By: Mike Kulej

During the last few weeks, the Canadian Dollar started to lose some of its luster. After posting steady gains in relation to the US Dollar, the CAD became significantly weaker, shedding almost 400 pips – the USD-CAD rallied from 0.9440 to 0.9817.

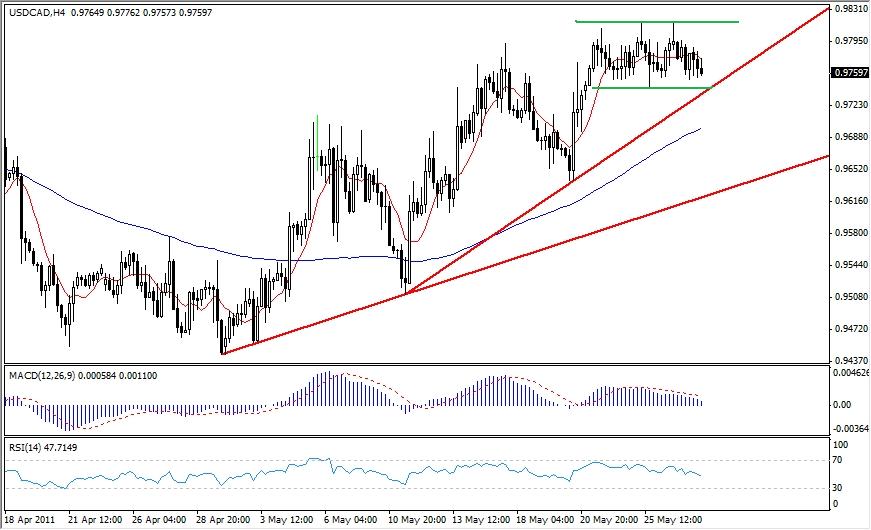

While that might be only a corrective price swing within the main downtrend, this move is relatively big on a smaller time scale. On the intermediate term chart, for example, this appreciation became a new uptrend that developed higher highs and higher lows. At present, the USD-CAD is in a consolidation on this chart.

This price is contained in a narrow band between 0.9740 and 0.9815. Chances are that the USD-CAD will soon break out from this congestion zone. Because the preceding trend was up, a breakout in that direction is a little more likely than down, especially with a trendline providing a solid support nearby.

No matter the direction of the breakout, it should be confirmed by other technical factors. The MACD and the RSI indicators need to shift from the current neutral readings in line with the price action. Increased activity could happen as early as Monday and push the USD-CAD as much 100+ pips in a short order.