The Bank of Japan recently released its monetary policy meeting minutes, in which policymakers discussed forms of making their monetary stimulus measures more sustainable.

One member suggested adjusting the bank’s purchase of risky financial assets, while others discussed how to achieve the bank’s 2 percent inflation target.

Most members agreed that the bank's steps to ease corporate funding channels are having the intended effects and that the institution shouldn’t hesitate to do whatever is needed to deal with the spread of the coronavirus.

So far, 200,658 COVID-19 cases have been reported in Japan, as well as 2,944 total deaths. Cases have been surging, with medical experts sounding the alarm due to the quick advance of the virus. Despite this, the prime minister reiterated that there is no need to call for a state of emergency.

“We need to show the results of our coronavirus countermeasures,” said the prime minister during an interview. “I’ll spearhead the effort with a mindset to do everything that must be done.”

The last time the bank met, the monetary policy committee decided to leave the short-term cash rate unchanged at -0.1 percent.

Economic Calendar

The markets have not learned much about the current state of the Japanese economy this week.

The Cabinet Office reported that the Leading Economic Index for October stood at 94.3, after being at 93.3 in the previous month and higher than expectations of 93.8. The Coincident Index was lower than expected at 89.4, after being at just 84.8 in the previous month.

On Friday last week, the Bank of Japan announced its decision to leave the cash rates unchanged at -0.1 percent, remaining in line with analysts’ expectations.

Japanese Yen Loses Steam

So far this week, the Japanese yen has lost 0.10 percent against the US dollar, breaking a two-week gaining streak. Meanwhile, the dollar has been gaining ground against a bundle of its main competitors and recovering from the previous week’s losses, advancing 0.49 percent after a 1.06 percent decline.

The relative strength of the yen is concerning Japanese policymakers, who are clearing the path for a foreign exchange market intervention. Exporters need the exchange rate to stay at around 100 yen per dollar.

"Make sure the yen-dollar exchange rate does not cross the 100 yen mark,” Prime Minister Yoshihide Suga told Finance Ministry officials.

Despite the government doing what it can to avoid this situation, analysts expect the yen to break this barrier at some point, especially given the recent weakness of the US dollar.

“Strength in the U.S. economy and Japan’s years of monetary easing have prevented adjustments, but the yen’s advance may pick up a bit next year given the state of the U.S. and its monetary policy stance,” said an analyst at State Street.

Japan’s Economic Numbers Better Than Expected

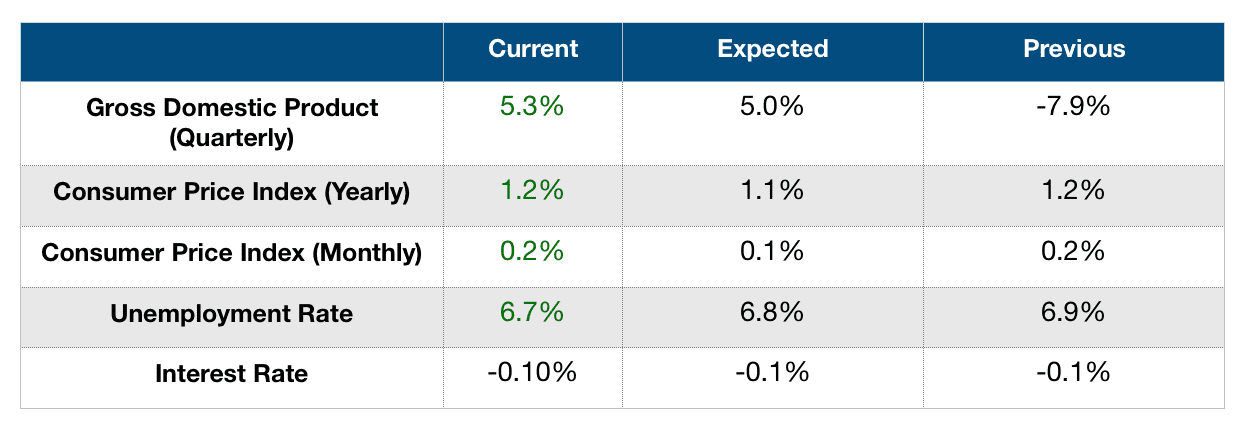

Numbers are favoring the Japanese economy, which has largely outperformed analysts' expectations. Economic growth surged in the third quarter, gaining 5.3 percent against forecasts of a 5.0 percent increase, but remained below the second quarter’s 7.9 percent.

The Consumer Price Index also surprised analysts, gaining 1.2 percent annualized and remaining unchanged from the previously released figure. In monthly terms, the index climbed by 0.2 percent, also remaining unchanged from the previously released figure but higher than forecasts of 0.1 percent.

Unemployment levels have also improved with a current rate of 6.7 percent after the previous month's 6.9 percent, and better than expectations of 6.8 percent.

Upcoming Events

With New Year’s Day next week, not many relevant releases are expected, aside from industrial production data for November, which will be released on Sunday.