By: Andrei Tratseuski

Why are pessimists think that there is a double dip recession is in the making? Well there are plenty of reasons why the United States and for that matter worse off Euro-zone may dip into another recession. The probability of falling into another recession are low, however, let's list some of the biggest reasons why some think that there is a possibility that the following may occur.

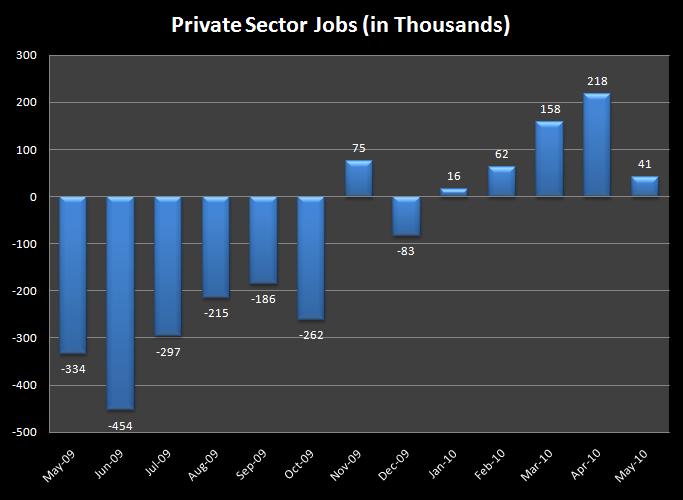

Consumer Confidence slipped to 52.9 in June, a superbly low reading compared to expectations of 62.5. Consumer Confidence is among the key predictors of a possible downturn. The index has a pretty solid track record in foreshadowing a possible recessionary pressures. The following comes amidst a weak labor market. The figures that are seen are of course deceiving as most of the jobs added throughout last couple of month were artificially created by the U.S. Census Bureau. This Friday will represent a real number of the jobs created with the markets anticipating a loss of 110,000 jobs. A consumer is not participating in a good feeling mood of the recovery. Let's look at the facts: Retail Sales slipped in May by 1.2%, while Durable Goods Orders slipped by 1.1 during the same time frame.

Ladies and Gentlemen, fiscal help from the government has dried up or expired. We are on our own, we will determine where the markets are heading, no longer the government actions. Housing market tumbled tremendously after the tax credit expired. New Home Sales are lingering near 30 odd years low at a pace of 300,000. Existing Home Sales are not doing to well either, printing at 5.66M in May. The catalysis to this? Government's withdrawal of monetary help. Now, what will happen when no longer government is holding our hand? Can we do this on our own?

Well, to answer the precluding questions, the economy is expanding at a pace of 2.7 percent in the first quarter. Core Personal Consumption rose by 0.7 percent in the same period. Personal Income is continuing to rise higher as well as Personal Spending. Nonetheless, the surprising driver of this growth is Manufacturing sector, not our usual service sector. However, if we really think about it, the government is behind that jump as well. U.S. Government couple of month ago promised to give funds to the small businesses and jump start exporting oriented companies.

So the question remains, what data should we look at in order to determine where the economy is heading? First and foremost we should pay especially close attention to the Non-Farm Payroll figures. The figures are always important. However, the more accurate reading of the U.S. Labor market will come from the reading of Private Payrolls. The markets are looking for an increase of 113,000 private jobs. Secondary data that should be paid attention to is continued growth in the Manufacturing Sector and Service Sector. So to sum this up, the markets will be led by the Private Sector created in June.