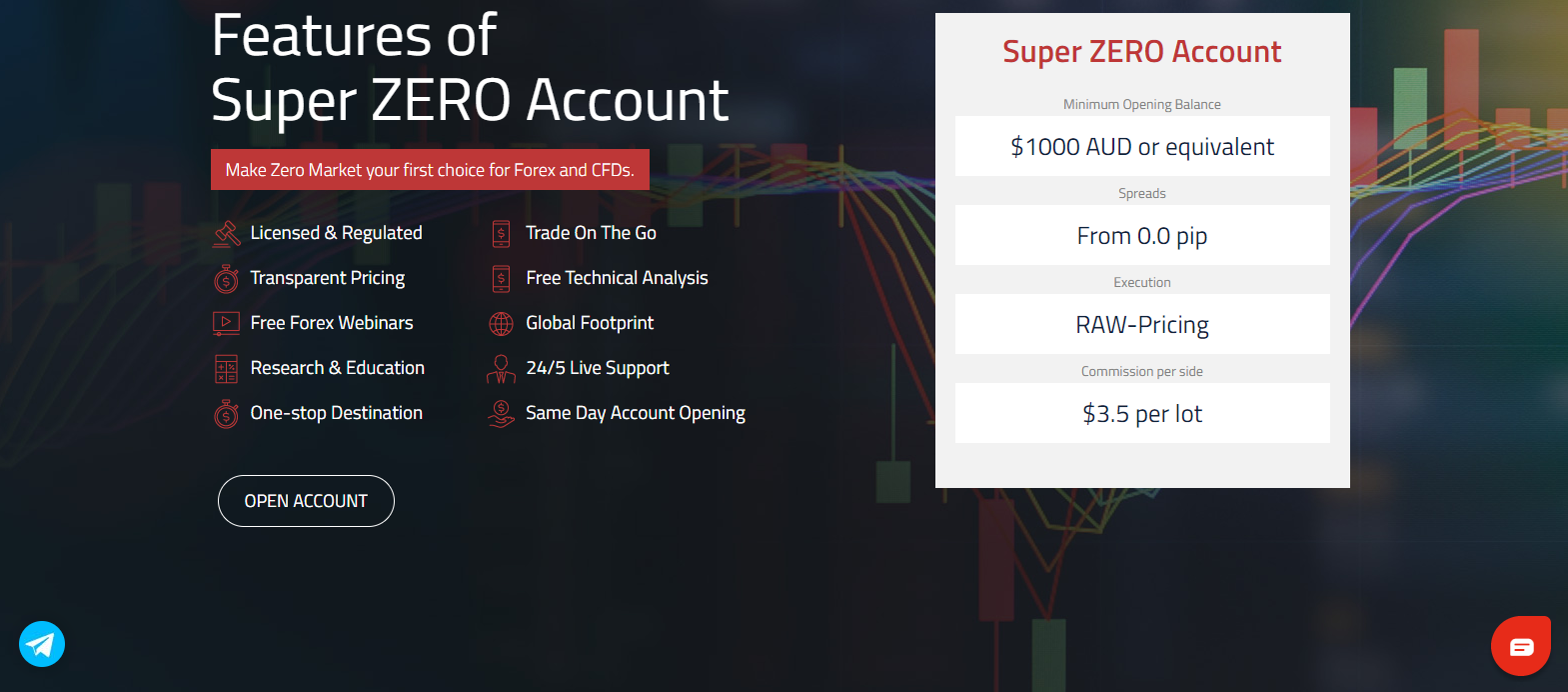

Traders have a choice between a Standard Account and Super ZERO Account. The former is a commission-free account with a 1.0 pips minimum spread, which is well suited for low-frequency retail traders. The latter account type carries a minimum average spread of 0.1 pips for a commission of $3.50 per lot; high-frequency traders, scalpers, and asset managers will benefit considerably from this account type. Both account types feature maximum leverage of 1:500, and the minimum deposit is $200 and $1,000, respectively. MAM/PAMM accounts support asset managers; a minimum deposit of A$20,000, or a currency equivalent, is mandated and provides a reduced commission per lot of $1.

The Standard Account is best suited for retail traders with limited transactions and volume.

Most traders will manage portfolios from the competitively priced Super ZERO Account.

Trading Platforms

ZERO Markets provides traders with the full suite of the retail favorite, the MT4 trading platform, together with its failed successor, MT5. Automated trading is fully supported by the MT family of trading platforms; traders should be cognizant of the fact that the MT5 lacks backward compatibly to MT4, where the most significant portion of investment by third-party FinTech is focused. Dedicated traders may need to invest in third-party plugins for MT4 to unlock its full potential.

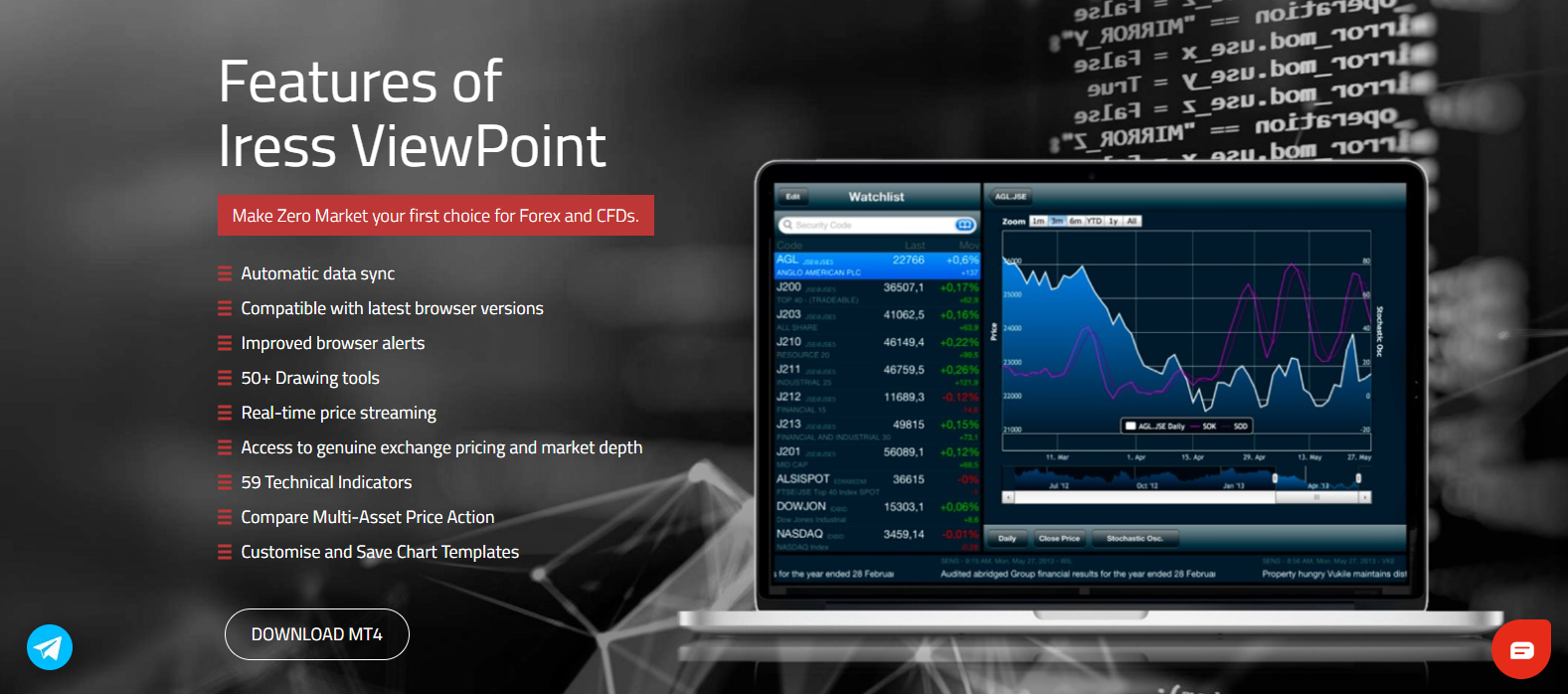

Alternatively, Iress ViewPoint is available as a webtrader platform. Iress ViewPoint features an extensive charting package and clean user-interface, though it is best suited as an alternative for manual traders.

The popular MT4 trading platform is available at ZERO markets.

MT5, the failed MT4 successor platform, is also provided.

Manual traders may alternatively opt for Iress ViewPoint, which is a webtrader platform.

Unique Features

No unique features are available at ZERO Markets. This broker focuses primarily on the core trading environment where it succeeds in an excellent pricing environment.

Research and Education

An education section is maintained on the website, though it appears to be a work in progress. The Learn to Trade category consists of three sub-categories, e.g., Beginner, Intermediate and Advanced. An extended glossary is provided to assist new traders by providing brief explanations of relevant terminology.

Technical Indicators follow the established glossary-type format of presentation. Though it lacks charts and examples, this section provides an in-depth explanation of each type of indicator, which includes an introduction and construction of the indicator, as well as strengths and weaknesses of each.

The section on Technical Indicators provides an in-depth explanation of the various indicators.

In-house research, in the form of an in-house blog, appears to be in development and will be a welcome addition, once realized.

In-house research is not currently provided by ZERO Markets but appears in development.

ZERO markets attempts to educate traders of all levels with featured content.

A glossary section is available to educate new traders.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

The most convenient method to reach customer support is via live chat which is available from every screen. A call back option and e-mail support are equally available. Operating hours for ZERO Markets' customer support team are 24/5.

Customer Support is available 24/5 via several channels

Bonuses and Promotions

ZERO Markets neither offers bonuses nor hosts special promotions.

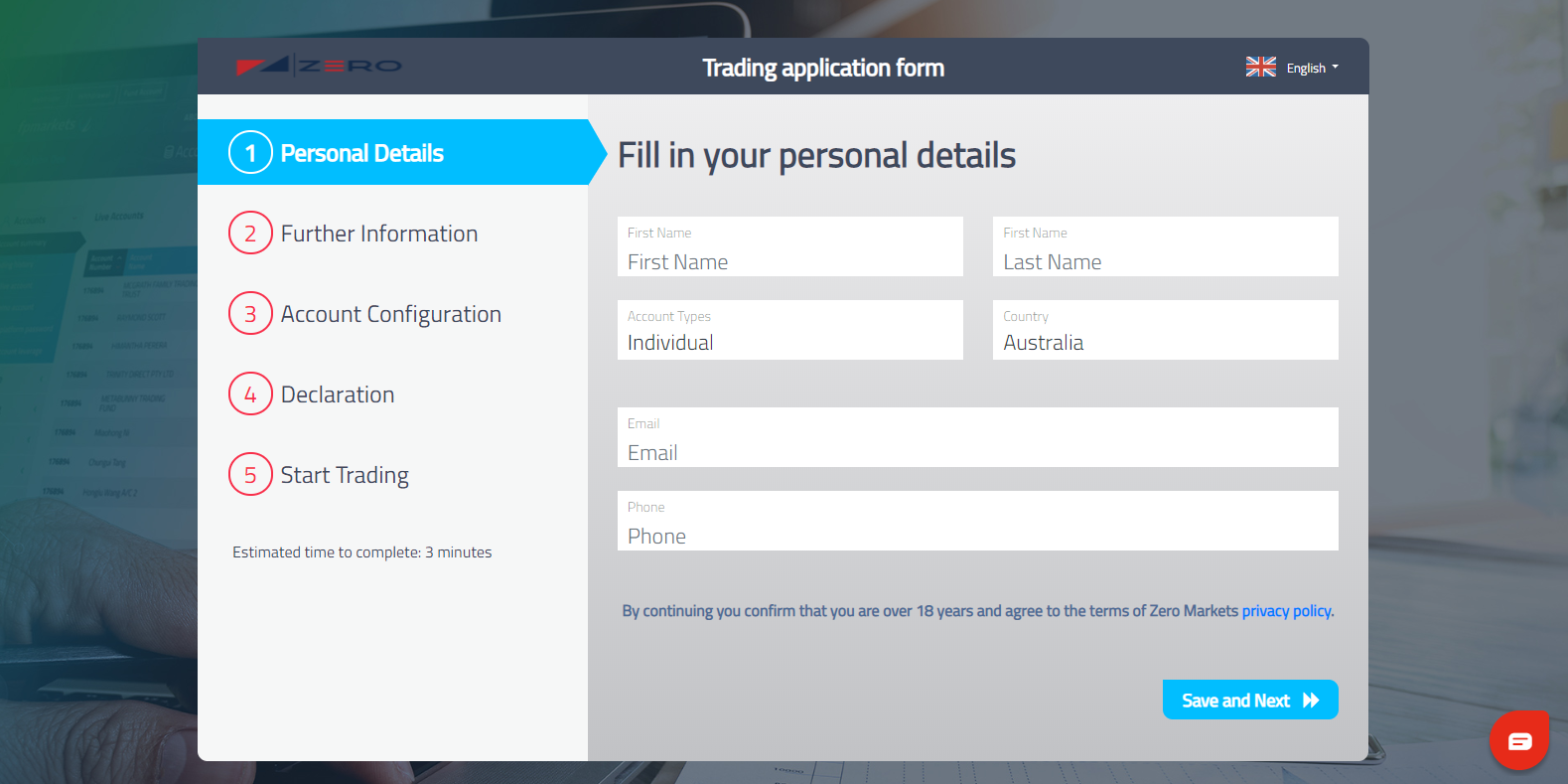

Opening an Account

Per established industry standards, the online application processes new accounts. ZERO Markets created a five-step process, with an estimated completion time of three minutes. As an ASIC regulated brokerage, new accounts require verification to comply with AML/KYC stipulations. Typically, a copy of the trader’s ID and one proof of residency document are required. Full regulatory compliance by this broker is maintained, and traders may trust ZERO Markets with personal information and deposits.

The Account Opening Procedure is in line with industry requirement.

Deposits and Withdrawals

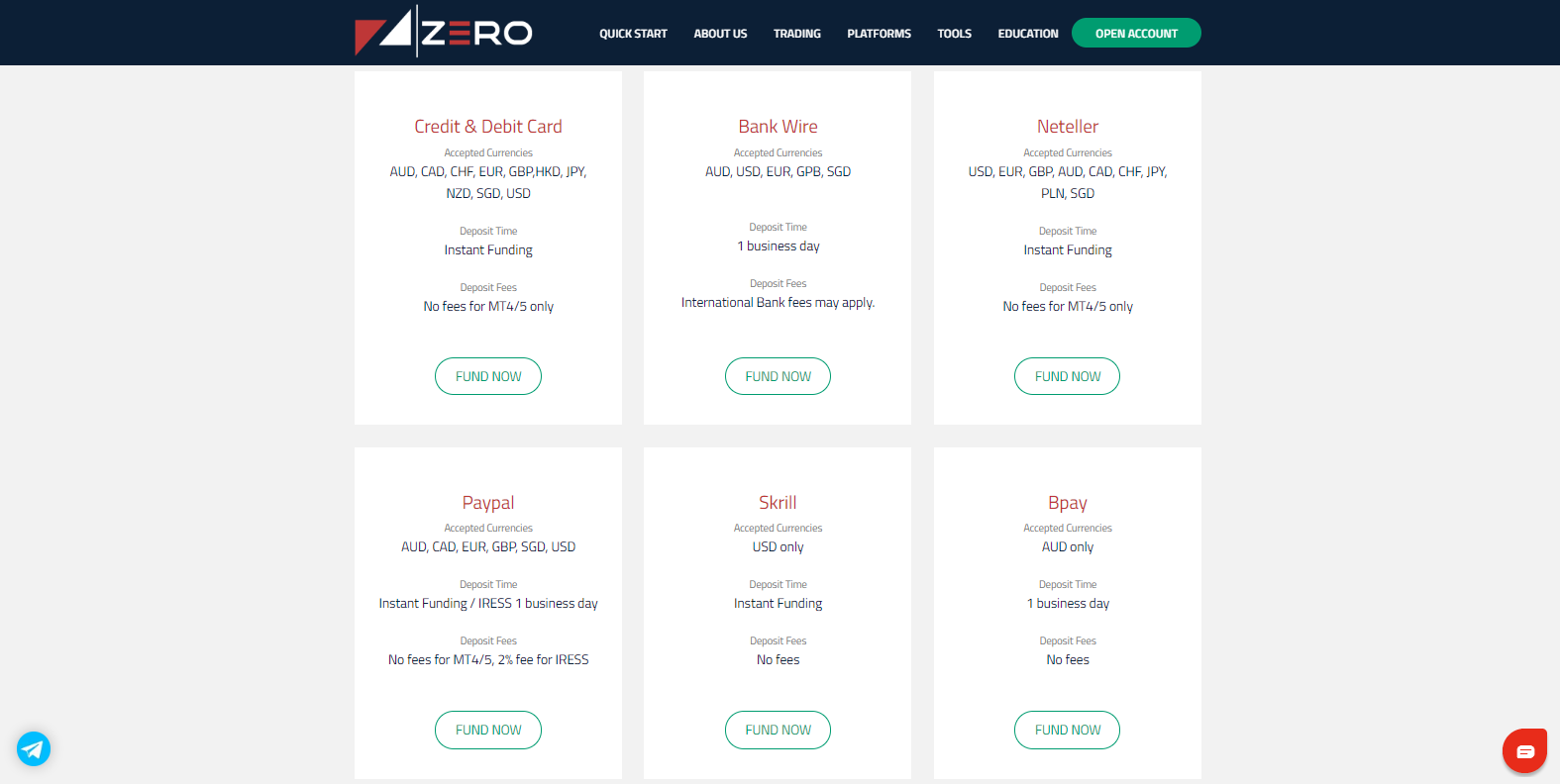

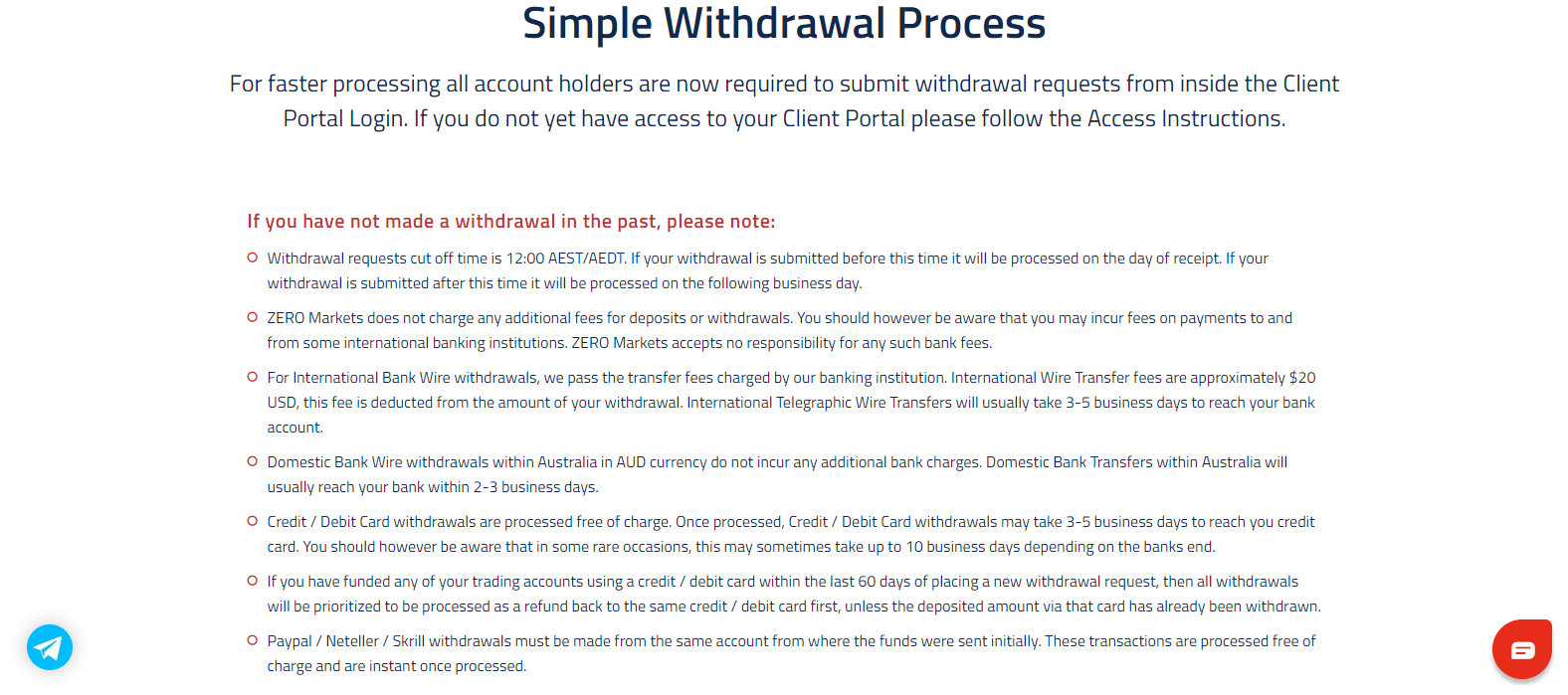

Funding methods consist of credit/debit cards, bank wires, Neteller, PayPal, Skrill, and BPay. Broker-to-broker transfers are also supported for traders switching brokers but seeking to maintain their existing portfolio; a $25 fee is charged for international broker-to-broker transfers. Third-party processing fees may exist. Charges from ZERO Markets apply to international bank wires and deposits into the Iress ViewPoint trading platform. This broker provides an acceptable choice of established processors. Per AML stipulations, the name of the ZERO Markets account and payment processor must be identical.

The overall choice of funding methods is acceptable for most traders.

The withdrawal process follows established standards and complies with AML stipulations.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

ZERO Markets is a trustworthy brokerage, which has been in operation as an authorized representative of First Prudential Markets Pty Ltd since November 2017. It is regulated by ASIC and has been fully compliant. This broker offers an excellent asset selection across the equity markets though selection across other maintained sectors is somewhat limited. Potential clients may be happy to learn that ZERO Markets' excellent cost-structure is geared towards trader profitability. This broker is a genuine, legitimate entity, in operation since November 2017. It is regulated by the Australian Securities and Investments Commission (ASIC), and is an authorized representative of First Prudential Markets Pty Ltd. This broker's cost-structure and leverage are excellent. ZERO Markets is a trustworthy Forex broker with an acceptable overall offer for new retail traders. The Standard Account requires $200 and the Super ZERO Account requires $1,000. As an ASIC regulated broker, the maximum leverage is 1:500. Yes, together with the MT5; third-party plugins may be required. The Iress ViewPoint trading platform provides manual traders with an alternative webtrader.FAQs

Is ZERO Markets legit?

Is ZERO Markets a good Forex broker?

What is the minimum deposit at ZERO Markets?

What is the maximum leverage at ZERO Markets?

Does ZERO Markets offer the MT4 trading platform?