Looking at the economic fundamentals and central bank policies of all the major Forex currencies, we begin the year 2020 with the U.S. and Canadian Dollars as the currencies in the strongest positions, while the Japanese Yen and Australian Dollar are in the weakest positions. Such fundamental situations, once established, tend to persist for some time.

Even if you agree with my analysis, this does not mean you should just open a long trade in USD/JPY right away, for example, and sit tight. I believe that fundamental analysis should ONLY be used as a filter to confirm technical analysis. This means that if the USD/JPY makes new long-term high prices, you could trade with this long trend and use my fundamental analysis of these currencies to confirm the trade, and to have more confidence in it. Price action is more important than fundamental analysis.

In my last yearly Forex fundamental analysis, at the end of 2017, I called long USD/CAD as the strongest fundamental trade for the coming year. During 2018, the value of the USD/CAD currency pair rose by 8.48%.

Building a Fundamental Analysis of Major Currencies

The first step is to conduct a basic fundamental analysis of each of the eight major global currencies most relevant to Forex traders, by examining the current state of key economic indicators and central bank policies and interest rates. Additionally, it is important to see where the consensus forecasts are pointing towards. So, let’s look at the eight major currencies important to Forex traders one by one.

U.S. Dollar

The interest rate paid by the Dollar’s central bank, the Federal Reserve, is just under 1.75%. This is relatively high, just a little less than that paid by the Bank of Canada, meaning that over the short term the interest rate should contribute to a rise in the Dollar’s value. However, the rate differentials are quite small so it may not be a strong factor. Markets are expecting the Federal Reserve to hold rates steady over the next few months, and the most recent action was a rate cut.

Gross domestic product is currently running at an annualized rate of increase of 2.1%, slightly higher than had been expected. Most forecasters expect the rate of growth to slow slightly in 2020, but still to be a relatively healthy 2.0%.

Inflation is running at 1.8% now, meaning the real interest rate is very marginally negative.

The Federal Reserve can be said to be in neutral mode – it is neither tightening nor loosening monetary policy but is watching on the sidelines.

Euro

The interest rate paid by the European Central Bank is approximately zero. This is relatively low, higher only than Japan and Switzerland, meaning that over the short term this interest rate should contribute to a fall in the Euro’s value. Markets are expecting the ECB to hold rates steady over the next few months, but their most recent action by the ECB on rates was a rate cut.

Gross domestic product is currently running at an annualized rate of increase of 1.4%, slightly higher than had been expected. Most forecasters expect the rate of growth to increase a little in 2020, to 1.6%.

Inflation is running at 0.7% now, meaning the real interest rate is a negative -0.7%.

The ECB can be said to be in neutral mode concerning overall monetary policy.

Japanese Yen

A negative interest rate is imposed by the Bank of Japan, at -0.1%. This is low, higher only than Switzerland’s rate, meaning that over the short term the interest rate should contribute to a fall in the Yen’s value. Markets are expecting that the Bank of Japan will be prone to cutting its already negative rate even further over the coming months.

Gross domestic product is currently running at an annualized rate of increase of 0.8%, slightly lower than had been expected. Most forecasters expect the rate of growth to decrease in 2020, to only 0.5%.

Inflation is running at 0.2% now, meaning the real interest rate is a negative -0.3%.

The Bank of Japan can be said to be tilting towards a looser monetary policy.

British Pound

The interest rate paid by the Pound’s central bank, the Bank of England, is 0.75%. This is average, neither high nor low in relatively terms. Markets are expecting the Bank of England to hold rates steady over the next few months, but the most recent action was a rate hike.

Gross domestic product is currently running at an annualized rate of increase of 1.0%, slightly lower than had been expected. Most forecasters expect the rate of growth to increase in 2020, to a healthier 1.6%. The precise terms of Brexit, which is likely to happen at the end of January 2020, are still unknown, so it may be that Brexit has a negative impact on 2020 growth.

Inflation is running at 1.8% now, meaning the real interest rate is a negative -1.05%.

The Bank of England can be said to be tilting towards a looser monetary policy.

Swiss Franc

A negative interest rate is imposed by the Swiss National Bank, at -0.75%. This is very low, meaning that over the short term the interest rate should contribute to a fall in the Franc’s value. Markets are expecting that the SNB will not be making any cuts or hikes in the foreseeable future. The SNB’s last rate action was a cut.

Gross domestic product is currently running at an annualized rate of increase of 0.8%, a fair bit lower than had been expected. Most forecasters expect the rate of growth to increase in 2020, to 1.7%.

Inflation is running at 0.3% now, meaning the real interest rate is a negative -1.05%.

The SNB can be said to be running a loose monetary policy, due mainly to the fact that the CHF is a “safe haven” but an overly strong CHF hurts the non-banking sector of the Swiss economy, therefore the interest rate is kept very low.

Canadian Dollar

The interest rate paid by the Loonie’s central bank, the Bank of Canada, is 1.75%. This is the highest of all the major global currencies. Markets are expecting the Bank of Canada to hold rates steady over the next few months, but the most recent action was a rate cut.

Gross domestic product is currently running at an annualized rate of increase of 1.7%, slightly lower than had been expected. Most forecasters expect the rate of growth to drop strongly in 2020, to only 0.6%.

Inflation is running at 1.75% now, meaning the real interest rate is effectively zero.

The Bank of Canada can be said to be tilting towards a tight monetary policy, making it unusual amongst the richest nations. However, many analysts see it as likely that the Bank of Canada will be forced to loosen monetary policy, probably by cutting rates, later in 2020.

Australian Dollar

The interest rate paid by the Aussie’s central bank, the Reserve Bank of Australia, is 0.75%. This is average, neither high nor low in relatively terms. Markets are broadly expecting the RBA to hold rates steady over the next few months, although a further cut soon would not be a great surprise. The most recent action on rates was a rate cut.

Gross domestic product is currently running at an annualized rate of increase of 1.7%, slightly lower than had been expected. Most forecasters expect the rate of growth to drop strongly in 2020, to only 0.8%.

Inflation is running at 1.90% now, meaning the real interest rate is effectively a negative -1.15%.

The RBA can be said to be tilting towards a looser monetary policy. Many analysts see it as likely that the RBA will be forced to loosen monetary policy, probably by cutting rates, later in 2020.

New Zealand Dollar

The interest rate paid by the Kiwi’s central bank, the Reserve Bank of New Zealand, is 1.00%. This is a little above average in relative terms. Markets are broadly expecting the RBNZ will have to cut its rate soon. The RBNZ surprised analysts by passing on an expected rate cut near the end of 2019.

Gross domestic product is currently running at an annualized rate of increase of 2.1%, the highest of all the major global currencies’ nations. Most forecasters expect the rate of growth to drop strongly in 2020, to only 0.8%.

Inflation is running at 1.70% now, meaning the real interest rate is effectively a negative -0.70%.

The RBA can be said to be tilting towards a looser monetary policy. Many analysts see it as likely that the RBNZ will be forced to loosen monetary policy, probably by cutting rates, later in 2020.

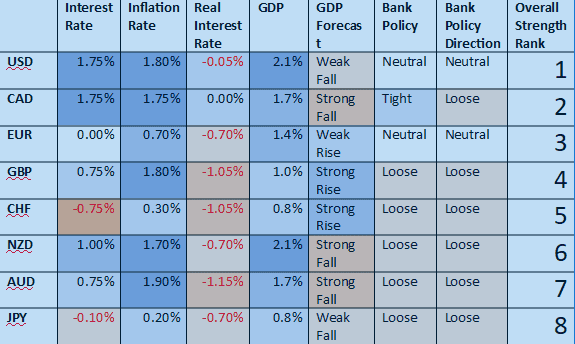

Current Fundamental Status of the Major Currencies

Now we have the information, we can build a spreadsheet to help us determine what verdict to give each currency. This is as much of an art as it is science, as there is no single factor which can automatically determine a currency’s fundamental strength or weakness. The data is colour-coded and then overall rankings are assigned in the right-hand column.

Currencies with Strong Fundamentals

We are in an environment of generally low interest rates and loose monetary policy. This means that almost every currency is relatively “weak”. One statistic which demonstrates this is that there is not a single currency here which truly gives a positive yield: every single currency is subject to an inflation rate equal to or greater than its interest rate.

A currency’s yield is one of the two major fundamental factors, which is why I see the U.S. and Canadian Dollars as strong. This is reinforced by the fact that the rates of economic growth in both countries are strong. The second major factor is the policy and attitude of central banks, and in the U.S.A. and Canada we have two central banks that have more recently tightened monetary policy, or at least refused to loosen monetary policy, than loosened it. Arguably, the U.S. Dollar has stronger fundamentals than the Canadian Dollar, because economic growth in the U.S.A. is expected to barely decrease from its current healthy level, while Canadian GDP is expected to fall strongly, although there have been signs that this fall is not going to happen as strongly as had been expected.

Currencies with Weak Fundamentals

Japan appears to have the weakest fundamentals: negative rates, seriously negative yield, and relatively low economic growth. Australia is also looking problematic as a major economic slowdown is expected there, while inflation is strong and the yield on the currency is also meaningfully negative.

Trading Fundamental Analysis

It is vital the fundamental analysis is used as a filter only in determining what trade to take, if it is used as a trading method. This is because mechanical trading strategies based upon fundamental indicators perform even worse than those based upon technical indicators. Of all fundamental strategies, trading currencies with higher interest rates long against currencies with lower interest rates has tended to work relatively well.

Another factor is that market sentiment can drive money into a currency even if the currency’s fundamentals are weak. A good example is the Japanese Yen. If the current bull market in U.S. stocks comes to a crashing halt with a bear market, you can expect money to flow into the Japanese Yen as a “safe haven” currency, regardless of Japan’s economic health or negative interest rate.

It is better to use a price-based trading strategy and use fundamental analysis to decide whether to take the trades or not. A similar approach is to risk more on trades that are in line with your fundamental analysis.