By: Mike Kulej

The Swiss Franc has been the strongest currency among the majors in recent weeks, pushing the US Dollar to ever-lower lows. Long gone is the time of parity, or even the 0.9000 level. On Tuesday, the USD/CHF made yet another all time low at 0.8325.

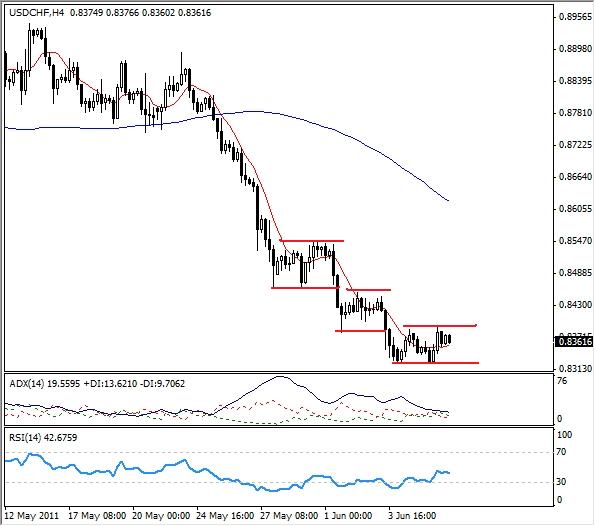

Just in the past two weeks, the USD/CHF dropped about 600 pips, in a directional move. However, this price swing may be losing momentum, at least in the near term, perhaps best visible on the intermediate term chart, where the trend became a little choppy, with each leg down a little shorter the last one.

Currently the USD/CHF is in a third consolidation, between 0.8325 and 0.8390. The more of these tight ranges happen in a quick succession, the lower the chances for a trend continuation, so one should consider some kind of correction within the downtrend, or at least the price settling into a sideways moving period.

We can see that the ADX has already turned flat, indicating a trend that is losing momentum. In addition, the RSI has been at or near an oversold level for a long time, another sign suggesting that a trend in the USD/CHF may have run its course.