U.K. Prime Minister’s Boris Johnson trip to Brussels has ended and has not produced an agreement with the European Union. The U.K. and E.U. have announced on the evening of 9th December that December the 13th is now the deadline for achieving a final settlement.

The U.K. changed its Internal Market Bill in order to display good faith to the European Union as talks between Boris Johnson and the E.U. leadership got underway this week. However, an impasse continues to be demonstrated before the end of the month deadline. Failure to reach an agreement could result in tariffs and quotas from both sides which would produce troubling economic implications.

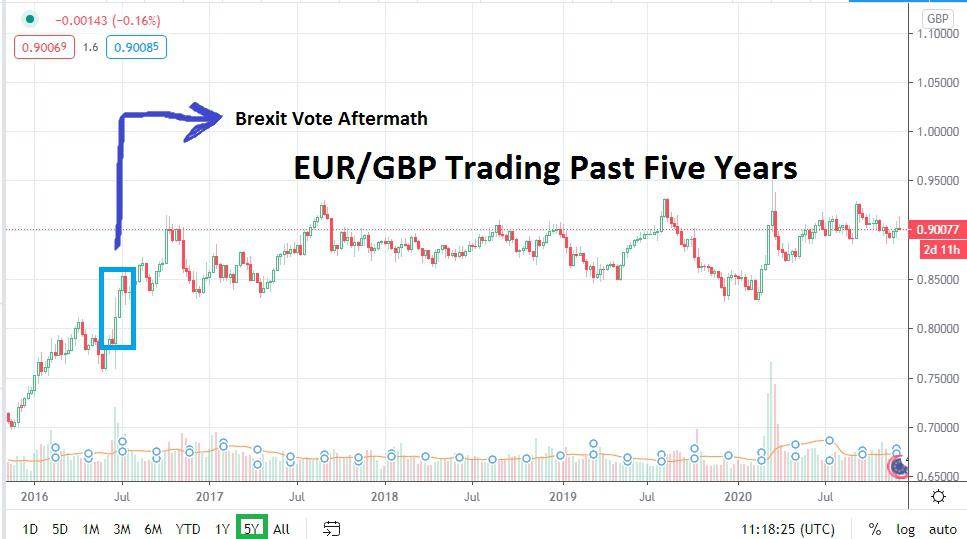

EUR/GBP Rates Track Negotiation Outlook

The current talks, which had been focusing on internal measures between the U.K. and Ireland, future trade between the E.U. and Britain, and fishing rights, appear to face continued obstacles. The U.K. and E.U. have created several deadline extensions in the past, but the current deadline seems to have caused a real focus. Investors are nervous as both sides grumble about the potential for a ‘hard’ Brexit which would cause financial pain and unknown economic implications.

The current talks could be conceivably extended through the month and into next year. However, no one wants to see that take place, as stalled negotiations will produce unhappy corporations and investors as they try to gauge their economic futures.

In the midst of an unclear result, the EUR/GBP and even the GBP/USD are affected. The EUR/GBP is currently trading within what has become a comfortable range of approximately 0.8900 to 0.9200. The question is what will happen if a deal is not reached, which could conceivably damage the GBP because of the psychological effects via financial concerns. A failure to agree a deal could cause the EUR/GBP to surge higher, giving a GBP to euro forecast eventually challenging values in the 0.9300 to 0.9500 range.

The U.K. never became a monetary partner of the E.U. by joining the EUR, but the value of the EUR/GBP due to the trade agreements and joint economic policies certainly helped create a clear and positive outlook for the two major currencies. If an agreement can be made in the near term between the U.K. and E.U., the EUR/GBP could produce a solid downturn and trade in the 0.8700 to 0.8500 price range again, giving a downwards pound to euro forecast over the next 6 months into 2021.

Since the UK voted to leave the E.U. in June 2016, the GBP has suffered in value against the EUR and against the USD as well. The U.K. and E.U. have been languishing in negotiated chatter regarding their future ‘living’ arrangements for a few years and investors have grown wary and fatigued by the lack of a positive outcome. Remaining important trading partners and figuring out how best to manage the welfare of their citizens via assorted rights like work and travel visas and trade within the two entities in a productive manner is crucial.

The GBP/USD has been trading within a range of 1.2800 to 1.3400 with relative comfort mid-term. A failure to reach an agreement between the UK and EU could see the GBP/USD again challenge lows near 1.2400 to 1.2100 levels over the long term. If a deal is made, the GBP/USD could rise eventually to the price area between 1.3700 and 1.4000.

Key Obstacles to Brexit Deal

Interestingly, one of the key problems the U.K. and E.U. are facing is what outsiders may consider a simple task: the rewriting of fishing rights. While certainly not the most important industry and greatest threat to overall value of total trade commerce for the U.K. and E.U., the fishing industry in the E.U. has made a populist and political stand as it fights for its right to retain ‘catch’ rights in U.K. waters.

On average, European fishing companies take close to 6 million tons of product from the sea and, on average, these same companies take about 700,000 tons of that total from U.K. waters. European companies do not want to lose the ability to fish in U.K. waters. If an agreement on fishing rights can be agreed upon it will highlight that other facets regarding trade will be able to be worked out too.

Britain knows the fishing rights for the EU are important, and after the UK agreed to change the Internal Market Bill earlier this week, the ongoing talks between the UK and EU likely have given Prime Minister Boris Johnson some additional firepower as he negotiates.

Bottom Line

Eventually, it seems reasonable to believe the U.K. and E.U. will find a way to move forward and agree on a proper way to continue a prosperous working relationship. No matter how acrimonious the current talks sometimes seem to be, it does seem rational that a deal will eventually be made. The big question is when an agreement will be achieved.