By: Mike Kulej

There have been some serious gyrations in some currencies lately. The earthquake, the intervention and the renewed debt crisis in Europe created large price swings. A currency can be popular for a week, only to reverse dramatically the next.

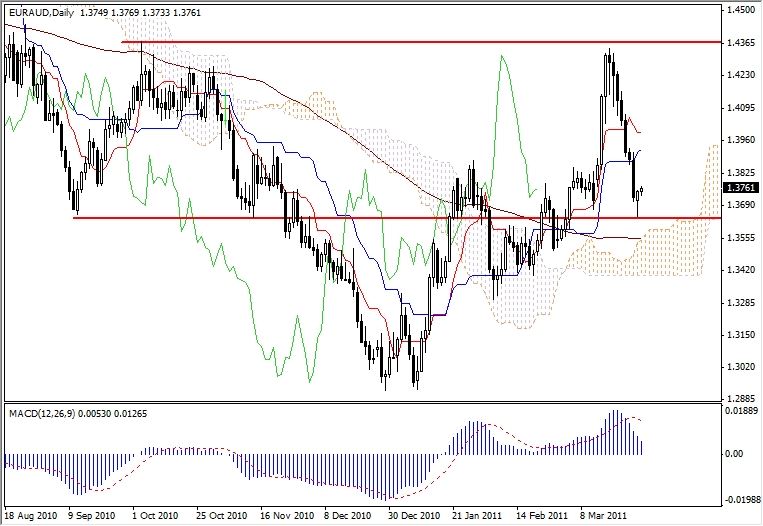

Such is the case of the Euro – Australian Dollar pair. It went on a 700 pips roller-coaster ride in two weeks. However, looking at this action from a larger perspective makes sense, because this swing fits nicely between past support and resistance levels.

A Deeper Look at EUR-AUD

The EUR-AUD reached a high for this move at 1.4342. On a daily chart that is an important resistance established by the latest high before the rally started. The current sell touched 1.3650, which is also a past support level, suggesting the price could turn around again and resume the uptrend.

On Monday, the daily candlestick formed a hammer, a reversal pattern. In addition, there are multiple supports levels, a cluster of them, just below this hammer. All this implies limitations to further down move and increase the chances for a bullish reversal. If that happens, the EUR-AUD could rally back to 1.4340.