By: Sara Patterson

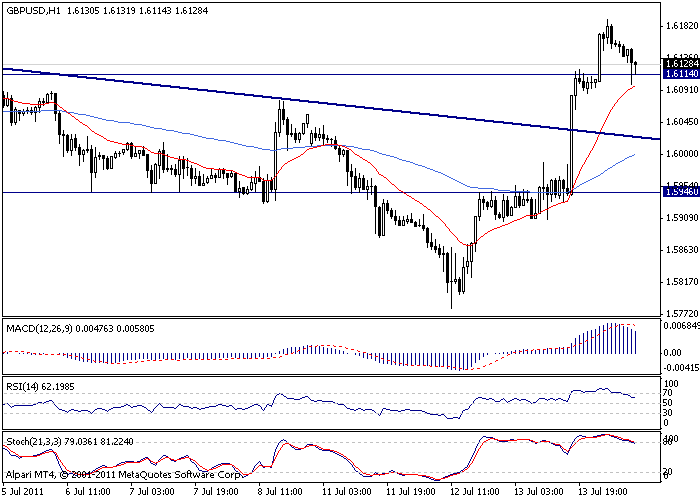

GBP/USD: 1.6128

Very Short-Term Trend: uptrend

Outlook: Much to the surprise of many traders, the GBP rallied hard yesterday once it firmly broke above the 1.5945/55 level. Consequently, the hourly chart now shows a strong trend on the upside and further gains are expected after a small initial consolidation. The next level of potential resistance is likely to be at 1.6260.

On the downside, a decline below 1.6090/80 negates and risks losses toward 1.6020 before another rally attempt takes place.

From a trading perspective, longs are favored, but trade cautiously because the currency is clearly volatile. In a time like this, it is usually best to stay out for a few days to try to evaluate the market from another perspective.

Strategy: The theoretical short position from 1.5940 was stopped out at 1.5985 with 45 pts loss. Stand aside.