During last week’s trading, the USD/CAD dropped by a 1.0%, towards the 1.3170 support, the lowest level in one month, before it settled around 1.3210 level at the beginning of this week’s trading. The CAD got support from the rising oil prices and investors’ optimism for a trade deal between the US and China, and increased investors’ risk appetite. The Canadian economic indicators’ results came positive overall, as the building permits made strong gains of 6.1% in August, achieving consecutive gains. Last Friday, employment data were announced with stronger than expected results, as the economy succeeded in adding 53,700 new jobs in September, while expectations were at 11,200 jobs only. This comes after incredible gains of 81,100 jobs in August. Unemployment rate dropped to 5.5% in September from 5.7% in August.

From the United States. The Fed released the minutes of its last September meeting, in which the Fed cut US interest rates by a quarter-point, the second time this year. The tone of the minutes was mostly pessimistic, with members asserting that the risks to US economic growth were "leaning negatively." Policymakers have raised concerns about weak global economic growth, the impact of the US-China trade war and low inflation in the country. The Fed seems ready to cut rates again. Expectations reached 75% that at the October meeting the bank will cut US interest rates for the third time this year. The drop in US inflation for September also fueled the expectations. CPI slipped to 0.0% and core CPI slowed to 0.1%. Thus, inflation remains low, well below the Fed's 2.0% target.

Learn about the most important data and events that will affect the Canadian dollar this week:

Wednesday: Canadian inflation data will be released. Canada is leading a series of inflation indicators, led by the consumer price index. The index points to weak inflation levels, with two declines in the past three months. Another weak reading is expected in September, with expectations of -0.3%. On Thursday, Canadian manufacturing sales will be announced. Under the global trade war, the manufacturing sector is still struggling, and manufacturing sales have recorded consecutive declines. The July reading came in at -1.3%.

Learn about the most important data and events that will affect the USD this week:

There will be a public holiday in the US on Monday to celebrate Columbus Day. On Wednesday, US retail sales figures will be released and retail sales are expected to rise 0.3 percent from 0.4 percent last month and core retail sales are expected to grow 0.2 percent after falling to 0.0 percent last month.

On Thursday, the US housing market figures, which remain strong despite the trade dispute with China, will be released. Housing starts are expected to register 1.32 million homes from 1.36 million previously.

On the same day, the jobless claims will still be released, which still show positive figures showing the strength of the US labor market and that layoffs are still at historic lows. As for the industrial index, it is expected to drop to 7.0 after a historical reading of 12.0. On the same day, the US dollar will react to remarks by members of the Federal Reserve's monetary policy.

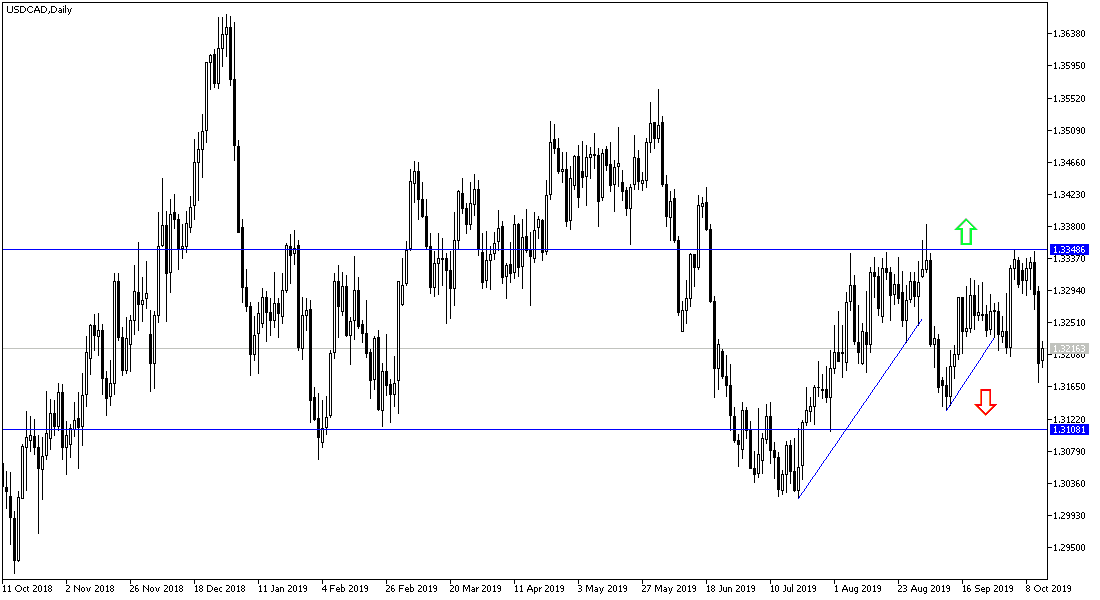

USD / CAD technical outlook for this week:

Stability below the1.3200 support level will support the strength of the bearish correction of USD / CAD. US PMI and inflation indicators point to a slowing US economy, which may bode well for the Canadian dollar. As it is always said, “when the United States sneezes, Canada gets a cold,” referring to the fact that the Canadian economy is heavily dependent on its southern neighbor. Falling oil prices in recent weeks could also affect Canada's important energy sector.

The most important support levels for the USD / CAD for the week: 1.3170, 1.3050 and 1.2900 respectively.

The most important resistance levels for the USD / CAD for the week: 1.3275, 1.3350 and 1.3465 respectively.