By: Allon van der Sluis

Background

Since the proclamation by the freshly appointed Minister of Finance of Greece, Mr. Varoufakis; announcing direct talks with the Troika to be obsolete, an icy Greek breeze is blowing northward through Europe. Instead of continuing along the road of debt redemption, Greece rather mockingly revealed its intention to renegotiate terms with the respective creditors individually. In short: Greece with its newly elected government sent a chilling message to the Troika's representative, Mr. Dijsselbloem. This message represents a striking allegorical resemblance to an excerpt from the famous fairytale "The Pied Piper of Hamelin". In this classic German tale, the piper was told by the mayor of Hamlin, when reclaiming his outstanding debt of a thousand guilders:

“And a matter of money to put in your poke;

But as for the guilders, what we spoke

Of them, as you very well know, was in joke.

Beside, our losses have made us thrifty.

A thousand guilders! Come, take fifty!''

In 2012 Germany’s Prime Minister Merkel toiled personally to avoid the much-feared “Grexit”. She convinced her reluctant minister of Finance, Mr. Shaüble, not to give up on Greece as part of the EMU. Eventually support was granted, provided Greece would adhere to a strict reform programme to be monitored by the Troika (EU, ECB & IMF). After the Greek elections and Juncker’s recent statements, it seems the Troika’s days are numbered. Is the comparison of Greece with the mayor of Hamlin baseless? In effect, will Greece ever pay the piper?

Greece’s Strategy

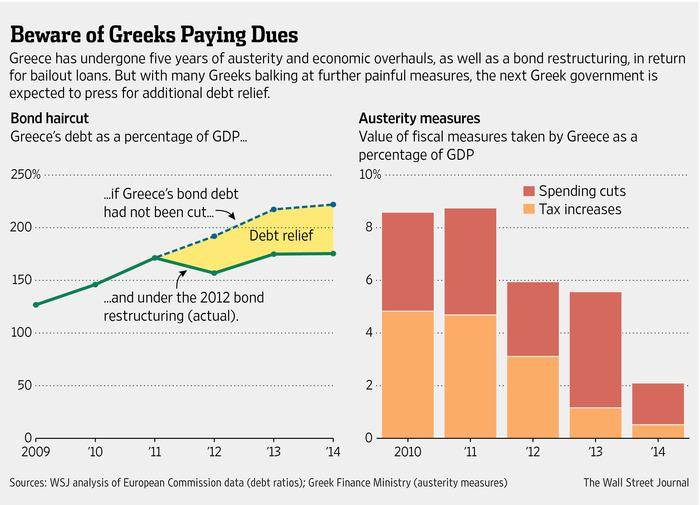

Of the total debt of Greece €323 billion, 60% (€240 billion) is directly owed to the Eurozone, with Germany as its biggest creditor. The result of Greece’s elections seems to herald an end to the five year course of austerity measures and economic reforms. During this period, Greece has managed to significantly reduce total debt as a percentage of its GDP, from 225% to 175%. Regardless, since 2008 Greece’s economy has been shrinking and its unemployment rising. Prime Minister Tsipras has won the elections with a programme promising his people to reverse austerity measures and economic reforms. Pending the success of the outcome of Greece’s renegotiation of terms, a financial shockwave would be felt throughout the Eurozone. Moreover, such an event would set the stage for an inevitable undesirable “spillover-effect” to countries like Portugal, Italy and Spain, who would rightfully feel encouraged to employ the same strategy.

Rampant Tax Evasion

While Greece endeavors to renegotiate terms, the risk of a growing elephant in the room remains blatantly unchecked. Greece’s dire situation is not merely limited to the state of its economy and the size of its debt; the influence of the prevalent culture of corruption and rampant tax evasion needs to be taken into account. In 2009 the OECD estimated over €20 billion of unpaid taxes from the shadow economy at an estimated size of €65 billion, representing 25% of Greek GDP. For benchmarking purposes: Germany’s shadow economy represented 15% of its GDP. Finally in 2013, 31.9% of its labor force was registered as self-employed versus an EU-average of 15%. Studies have shown a clear positive correlation between the degree of self-employment and tax evasion.

Analysis

The creditors in the Eurozone, consisting mainly of North-western European members, are concerned that Greece won’t fully redeem its debt. The fear of its taxpayers is that they will be the ones picking up the tab for potential renegotiation. Will the new government, besides reversing the austerity and economic reform programmes, also be able to reverse the Greek culture of tax evasion and corruption? Or will it continue to pursue renegotiation of the size and/or terms of its debt? Ironically, the event of successful renegotiation could very well punish the faithful taxpayer and reward the institutionalized tax evader. The schism between the Eurozone’s creditors and debtors would then widen even further. The Troika talks have already effectively been eliminated. The final question remains; what’s next?

Euro Outlook

--Two-week outlook on Euro, pending result of Greek renegotiation:

Scenario A: Neutral to Positive

The ECB recently approved a QE programme, a bond buying power on secondary markets of a maximum of €60 billion per month. With this programme Draghi hopes to battle deflation in the Eurozone. The ECB has also announced it will not accept Greek bonds in return for lending. During the coming weeks the ECB and Eurozone creditors will manage to convince the Greek government to honor previous agreements and will end its endeavors to renegotiate. This would (temporarily) silence speculations on the inner strength of the EMU and boost the Euro.

Scenario B: Negative

During the coming weeks the Greek government will productively renegotiate terms of debt with its creditors. This could be related to either size or embedded terms. Such an event would send a signal of encouragement to other P.I.I.G.S.-states (i.e. Portugal, Italy, Ireland and Spain) and potentially set the stage for events to come. An announcement of successful renegotiation would feed speculations on weakening control and unity within the EMU. Such events are bound to weaken the Euro. This scenario might even prove to be the prelude to the feared “Grexit”.

Mr. Allon van der Sluis holds a Master's degree from the University of Amsterdam, The Netherlands. His thesis, "Race to the bottom", focused on the competition for FDI between member states of the EU. From 2004 to 2009, he was a senior Portfolio Manager and Investment Advisor with the Dutch Private Bank, F. van Lanschot Bankiers.