Nervous Sentiment and Panic Selling Hits Crypto Markets

BTC/USD and ETH/USD both hit long term lows in value on Monday. The selling displayed in yesterday’s price action followed a poor performance of trading in the broad cryptocurrency marketplace over the weekend. The bearish trend which has gripped the digital asset landscape has grown more intense the past week as perceived technical support levels have been brushed to the side and prices have taken a beating.

Correlations with the cryptocurrency world and the NASDAQ 100 index have been made during the selloff which has grown more violent over the past few weeks.

There is a belief that because cryptocurrencies have received the backing of large institutions such as hedge funds, that they are suffering the same plight as riskier equities of the NASDAQ 100. This has seemingly produced strong selling in both cryptos and equities as riskier assets are being sold and safe havens are being sought as the markets react to economic outlooks which are not particularly clear in the mid-term.

Right or Wrong: Cryptos Mirroring NASDAQ

The correlation regarding the price action in the crypto markets compared to the NASDAQ 100 have not been proven, but the nervous sentiment in both spheres can be seen through similar pictures in their respective price charts. However, cryptocurrencies have extra worries which may be affecting current sentiment in the major digital assets and causing rampant selling.

While some optimists and influencers may say that long term holders of cryptocurrencies are simply cashing out of the market, it is questionable if long term speculators in digital assets have profited over the past year as the market has been extremely volatile. Price ratios in many of the major cryptocurrencies are hitting lows not seen since July of 2021, like Bitcoin and Ethereum. If these technical support levels do not hold, then a retest of values seen in March of 2021 could develop rapidly too.

Bitcoin Price Chart: Near 1-Year Lows

Margin Calls and Capitulation in Cryptocurrencies

Speculators who have been using margin to make their crypto wagers with brokers allowing very high leverage, may be getting hit by calls from these brokers to either put more money into their accounts or cash out their losing positions. If the prices within the broad cryptocurrency market continue to fall, it is logical that some sellers are not doing so by choice, but because they are being forced to by high-leverage exchanges and brokers.

Nasdaq 100 1-Year Chart

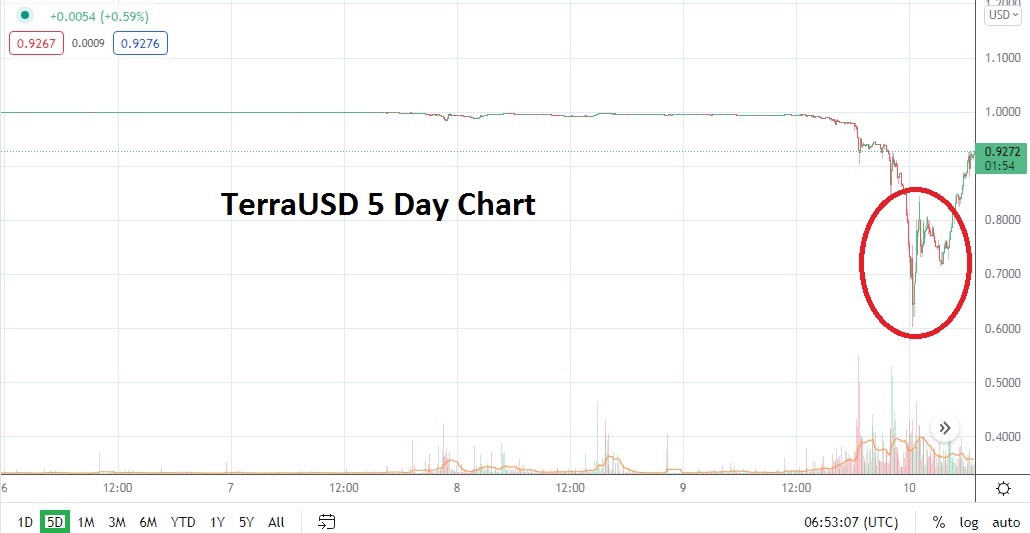

Stablecoins Under Sudden Pressure: TerraUSD

Monday’s trading also saw evidence that ‘so called’ stablecoins like TerraUSD and Tether have come under pressure. While Tether’s USDT/USD only sank to 99 cents in trading yesterday, which is not a huge differential, the price of the TerraUSD coin which serves the Terra ecosystem, and its LUNA/USD pairing were shaken. The price of TerraUSD plunged wildly yesterday and is still seeing violent trading at the time of writing, as it moves slightly below 0.92 cents per coin.

A systemic failure in the stablecoin marketplace would cause massive alarm bells to be sounded in the world of cryptocurrency. The price of TerraUSD should be monitored as a barometer of behavioral sentiment. If the value of TerraUSD remains starkly below its intended $1 USD target, this could potentially set off volatile knock-on effects in the cryptocurrency world. There is a belief this if Terra needs to stabilize its TerraUSD coin, that this would have to be achieved by selling some of its Bitcoin holdings.

TerraUSD Price Chart

Final Thoughts

Since the start of April, the broad cryptocurrency market has essentially killed off the two-week bullish run higher many digital assets enjoyed starting in the middle of March 2022. The two-week run up in cryptocurrencies was seen as a potential turning point, which was about to wipe the bearish shadows which had been plaguing digital assets since November 2021. However, not only has the bearish trend arisen again, but it has brought many of the major cryptocurrencies down to new lows.

Day traders can speculate on short term positions and take advantage of the marketplace. However, wagering on cryptocurrencies and being on the wrong side of the price action can prove to be an extremely costly mistake. If the broad digital asset market remains under pressure in the near term and BTC/USD breaks down below $28,800, this will set off additional fears that not only are perceived long term support levels about to show more weakness, but more dramatic declines could develop. Long term traders who have held onto positions may be forced to sell their digital assets if their accounts falter below necessary margin requirements, which could cause additional downwards price pressures in the crypto market.