The final day of the 2016 U.S. Presidential election is less than 48 hours away now, and by the early hours of Wednesday 9th November we will probably get a good idea as to whether Trump will win and become the next President of the United States of America or not.

Clinton has been the favorite all along and until about two weeks ago, it looked like she was heading for an easy landslide victory. However, since then the Trump polls have narrowed considerably, and at the time of writing her lead in the national polls and in the crucial battleground states is within the pollsters’ margin of error. This is a strange election, with at least a limited realignment of the electorate undoubtedly taking place, which makes it harder to predict, so while Clinton continues to be the forecasters’ favorite, the dominant perception is that the chances of Trump becoming President are increasing and at least one major pollster currently puts them at about 35%.

I continue to feel very confident that Clinton will win, but what if Trump wins? What would that be likely to mean for the financial markets, and how might a Trump victory be exploited by traders?

What If Trump Wins?

The first point worth noting is that as it would be an upset, even if Trump looks like winning as soon as the earliest results from competitive states are released, the perception of a Trump win will build more slowly than a Clinton win. It is also likely that any Trump victory would be narrow and hinge on a single swing states, so I think that a Trump victory would come late and suddenly. The instant the perception becomes general, stock markets globally, and within the United States particularly, will fall sharply, and all markets involving stocks and havens or the U.S. Dollar will become very volatile.

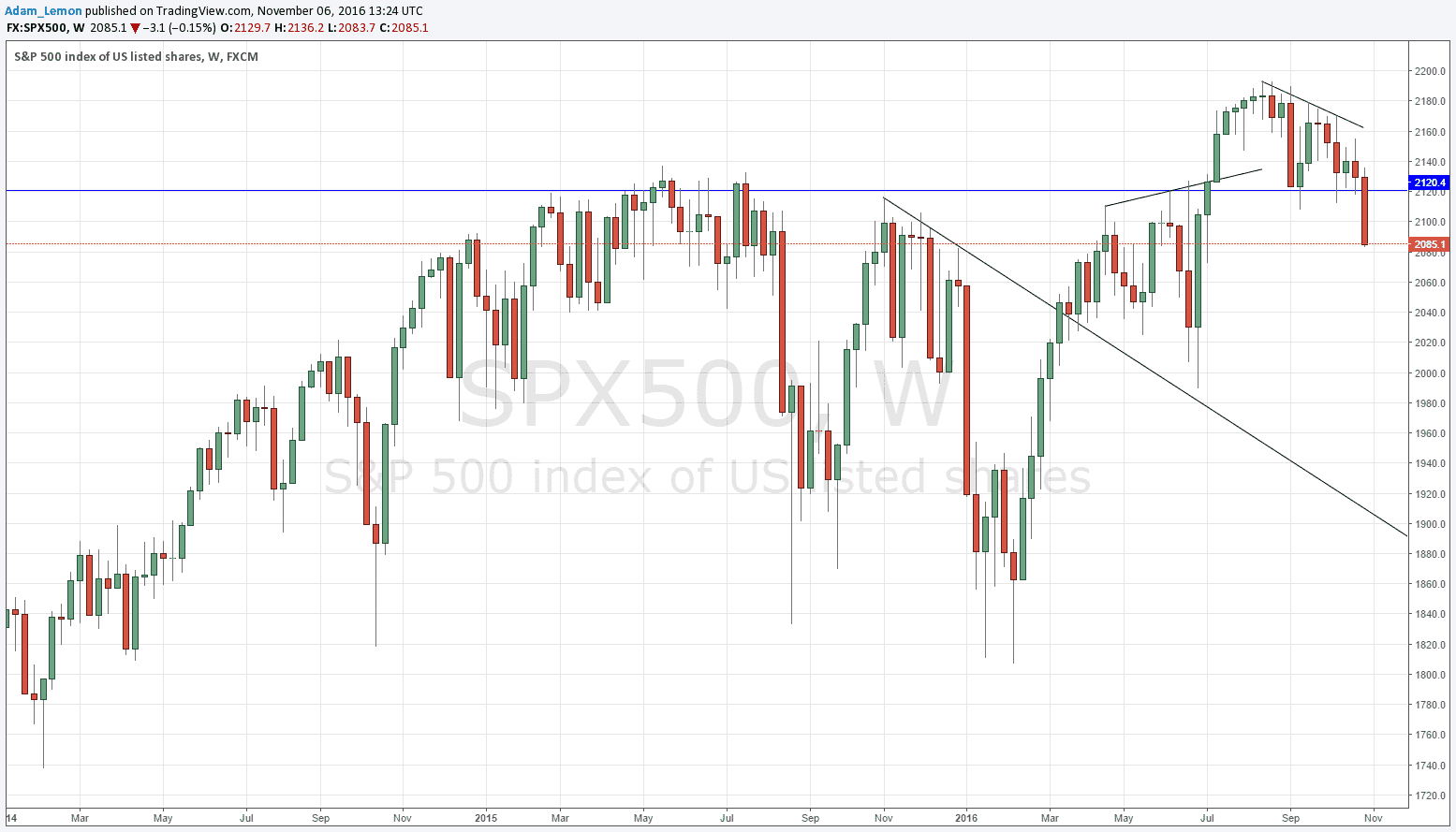

There are three reasons why stocks will probably fall right away: because decision-makers are very afraid of what an obviously temperamental and politically inexperienced man such as Trump might do in general, but also particularly fear his protectionist economic policies which have been the centerpiece of his campaign. The third reason is subtler: the stock market is ready for a fall. The weekly chart below covers the past two years’ prices in the key major S&P 500 Index. It does not look bullish overall, with the price having fallen below the key support level at 2120, and the action is instead suggestive of broad distribution at the tops.

Forex Market Impact of Trump Presidency

The first and most predictable impact on the Forex market will probably be a rise in “haven” currencies. That is simple and obvious enough to forecast amidst of fear and uncertainty, but there is some doubt over which currencies are safe havens! The U.S Dollar will not qualify in this case, and can be expected to fall in line with the U.S. stock market. The major beneficiaries here will be the Japanese Yen and the Swiss Franc, as well as precious metals such as Gold and Silver (of those two metals, Gold looks a little stronger). It has been interesting in recent months to see the Euro often strengthen in line with the traditional “haven” currencies: more on that later.

The flip side of a rise in the “safe havens” will naturally be a fall in the “risk” currencies, and I think we can identify these as the commodity currencies which are AUD, NZD and CAD. Of these three, CAD has recently shown the greatest weakness, and due to its high level of economic integration with the United States, I see it as likely to be the weakest of these three in this scenario. The NZD has been strongest and as it has the highest yield, that is also likely to continue.

This leaves the GBP and the EUR, which would usually be classified as “risk” currencies, but I see these two as likely to behave differently, with the EUR acting somewhat like the Swiss Franc and rising against the USD. Regarding the GBP, I think this currency will be independently driven by Brexit-related developments, so that will be a wild card.

Longer-Term Impact

So far, these are the obvious short-term impacts of a Trump victory, looking only a few days or a week or two into the future from the time the result becomes obvious. Longer-term forecasts are always much harder to make, but I think a bear market in stocks is something that will continue to develop over time and will inevitably be accelerated if not caused by a Trump presidency.

The bigger question is what the Federal Reserve will do if the stock market has turned fully bearish and is still falling by the time they are expected to announce a quarter-point rate hike in December. They will be tempted to abandon the plan due to not wanting to make a bad situation even worse, although they may conclude that if the fall is quite strong but not catastrophic that they might as well make the hike anyway if only so they can reduce it again later. Yes, the world of monetary policy has become this crazy.

Much will depend upon the behavior of a President Trump during his first 100 days in office, should he be elected. It may be that he behaves with restraint and does not drop any bombshells. If that is so, markets may take a more positive tone, but they will take some convincing.