COIN: A Public Offering, Not an IPO

The Coinbase Global public offering was held yesterday, and its solid results matched the hype which was generated in the week leading up to its initial trading on NASDAQ. Importantly Coinbase was careful to make sure it publicized it first trading day on NASDAQ was not an IPO, which meant the stock was not underwritten by big financial houses.

The timing of the opening of trading yesterday was kept secret. This certainly added to marketing hype surrounding COIN and helped create a feeding frenzy when the equity began to trade in earnest early on Wednesday afternoon for Wall Street.

The direct public listing instead of an IPO may have been a calculated marketing technique too, which Coinbase knew coming from the cryptocurrency sector would be a vital element to gain favor from its supporters who believe in decentralized finance. COIN clearly understood it was good to have influencers and social media ‘knights’ on their side, even as Coin as the biggest cryptocurrency exchange was being brought forward to the world of ‘conservative’ financial institutions to be traded on NASDAQ.

Big Anticipation Created Big Demand for COIN

By not disclosing the exact time COIN would start trading the stock not only continued to be a talking point in the media, but it created anticipation within investment houses which flocked into the public offering as soon as it was possible.

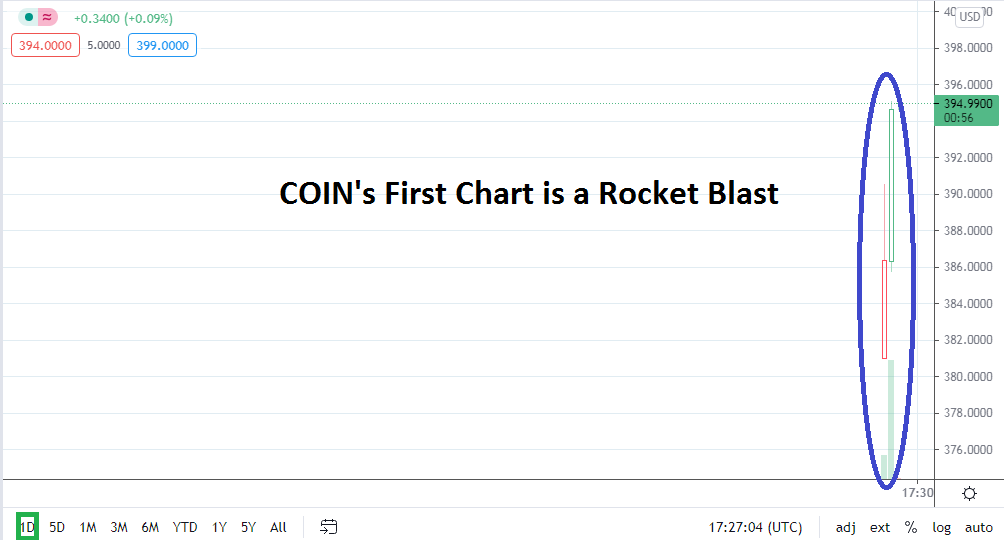

Coinbase trades under the ticker COIN. Its reference point via a starting value for traders on Wednesday was earmarked at 250.00 per share. This price reportedly created a valuation for COIN of nearly 50 billion USD. Upon opening, COIN swiftly rose from a price of approximately 378.00 and nearly attained the 425.00 mark as a high, until finishing the day near 330.00 and a valuation of 85 billion USD.

Some analysts predicted gain as much as a 60% in the first week of trading for COIN, but this percentage was surpassed in the first day of trading. The success of COIN on NASDAQ certainly helped fuel a positive trading environment across the major indices and within the cryptocurrency markets.

Cryptocurrencies Surged Higher along with Stock Indices

BTC/USD was able to make a new record high yesterday and as of this writing is near 63000.00. ETH/USD also has hit it highest value and is trading within sight of 2500.00. New highs were achieved on the Dow Jones and S&P yesterday too.

Traders have been warned to expect volatility from COIN in the coming days as speculative forces and investment institutions likely will create a whirlwind of value fluctuations. Due to the success of COIN being traded on NASDAQ it is also quite possible the US government will increase its supervision of the cryptocurrency world.

The shadow of supervision and regulation have been spoken about before by US watchdogs, but as the cryptocurrencies continues to grow and profit, governments are certainly beginning to grow more intrigued by their success. The US government which is mired in a tiered multi-trillion dollar stimulus program due to coronavirus may see the emergence of the cryptocurrency world as a tax source to help pay for costs the government is accruing.

Tax Supervision Potential Shadows Cryptocurrencies

When asked recently how much money the IRS thinks will go unpaid via uncollectable taxes in the coming year, the head of the IRS responded to Congress that it is nearly 1 trillion USD. When astonished lawmakers asked where the money goes missing from, the head of the IRS said wealthy corporations and individuals do not pay what they owe sometimes, but the IRS leader also pointed the finger at cryptocurrency profits as a problem.

Profits enjoyed by cryptocurrency investors will be taxed with greater supervision certainly. The success of Coinbase will also add to the belief cryptocurrencies need to be supervised by the US government regarding regulations and oversight of blockchain technologies. The cryptocurrency market has grown from a one trillion dollar valued sector to over two trillion dollars based on the rise of prices the past couple of months via digital currencies.

Respectability and Acceptance via COIN

The public offering of COIN on NASDAQ as an equity to be traded, also may serve as a way for conservative investors who have not had the luxury of speculating on cryptocurrencies because of their cautious philosophies, to now speculate on the cryptocurrency market. COIN may allow these investors to use its equity as a ‘gateway’ cryptocurrency investment which they have been avoiding the past five years.

There is certain to be volatility within COIN and the cryptocurrency world short term; the exuberance within the sector is huge but it will not continue to act like a rocket ship forever. Traders need to expect reversals will be demonstrated, and sometimes this will have devastating effects on speculative positions which are pursuing the seemingly endless one way avenue higher which will eventually slow.

Yesterday’s public offering of Coinbase may prove to be a historic day in cryptocurrency, when the conservative financial world finally proved cryptocurrency is accepted by the Wall Street community. Respectability is hard won and Coinbase has the ability to serve as a foundation for the cryptocurrency world.