Investor risk appetite, even as the US dollar weakened, helped the USD/JPY pair to correct higher and reach the 108.93 resistance during last week's trading, the 2-1/2 month high. Contributing to stopping gains were the recent negative US economic data, which reinforced expectations of a possible US rate cut when the US Federal Reserve meets at the end of this month. The pair is stable around the 108.30 level at the beginning of this week amid expectations that investors will buy back the Japanese yen.

In terms of economic news. Inflation in Japan remains weak. The core national CPI fell to 0.3% in August, down from 0.5% the previous month. It was the weakest reading since March 2017. BOJ Governor Kuroda noted that the consumer price index is around 0.5%, which is far from the Bank of Japan's inflation target of 2.0%. Kuroda said the bank would increase monetary stimulus until the bank's goal was met.

It is the United States. Disappointing results were announced as retail sales shrank in September. The main reading dropped by -0.3%, after rising 0.4% in the previous release. Core retail sales fell -0.1%, below expectations of 0.2%. There was no relief from the manufacturing sector, with the Philadelphia industrial index falling to 5.6 in October, compared with 12.0 the previous month.

Learn about the most important economic data and events that will affect the performance of the dollar this week:

There are not many major US economic releases this week. Only on Tuesday, we have the release of existing home sales and on Thursday new home sales overall. The US housing market remains strong and unaffected by the trade war with China. The most important release for the US economy this week will be durable goods orders, and after a strong increase in the latest release, it is expected to decline now. If this happens, the picture of a weak US economic performance will be completed.

Learn about the most important economic data and events that will affect the JPY's performance this week:

Japan's trade balance will be announced on Monday. On Tuesday, there is a Japanese holiday and on Thursday the manufacturing PMI will be released. The Japanese yen will react more if investors' concerns about trade relations between the United States and China are renewed in the wake of the recent truce and the failure of the recent Brexit deal.

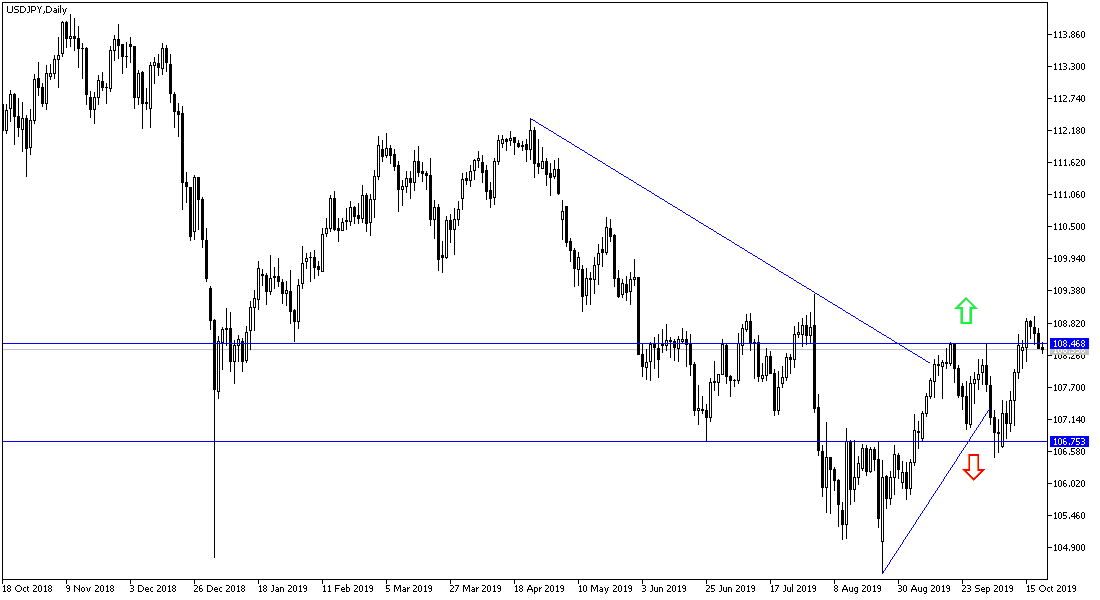

USD/JPY technical outlook for this week:

Despite the optimism that the bullish correction of USD/JPY will continue to stabilize above 108.00 resistance, I still expect Japanese yen's strong gains against other major currencies to return, as renewed global trade and geopolitical tensions start to loom. The US economy is still sending strong signs of weakness. But there was little to attract investors to the greenback, especially with strong expectations of a US rate cut soon. The partial agreement between the United States and China did not amount to an end to the trade dispute between the world's two largest economies.

The most important support levels for the USD/JPY this week are: 107.90, 107.00 and 105.65 respectively.

The most important resistance levels for the USD/JPY this week are: 108.85, 109.65 and 111.30 respectively.