The ask and bid price is a price quotation that states the best rate at which a security can be bought or sold at any point in time. The difference between the two price points is called a bid ask spread. The bid ask price is of significance to investors because it directly impacts their buying and selling of shares. They can’t sell at the price they buy something. Let’s take a deeper look at the ask price and bid price definition, advantages, examples, and more.

Top Forex Brokers

What is Ask and Bid Price?

Ask and bid price are the collective figures that describe the current price at which a security can be sold or bought. Traders always keep an eye on them and the difference between them to understand the overall value of a commodity.

Definition of Ask and Bid Price

The ask price in forex refers to the minimum price at which the seller of a security will sell it. The bid price is the maximum price a buyer is willing to pay for acquiring a security. An offer between the two occurs only when both agree to the prices set by the other. Traders cannot sell a security immediately after buying it at the same price because there is a sizable difference between the two values.

What Is Bid Ask Spread?

A spread is simply the difference between the bid vs ask price. It indicated the liquidity of an asset. The security will be more liquid in nature if the difference between the ask price vs bid price is smaller. A larger spread represents a higher risk in trading a security. As the asking price and bid prices are constantly changing, so is the spread.

How are Ask and Bid Price Calculated?

The market decides the ask price and the bid price of a commodity. They are determined by the asking and selling prices set forward by traders in the market in the past. The spread is the difference between the two. The illustrative image below demonstrates the calculation of the spread percentage: For example, if the bid price is $9 and the asking price is $10, the spread would be $1. The percentage of the spread will be 10%.

What Are Examples of Ask and Bid Price?

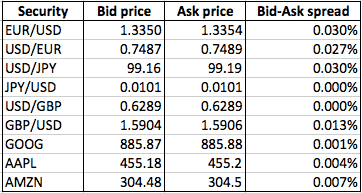

A bid ask price example can be seen in the market every day. If the bid/ask rate is $10/$12, buying 10 securities would cost you $120 while selling them right away would earn you $100. You will incur a loss of $20. Traders often wait for the prices to change and invest in securities whose prices they expect to change in the future based on historical data and trend forecasts. Now, say, the bid price increases to $ 15 after the trader purchased it $12. Selling the 10 securities at the new bid price will earn the trader $150 and a profit of $30. Given below are some examples of what ask-big prices look like in the market:

How Are Ask and Bid Price Set?

As discussed above, both the bid and the ask prices are set by the market in advance. They are constantly changing in value so you need to keep an eye to take advantage of the fluctuations in the spread. There are two factors that determine the bid and ask rate: volume of trade and market volatility. Securities exchanged in large volumes will have smaller spreads and more consistent bid and ask rates. Similarly, volatile market conditions will lead to wider spreads and inconsistent prices.

Who Should Take Advantage of the Bid Ask Spread?

The market maker is the one that takes advantage of the ask and bid prices and the spreads between them. A market maker is a term used to describe the kind of trader who specializes in two-sided deals. They make bids and purchase securities at the quoted ask price and net the difference between the two. They need to be adept at analyzing trends and predicting price changes to be able to make profits from their deals.

Conclusion

The ask and price is a two-way quotation that states the price at which a commodity can be sold or purchased. The difference between the two is called a spread. The prices are set by the market and are usually affected by the trade volume, volatility of the market, and historical price quotations of the trades. Traders need to be able to analyze and predict the price and spread changes to be able to make profits from the buying and selling of securities in two-way deals.

FAQs

1.How is it when bid ask spread is low?

A low spread is an indicator of the higher liquidity in the market. The prices will be more consistent and close and traders can make small profits by making two-way deals.

2.Should I buy at ask or bid price?

The prices offered are more or less the best prices a security can be bought or sold for at the moment. You can make the deal if you find it suitable for your trading strategy.

3.Why is ask price higher than stock value?

If the asking price of a commodity is higher than the stock value, it could be because of an increase in trading volume. With more people bidding on the commodity, there will be more offers and the price is bound to fluctuate.

4.What happens if the bid price is higher than the ask price?

It means that there is high demand for the commodity and you can make gains by trading the commodity at the moment.