By: Andrea Cohen

In light of the expected elections in Japan in December, we thought it would be beneficial to revisit the consequences of a possible change to the country’s inflation policy.

First, we will examine the current state of Japanese inflation and explain how inflationary expectations are reflected in the market. Then, we’ll proceed to make some assumptions about what the new policy will be under certain election outcomes. Finally, we will examine the consequences of the new policy.

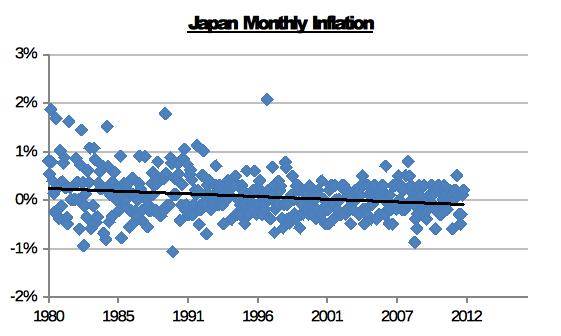

Japan has been in a state of deflation or positive, but close to zero inflation for quite a few years now (since the real-estate bubble burst there in 1990).

We usually discuss inflation in the context of curbing it when it is too high. It is easy to conceptualize why high inflation is bad and how it adversely affects consumptions and production. But what’s the problem with low inflation and deflation?

While intuitively decreasing prices seems like a good thing the reality is that if it is persistent, deflation can easily cause economic slowdown and recession. When prices go down, people refrain from buying, as they expect even lower prices in the future. In addition, people save less because they hold their money instead of putting it in the bank, where it would yield positive returns while maintaining liquidity.

On the firms' side, production is slower because there is less demand from consumers, and wages have to go down as well (based on the identity between marginal cost of labor and prices, which increases unemployment as well as limiting the disposable income available to consumers.

There are other negative implications to lingering deflation - on financial institutions, public debt, etc. But the bottom line is that deflation causes recession and should be avoided.

The Bank of Japan (BoJ) has an inflation target of 1% at the moment, yet, the market is of the opinion that this target will not be met. How do we know that? We know it thanks to observing the yields of Japanese government bonds.

There are two types of government bonds: nominal (regular) bonds and real (inflation-indexes) bonds. Linked (inflation-indexed) bonds are unique in that the principal and interest rate is periodically adjusted to (actual) inflation. Similarly, the market prices of linked bonds are derived from what the buyers and sellers think that inflation will be. “Breakeven inflation” is a term referring to the plug number that should be used as inflation expectation, and used to price linked bonds in a way that equates their value to regular (non-indexed) bonds. Current breakevens are at +0.6%. That means that although the BoJ targets +1% as annual inflation rate, the market is assuming it will manage to push only as far as +0.6%.

With deflation a target of politicians’ fury, there is a good chance that following the upcoming elections, the new government will revise the current target upward in order to stimulate inflation and break out of the deflationary cycle mentioned above. The likely winners of the elections are the Liberal Democratic Party (LDP) and prominent members of the party have already insinuated that with the BoJ not meeting the 1% target, perhaps a more aggressive target is warranted in order to bring about more determined action on behalf of the central bank.

Let’s examine what would happen if the target is indeed revised up to the “hinted” 2% level. Just as currently the market doubts the ability to meet the 1%, let’s assume the new expectation will be 1.6% (and not 2%). That’s a +1% move in inflation expectations.

Without going into the technical calculation and the scenario analysis that produces possible outcomes, one theme is clear under all possible scenarios: the JPY is going to get hurt in the process of adjusting inflation expectations upwards. Why? It is the case because higher inflation expectations mean lower government income, in the form of taxes. Under some assumptions, the net present value of the government is decreased by as much as 18%.

The only question is to what degree and for how long, but there is little doubt that this revision means that a short JPY positioning ahead of a decision is a smart move. With the elections in December and a policy change expected in the first half of 2013, investors should be alert regarding market chatter over this issue and be ready to put on trades mirroring their views.