For the second consecutive day, the GBP/USD pair is trying to recover from its recent losses, which pushed it towards the 1.2247 support, but gains did not exceed the 1.2385 barrier before settling around the 1.2360 level of at the time of writing, awaiting the results of important economic data from Britain and the United States. The British Pound's losses were stalled as risk appetite returned, albeit relatively, after sharp operations that followed the collapse of crude oil prices to historical levels, whereas, West Texas Intermediate crude futures fell from above $20 a barrel to -$37 a barrel for the first time in history amid an unprecedented abundance of supplies that pushed storage capacity constraints to critical levels.

As oil storage facilities are full, factories are closed and office complexes are empty, oil production continues, posing a challenge to producers and policy makers alike as the global economic stalemate caused by the Coronavirus, which has brought oil demand to an all-time low, continues. This is first and foremost a burden on the currencies of oil producing countries, of which the UK is not one, although sterling still has a strange relationship with the price of Brent crude futures.

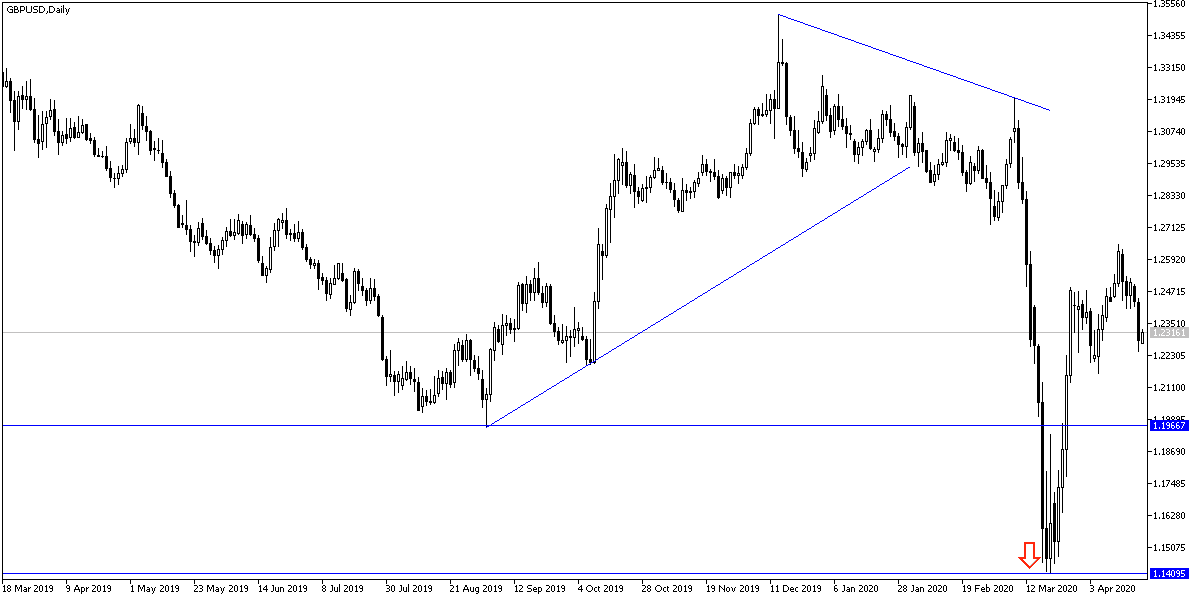

The GBP/USD rate is positively correlated with the price of Brent crude, which is clearly noticeable over a long period of time on the long-term charts, so any sharp moves lower may risk the temporary exchange rate recovery. This comes after the GBP/USD closed below the 21-day moving average on Tuesday, just days after the failure of a fourth weekly attempt to overcome the 61.8% Fibonacci retracement of the downtrend for 2020, both of which are bearish signals.

In general, the decline in oil prices and European expressions of "solidarity" will affect the price of the pound against the dollar, while raising the price of the Euro against the dollar. The British pound is exposed to its lowest levels since the 2008 financial crisis.

According to technical analysis of the pair: On the daily chart, the price of the GBP/USD is closest to a head and shoulders formation, especially if it fails to correct upwards and exceeded the 1.2500 resistance barrier, and if it occurs, sales may increase to push the pair towards the support levels 1.2270, 1.2190 and 1.2080 respectively. The cable is facing intense pressure between the return of anxiety about the future of the Brexit, the tumbling oil prices and facing the Corona epidemic.

As for the economic calendar data: From the UK, the industrial and services sectors PMI will be announced, and from the United States, unemployment claims and new home sales data will be released.