By: Andrei Tratseuski

The markets are patiently waiting for the upcoming Non-Farm Payroll figures to be released. NFP generally sets the mood for trading in either risk appetite or risk aversion direction. Being the broadest economic indicator that states the strength of the U.S. economy, all of the eyes will turn to Friday's figures. Currently the markets are waiting for the Non-Farm Payrolls to print roughly around -125K. Nonetheless, the figure might be relatively skewed to the downside due to the fact that US Census workers are beginning to shed their jobs. The latest calling is around 240,000 Census workers being re-leaved of their duties. Therefore, the markets will look at another important factor in the markets: Net Change in Private Job. Current expectation is addition of 110,000 workers during the month of June.

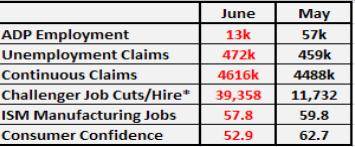

However looking at the forecasting indicators for the employment figures, the picture does not seem to be happy. Variety of indicators printed well below the expectation and showing possible signs of NFP numbers performing relatively poor. Here is a quick list of what has happened during relative to job growth from the previous month:

* Challenger Job Cuts/Hire: Expected Cuts = 39,358; Expected Hiring = 11,732 in June

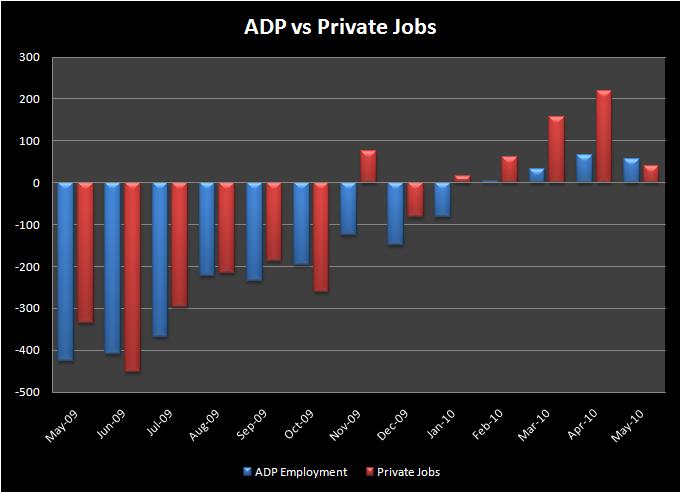

Nonetheless, at the current juncture of time we are better off predicting private job growth than looking forward to misrepresented NFP figures. Monster Employment Index has shifted to the upside from 134 to 141, a projected growth of 21% on year-over-year basis. However, when we look at other components we notice a sort of horrific picture. ADP Employment came in much less than expected, Unemployment Claims continue to tick upwards, Continues Claims still hanging around in upper territories compared to stable conditions, Challenger Job Cuts outweigh Hiring, while Consumer Confidence slipped by a enormous amount. Looking at the Employment component of ISM Manufacturing we see a relatively solid step backwards. Home Sales continue to plummet, reflecting unwillingness of a consumer to spend on projects. The following may undermine Construction jobs, putting more pressure on the NFP.

Since we are looking for the creation of Private Jobs and not NFP, we will turn to ADP Employment Change for guidance. While running our study, we find that there is a 93.68% correlation between ADP figures and Private Jobs creation. The latest ADP figure printed at mere 13,000. An average Standard Deviation or discretion between Private Jobs created and ADP is 57,000 jobs, with a range between 5,000 to 141,000. Since the figures came in relatively low at 13,000 jobs being created, the probability of Private Jobs exceeding 110,00 is relatively low. Therefore, we believe that Private Jobs will come underneath the expectations.