By: Andrea Cohen

This piece is more about adjusting expectations rather than expressing a very directional view.

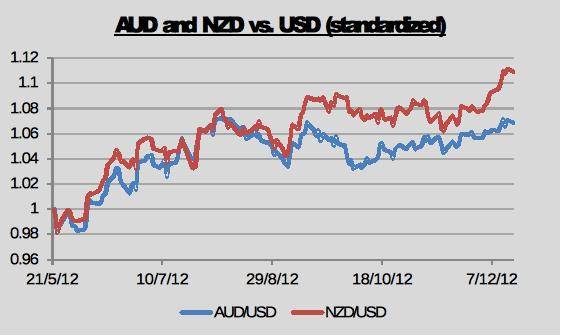

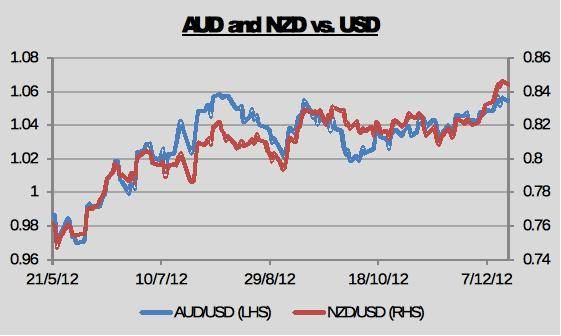

With the Fiscal Cliff situation not getting resolved, many have rushed to other G10 currencies in an attempt to capitalize on the troubles in the US. A prime example of that is the currency of Australia and New Zealand – AUD and NZD, respectively. Since mid-May, the AUD and NZD have significantly appreciated against the USD. The slowdown in the US economy, the uncertainty surrounding the rather-tied Presidential elections and the looming Fiscal Cliff made many investors seek other major currencies to park their cash in. In addition, speculators have sought risk-sensitive currencies to bet on against the USD. Although we believe that by now, the big speculating players have unwound their positions to a large extent, there is still a considerable long position in these currencies.

The AUD and the NZD are highly correlated. In the last 6 months or so, the correlation between changes in these assets is over 85%. Since we would like to refrain from going into the differentiating factors between them (this is not a relative value trade idea), we’ll discuss them almost as one. Also important to remember that these two economies are closely tied to each other in terms of trade, policy, politics and regional factors.

ANZ are rather commodity-sensitive. Relevant commodities (mainly metals) have seen process dropping lately and there is little indication for the trend to reverse. For example, Gold is down from just over $1,800 to under $1,700 now, in less than three months. A main supplier of commodities to China, the local slowdown there is also bad news for Australia (mainly) and New Zealand.

Although fiscal policy in the US is the thing many focus on, attention should also be given to monetary policy in Australia and New Zealand. For example, the Reserve Bank of Australia (Australia’s central bank) has cut rates recently, while the US Fed has left its Fed Funds Rate unchanged. The narrowing of the spread between Australian and US (and New Zealand, relative to US) interest rates make the AUD and NZD less attractive against the USD relative to a few months ago (the carry trade has less potential and more risk).

We hardly think that US politicians (mainly Republicans at this stage) are suicidal enough to let the Fiscal Cliff materialize. A compromise (at least a partial one) will probably be reached if not by year-end, then in the first quarter of 2013 (after an emergency extension of the bills is due to expire). Less uncertainty is a USD positive.

Our bottom line is that if you are long AUD/USD or NZD/USD, it will be wise to revisit the rationale of this trade. If you do not have a position in these currencies, it will be wise periodically revisit their levels – our estimates indicate 1.05 and 0.84 as the levels to short at in 3 months’ time (for AUD/USD and NZD/USD, respectively).