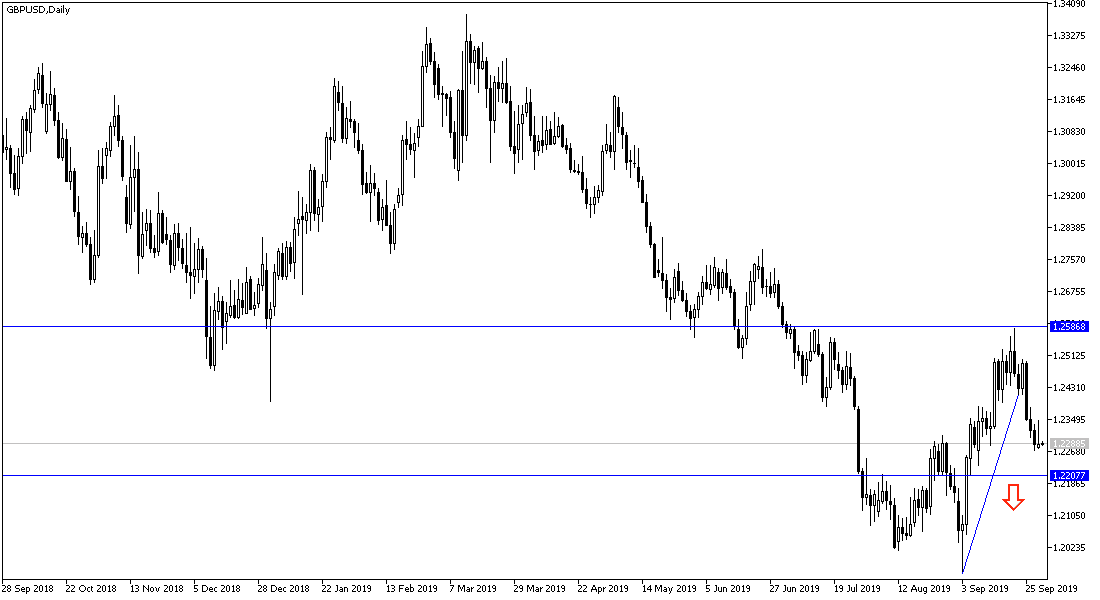

The GBP/USD pair was not able to celebrate much on the release of positive results for the British economy, which pushed it towards the 1.2345 resistance level early this week. Continued buying of the dollar returned the pair to decline again to the 1.2275 support level, where it is stable around the beginning of trading on Tuesday also. The data showed that the UK economy grew slightly faster than previously estimated in the second quarter. GDP growth was revised to 1.3 percent year-on-year in the second quarter, from a previous estimate of 1.2 percent. This followed a 2.1 percent growth in the first quarter.

The Bank of England announced that British household borrowing fell in August as uncertainty over Brexit weighed on consumer confidence. The number of mortgage approvals for home purchases fell to 65,500 in August from an 18-month high of 67,000 in July.

Regarding the Bank of England policy, a senior policy committee official said that the Bank may cut interest rates even in Brexit was with a deal, because distrust will continue to have a negative impact on the UK economy.

In terms of Brexit, the strongest influence on the Pound's trends, British Prime Minister Boris Johnson still has a lot of difficult tasks at a very sensitive time. The official exit date is October 31. Johnson wants Britain out of the EU under any status, with or without an agreement, and relies on the Trump-led United States of America to make huge trade deals to force the EU to accept his proposals, and thus avoid fierce political opposition, which forces him not to leave the EU without an agreement that ensures smooth future relations between Both sides, as they see that a no-deal Brexit means a recession for the British economy and a collapse of the country's currency rate.

From a technical perspective, the performance of the GBP / USD pair will be affected today by the release of the UK Manufacturing PMI and any new Brexit developments. Stability below 1.2300 support will remain a catalyst for a downward correction and may strengthen this trend if the pair moves towards the support levels of 1.2245, 1.2180 and 1.2090 respectively. We still recommend selling the pair from each bullish rebound.