The ripple effects of global jitters around Brexit has reached around the world and as far as New Zealand. When opinion polls suggested the momentum was tipping towards the "leave" camp last week, the New Zealand stock markets dropped almost 2 per cent last week, the worst weekly performance in the past four months. Exit polls have turned around and the latest figures show the Leaves vs the Remains votes are almost tied.

Britons will vote on Thursday on whether Britain should remain a member of the European Union, with the result expected to become clear late Friday, New Zealand time.

According to Craigs Investment Partners head of private wealth research Mark Lister, if Britain left the European Union, equity markets around the world would fall, affecting Britain and Europe the most and New Zealand and the United States to a lesser extent. If Britain remained, markets would respond positively, with Britain and Europe rallying the most and New Zealand and the US more modestly.

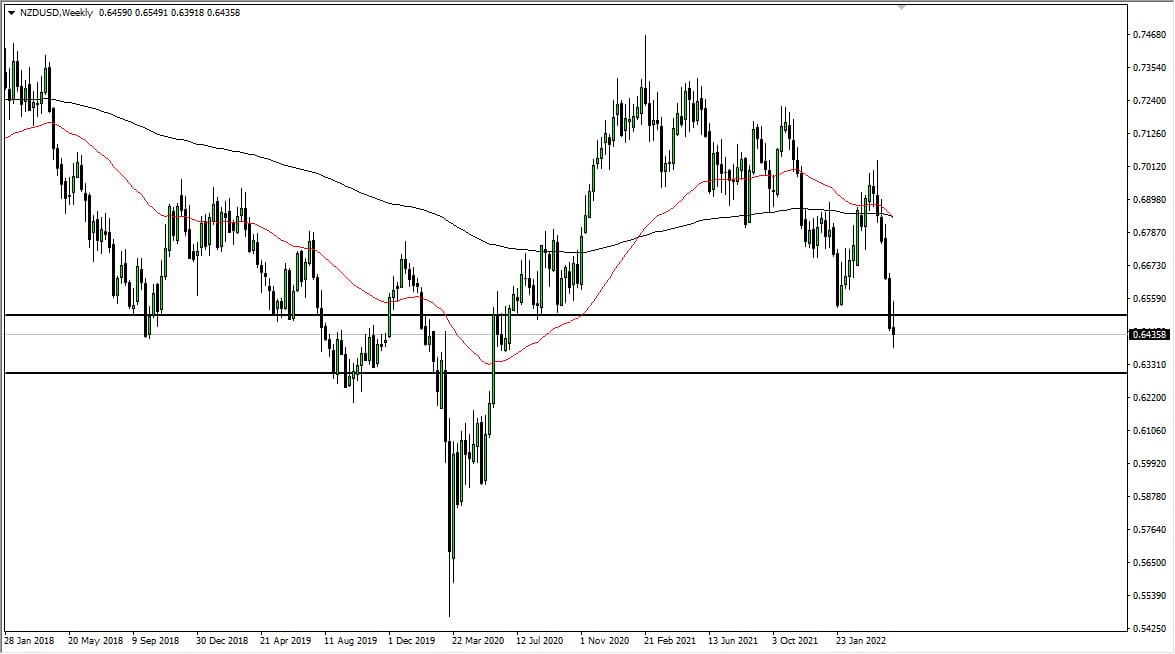

Currencies around the world are expected to react sharply to the results of the vote, with the pound and euro falling if Britain left, and "safe haven" currencies such as the Japanese yen and US dollar set to benefit. If the 'Remain' camp wins, the New Zealand dollar would probably fall against the pound and euro while should an exit be voted in, the kiwi would probably rise compared to the euro and pound but decline slightly against the yen and greenback.

Analysts predict that a Brexit would mean a weaker UK economy and less demand for New Zealand exports. As a relatively small country and with just 2.3 per cent of Kiwi exported goods going to the UK, New Zealand is likely to fall down the list of priorities in new trade agreements.

In the longer term, analysts are concerned about the UK's future trade relationships as they will only have a short time period to negotiate new trade arrangements with a vast number of countries, including New Zealand.

Possible Drop in Tourism

Of equal concern to analysts is the effect of a Brexit on New Zealand tourism. Record numbers of tourists have of late been pouring much needed cash into New Zealand as its farmers struggle with depressed dairy prices, but some of that spending could dry up should Britain vote to leave the European Union.

According to official figures released Wednesday, 193,600 visitors came to New Zealand in May, an all-time high for that month. The annual total of 3.29 million equaled 70 percent of the entire population of 4.7 million.

The United Kingdom is New Zealand's fourth-largest tourism market, accounting for around 11 percent of visitor spending. The number of tourists from the UK surged 10.3 percent in the year to April to 90,848 arrivals and they are particularly appreciated because they tend to stay longer and spend more with 28 days being the average length of stay.

International tourism to New Zealand has boomed over the last few years with visitors eager to view locations used in the filming of movies such as the Lord of the Rings and the Hobbit and contributing around NZ$12 billion a year to the economy according to New Zealand's Ministry of Business, Innovation and Employment. This has managed to offset the sharp decline in dairy exports, which has weighed heavily on economic growth.

Dairy has, up until recently, been the mainstay of the economy, producing around 25 percent of exports. But dairy prices have dropped sharply since scaling record highs in 2013, as a result of China's economic slowdown and global oversupply.

Kiwis are also worried about the threat of a run on the pound. ANZ Economist Philip Borkin said a weaker pound could hit tourism revenue as it would make New Zealand more expensive.

The referendum is less than 24 hours away but speculation on the effects of the ballot results will continue well after the votes are counted.