By: Sara Patterson

As protesters continue to riot against the reign of Egyptian President Hosni Mubarak for the seventh straight day, spectators throughout the world are waiting anxiously to see whether the country’s octogenarian leader will maintain his control, or whether the insurgents will successfully oust the regime that has controlled Egypt for over three decades. And yet, while such unrest begs many global political concerns, it also raises serious questions regarding the Forex market and how currency trading will be impacted by the fluctuation in the Egyptian currency.

Although the Egyptian pound has historically been strong, the recent turmoil has brought both the previously solid Egyptian pound (EGP) and the stable Egyptian stock market tumbling down. Consequently, it’s important to take a wider look at how both the fluctuation of the Egyptian pound and the volatility of the country’s political landscape will affect the global economy.

Egyptian Stock Exchange Closes on Sunday and Monday

Upon announcing the close of Egyptian banks on Sunday, Egyptian Central Bank Governor Hisham Ramez noted that the delayed start of the banking week was purely “precautionary”, and he maintained that the country maintained ample reserves, to the tune of $36 million. He also insisted that all privately held accounts were in order, and that there was reason to be optimistic about the future.

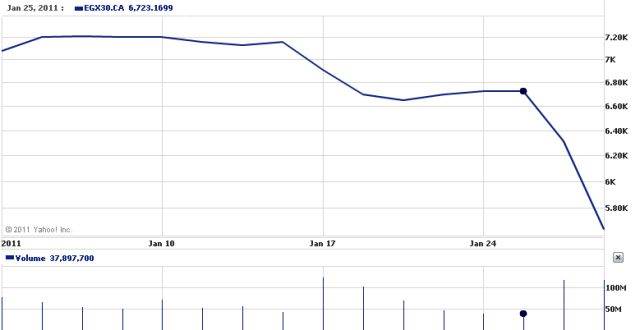

Despite this optimism, however, announcements that the banks would be closed again on Monday, January 31st, were hardly surprising, and raised questions about how long it would truly take to stabilize the Egyptian pound. In a move that mimics the bank closings, the Egyptian stock market will also be closed for at least two days. Prior to announcements of the market closings, the country’s benchmark index, .EGX30, fell a shocking 16% during the first two days of the unrest, and the Egyptian pound reached six-year lows.

EGX 30 - Year to Date Chart

Not surprisingly, the US stock market dipped considerably at the end of last week as well, reflecting the downswing in the Middle East markets. The Dow’s 8 week upswing was ended abruptly, and the S&P 500 dipped below its 14-day moving average for the first time in two months. Equally distressing is the fact that industry analysts don’t expect that the worst has passed. "I think the next two to three weeks, the crisis in Egypt and potentially across the Middle East, might be an excuse for a big selloff of 5 to 10 percent," Keith Wirtz, the president and chief investment officer at Fifth Third Asset Management in Cincinnati, Ohio told Yahoo! News. Whether the Egyptian stock market opens on Tuesday or at some other point in the future, there is no question that both Egyptian currency and Egyptian stock prices will remain shaky until the country can restore its political stability.

Impact on the Gulf Markets

Unfortunately, neither the decline of the Egyptian pound nor the fear that has been evidenced in the global stock arena has been an isolated casualty of the Egyptian infighting. Economic declines were recorded throughout the Gulf region, with Dubai leading the economic fall with its index, .DFMGI falling 4.3 percent to reach a 21-week low. Indexes in Abu Dhabi, Omran and Kuwait also fell notably.

Among the victims of the economic collapse in the Gulf are companies that have significant business interests in Egypt, such as discount airliner Air Arabia, and those that frequently make use of the Suez Canal and other Egyptian ports. Anxiety over the market fluctuations has prompted investors to pull out of risky investments and to favor the purchases of gold and other precious metals, shifts which are often considered safer during times of market instability.

Effect on Oil Prices

While both Egyptian currency and many of the Gulf markets have been notably weakened as a result of the riots thus far, the price of oil has risen conspicuously. In London, ICE Brent crude prices rose $2.03 to $99.42 a barrel. In America, the price of oil jumped over $2 a barrel after the White House expressed concerns about the Egyptian unrest, although analysts don’t expect this increase to be reflected in U.S. pump prices in the near future.

USD/EGP - Year to date Chart

"Rapidly escalating tensions in Egypt that are spreading into surrounding countries such as Yemen are forcing a significant amount of geopolitical risk premium into the oil complex," Jim Ritterbusch, president at Ritterbusch & Associates in Galena, Illinois, wrote to Reuters, a sentiment which accurately describes the volatile situation.

Influence on the Forex Market

There’s no question that the strain on the Egyptian stock market and the recent weakening of the Egyptian pound has already traumatized the Egyptian economy. It’s important to realize that this crisis will also have extensive effects on global markets. As the producer of only 600,000 barrels of oil per day, Egypt isn’t counted among the world’s major oil producers. However, with about 2 million barrels passing through the Suez Canal daily, a blockage of the Canal can have serious global economic repercussions. The price of oil has already begun to rise as a result of the crisis in Egypt, but as long as the Canal remains open, global markets should be protected from extreme collapses.