Investors are pondering this very question. Three weeks ago the answer was a resounding Dollar Bull. Just 9 months prior, though, the answer was an unequivocal, Dollar Bear. So what changed? The biggest changes were in perception. The markets perceived that the U.S will take a stronger role in the Global recovery. More importantly, the recovery had evidenced itself in economic data releases such as Unemployment and Manufacturing.

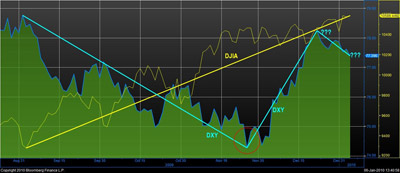

From a technical stand point, we would point to the break down in the correlation between the Greenback and positive economic news. The chart below highlights the correlation between the DXY, the Dollar weighted index basket, to the DJIA. Notice how the DJIA rises but the DXY declines up through the end of November, when a normalized correlation returns, as signified by the red circle. However, the DXY appears to be losing steam as the stock market continues to chug along. If you believe in the Elliot Wave Theory, you might even say that Wave 2 is just taking shape.

We should also understand the composition of the DXY basket. Below is a screen shot from Bloomberg. The indexed weighted basket contains the following currencies; EUR, JPY, GBP, CAD, SEK, and CHF. The basket is also weighted in that order with the EUR at 57.6%, the JPY at 13.6%, the GBP at 11.9% and the CAD at 9.1%. The index is obviously missing the Kiwi and the Aussie, the 2 strongest performing currencies against the Greenback since mid March. The AUD advanced 30.68% and the NZD 29.75% while the EUR is only up 5.76% to date.

So are the Dollar Bulls roaming free or are the Dollar Bears waking from hibernation once again? As pure traders we are actually indifferent so long as we are on the correct side of the trade, which transitions us back into a possible answer.

We assumed a EUR short at 1.4820 with a take profit level at 1.4150. The EUR hit a low of 1.4216 before retracing. Our exit strategy was to exit the position if the retrace hit 1.4450+, but to renter the Short if price bounces off of 1.4484 or the Fibonacci 38.2% retrace level (see December 27th GoLearn Forex Technical analysis). That has since transpired and we therefore resume our Long Dollar position. The same scenario repeats itself with the GBP and JPY.

In short, the currencies weighted in the DXY still leave us in a Long Dollar position, a Dollar Bull. Curiously, the 2 currencies we mentioned not in the DXY basket, the NZD and AUD both signaled an end to the Long Dollar position, thus a Dollar Bear. The markets have been volatile to start 2010 and traders are realigning their positions. As more economic data hits the wire a trend will start to reemerge, but until then there are no bulls or bears running wild, for now just traders.