By: Orville Bailey

As widely expected the FOMC maintained overnight lending rates at 0.25%. For first timers, the FOMC or Federal Open Market Committee is an entity of the US

central bank or Federal Reserve. This body is responsible for the management of monetary policy and Interest rates and is closely observed by players in the financial world.

So with all this talk about the recession being over, many would have thought that 2010 would signal the dawn of a new era. But before you go celebrating, some key indicators must be observed in order to predict the next Fed move.

I should inform you that although the Federal Reserve board and Congress, to many, seem to be separate entities, they should be viewed as having one goal as their agendas must intersect at some point for the stimulation of economic growth.

So here is the deal: right now for congress, the employment rate is probably the heaviest dish on the table. And even though the job numbers out there look bad, they are probably much worse, so be cautious when using these fundamentals for your medium to long term projections.

To establish an immediate bias in whichever market, things are best taken from a technical perspective. This time around let us look at the S&P 500, which is probably the most watched index by traders. The S&P 500 is a leading indicator of U.S. equities, and is one of the most used benchmarks for the overall U.S. futures market. Every serious forex trader should pay some attention to its movements as there is a correlation between it and many currency pairs such as the AUD/JPY and EUR/USD.

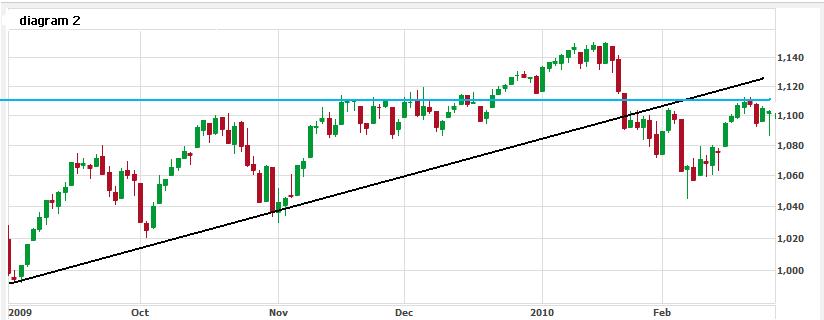

In diagram 1 since the golden cross back in July 2009 the S&P 500 has been a champion performer, but for the first time in 6 months it has broken and holds below the 50MA line, testing now around the 1,100 level with momentum decreasing steadily forming divergence on the MACD. This is one of the first major signs of a retracement with the possibility of a reversal. You should note that this pull back, in January, was so dramatic, due to fundamentals, including the US Jobless claims and the FOMC decision. In diagram 2 notice that the medium term uptrend line was broken on the move in January with a counter move to approx 50% of the 1140 – 1045 area. We might be seeing some set up for a further bear move as another failure approaching 1120 could see a move to 1060 and then a break to 1000 which would be my forecast if this first reversal setup holds.

Also note the following:

1.Two major levels to watch are around 1140 and 1060.

2.If the support around the 200MA holds above 1000 we might have a shifting of the uptrend. Below 1000 could see 950

I will give some more perspective on this in the coming months.

So has the recession ended? – let us put it this way, this thing can’t be rushed. As one of my friends would say, you can’t have a baby in one month by impregnating nine women, it just cannot work, what should have been done months ago has to be done first, like a second stimulus.

Employment, that’s my biggest indicator for recovery in the USA for 2010, because ultimately people are the engines that keep the wheels of development turning. Basically here is the formula Jobs + Production = growth, and If there are no jobs the Fed can’t move, that’s what the FOMC is up to. And Just in case anyone asks you where you are getting this, you can just say it’s all according to PipVille.