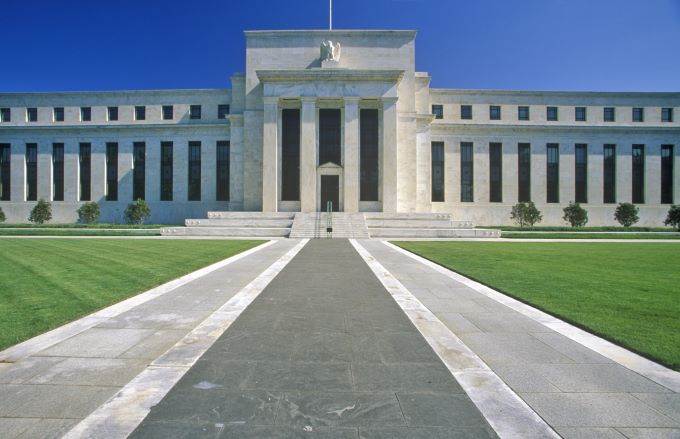

The Federal Reserve also is expected to maintain its dovish policy, which will keep the greenback depressed relative to its rivals. Similarly, the European Central Bank on Thursday left no doubt that they would also keep interest rates at current lows. As predicted by analysts according to a recent survey, the ECB left their lending rate at zero percent, and their deposit rate at -0.5%, in an effort to encourage private lending through the European banking system. The ECB also pointed out in its policy statement that they expected that the surge in the Coronavirus infection rate was likely to pose a serious risk to the economic recovery of the Eurozone.

The Federal Reserve also is expected to maintain its dovish policy, which will keep the greenback depressed relative to its rivals. Similarly, the European Central Bank on Thursday left no doubt that they would also keep interest rates at current lows. As predicted by analysts according to a recent survey, the ECB left their lending rate at zero percent, and their deposit rate at -0.5%, in an effort to encourage private lending through the European banking system. The ECB also pointed out in its policy statement that they expected that the surge in the Coronavirus infection rate was likely to pose a serious risk to the economic recovery of the Eurozone.

In Asian trading, as of 9:05 am in Tokyo, the EUR/USD was trading at $1.2170, down 0.0123%; the pair has ranged from $1.21586 at the low end to $1.21782 at the high end during the trading session. The AUD/USD was trading at $0.7756, down 0.0902%, off the session peak of $0.77713; the NZD/USD was also lower at $0.7211, down 0.061%.

Markets Eye PMI Reports

On Thursday, the US Department of Labor reported that initial and continuing unemployment claims were better than analysts had predicted. For the week ended January 15th, initial claims for jobless benefits hit 900,000, less than the 910,000 predicted, while continuing claims for benefits 5.04 million for the week ended January 8th, well off the 5.4 million that had been predicted. The Federal Reserve Bank also published the Philadelphia Fed Manufacturing Survey which came in at a surprising reading of 26.5, well above the expected 12. Later today, markets will focus on the flurry of PMI surveys to be released for the UK and the Eurozone. Analysts and economists recently polled are predicting a drop in the readings, across the board, for all of the major EU economies including Germany and France, as well as the EU composite, and for the UK.