By: Mike Kulej

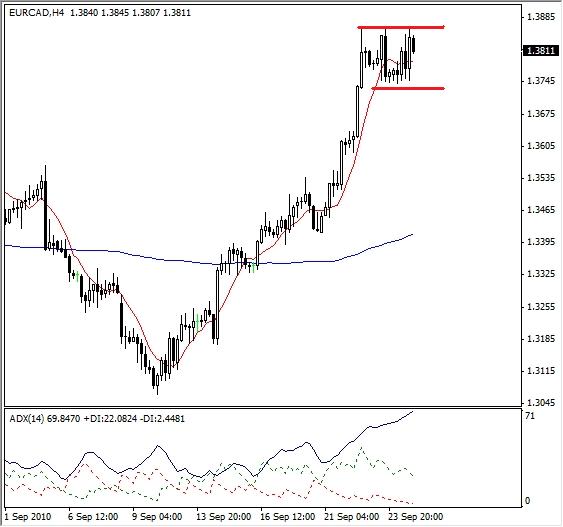

The common currency, the Euro, has staged a good size rally recently. Not a narrow one, limited to just one pair, but rather across the board, showing against most of the major currencies. This includes the EUR/CAD cross, which advanced about 800 pips during the last two weeks.

There is little doubt about market direction here. The price has moved practically straight up, with hardly a pause. Until now. On the intermediate term chart, it started to drift sideways, creating a small congestion zone, which is taking on the shape of a flag formation. Flags are continuation patterns, forming during strong, directional moves. They typically precede another large price swing in the direction of the original move. Here, it means more upside potential, if confirmed by the EUR/CAD breaking outside of the flag’s resistance level.

The strong bullish trend is confirmed by the ADX indicator, with a reading of 70 and not dropping yet. This is supportive of the flag – these formations are of short duration, not giving other indicators much time to change. However, the upside breakout must happen soon. Otherwise, the flag will become invalid.