Editor’s Verdict

Zerodha is the largest and cheapest online broker offering commission-free investments, low-cost trades, and proprietary trading platforms that support API trading. Zerodha notes that 10M+ of Zerodha traders account for 15% of Indian retail order volumes. I decided to review this broker to determine if its low-cost trading environment suffices to offer Indian investors and traders a competitive edge. Should you trade with Zerodha?

Overview

Low-cost multi-asset broker with a dominant market position.

Headquarters | India |

|---|---|

Regulators | SEBI |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Minimum Deposit | 0 |

Trading Platform(s) | Proprietary platform, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | 0.03% or ₹20 (whichever is lower) |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the low-cost flat trading fees at Zerodha, which can save active traders over 90% in trading costs versus competitors. Zerodha, a combination of zero and rodha (Sanskrit for barrier), delivers on its zero-barrier promise, as everything is simple, low-cost, and functional. I also like that Zerodha supports API trading, as the web-based trading platform lacks advanced features but suffices for manual retail trading.

Zerodha Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Zerodha presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

India | Securities and Exchange Board of India | INZ000031633 |

Is Zerodha Legit and Safe?

Zerodha is the leading online broker in India, operational since 2010 with a clean record. Complaints with relevant exchanges against Zerodha exist. The latest data covering the financial year 2022/2023 shows 573 complaints and 10,755,422 active Zerodha traders, of which exchanges resolved 500 complaints, while 38 were non-actionable. Therefore, I rank Zerodha as an exceptional online brokerage and highly recommend it.

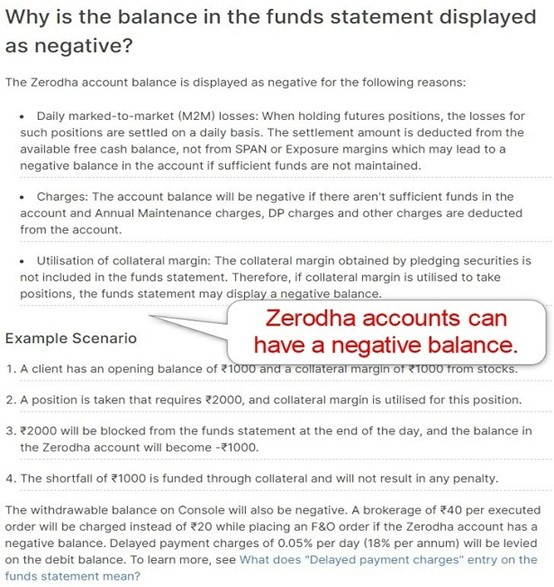

All client deposits are segregated from corporate funds, following SEBI guidelines. Zerodha continues to expand and is a transparent, legit, and safe broker, but I must note the absence of negative balance protection.

Fees

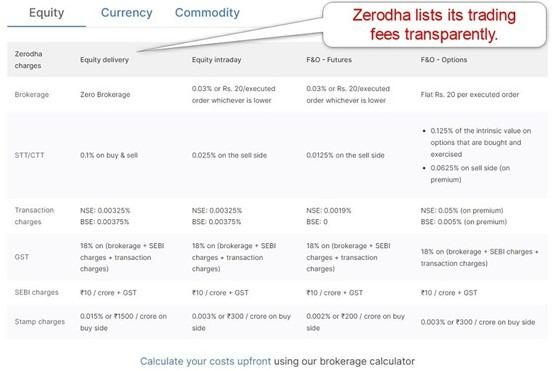

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Zerodha offers commission-free investments in Indian-listed equities and mutual funds. Traders pay 0.03% or ₹20 (whichever is lower) per trade, where I appreciate that Zerodha takes the lower fee versus competitors who take the higher one. I wish Zerodha would list its spreads transparently, and I want to note the existence of deposit fees, account opening fees, and annual maintenance fees on Demat accounts. Phone-assisted traders incur a ₹50 cost.

Annual costs for value-added services only apply if clients wish to add them to their trading environment. Traders must also pay regulatory and exchange fees plus the GST. Since they apply to all Indian brokers and traders, the trading fees at Zerodha are the cheapest across the increasingly competitive Indian brokerage sector.

Minimum Raw Spreads | Undisclosed |

|---|---|

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | 0.03% or ₹20 (whichever is lower) |

Deposit Fee | |

Withdrawal Fee |

Here is a snapshot of Zerodha trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. Zerodha offers leveraged trading, but I could not find any reference to its swap rates, a rare oversight by an overall transparent listing of trading and non-trading fees.

Range of Assets

Zerodha offers Indian-listed equities, mutual funds from fund families, options, futures, Forex, commodities, indices, and IPOs. Indian-resident traders get an excellent range of assets but no international diversification. Therefore, despite the number of trading instruments, the quality for managing well-diversified portfolios does not exist. I find the absence of ETFs and cryptocurrencies the most notable downside to the asset selection at Zerodha.

Zerodha Leverage

Zerodha offers maximum leverage of 1:20 on equities and does not mention limits on other assets. The demo trading platform fails to list leverage, margin requirements, and swap rates, but Zerodha offers a margin calculator. I want to caution traders against leveraged trading at Zerodha, as negative balance protection does not exist.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Zerodha Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 09:00 | Friday 17:00 |

Commodities | Monday 09:00 | Friday 23:55 |

Crude Oil | Monday 09:00 | Friday 23:55 |

Gold | Monday 09:00 | Friday 23:55 |

Metals | Monday 09:00 | Friday 23:55 |

Stocks (non-CFDs) | Monday 09:00 | Friday 16:00 |

Futures | Monday 09:00 | Friday 17:00 |

Noteworthy

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5

Account Types

The Zerodha account types are Equity & Derivatives Trading Account for traders, Equity Demat Account for investors, and Commodity Trading Account for commodity-only portfolios. There is no minimum deposit requirement, but traders must pay a fee to open an account. The Demat account also incurs an account maintenance charge (AMC) of ₹300 + 18% GST.

Zerodha Demo Account

Zerodha does not offer a demo account, but traders can evaluate the Kite trading platform. I find the absence of a demo account inexcusable.

Trading Platforms

Zerodha offers proprietary trading solutions, and the web-based Kite trading platform is its flagship product. It also developed a mobile app labeled Coin for mobile mutual fund purchases added automatically to Demat accounts. Kite is a user-friendly but basic trading platform that lacks advanced functions, algorithmic and copy trading options.

I want to note the availability of level 3 data and the charting package with hundreds of indicators, tools, and studies. The best feature of Kite is that it presents an entire ecosystem rather than just a trading platform.

I like that Zerodha offers API trading, allowing third parties to develop cutting-edge trading solutions and connect to the Zerodha trading infrastructure.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

I like how Zerodha does not just offer a trading platform but how it has created an ecosystem for investors and traders. Besides its Kite trading platform, Zerodha features its thematic investment platform smallcase, Streak as an algo and strategy platform, a dedicated options trading platform, sensibull, a bond trading platform, GoldenPi, and ditto, an insurance service.

Another unique feature is that Zerodha takes the smaller trading fee out of two pricing options rather than the expensive one like most competitors.

Awards

Zerodha received several awards for various aspects of its trading environment.

Among the most recent ones are:

- Economic Times Startup of the Year - 2020

- NSE, BSE, MCX Best Retail Brokerage Award - 2020

- NSE, BSE, MCX Best Retail Brokerage Award - 2019

- NSE, BSE, MCX Best Retail Brokerage Award - 2018

Research & Education

Zerodha does not offer actionable research but provides written market commentary on its Pulse News portal. Traders may also source valuable content on the Zerodha z-connect blog. While actionable research results in a value-added service, I do not consider its absence negative against Zerodha, given the abundance of available research online for free and via paid-for subscriptions.

Beginners get an excellent educational offering via the Zerodha Varsity service, led by Karthik Rangappa. It is a well-structured offering, including a five-book course for children to learn about finances. I highly recommend Zerodha Varsity to beginners and rate it among the best Indian financial educational sections, with an excellent structure and quality content.

I recommend beginners start with the Zerodha Varsity before funding a Zerodha account. It includes lessons covering trading psychology and risk management to deepen their foundation and avoid paid-for courses.

Customer Support

Support Hours | M-F, 9:30 a.m. - 6.30 p.m. (GMT + 5:30) |

|---|---|

Website Languages |  |

Zerodha relies on phone support, which I appreciate, as it ensures personalized service. An online ticketing system also exists. Since Zerodha explains its products and services well, I doubt most traders will require customer support, but Zerodha ensures it stands by if the need arises. The Zerodha support portal answers most questions, reducing the need to contact customer support.

Bonuses and Promotions

Zerodha neither offered bonuses nor promotions when I conducted my review, but the low trading fees remain superior to any incentive.

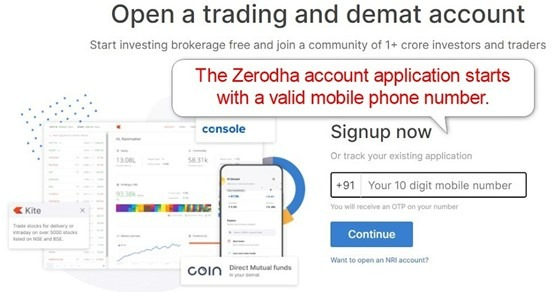

Opening an Account

Zerodha features an online application form that begins with a valid Indian mobile phone number, where new clients will receive an OTP to proceed with their application.

Like all regulated brokers, account verification is mandatory at Zerodha, in compliance with global AML/KYC requirements enforced by regulators. Zerodha requires in-person verification (IPV) via webcam, where new traders will verify their government-issued ID and one proof of residency document.

Minimum Deposit

Zerodha does not have a minimum deposit requirement.

Payment Methods

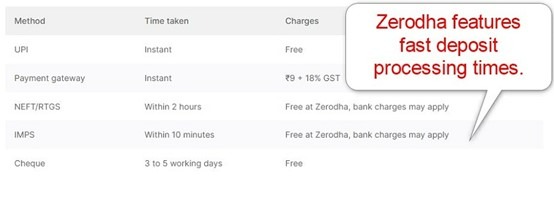

Zerodha supports UPI, Instant Payment Gateway, IMPS/NEFT/RTGS transfers, and cheques.

Accepted Countries

Zerodha is an Indian brokerage and only accepts Indian-resident traders.

Deposits and Withdrawals

The secure Zerodha console manages all financial transactions for verified clients.

Zerodha has no minimum deposit requirement, and the minimum withdrawal amount is ₹100. NEFT and cheque deposits are free, but other methods incur a fee of ₹9 + 18% GST. Third-party bank charges may apply, dependent on the payment processor. The Zerodha finance department process all withdrawal requests electronically, and states that clients will receive funds in their primary bank account within 24 hours.

Is Zerodha a good broker?

I like the trading environment at Zerodha as it offers low trading fees, and investors benefit from commission-free costs. Beginners get an excellent educational portal, which I rate among the best in India. The proprietary Kite trading platform supports API trading, and Zerodha developed an entire ecosystem dedicated to investing and trading.

The lack of a minimum deposit requirement ensures all traders have access, and the mobile app caters well to younger clients and their mobile centrist approach to financial markets. My review confirmed that Zerodha is the most competitive Indian online discount broker with a bright future and an ever-expanding product and service portfolio.

Nithin and Nikhil Kamath founded Zerodha, and their family firm maintains ownership. Zerodha offers the infrastructure to make money, but it depends 100% on clients to successfully earn from their investments and trades. There is no minimum deposit requirement at Zerodha. Zerodha is popular because it is a low-cost broker with a high-quality financial ecosystem and an honest management team. Zerodha is an excellent choice for beginners, and it offers its high-quality educational portal Zerodha Varsity. Clients can withdraw 1.0 crore from their Zerodha account if they have the amount in free margin. The only monthly fees at Zerodha are for value-added services if clients request them. Zerodha features a host of fees, some beyond its control. While trading fees apply, transparently listed on the Zerodha website, Zerodha remains the cheapest broker in India. Zerodha is a SEBI-regulated broker with over ten years of experience and an excellent operational history. I rate it among the most trustworthy Indian brokers.FAQs

Who owns Zerodha?

Do people make money on Zerodha?

How much money is required for Zerodha?

Why is Zerodha so popular?

Is Zerodha good for beginners?

Can I withdraw 1.0 crore from a Zerodha account?

Does Zerodha charge monthly?

Is Zerodha really free?

Is Zerodha trustworthy?