NZD/USD: We are not suggesting the Dollar bulls are running wild, however, every rally in hindsight has a defining moment. Every trader on the street is aware that when the Dollar bulls get set free they are going to come charging. Even if you are a skeptic to the end just the mere massive unwinding of the carry trade would rocket the Greenback.

Our pick would be the NZD and here 3 reasons why:

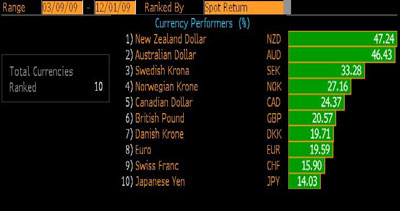

Performance – Going back to March 9th, 2009 through December 7th, 2009 the top performing G-10 currency (on a percentage basis) against the Greenback has been the Kiwi. It is up 47.24% which is quite shocking given the New Zealand economy is not among the largest of the G-10. To put some perspective on it the EUR is only up 19.59% and the GBP 20.57%

Technical – There are 2 obvious technical reasons that stand out to us. A) A pattern we look for are lower lows and lower highs and vice versa. In the chart below we have depicted the initial emergence of this pattern. B) The Kiwi is already trading below its 50 day MA and on the verge of taking out its 100 day MA, a more significant breakout level than the 50 day MA, which many other G-10 currencies have yet to crack.

Commodities – The Kiwi benefits from rising commodity prices as it is a commodity currency. Commodity prices are quoted in USD so as the Dollar strengthens commodity prices cheapen. If commodity prices cheapen so will the NZD.

Combine these three factors and you may see significant price action on this pair. Of course if the Dollar rallies all currencies will be on their heels but as a trader you are looking for the best trade, and this may be it. We define the best trade as the one with the best risk to return ratio.