By: Christopher Lewis

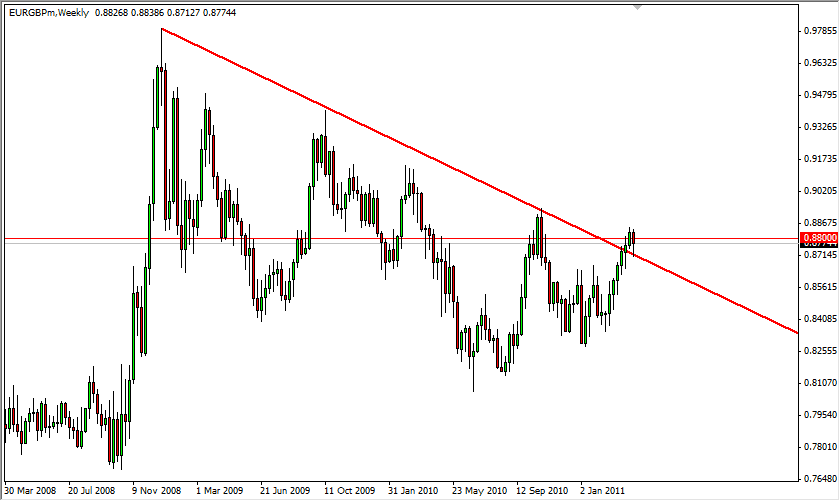

The EUR/GBP pair finds itself currently just over a bearish trend line that started in late 2008. The pair has been on a relentless march downward since that time, and as such has been a very easy short sale for months. This made sense, as the Europeans found themselves dealing with a sovereign debt issue that had quite frankly scared most traders away from buying the multinational currency.

For the last 2 1/2 years the pair has gradually made lower highs, which in and of itself would determine it to be in a downtrend. However, it should be noted that in the overall big scheme of things, the pair is still technically an uptrend on the monthly chart. Because of this, this latest move would have simply been a pullback albeit a very vicious one.

Two weeks ago, the pair had tested the 0.88 level, a key level in this pair. Although it failed, we found ourselves pushing above it the following week. This past week has had us fall again, only to bounce northward as buyers stepped in. It should be noted that there was a massive downtrend line that had gotten violated two weeks ago. This trend line was not only broken, but at the lows of this week was retested and confirmed as support.

Following Trend Lines

When looking for a breakout, the more conservative traders will wait for a pullback and a retest of the trend line to find if it will reverse courses. As the trend line was such heavy resistance since November of 2008, it should be expected to serve as fairly strong support as well. As we push higher, the 0.88 level is proving to be a pivotal level yet again as it attracts so many buyers and sellers.

By looking at this trend line however, it appears that the bulls are starting to take control again, and we may have seen a capitulation of sorts by the sellers. The trend appears to be reasserting itself as this pair will certainly target the 0.90 level and then on to the 0.92 and 0.97 areas as well. Of course, if the pair breaks lower than the trend line, or the 0.87 level - we would have a false breakout of sorts.

The fundamentals also line up for this move, as the European Central Bank is getting ready to raise rates this week for the first time in a couple of years. This should be very bullish for the Euro in general, and should play out to be quite a healthy move in this pair. Of course, the real focus this week will be on the statement that the central bankers make as to whether or not more rate cuts are likely. However, it appears that the fundamentals and the charts are starting to line up which may be a sign of things moving back to some sense of normalcy. This pair shouldn't be any different.