By: Mike Kulej

Like most others Japanese Yen pairs, the EUR-JPY has been somewhat of a sleeper lately. That is, of course, when compared to previous volatility in this instrument. Since the summer of last year, the price has been moving sideways, with most of the movement linked to activity in the Euro, rather than the Yen.

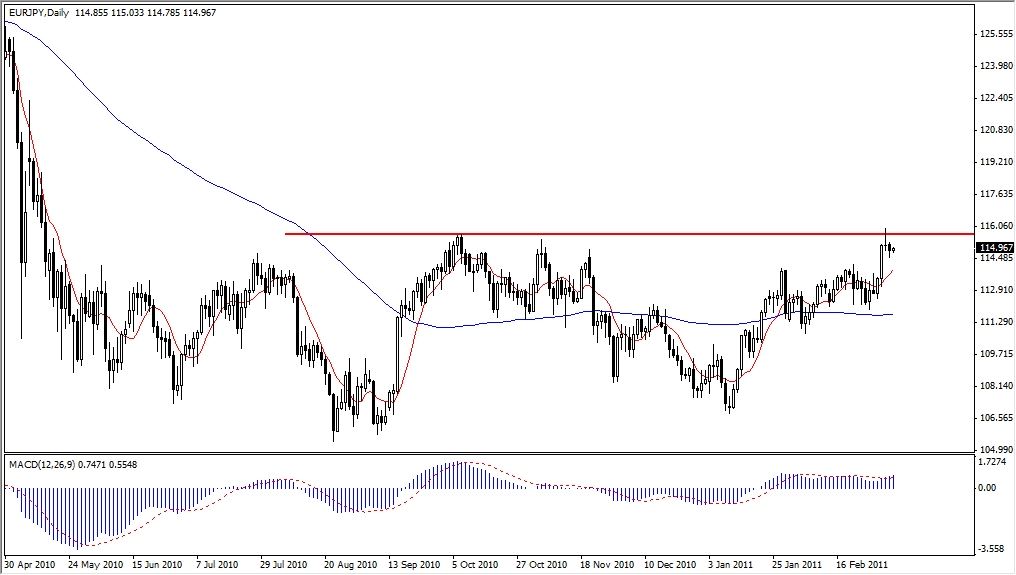

When looking at the daily chart, this behavior of the EUR-JPY gives a distinct impression of a major bottom forming here. With the low of 107.79 and a high 115.66, this congestion area could mark a turning point in the massive bear market, which started in 2008.

Is a Reversal on the Way?

The pivot level for this possible reversal is the 115.66 high from early October of 2010. Last Friday the EUR-JPY tested that resistance, climbing to 115.98. Unfortunately, for the bulls, it failed to close above the breakout level, leaving the bottom in need of further confirmation.

In order to complete this elaborate trend reversal pattern, the market must close above this pivot level on at least daily chart, perhaps even weekly. That would confirm a shift in market sentiment from bearish to bullish and open a possibility for a strong advance measured in hundreds or more pips.