The U.S. Dollar is the world’s reserve currency and the key driver of activity in the Forex market. The longest and strongest trends in Forex are driven by the U.S. Dollar. Trading the USD against other global currencies is also the cheapest way to trade Forex as spreads and commissions for these Forex pairs tend to be cheaper than for Forex crosses that do not involve the USD on one side.

In recent years, the best trends have been driven by the USD, especially during 2014 when the USD rose spectacularly against currencies such as the CAD and the JPY. There was a general perception in the Forex market that these were intelligent position trades as technical analysis matched fundamentals and central bank policies in the cases of comparing the U.S. to countries such as Canada and Japan.

Apart from a quick flurry of strong U.S. dollar movement against the Euro and the Canadian dollar during the early part of 2015, the U.S. dollar in particular and the Forex market in general has become flatter less active. One major reason for this is that the outlook for the U.S. dollar has entered a kind of nowhere zone.

The USD Flattens Out

During 2014, the fundamental and technical outlooks for the USD not only looked strong, it was also widely felt that it was the strongest of all the major currencies. Not only was it making new highs just about everywhere, its central bank (the Federal Reserve) was beginning to talk about getting ready to raise its interest rate for the first time in several years. Moreover, the key economic data releases coming out of the U.S. such as Retail Spending and Non-Farm Payrolls were getting higher and higher and exceeding market expectations.

This picture has changed over recent months as the Federal Reserve continued to hedge its bets about raising the interest rate. It has recently signaled it MAY raise rates in December, but the market does not see this as especially probable. Perhaps more ominously, a feeling has grown that the U.S. economy continues to experience a “Potemkin recovery”, i.e. one that is not a true, strong economic recovery. Perhaps the fact that commentators are still talking about a “recovery” 7 years after the crisis tells you all you need to know! Finally, recent key economic data has been mostly disappointing.

How is the USD Performing?

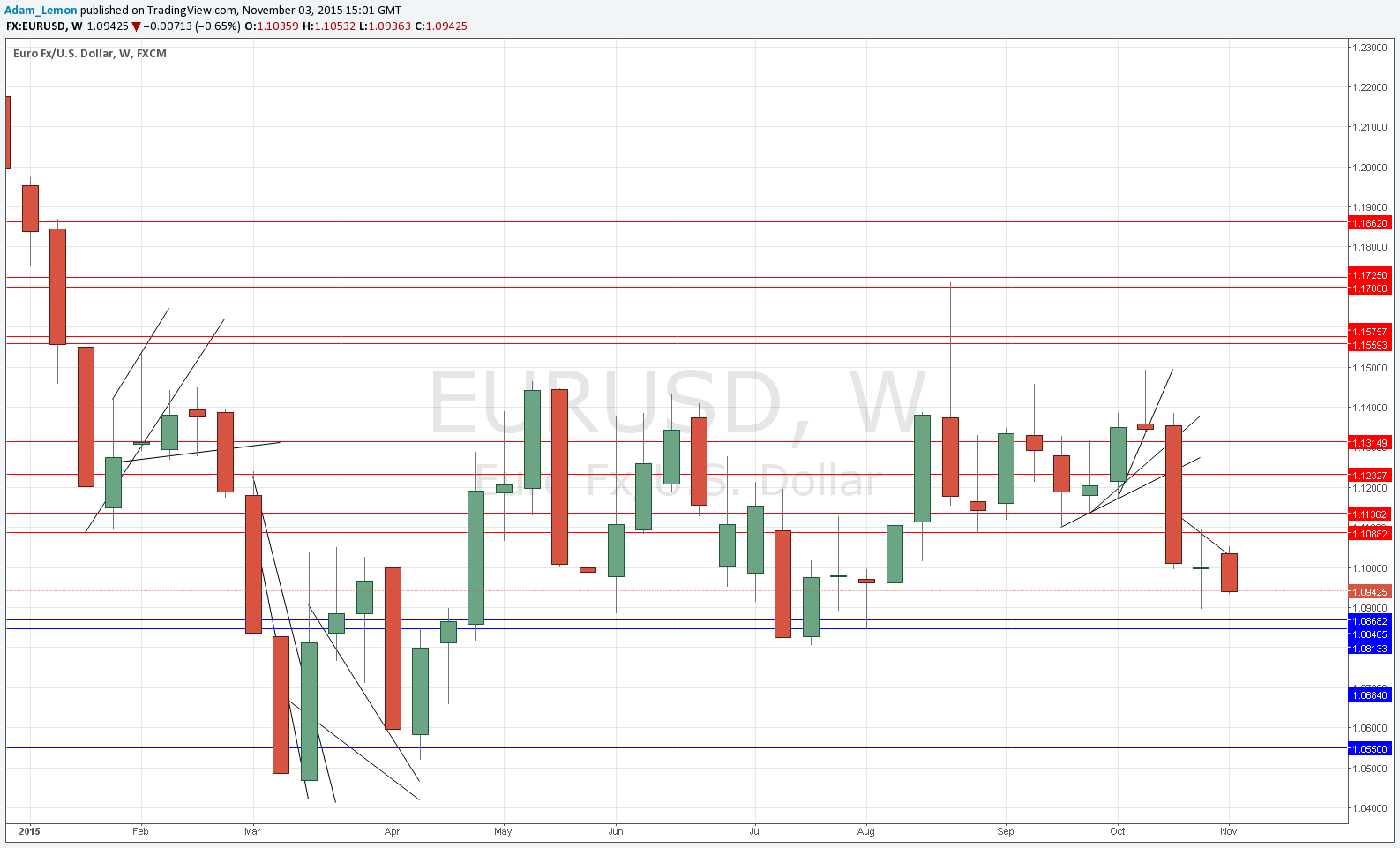

Against the Euro, it has been more or less going nowhere:

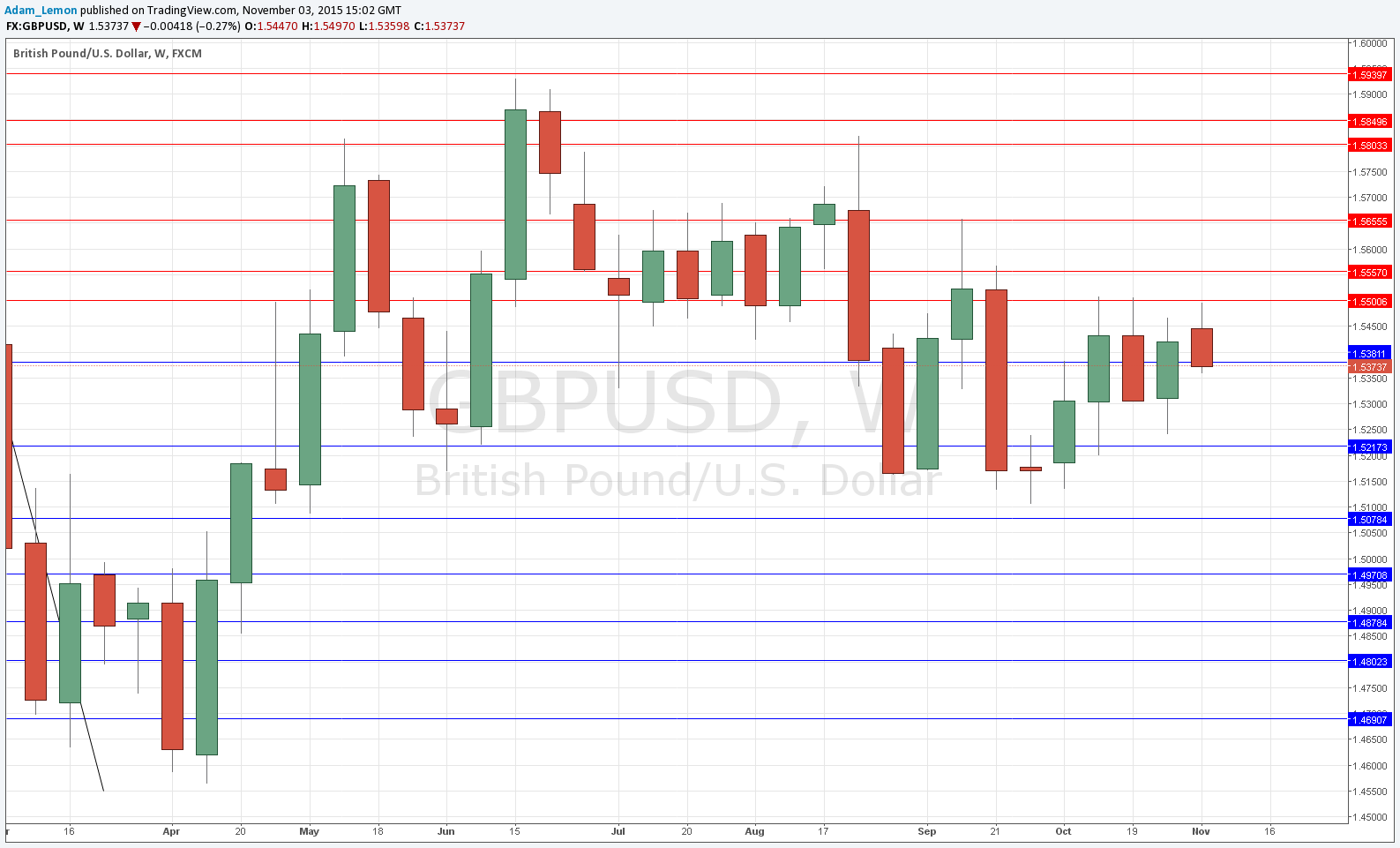

Against the British Pound, it is very slightly up over the past 3 months or so:

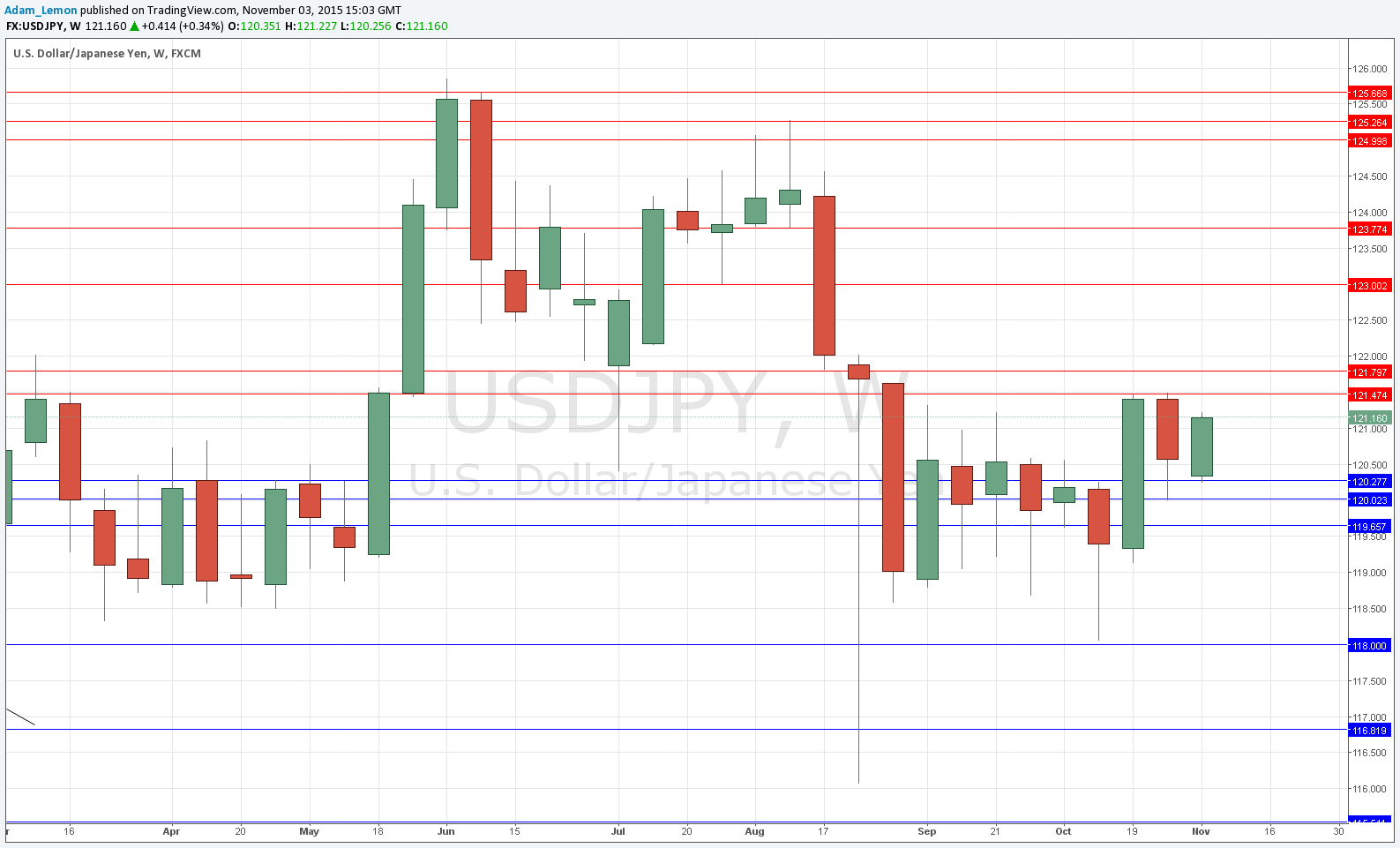

Against the Japanese Yen, the U.S. Dollar is actually down over the past 3 months, although it has been recovering in recent weeks:

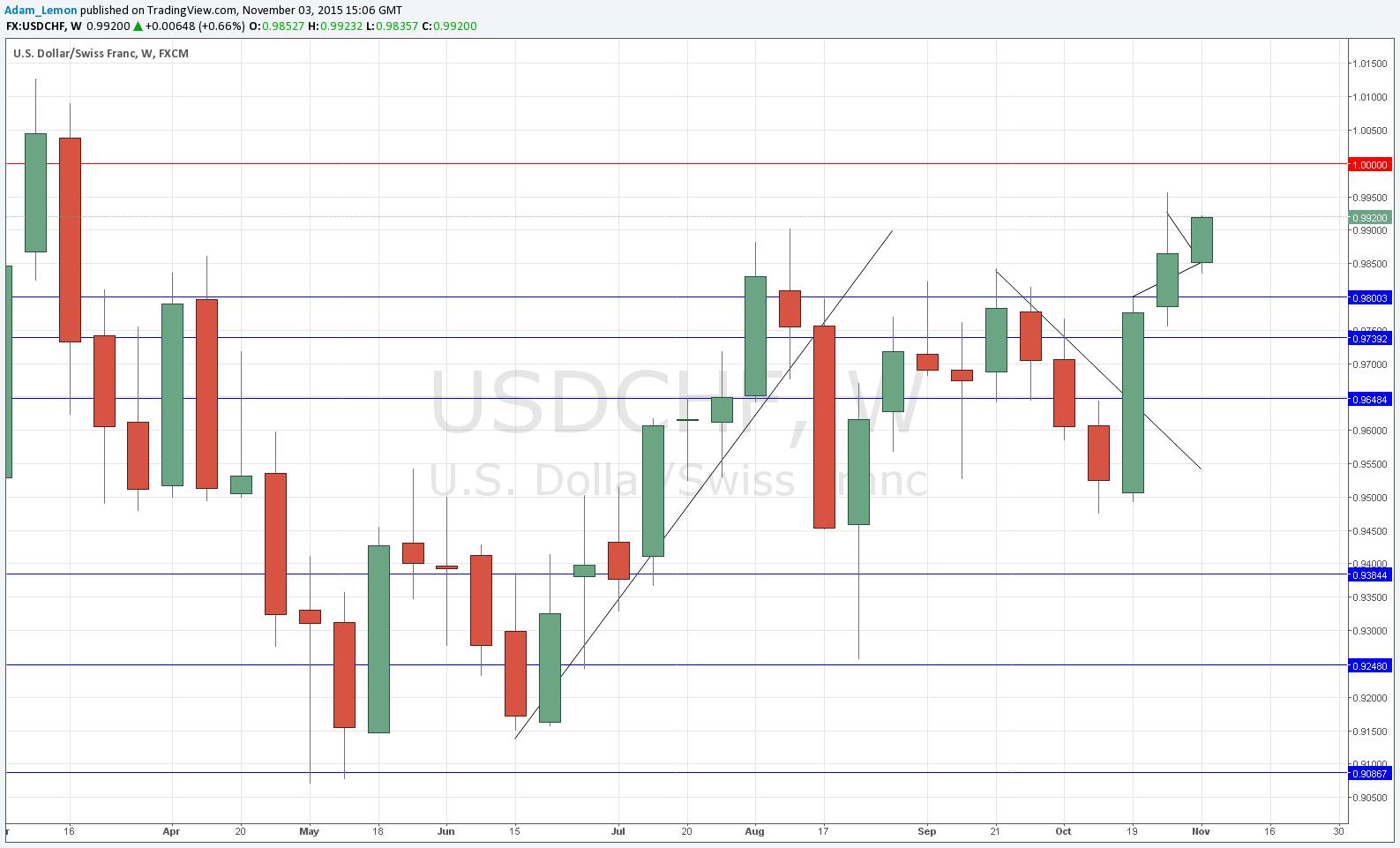

Finally, against the Swiss Franc, the U.S. Dollar has actually been making new 6 month highs recently:

The fact that we are getting a mixed picture when we compare the U.S. Dollar to other major currencies in indicative that the currency has been stuck in limbo. However we can see that it looks strongest against the CHF and weakest against the JPY.

November Release of Non-Farm Payrolls Data

This Friday, like the first Friday or every month, there will be a release of this key economic indicator. It is widely seen as a crucial barometer of the health of the U.S. economy, although in recent years the monthly FOMC statement has probably become more important. The market’s expectation is that the economy will be shown to have created about 180,000 new jobs. If this figure is significantly exceeded, meaning we get a number in excess of at least 200,000 then the market will begin to see a December rate hike as probable. This should cause the USD to jump in value, probably mostly against a currency such as the CHF which pays a negative interest rate and which has also been very weak lately across the board.

If, on the other hand, the number comes in below 180,000 it will be seen as a continuation of the gloomier view of the U.S. economy, and would probably cause a flow of capital into the Japanese Yen. If the number was 160,000 or even lower this would be seen as a very poor outlook and would be likely to push the USD/JPY pair down to at least 119.00.

Overall, it seems likely that the Non-Farm Payroll data due later this week is going to be more important than usual in determining the direction of USD currency pairs.

Further Economic Data

There is more crucial data still to come before December’s FOMC announcement on rates. Next week on 13th November there will be Retail Sales data, followed on the 19th by Unemployment Claims. The 25th will see Core Durable Goods Orders. There will be one more Non-farm Payrolls data on 4th December, followed by more key Retail Sales data on the 11th of that month, before the FOMC announcement is finally made on 16th December. So there is some way to go yet.