Things move very rapidly in tech; doubly so in cryptocurrencies. It may have taken bitcoin more than a decade to rise from obscurity and take on the mantle of a global decentralised asset, but at the same time, a revolution has been brewing beneath the surface of the cryptocurrency market.

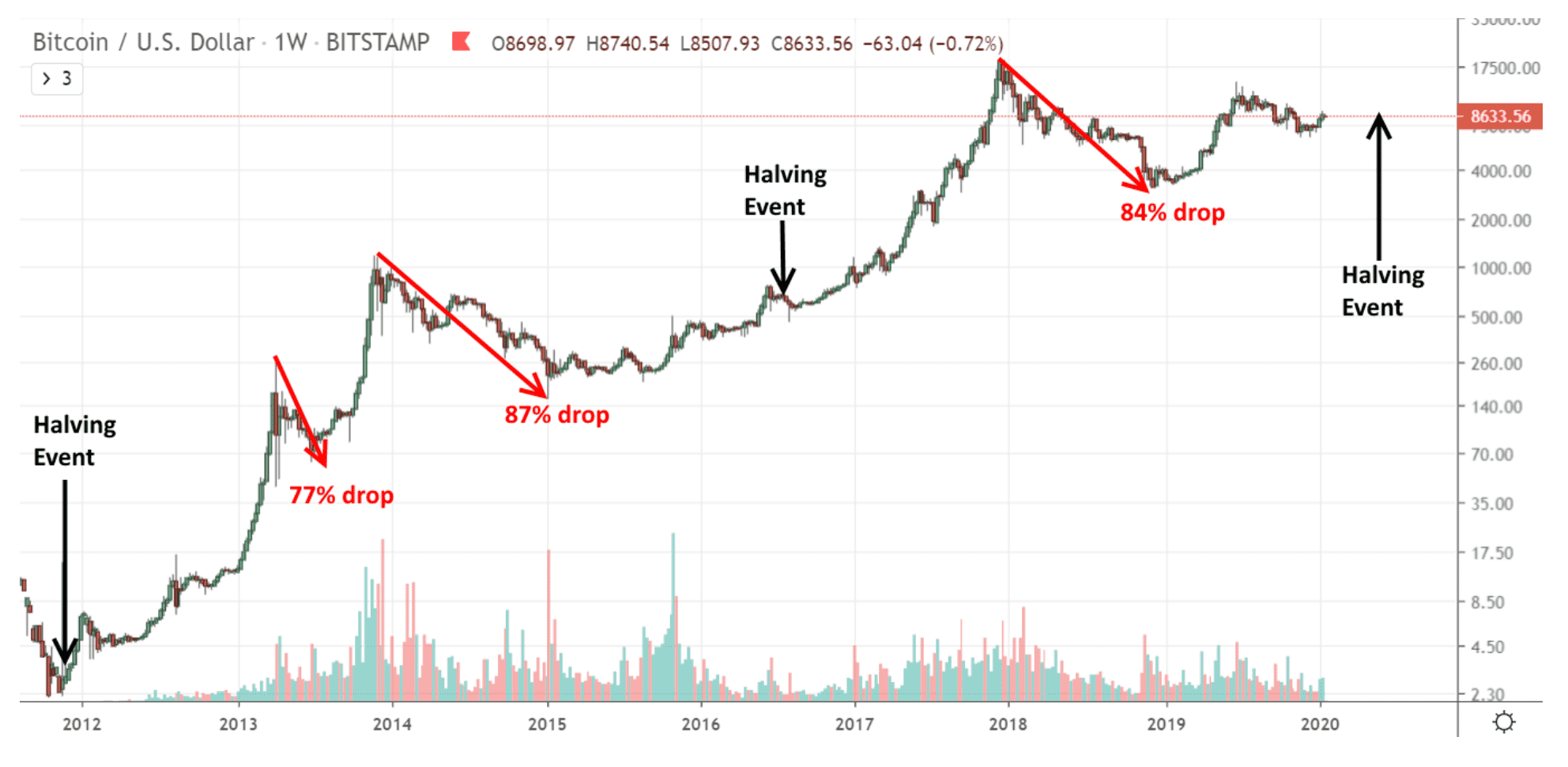

Bitcoin has made many attempts to break into mainstream awareness in its short but storied history. From 2011 to 2012, just as the European sovereign debt crisis was moving into full swing, many people started hearing about a type of digital money that nobody was in control of. By the end of 2013, it had gone on an unprecedented run that took the price from under $10 in January 2012 to just shy of $1200 in November 2013. That’s an almost 17,000% increase in less than a year. What followed was a prolonged bear market that would see the price dropping as low as $150 per coin by January of 2015. As is often the case when an asset plunges in value, especially one as controversial as bitcoin, it inevitably drops from the headlines and obituaries start being written about it.

During the next cycle, between 2016 and 2017, an even larger group of people found out about bitcoin. This was partly hastened by a greater degree of public awareness surrounding the “halving” event, which occurs once every four years and effectively halves the amount of new bitcoin that is mined. The supply shock which resulted has been enough to send bitcoin to new highs in the wake of every halving to date. By this time the market had grown sufficiently to support a slew of other “altcoins,” many attempting to ride bitcoin’s coattails, while others ambitiously tried to disintermediate other areas of the social fabric, just as Bitcoin was trying to do with money. During this period, Bitcoin’s price surged again from under $400 in January 2016, to around $20,000 by December 2017. Another incredible rally, this time 5500%.

What ensued was yet another prolonged downturn that would see the asset losing between 80-90% of its value. In the year between bitcoin’s all-time highs and its lows in December 2018, much had changed in the space. So much so, that when the media picked the story back up again in April 2019 (just as the price action began to indicate a new bottom), many were bemused to find the coverage being solely about bitcoin as digital gold, with hardly a mention of all the ground that had been broken in the space since the previous high. As another halving looms on the horizon and we enter yet another cryptocurrency cycle, now may be the perfect time to take stock of a few important developments since you last paid attention to this story.

Staking

By now most people will have at least heard of the practice of mining. The resource-intensive method called proof-of-work, which involves using specialised computer hardware to solve incredibly complex mathematical problems that bitcoin and other cryptocurrencies rely on in order to achieve distributed consensus and security. However, not as many have heard of proof-of-stake, a rival algorithm that achieves consensus by stakeholders using their own coins to guarantee the network.

The strengths and weaknesses of proof-of-stake have been debated for many years. One of the most compelling arguments for this type of consensus is that PoS is fundamentally a greener technology. It eliminates costly, energy-hungry mining hardware that proof-of-work cryptocurrencies rely on. As an example of just how wasteful proof-of-work is, the Bitcoin network currently consumes more energy per year than the country of Switzerland. Another argument for proof-of-stake is that it aligns the incentives of miners and holders. In proof-of-work, miners are a type of special interest group that is separate from the users of the network. In proof-of-stake, the holders and users are themselves responsible for securing the network by locking up their own coins.

Among the top 20 cryptocurrencies by market cap, 6 currently utilise proof-of-stake to achieve consensus (EOS, TRX, XTZ, DASH, ATOM, and NEO) with a seventh (ADA) due to launch its own PoS algorithm in the coming weeks. Ethereum, the second-largest cryptocurrency, is currently in the middle of its own transition from proof-of-work to proof-of-stake. It’s extremely unlikely that we’ll ever see Bitcoin changing its consensus algorithm, but the general trend does seem to be moving away from PoW and towards PoS. We’ll discuss some of the other implications of this trend later when we look at yield.

DeFi

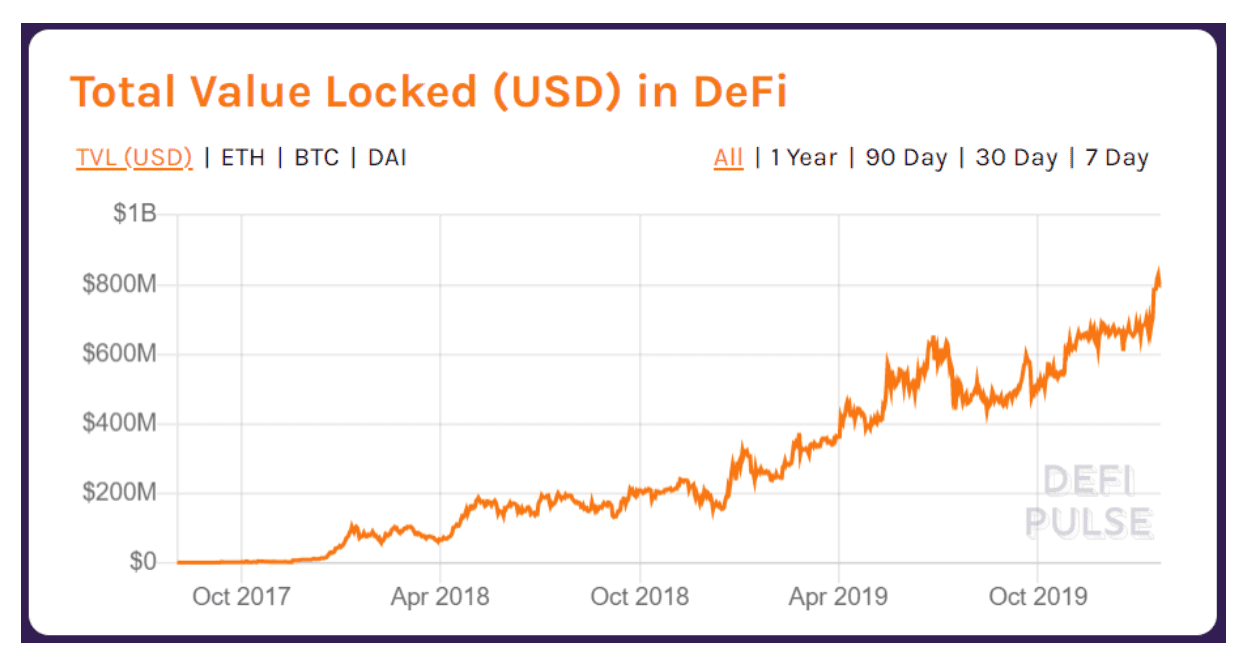

DeFi, or Decentralised Finance, emerged during the last crypto bear market as one of the new killer applications of the crypto space. Again, it appears to be too new, not understood enough, and too removed from Bitcoin itself to have made any significant impact in the mainstream media yet. DeFi relies on 2nd and 3rd generation “smart contract” blockchains, like Ethereum, that can process more than just the movement of units of cryptocurrency. A smart contract can be thought of as a type of agreement written in code that binds parties to a certain set of rules enforceable by the blockchain itself. No need for lawyers or for pages upon pages of fine print to be signed, monogrammed and witnessed. By contrast, 1st generation crypto networks like Bitcoin are only able to handle the movement of units of currency. This is also why you may not have heard anything about it. Crypto is a highly complex area and the public narrative moves a lot slower than the technology itself, hence the focus on bitcoin as digital gold.

In a nutshell, DeFi does for financial services what cryptocurrencies like bitcoin did for money a decade ago. It allows anybody to take advantage of services like decentralised lending, exchange, and derivatives contracts in a completely permissionless manner. Since the end of 2017, savvy crypto investors have been locking up their crypto holdings in order to earn a passive income throughout the bear market.

As more and more DeFi projects have come online, it has led to the growth of an ecosystem of distributed financial services that mimic the money markets of traditional finance, with the exception that DeFi excludes no-one. Any person (or indeed bot) with a crypto wallet is treated as an institution of sorts and can access and take advantage of services (and rates) ordinarily reserved for banks. Of course, it’s still very early days for DeFi, however, the amount of value locked up in DeFi smart contracts continues to grow and by some measures has already exceeded $1 billion. While there are DeFi products available on several blockchains, Ethereum currently holds the lion’s share of DeFi activity and is growing at an exponential rate. Between January 13 and January 19 alone, a further $130 million was locked up in Ethereum-based DeFi projects.

Yield

One of the earliest criticisms levelled at crypto by some economists was that, like gold, its deflationary nature and status as a bearer instrument make it highly problematic as the basis for a modern global economy. As a bearer asset, it was said, all crypto can do is sit there dumbly, awaiting a greater fool to come along and pay you more than what you paid someone else for it. This is changing. While many stopped paying attention when the bubble burst and the wild speculation came to an end, crypto suddenly became an asset class with a yield. In fact, another part of crypto’s untold story is that as a yielding asset class, crypto currently provides higher yields than much of the traditional financial system.

Among the proof-of-stake protocols in the top 20 mentioned above, their stakeholders currently earn somewhere between 3% and 13% annually, depending on the project. So, for some crypto projects, the notion of being a holder (or hodler) has fundamentally changed. Those holdings can now earn an income when staked, allowing investors to increase their holdings, diversify or take an income. And that’s just staking.

DeFi users can lend out assets that can’t currently be staked, like Ether, Dai, ZRX and Basic Attention Token, and earn interest on these. In mid-2019 the demand for Dai, a stablecoin built on Ethereum and algorithmically pegged to the US dollar, rose so much that the interest payable on lending it rose to 15%. It’s currently at around 6%. To get anywhere near those percentages in the traditional banking system you would have to convert your capital into another currency and park it in places like Argentina, Turkey or Iran. Something very interesting is happening for this nascent market to be offering the kind of interest rates many Western savers fondly recall from the 80s and 90s. It’s definitely something to keep an eye on. Particularly since DeFi protocols ordinarily require that the network’s token (Ether in the case of the Ethereum blockchain) is locked up as collateral, meaning less is available on the open market.

Final Thoughts

Bitcoin obviously rules this market, comprising 66% of its market cap at the time of writing. The entire market necessarily follows bitcoin’s own broader cycle as described above. When it’s up altcoins benefit from the run-off, when it’s down they suffer even greater than bitcoin itself. However, a frenzy of activity has been taking place in other less visible projects despite what the price of bitcoin has been doing. And as bitcoin enters a fresh bull market these projects will be the benefactors of a fresh wave of interest that the entire space is about to receive. Equipped with some knowledge of the three trends we have discussed here, you should have a good starting point from which to cut through a lot of the hype and make smarter decisions than the rest of the crowd. The CliffsNotes version is that Bitcoin is still king, but there are more scheming princes in the realm than you may have thought.

*Cryptocurrency trading is not available under HYCM (Europe) Ltd

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.