By: Mike Kulej

Just last week the GBP-CHF touched 1.4108, another all time low. This pair has been in bear market for, well, years now, with the current main price swing starting in 2007, from the high of almost 2.5000. Most recently, the driving component here was the strength of the Swiss Franc, rather than an unusual weakness of the British Pound.

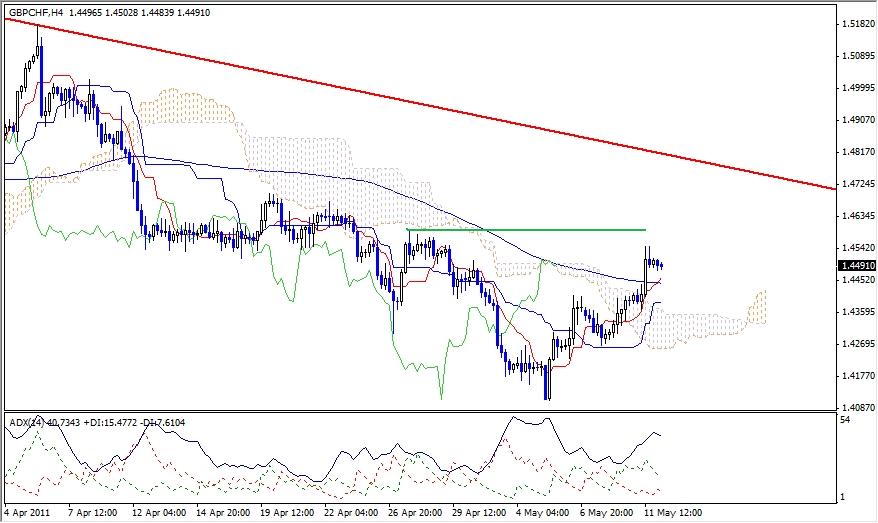

The GBP-CHF has tried numerous times to reverse this trend and failed repeatedly. At present, the price is once again attempting to stage a rally, which, at these early stages, is best visible on the intermediate term chart.

We can see the GBP-CHF advancing from the all time low to 1.4550, a healthy run in a few days. In the process, the price managed to move above couple of resistance levels – the Ichimoku cloud and the 100 SMA, both of which could become supports now.

However, there are even more resistance levels ahead. The most immediate one is at 1.4600, the most recent minor high. And, of course, the main trendline. Until these obstacles are cleared, we cannot talk about a reversal. Therefore, for the moment, the GBP-CHF is in corrective move that possibly can become a reversal.