New Zealand reported a collapse in its business PMI, but as the nationwide lockdown was eased, next month’s data is in focus. Prime Minister Ardern acknowledged there was no plan in place as the eagerly anticipated budget will be scrutinized. She faces an election in September and defends her strong health response. New Zealand recorded the second day without new infections, and 94% of confirmed cases have made a full recovery. Yesterday the lockdown level was reduced to two, allowing groups up to ten to socialize outside. Opposition parties worry that taxes will increase to pay for the government response to the Covid-19 pandemic. It adds pressure to the NZD/JPY, which was rejected by its short-term resistance zone.

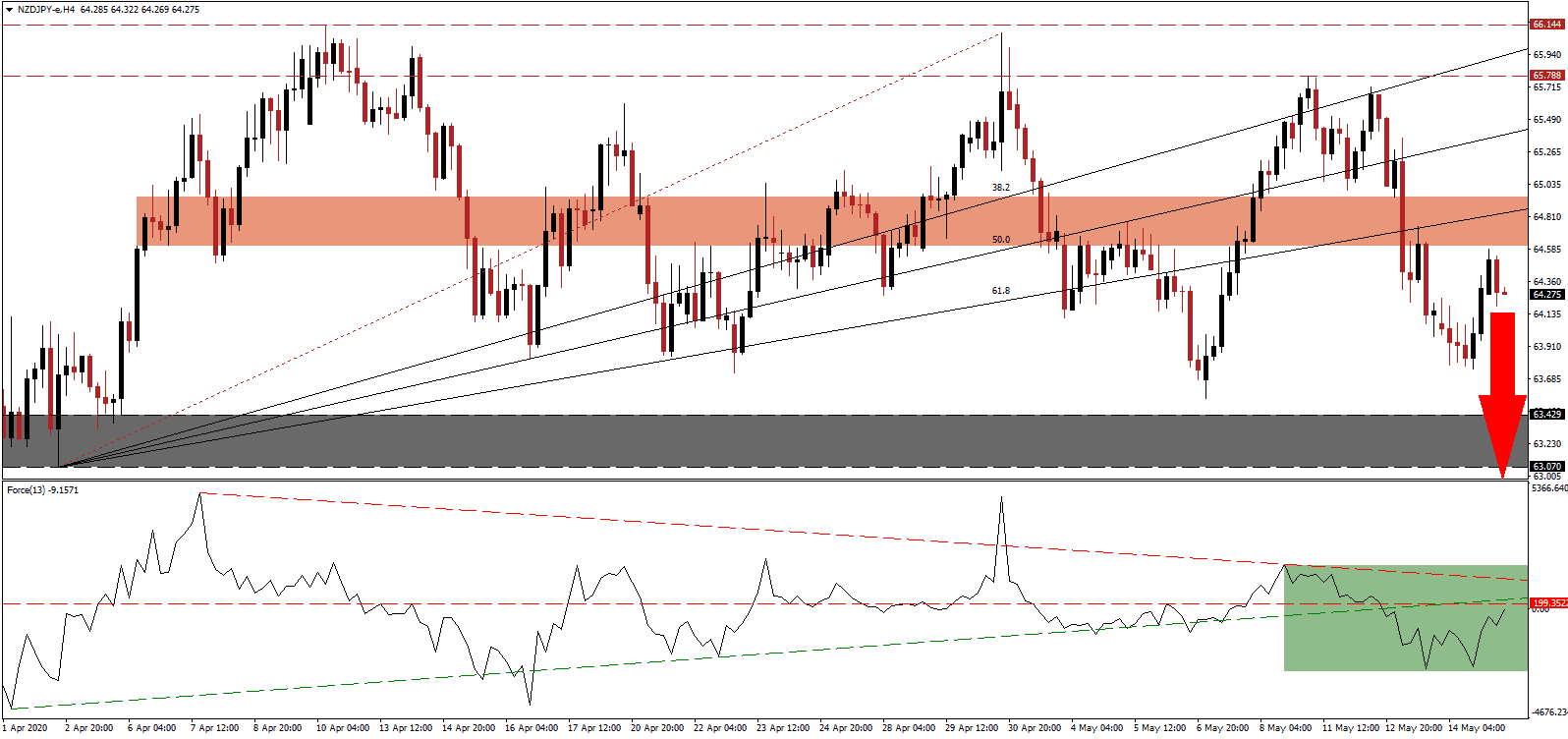

The Force Index, a next-generation technical indicator, recovered from its most recent low and has now approached its horizontal resistance level. With the descending resistance level closing in, and after the breakdown in the Force Index below its ascending support level, as marked by the green rectangle, a renewed push to the downside is anticipated. This technical indicator remains below the 0 center-line and bears in control of the NZD/JPY.

With Prime Minister Ardern suggesting a playbook to tackle the post-Covid-19 economy is not necessary, doubts over her leadership are apparent. It confirms fears of uncontrolled spending without a proper plan to balance the budget. Uncertainty over how a recovery will materialize is providing a bearish catalyst to the NZD/JPY. Following the breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level, and its short-term resistance zone located between 64.610 and 64.947, as marked by the red rectangle, an accelerated sell-off is expected to emerge.

Japan is accustomed to economic hardship since the 1999 bailout of its financial system. Most countries report indicators plunging to all-time lows or levels not seen since the 1933 Great Recession. By contrast, Japan is printing reports not seen in nine years. The safe-haven appeal of the Japanese Yen is adding to downside pressure on this currency pair, well-positioned to challenge its support zone located between 63.070 and 63.429, as identified by the grey rectangle. A breakdown extension in the NZD/JPY is probable, and the next support zone awaits between 61.101 and 61.750.

NZD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 64.250

Take Profit @ 61.100

Stop Loss @ 65.100

Downside Potential: 315 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.71

In the event the Force Index reclaims its ascending support level, serving as current resistance, the NZD/JPY is likely to attempt another push higher. Given the lack of a clear plan for recovery, in combination with the threat of a new global infection wave, Forex traders are advised to consider any breakout as a secondary selling opportunity. The upside potential is limited to its long-term resistance zone located between 65.788 and 66.144.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 65.500

Take Profit @ 66.100

Stop Loss @ 65.200

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00