By: eToro

According to data released by the International Monetary Fund the UK growth is expected to outpace that of the Euro zone with a projected growth of 1.3% for 2010 against EU projected growth of 0.8%. The IMF forecast which comes after more than a 2% weekly gain of the Sterling against the Euro and after UK GDP figures showed the UK exited one of its worst recessions provided further fundamental support for Sterling. The Euro which fell from as high as 94 pence in Q4 to lower than 90 pence to the Sterling where it is currently trading is continuing to show signs of weakness. It seems that the Euro zone failure to secure the Greek debt in a smooth manner is overshadowing UK problems and waning down Euro long positions.

Are the gains sustainable?

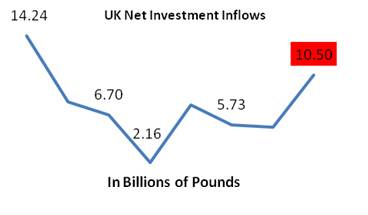

The UK economy still faces a choppy waters with the UK a deficits of around 12% of GDP needs to be addressed and an unclear political future ahead of the upcoming election in May. However the UK has an important advantage over the Euro zone, the UK is fiscally and monetarily independent. This allows UK decision makers to be more flexible especially in stimulating the Economy. The BoE for example can easily resume its QE program to stimulate the economy further. In addition the UK prime minister reiterated he intends to tackle the budget deficits only at 2011 as to allow the economic recovery to gain momentum. Although such measures are generally Sterling bearish if handled effectively can generate long term strength for the currency. The US recovery is a great example of such a scenario where the US aggressive stimulus to the economy allowed the US to outpace the Euro Zone in economic performance. Investors which witness the EU paralysis during the Greek crisis are increasingly eyeing that factor. The UK GDP has now moved into positive territory rising by 0.4% in Q4 and investment inflows one of the most important factors in Sterling strength is showing signs recovery rising by £10.5B for Q4 the highest gain since March 2008.Ahead of the UK elections due at May 6th Sterling gains could be capped as political uncertainty still looms, nevertheless in the long term if UK data will continue to spur carful optimism Sterling gains against the Euro could continue with the political uncertainty fading after the May elections.

The BoE Rate decision

The BoE is expected to leave rates unchanged at 0.5% with consensus polls pointing on an expected rate hike by the end of 2010.Investors will be alert to the BoE remarks on two major subjects QE and economic growth. QE an emergency measure which involves capping bond yields and printing money simultaneously is used to stimulate credit in a weak economy. If the BoE will mention future QE this literally mean the BoE sees more future economic weakness and will be ready to print more money. This will be of course Pound bearish. In addition if the BoE will outlay a rather subdued economic growth story even without mentioning QE then investors’ consensus on the BoE rate hike could shift from the end of 2010 to 2011 which is also rather bearish for the Sterling Bearish. However if the BoE will suggest carful optimism this could confirm investors bets on a better than expected UK recovery and will move investors to crowd on more Sterling bets. This will probably affect the most on EUR/GBP which could fall further.