By: Andrea Cohen

In recent months we have seen a lot of chatter and headlines regarding oil shale. In this writeup we will explain what shale oil is and connect it to the Forex world. Specifically, we will discuss the connection between shale oil and the USD.

Oil shale is basically a rock that can be turned into oil. Without getting into the specifics of the type and chemical composition of oil shale, the importance of this mineral is its abundance and recent developments in the process of extracting oil from it.

Traditionally, the process of producing oil from oil shale requires large amount of water and produces huge quantities of pollutants into the air. This traditional methodology is to mine the oil shale and then execute the extraction process on the ground’s surface.

The United States has the largest deposits of oil shale in the world. Yet only a small portion of its energy needs are met using them. The reasons are both economic and environmental. A good case-in-point for this is Estonia. Estonia (located in northern Europe, formerly a part of the Soviet Union) relies heavily on oil shale for its energy needs. In a survey done in 2004 it was revealed that 97% of air pollution in Estonia is attributed to power generation. As 95% of power generation in the country is fueled by oil shale, the connection is clear. In addition, the power industry in Estonia accounts for more than 90% of water consumption in the country. It’s no surprise then, that the use of oil shale in the US is fairly limited.

Recent improvements to the process, and studies that project a significantly reduced production cost and improvements to the process along the years, have put oil shale back on the table. With oil process persistently high, the economics of oil shale becomes more and more attractive.

So with practically unlimited supply of the mineral, what are the implications for the American economy?

The current state is that the US is a huge net importer of oil. In 2012, the net cash flow from oil for the US as close to $300bn. With US GSP at just over $14.5 trillion, that amount represents 2% of GDP. The IMF estimates the US current account deficit to be about 3% of GDP. That means that two-thirds of the American current account deficit stems from the energy sector. A growing use of local oil shale will immediately translate into a lower deficit and smaller reliance on foreign oil.

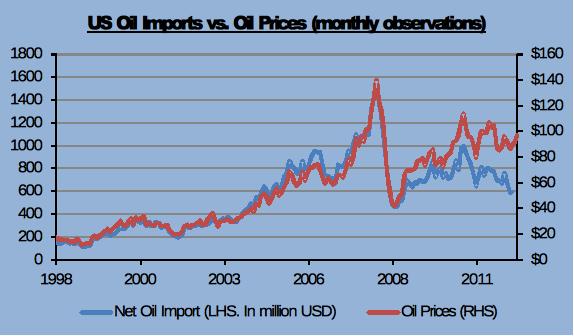

We see the beginning of this trend in data. Below is a chart showing the USD value of net oil import to the US vs. the price of oil. After many years of almost full correlation between the two, we see, in recent months a break in this pattern.

Source: US Energy Information Administration

The consequences of this trend for the USD are clear. A lower deficit will immediately translate into lower debt and a stronger currency. Although there are way too many moving parts in the long-term equation for the value of the USD, this story is a strong one in favor of a stronger USD. For the next year the Fed’s actions (namely QE3) will still play the most central role in determining the strength of the greenback, but we can definitely see the EURUSD at 1.20 by the end of 2013 and at least some of this strengthening should be attributed to the growing reliance on local oil shale. As time will go by, and this reliance will grow even further, together with more efficient and cleaner technology to extract the oil out of the oil shale, the USD stands to benefit even more.