Eurostat recently revised down the third quarter gross domestic product figures, showing that the eurozone economy grew less than previously expected, though at its fastest rate since 1995. Nevertheless, the GDP still decreased less than expected in the three months since June.

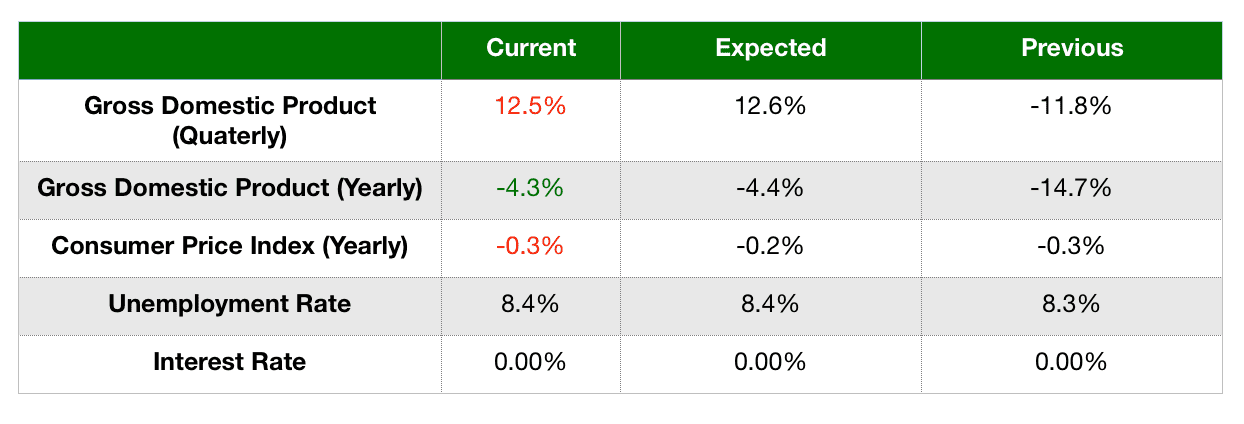

In quarterly terms, the GDP climbed by 12.5 percent (quarter-on-quarter), below the previous figure of 12.6 percent and against expectations. In yearly terms, the figure was also revised down at 4.3 percent in the third quarter, though this was better than expectations of 4.4 percent.

The agency attributed the third quarter rebound to an increase in both consumer spending and business investment. Among the best-performing countries were France, Spain and Italy, all of whom registered double-digit GDP increases.

Employment rose by 1 percent in the third quarter, better than the expected 2.8 percent decline. Eurostat commented that while the impact of stimulus measures certainly aided employment levels, changes in employment hours were more prominent.

Despite the good news, the outcome of the Brexit negotiations remains uncertain, with both sides unable to agree on key issues.

The EU has signaled its willingness to continue with the negotiations after the deadline is reached, even as the British Prime Minister plans to meet with the European Commission President to discuss the issue.

European Union members are also struggling to reach a consensus in fiscal policy matters. Hungary and Poland are currently vetoing the implementation of a 2 trillion euro fiscal stimulus package, which can jeopardize their own receipt of funds should the other 25 Eurozone members push for an exclusionary ad hoc agreement. The delay in the implementation of this stimulus package may hinder the economic recovery of the Eurozone, increasing concerns about the fate of the union.

Economic Calendar

Last week, important data about the economic situation of the Eurozone was released. The Eurozone manufacturing sector expanded at a faster pace in November at 53.8 after being at 54.8 in October, while the services sector declined at 41.7. The business sector also declined at 45.3, though higher than expectations of 45.1.

The Core Consumer Price Index climbed by 0.2 percent in November according to preliminary data, remaining in line with analysts’ expectations. In yearly terms, it decreased by 0.3 percent, below expectations of 0.2 percent.

Retail sales rose by 4.3 percent in yearly terms, higher than forecasts of 2.7 percent. In monthly terms, they surged by 1.5 percent, also higher than expected, as analysts predicted 0.8 percent.

German industrial production surged in October, increasing by 3.2 percent after gaining 2.3 percent in September. Analysts attributed this increase to the surge of the German automobile sector, which gained 10 percent during the month.

Underlying Risks Threaten Euro’s Performance

So far this week, the euro has had a poor performance against the US dollar, dropping by 0.03 percent and breaking a three-week gaining streak. This month, the euro has gained 1.57 percent against the greenback, continuing the positive trend that began in November.

On the other hand, the euro surged by 0.77 percent against the pound sterling, rising for the third consecutive week. In monthly terms, it gained 1.53 percent, breaking a two-month losing streak.

It was somewhat surprising that the euro remained steady after the markets learned about the German industrial sector rebound, though it makes sense taking into consideration the underlying risks faced by European markets due to the negotiation deadlocks and the advance of the COVID-19 pandemic.

Given the fiscal deadlock, the ECB is now expected to expand its bond purchase program. Analysts predict that the central bank will add €500 billion to its emergency bond-perchasing program and expect it to be extended beyond June 2021.

Eurozone Economy Has Much Ground to Regain

As we already mentioned, the Eurozone gross domestic product decreased less than expected in yearly terms, mainly pushed up by an increase in consumer spending and business investment levels, which in turn is being boosted by an increase in government spending.

Despite the good news, the Eurozone economy has still to regain a lot of ground before getting back to pre-pandemic levels.

“A gap as bad as that seen in 2008 still remains, although we have to bear in mind that the economy was not completely open in the third quarter either,” commented an analyst at ING. “Still, this explains why we don’t expect the economy to fully recover before 2022, as there is a lot of ground to regain.”

Inflation is still far from the ECB's target, as the latest Consumer Price Index reading showed a 0.3 percent contraction.

The unemployment level signals a slight worsening in the labor market at 8.4 percent after being at 8.3 percent in September.

Upcoming Events

On Thursday, Eurostat will be publishing the Consumer Price Index for November.

On Friday, IHS Markit will be releasing December’s preliminary PMI data.

Also on Friday, Germany’s Federal Statistical Office is publishing the Producer Price Index.