ZuluTrade Editor’s Verdict

ZuluTrade ranks among the leading copy trading service providers with a bright future following its acquisition by an Indian FinTech firm. The choice of trading strategies remains unrivaled. ZuluGuard, ZuluScripts, and Automator are three tools separating ZuluTrade from its competition. Managed trading services adds to the competitive tools available at ZuluTrade. I reviewed this market-leading copy trading provider claiming 70%+ profitability to evaluate its ecosystem. Should you follow traders on ZuluTrade?

Overview

ZuluTrade, a Greek fintech company, was founded in 2007 and has grown into one of the dominant players in the social trading sub-sector of the Forex market.

Headquarters | Greece |

|---|---|

Year Established | 2007 |

Execution Type(s) | Market Maker, Binary Options, No Dealing Desk |

Minimum Deposit | Broker Dependent |

Trading Platform(s) | MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

The Daily Telegraph named the firm to its Start-Up 100 list in 2011. The company grew to over 120 employees by 2013, expanded into Japan the following year with the acquisition of regulated investment advisor Market Crew Investment Advisor LTD. In 2015 it became a licensed portfolio management company in the EU. ZuluTrade was acquired by Chinese based Formax Group for over $12.4 million, together with Dayo and AAAFX.com, the Greek brokerage owned by ZuluTrade. The company has partnerships with over 64 global brokerages and continues to expand globally. This ZuluTrade review will focus on the social trading offerings of the company, not its brokerage arm.

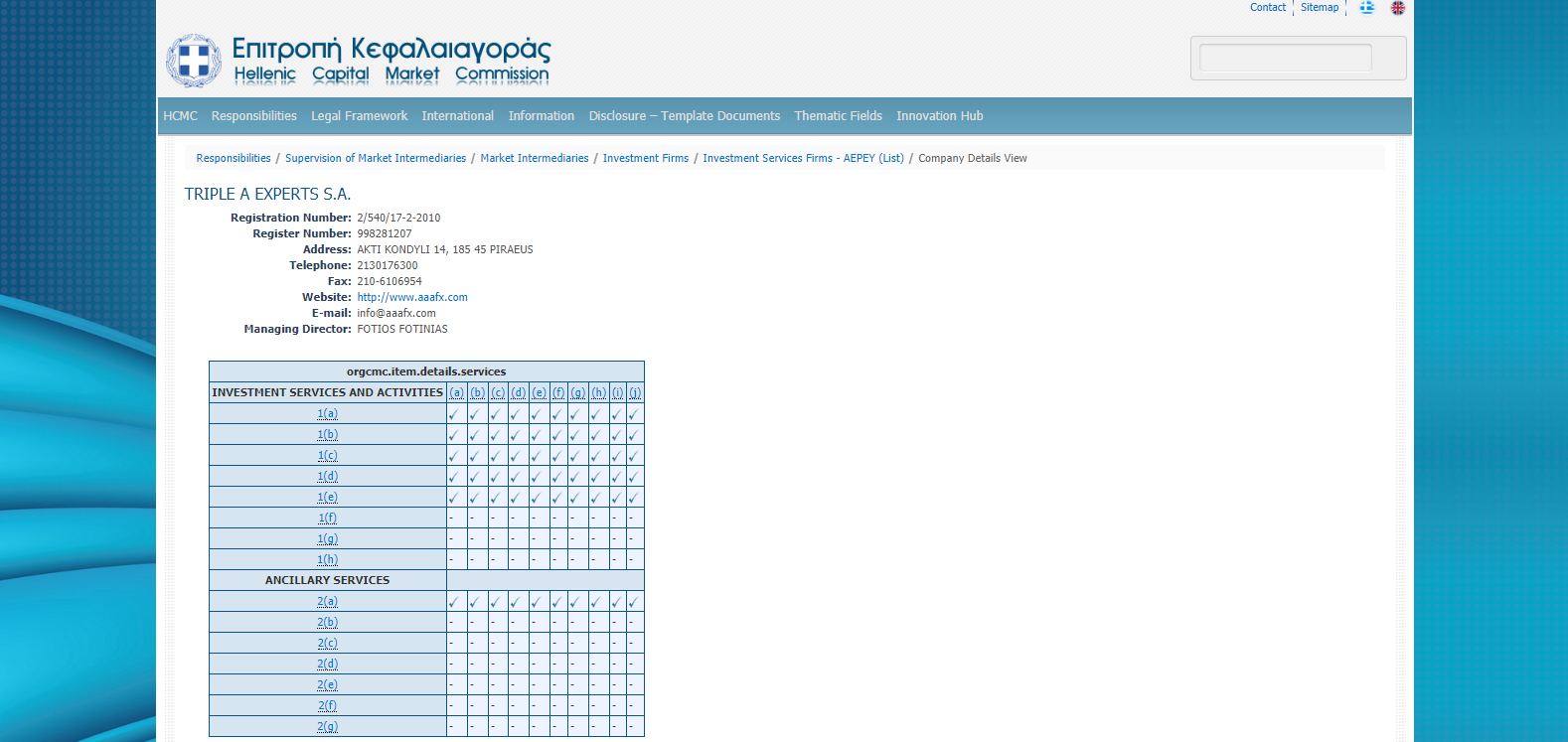

Regulation and Security

ZuluTrade received an EU Portfolio Management License in 2015. The company then created its own brokerage, Triple-A Experts Investment Services SA, which provides services to EU-based traders, and EU headquartered brokers. The company is regulated by the Hellenic Capital Markets Commission (HCMC) under registration number 2/540/17-2-2010. Its Japanese subsidiary is registered with the Kanto Financial Bureau (KFB) as an investment advisor. In the US, it is registered with the Commodity Futures Trading Commission (CFTC) as an IB and a commodity trading advisor. In 2014, the CFTC fined ZuluTrade $150,000, and the firm had to disgorge $80,000 in commissions and fees for failure to comply with the US Department of the Treasury’s Office of Foreign Assets Control’s (OFAC) guidelines.

Fees

Since ZuluTrade partners with brokers to provide their services, spreads for the Classic Account differ dependent on the selected broker. The most competitive pricing environment is granted at AAAFX, the brokerage owned by ZuluTrade via Dayo. Within the Profit Sharing Account, traders are charged a monthly fee of $30 plus a 25% performance fee if the account was profitable and exceeded the benchmark, defined as the most significant profit achieved by the signal provider at the end of each month.

What Can I Trade

The asset selection at this social trading platform is entirely dependent on its signal providers. Given the vast partnerships with leading global brokers, traders may have the best overall exposure across sectors through ZuluTrade, including cryptocurrencies, while the Forex market represents the most massive portion of trading strategies.

ZuluTrade fully supports the cryptocurrency market with a growing number of strategies to implement cryptocurrency trades.

Account Types

Investors may choose between a Classic Account and a Profit Sharing Account. The Classic account consists of higher spreads to compensate traders as well as ZuluTrade. The Profit Sharing Account displays a fixed cost of $30 per month plus a 25% performance fee if conditions are met. Due to the fixed fee, this is suitable for more massive portfolios. Traders, the signal providers investors will follow, are treated to identical conditions with volume-based compensation.

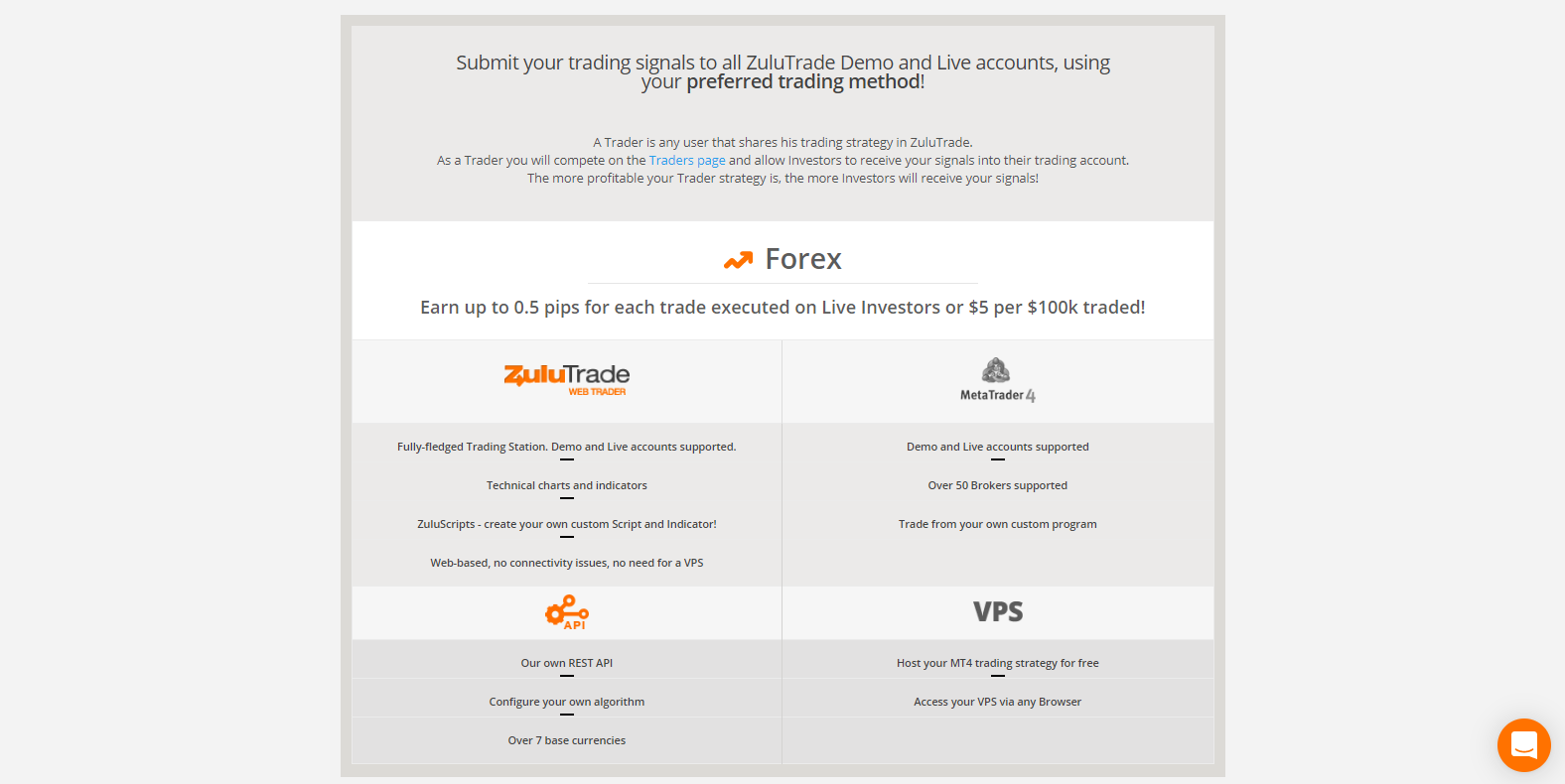

Traders at ZuluTrade receive volume-based compensation, equal to $5 per $100K traded.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

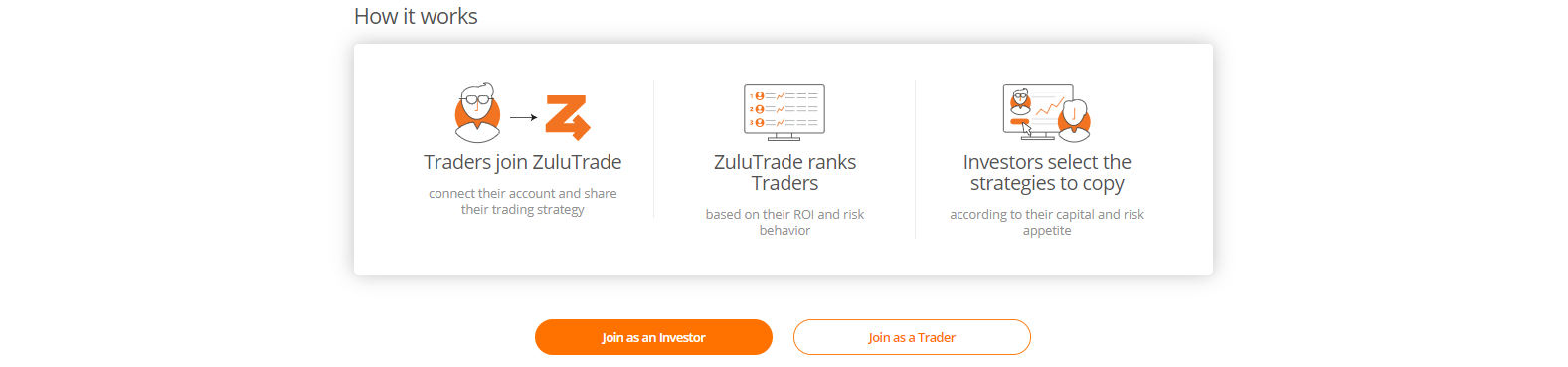

ZuluTrade doesn’t provide a trading platform. Investors will connect their MT4 trading accounts to their ZuluTrade account. It does provide full statistics of all traders, ranks their performance, and grants a risk assessment. Investors will have full access to all relevant information and portfolio management tools from the back-office, mobile versions are equally available.

Full statistics are provided on all traders, allowing investors to make the proper decisions.

A mobile version is available, making portfolio management more convenient.

Unique Features

Investors are provided with four unique features developed to maximize profitability, enhance security, simulate portfolios, and receive tailored portfolios selected by ZuluTrade’s professionals. The combination of the auxiliary services is one critical reason this company established itself as a prime source within the social trading scene, continuously extending its reach.

Automator provides investors the ability to create rules and automate their trading approach.

ZuluGuard protects portfolios from unexpected swings in traders' performances and automatically disable it from providing signals.

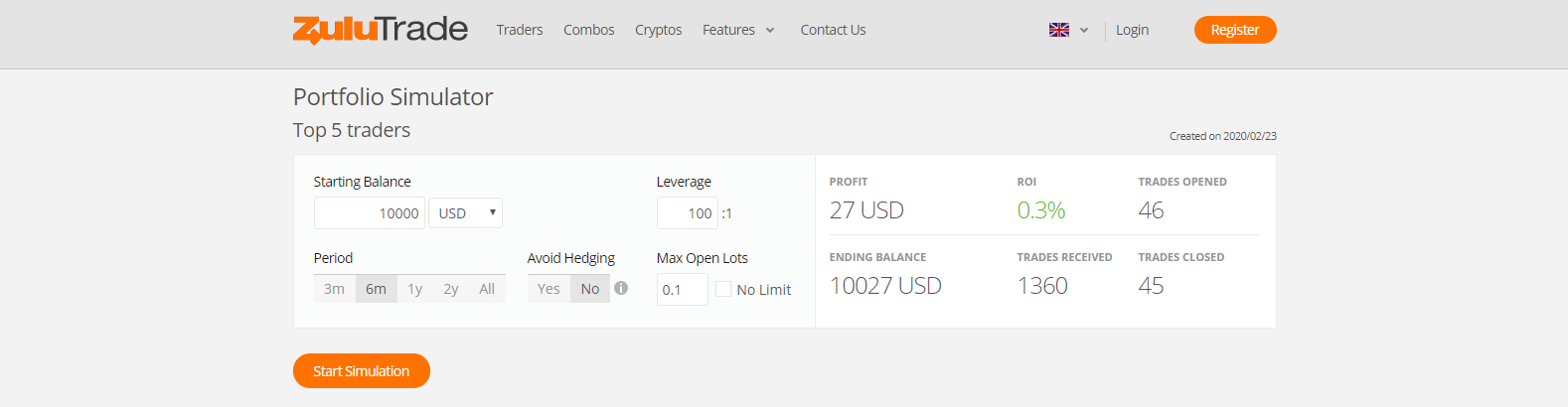

The Simulator will give investors an overview of past performances for a better understanding of what to expect.

Traders Combos, the managed trading services provided by ZuluTrade, enhances diversification, and risk reduction in portfolios.

Research and Education

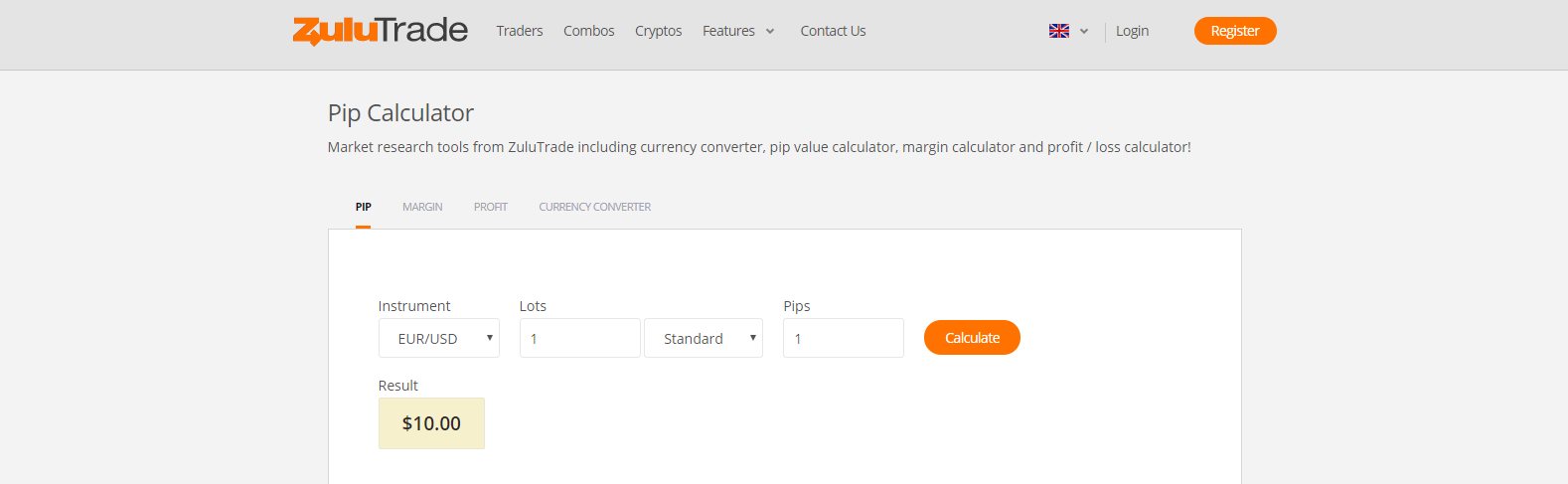

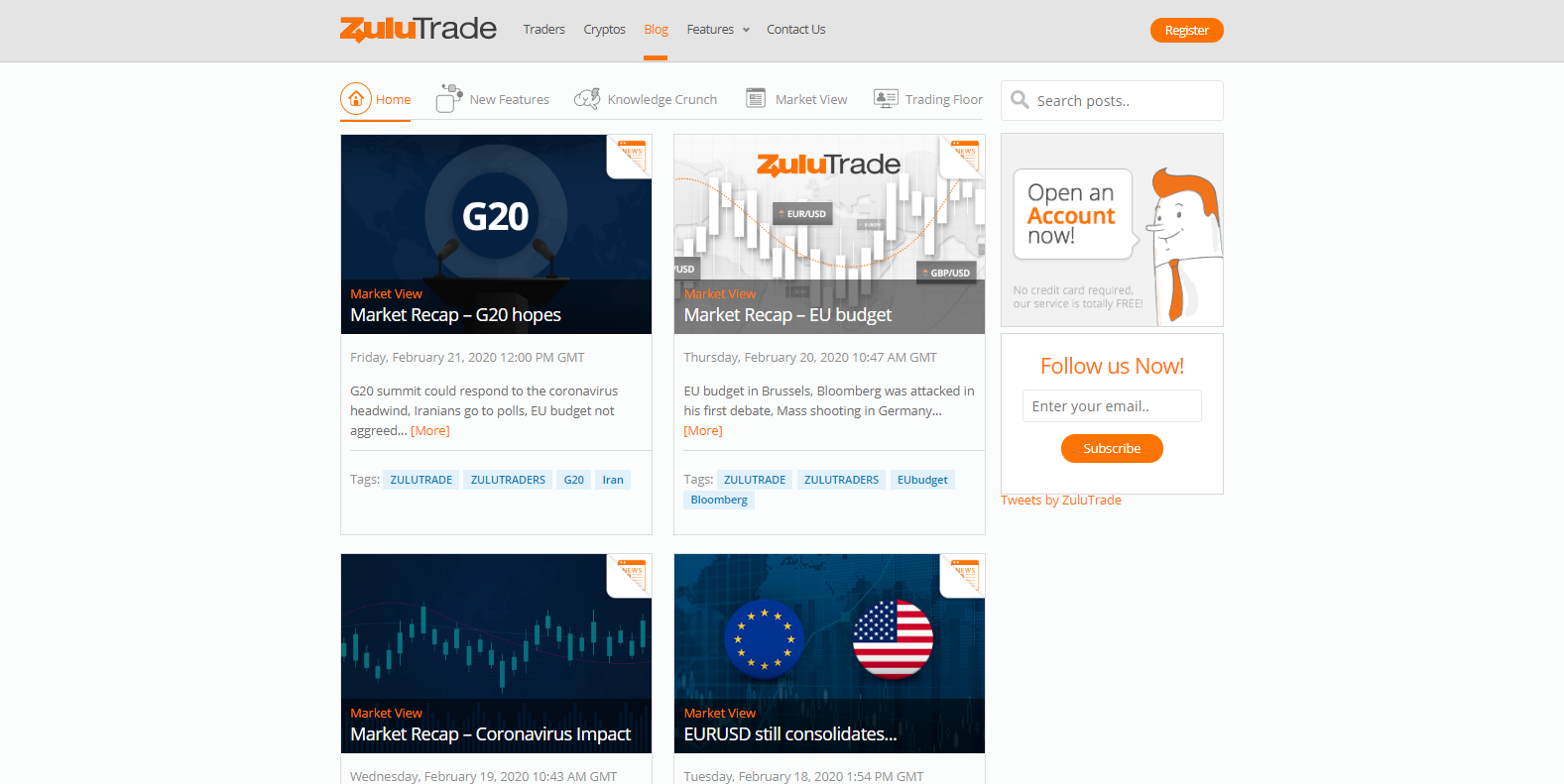

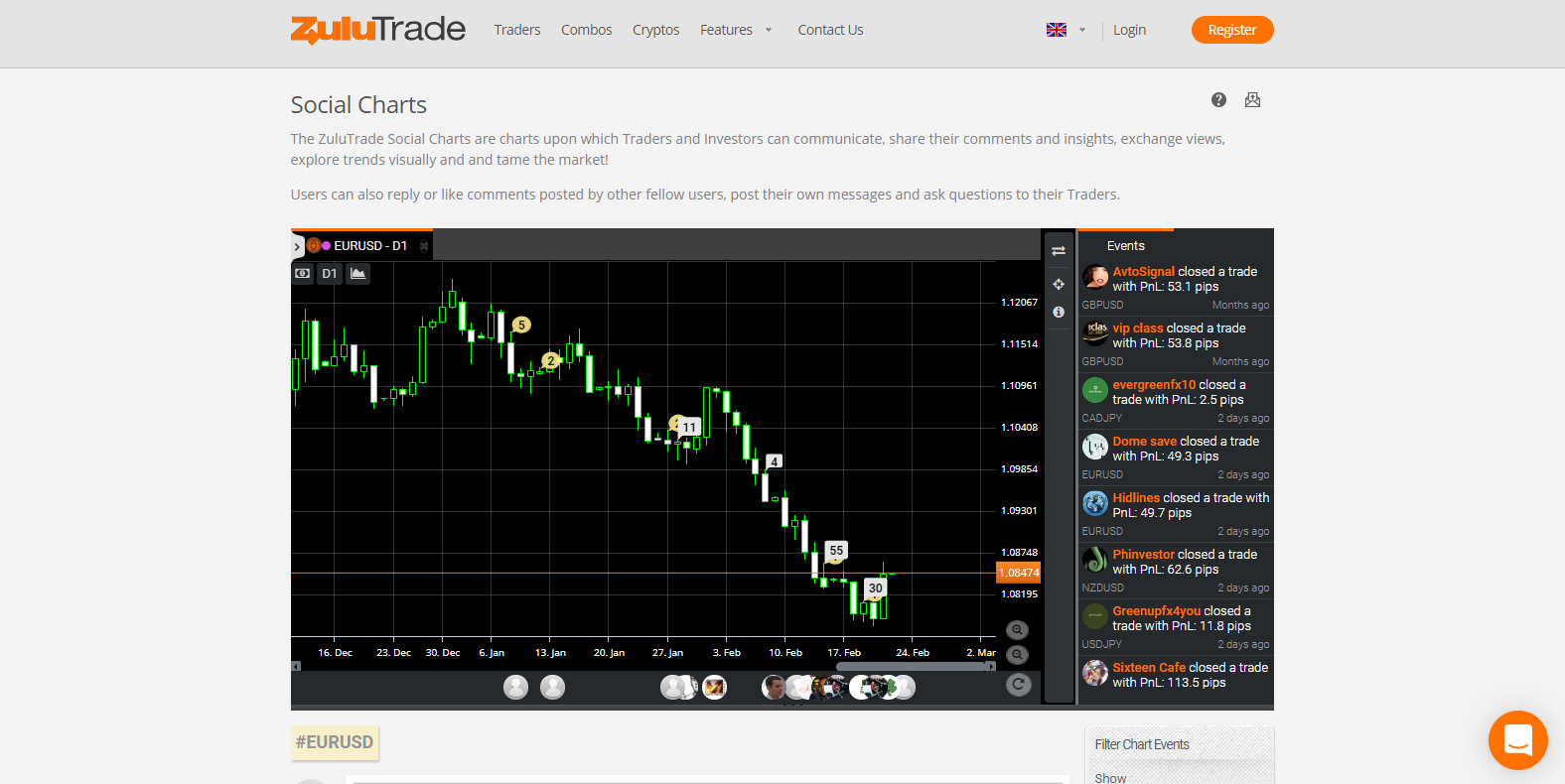

ZuluTrade operates a blog where it covers macro-economic events, but neither research nor education is provided. The blog is updated frequently and adds value to the core services of this company. ZuluTrade does rank traders based on return on investment (ROI) and risk behavior. Four calculators are provided, offering investors the opportunity to compute pip values, margins, and profits, while a currency converter is equally available. Social Charts allows traders and investors to share ideas, providing analytics within the community.

Four calculators are listed, allowing investors to compute key metrics.

ZuluTrade hosts a blog where macro-economic events are covered.

Social Charts provide the community to share ideas and provide analytics to each other.

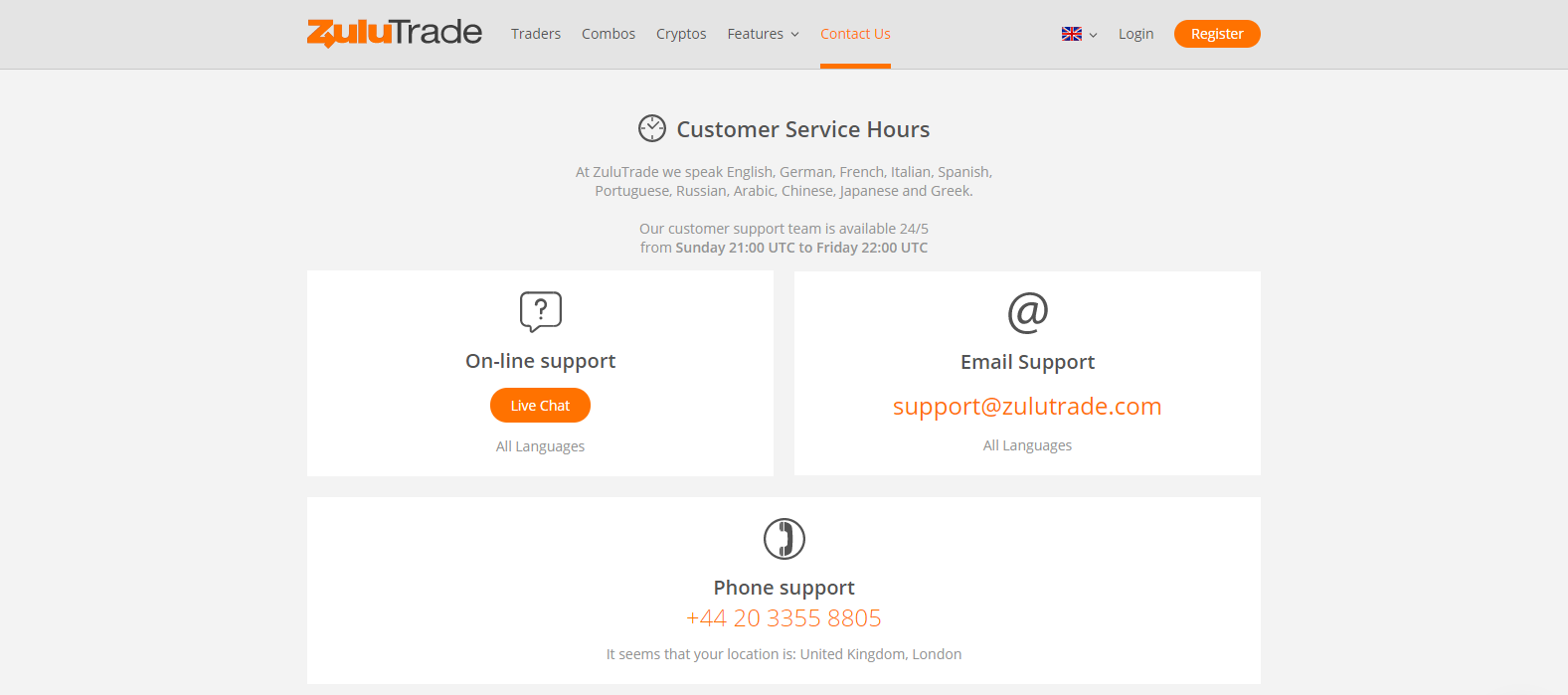

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                        |

Multi-lingual customer support is available 24/5 via e-mail, phone, or live chat. According to the latest available figures that we discovered during this ZuluTrade review, roughly one-third of ZuluTrade employees staff support roles within the company. The Help Center attempts to answer the most common questions.

Bonuses and Promotions

ZuluTrade neither provides bonuses nor promotions.

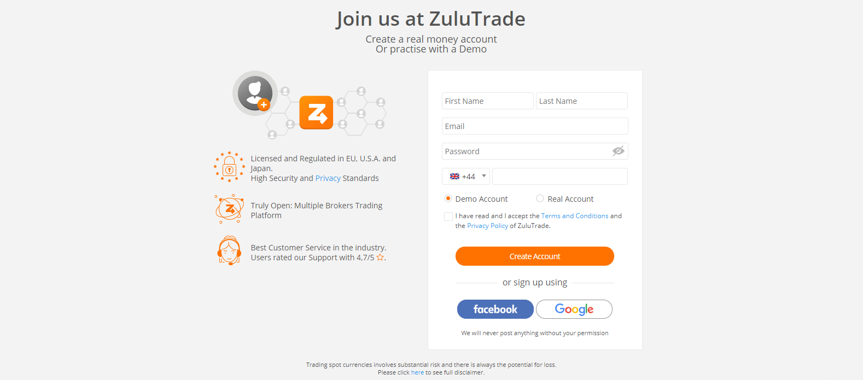

Opening an Account

A quick online application form processes new account applications. ZuluTrade also provides the option to complete this process via a Facebook or Google account. A verified MT4 trading account with a participating brokerage is required.

Deposits and Withdrawals

Deposit and withdrawal options are entirely dependent on the brokerage the investor or traders uses. ZuluTrade doesn't facilitate the processing of payments.

Summary

ZuluTrade is a well-established, properly regulated social trading platform. Investors who prefer following trading strategies should definitely consider ZuluTrade as a frontrunner. The vast partnerships with global brokerages grant maximum cross-asset exposure and strategy diversification. The cost-structure in the profit-sharing account may be too steep for many retail traders to bear, which is our most significant area of concern.

Traders Combos is one of the most appealing services provided by ZuluTrade, while three distinct features further enhance and protect investors. Since its acquisition by the Chinese based Formax Group, inspired by their quest to obtain the patents and technology powering ZuluTrade, it is changing into a fintech firm expanding in cryptocurrencies. Social traders will be well-served at this firm, while traders with successful strategies may boost their income through the volume-based compensation plan. The company offers traders volume-based compensation, acting as a liquidity provider, and introducing broker. Triple-A Experts Investment Services SA, ZuluTrade’s EU operations, received an EU Portfolio Management License in 2015. It is regulated by the Hellenic Capital Markets Commission (HCMC) under registration number 2/540/17-2-2010. In Japan, it is registered with the Kanto Financial Bureau (KFB) as an investment advisor. In the US, it is registered with the Commodity Futures Trading Commission (CFTC) as an IB and a commodity trading advisor. Investors and traders require an MT4 account with a partner brokerage, which is then linked with a ZuluTrade account. Following the initial set-up, ZuluTrade handles the entire operations automatically. ZuluTrade compensates its traders up to $5 per $100K traded or $5 per standard Forex lot. A complete list with performance rankings, as well as, key statistics are maintained by ZuluTrade.FAQs

Can you make money with ZuluTrade?

Is ZuluTrade regulated?

How do you use ZuluTrade?

How much do signal providers earn?

Who is the best Forex signal provider?