During last week's trading, it was a painful start for USD/JPY, where the price fell to 106.95, the lowest level in two weeks, and the rest of the trading sessions continued to correct up to the 108.17 resistance, and closed the trading around 107.95 level, while recent gains recorded the fifth consecutive weekly rise. The pair will be heavily influenced by Japan's decision to raise sales tax from 8% to 10% on October 1, which may weaken consumer spending in the world's third largest economy.

Japanese data for September was weaker than expected. Tokyo's core CPI slowed to 0.5%, the weakest reading since May 2018. The manufacturing PMI fell to 48.9, down from 49.5 in August.

From the United States, the most prominent headline in global markets - the isolation of Trump- where Democrats began the impeachment proceedings against US President Trump, after a leaked phone call showed that Trump discussed the business dealings of Joe Biden, the presidential contender, with the Ukrainian president. There were no surprises from the third estimated GDP for the second quarter, which came in at around 2.0%, confirming the second estimate. This was well below the strong gains of 3.1% in the first quarter. Durable goods orders were better than expected, with a reading of 0.2%, while core durable goods orders posted a gain of 0.5%.

Learn about the most important economic data and events that will affect the performance of the dollar this week:

The beginning will be on Tuesday with the release of the ISM Manufacturing PMI. The important sector witnessed a contraction in the latest issue as the trade dispute with the second largest economy in the world continues, and after falling to 49.1, it is expected to rebound to 50.4 in this release. The sector is likely to decline if the global trade war lasts longer.

Wednesday: The ADP Non-Farm Payroll Survey will be announced in the United States; it is an early indicator of new jobs, and is usually released before the official jobs report. After adding 195,000 jobs in the previous release, the index is expected to fall to only 140,000 new jobs.

Thursday: The ISM Services PMI will be released, and the US service sector remains strong and unaffected by the trade dispute with China. The latest reading of 56.4 is expected to reach 55.1 and as long as it is above the 50 level it will maintain its strong growth.

Friday: It will be the most important and most influential on the US dollar as investors awai the US jobs report figures by the Labor Department amid expectations that the US economy will add a total of 140,000 new jobs in the non-farm sector after it recorded 130,000 jobs in the latest release. Average hourly earnings are expected to fall to 0.3% from a 0.4% rise in the previous release. The US unemployment rate will remain unchanged at 3.7%. Any weaker-than-expected results could weigh on the US dollar and increase pressure on the Federal Reserve to make further rate cuts.

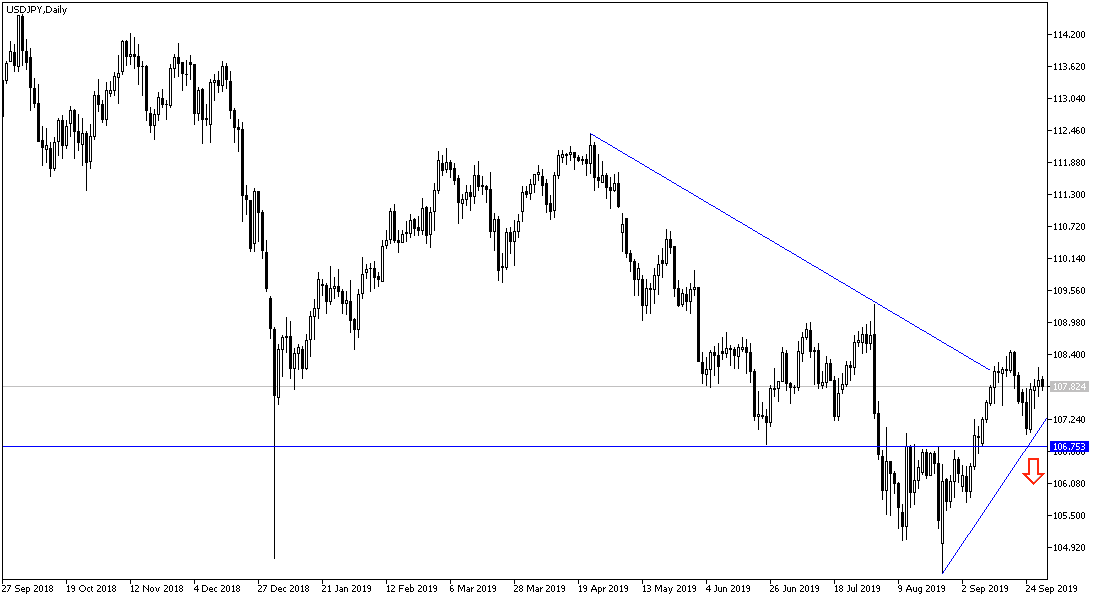

USD/JPY technical outlook for this week:

The general trend for USD/JPY is neutral with a more upward trend. The dollar continues to rise, and the Japanese yen has not benefited much as a haven currency from recent tensions in the Gulf region. With investors awaiting the effects of the new sales tax in Japan on Oct. 1 and its impact on consumer spending, which is expected to decline rapidly, which does not bode well for the Japanese economy and the yen.

The most important support levels for the USD/JPY for this week are: 107.20, 106.35 and 105.60 respectively.

The most important resistance levels for the USD/JPY for this week are: 108.70, 109.45 and 110.30 respectively.